Friday’s Stock Market Decline: Complacency vs. New Fed

Policy?

by the Curmudgeon with Victor Sperandeo

Introduction:

US stock indexes and sectors

suffered their biggest losses in two and half months Friday, as bullish traders

and financial institutions suddenly and unexpectedly became uncertain and

unhinged after months of calm, upward bias trading, despite deteriorating

economic fundamentals.

The NASDAQ and S&P 500

each lost 2.5%, while the small cap S&P 600 shed 3% and the Russell 2000

index was down

3.11%. Popular sectors were equally hard hit.

The Dow Jones Utility Average dropped 3.8%, while the Philadelphia Semiconductor

Index lost 3.7%.

Declines led Advancing issues

by a roughly 15-1 ratio on the NYSE and 6-to-1 on the NASDAQ. Volume rose solidly across the board, leaving

no doubt about institutional selling (most likely hedge funds and computerized

traders with quick trigger fingers).

Traditional stock market

hedges, like Gold stock ETFs, lost even more than the popular averages or

sectors.

·

Market Vectors

Gold Miners ETF (GDX) dropped -5.34% [Curmudgeon owns several hundred

shares and is not selling]

·

Market Vectors

Junior Gold Miners ETF (GDXJ) cratered by -7.09%

·

Direxion Daily Junior Gold Miners ETF (JNUG) was down

-21.00%

The Curmudgeon and Victor

provide their different market perspectives on Friday’s decline in this

article. Fasten your seat belts!

Curmudgeon Comments:

Many attribute Friday’s stock

market sell-off to a speech that same morning by Boston Fed President Eric

Rosengren who (like so many other Fed officials) hinted at a rate

increase. The Curmudgeon strongly

disagrees!!!

First, the Financial Select

Sector SPDR Fund (XLF) declined 1.80% along with banks shares (e.g.

Wells Fargo lost 2.36%; CitiGroup was down

1.30%). A Fed rate increase would

benefit financial and bank stocks, which should have rallied if investors were

so confident of a rate hike this September.

Second, the Saturday NY

Times published a Reuters article which mostly attributed the stock

sell off to North Korea’s nuclear test.

“Shares

fell on Friday as investor nervousness increased after a nuclear test by North

Korea, and comments from officials at the Federal Reserve led investors to

think that interest rates might be raised sooner. North Korea conducted its

fifth and biggest nuclear test and said it had mastered the ability to mount a

warhead on a ballistic missile, increasing a threat to its rivals.”

Instead of fixation on the

Fed, we think that investor complacency was so prevalent and sentiment so

bullish that any excuse could be used to trigger a sharp market decline.

We warned in a blog post earlier this

week that the disconnect between all-time high stock prices and the weak real

economy/negative profit growth/declining earnings estimates/negative corporate

guidance, etc. would end very, very badly.

While the timing of what we perceive as an “all assets decline” is

uncertain, it could start any day with no warning flags. We believe such a

decline is way overdue in bonds, stocks, REITs, and residential real estate

(especially in the SF Bay area).

The Fed has repeatedly

alluded to interest rate hikes so many times this year that it’s now perceived

as “the boy who cried wolf.” Most

recently (August 26th) Fed Chair Janet Yellen shouted “The case to

raise rates has strengthened in recent months.” US equity markets yawned. The NASDAQ 100 and Russell 2000 made new all-time

highs this past Tuesday and Wednesday while the S&P 500 < 1 point from a

new all-time high. All on continuing

earnings guidance downgrades as reported last week.

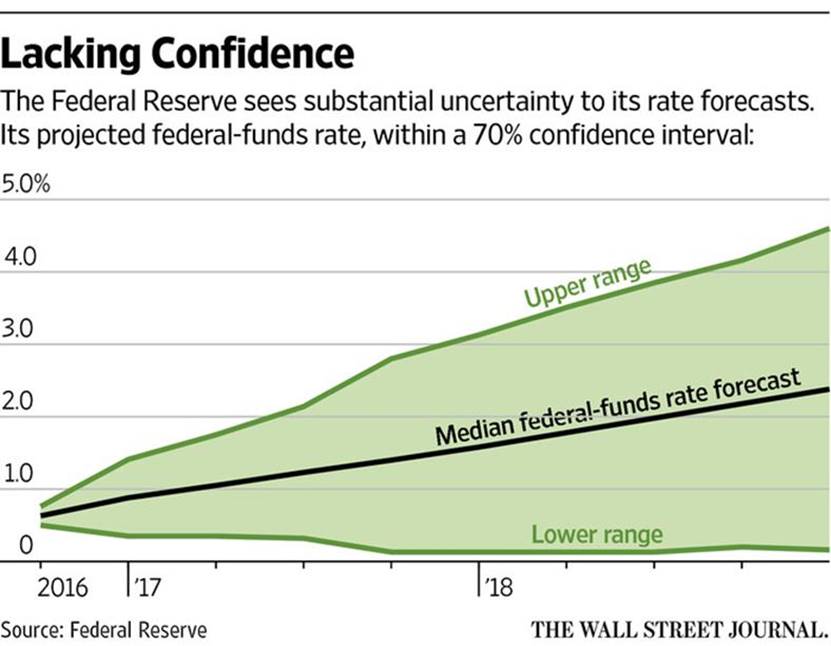

The Fed’s own internal

forecasts vary so widely, they’re useless for accurately assessing where rates

may be in the future. That’s shown in

this chart, which was shown by Doubleline’s Jeffrey

Gundlach on a webcast last Thursday:

