Commodity

Update, Fed Meeting, Citi and SoGen, US Dollar Crash?

by Victor Sperandeo with the Curmudgeon

Victor on Commodities:

In order of importance, commodities are influenced by the

following:

1. The US Dollar/Fed

Policy* - commodities are inversely correlated with the dollar;

2. China Growth- mixed to unknown;

3. OPEC Policy on oil- like the Fed, its been

all talk with no action on lowering supply;

4. GDP Growth worldwide- weak to poor;

5. War- unlikely, but possible.

* If the Fed were to raise rates, the dollar would likely

strengthen. The Fed wants a stable dollar for many reasons. One of them

is to prevent oil/gas prices from rising, so that the consumer has more money

to spend on other things. Increased

consumer spending would boost GDP growth in the second half of 2016. Also keep in mind the uncertainty of the

November US Presidential election, which is a key reference point for the

Fed. Almost no one predicts them to

raise rates at their November meeting.

..

Commodities are currently trend-less. Oil and the dollar are in

trading ranges, and will continue as such till the US election. IMHO, commodities (as a whole) go nowhere

till after the November elections. West

Texas Crude Oil continues (and will likely stay) in a trading range of

$40-50. Gold and silver are in up trends

and that should continue. Readers may be

interested in my earlier post on Gold being in a new bull market. You can read it here.

..

Heres a chart of the CRB index1 of 19 commodities,

which is stuck in a trading range since May of this year:

Chart Courtesy of StockCharts.com

Note 1. The CRB index has undergone periodic

updates as commodity markets have evolved and is now known as the Thomson

Reuters/CoreCommodity CRB Index, consisting of 19 commodities.

..

Curmudgeon Note: A survey of other views on commodities is

contained in a Forbes article titled: Investment

Banks Divided Over The Outlook For Commodities After A Strong Recovery.

..

US Dollar and GDP: Lets watch if the dollar index (DXY) stays above 92 (its

recent low reached this past May). That would keep the yield curve flat and

implies the economy will also be flat after 9/30/2016. 3rd quarter GDP will be in the ~2%+ range,

helped by government spending and inventory stocking for Christmas.

Victor: Fed Meeting a

Dud!

The Fed concluded the most unique meeting I have ever heard

about this past week. Academy Award "double talk," mixed with

confusing rhetoric, and nonsensical forecasting never seen before in the

history of the Fed. The dollar

declined this week after the Fed did NOT raise rates (stock prices rallied as

the Curmudgeon notes below). The Fed

will certainly not raise rates till after the US elections and maybe not even

in December.

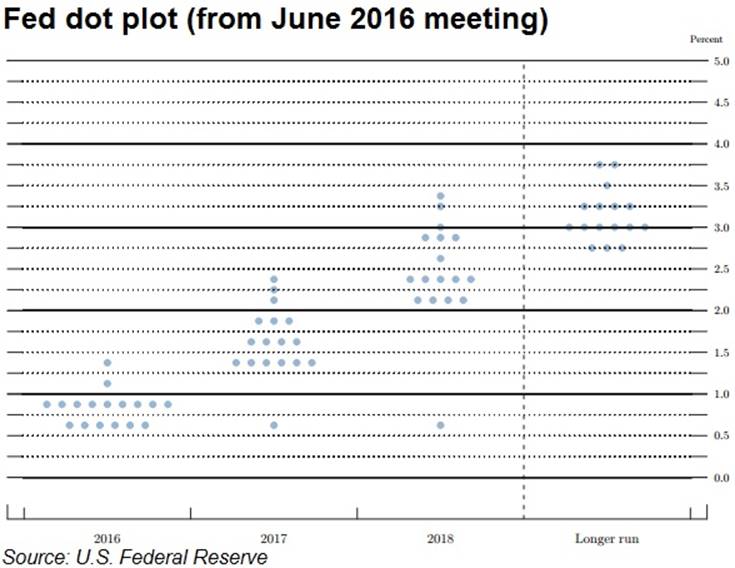

The Dot

Plot" of Fed Funds is projected higher, while GDP growth trends lower.