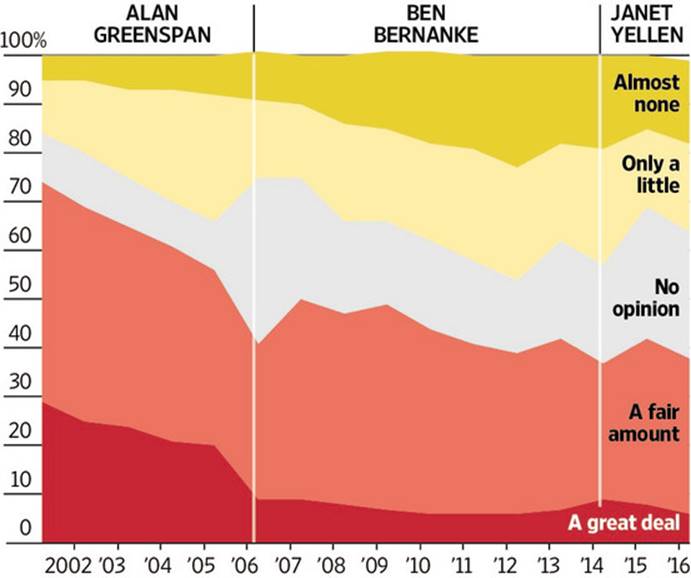

That “lack of faith in the

Fed” is depicted in the chart below, which is a response to the question: How much confidence do you have that the

Fed leader will do the right thing for the economy? Only 8% of current respondents have a “great

deal” of confidence in the Fed vs ~28% in 2001, when the survey first began and

“maestro” Alan Greenspan was Fed Chairman.

Courtesy

of Wall Street Journal

As a result, no one really

takes the Fed seriously anymore, especially when a Fed official says or hints

they’re going to raise rates. Traders

may jump on that news, but longer term investors seriously don’t believe the

Fed will raise rates anytime soon.

The CME

Fed Watch Tool, which is based on CME’s 30-Day fed-fund

futures prices, did have an uptick in the probability of a 25 bps Fed Funds

increase at the September FOMC meeting.

It’s currently 24% vs 18% the previous day. The Fed Watch tool probability should be more

like 75% for a rate hike to actually occur at the Fed’s September meeting.

………………………………………………………………………

What

Rosengren Really Said (Curmudgeon):

Mr. Rosengren only mentioned

that asset markets COULD become too ebullient IF the Fed

waited too long to raise rates. He later softened that remark by saying the

risk of raising rates is two sided.

Here’s what he actually said, according to the Boston Fed’s website summarizing

his speech (there’s also a video replay option on that website).

Rosengren

noted that waiting too long to tighten could lead to conditions that require

more rapid increases, risking a more pronounced slowing of growth and rise in

unemployment. It may also allow some

asset markets to "become too ebullient," and he reiterated previous

concerns over commercial real estate prices.

"The

risks to the forecast are becoming increasingly two-sided, in my view,"

Rosengren explained. "Weakness emanating from abroad poses short-term

downside risks to the domestic U.S. economy," yet there are also

"longer-term risks from significantly overshooting the U.S. economy's

growth."

Victor’s Comments:

I believe that traders

reaction to Rosengren’s remarks caused the markets to

drop on Friday – the biggest fall since June 24th - the day the UK

voted to leave the EU (BREXIT).

The Fed has never said before

that assets had "become too ebullient." Instead, the Fed has said

over and over, that interest rate increases they control (Fed Funds and

Discount Rate) were "DATA DEPENDENT."

That means a Fed rate rise is dependent on data showing the economy is

strengthening and inflation is at or above the Fed’s 2% target rate. Do you really think either of those is

happening?

To bring the obvious into the

policy mix – that asset bubbles have been created and could get bigger- throws out the data dependent or weak economy

EXCUSE that keeps the Fed from raising rates and thereby props up the

markets. It puts into play "a

new REAL reason" to raise rates: to prevent asset bubbles from getting

bigger.

This shock and awe surprise

statement is substantial. If the Fed decides to raise rates to prevent asset

bubbles from getting bigger, it’s over for all assets, except gold and

cash. The greatest bubble is in

bonds/debt; then equities, then real estate.

If the equity markets are

down on Monday by over 2% and volume expands above Friday's NYSE 1,080 billion

shares this is likely the beginning of the end for the huge bubbles in so many

asset classes.

THE BELL IS RINGING AND THE

FAT LADY IS SINGING! Until the Fed

realizes it shot itself in an artery before the election, changes its tune and

retracts the Rosengren remark that assets had "become too ebullient."

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).