Indeed, the Fed lowered its own forecast for 2016 GDP growth

from 2% to 1.8% on Wednesday. The Fed

also lowered inflation, using the PCE deflator, which is projected under their

target of 2% all the way out to 2018! The Atlanta Fed is projecting 2.9% GDP

growth in the 3rd Quarter, ratcheted down from 3.8% in July. The

Atlanta Fed is still respected as the Hot Hand in macro-economic forecasting.

Curmudgeon Note: The Curmudgeon has stubbornly claimed that the

Fed has lost all credibility by talking tough in between meetings then doing

nothing at the meetings other than Chairwoman Yellen saying: the case for a

rate rise has strengthened. We compared

that to the boy who cried wolf in a recent post.

Its amazing the markets react in a strong risk on mode after

every Fed do nothing meeting ends.

Its as if they were expecting a rate rise which doesnt occur, despite

the consensus for same being negligible.

For example, 90% of respondents to a CNBC

Fed Survey, said the Federal Reserve wouldn't increase interest

rates at its September meeting which ended on Wednesday afternoon. Other

analyst/economist forecasts and the CME Fed Watch Tool agreed no Fed rate

hike in September! Yet US stocks

rallied strongly after the Fed announced it didnt raise rates on Wednesday and

popped again on Thursday of this week.

Both the NASDAQ and NASDAQ 100 indexes made all time new highs. Its as if the markets were celebrating what

was already discounted (if you believe the market is a discounting mechanism,

which I dont)!

..

US Dollar Point of Order (Victor):

Jim Rickards projects a steep dollar decline/crash on

9/30-10/1/2016 due to China coming into the IMF reserve currency basket on that

date. Rickards is now also predicting Russias Putin

launching a currency attack on America.

I don't see a dollar crash coming, but I hope he is

correct. If it does happen, it would

cause a huge commodity rally.

Citis Look Ahead: Post-FOMC data flow crucial for next hike:

·

The September FOMC

statement looked through the dive in ISM non-manufacturing and the weakness in

the most recent hard data and concentrated on stronger underlying trends. The

onus on incoming data will be to confirm that these more positive trends remain

in place.

·

Next weeks data may

bring little comfort to those looking for signs that recent weakness is an

aberration. We see further downside risk to consensus estimates for a

contraction in durable goods orders.

·

A large number of Fed

officials speak next week. Most notable are Fed President Evans, who may or may

not wish to hike rates this year, and Presidents Harker and Kaplan who become

voters next year.

·

Next week the

political calendar also heats up with the first of several Presidential debates

and a major budget deadline for Congress.

The stakes are high as recent polling has shown a much tighter race.

With the September 30th close of the 2016 fiscal year and no budget, Congress

and the Administration will pass emergency legislation to fund the Federal

Government until Congress reconvenes after the election.

·

Plans for a December

rate hike remain intact for most FOMC members and this remains our baseline

expectation. The onus on incoming data will be to confirm that these more

positive trends remain in place. Against this backdrop, downside misses to

forecasts, which would fit with the narrative of slowing activity, may provoke

more of a market reaction than upside surprises.

Excerpt of SoGens Albert Edwards Global Strategy Weekly:

Disgraceful, disgusting and dangerous

Recent anemic

economic data in the euro-zone confirms what we already knew from the US, QE

is not the panacea for slow growth. Some 18 months and 1 trillion later,

the euro-zone remains in the doldrums. More concerning perhaps is that the

potential' GDP growth rate has slumped over the past decade or so. Angela

Merkel may have issued a mea culpa' for the lack of preparedness of the German

authorities last year in accepting one million refugees, but what has not

changed is the economic thinking that her open door migration policy should

boost Germany's low potential growth rate via population expansion. This policy

will fail however, as it will in much of euro-zone if policymakers do not

address the disturbing lack of opportunity that migrants face there-something

not seen in either the UK or US.

Policymakers and

investors have noted how potential GDP growth rates in virtually all developed

countries have slumped over the past decade with declining productivity growth

being seen as the main culprit. This is seen as a long-term, complex and

intractable problem, which is not readily open to policy solutions.

Victors Conclusion and End Quote:

Commodities are stagnant along with inflation. The Fed wishes

for 2%, but it never seems to reach that target. The problem is fiscal policy, but Yellen

wishes for the price rise anyway, and it never comes. She should read Jack

Welch:

"Face reality as it is, not as it was, or as you wish it to

be." Jack Welch

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative (non-correlated)

investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).