S&P 500 Earnings Continue to Decline as EPS Estimates

are Lowered

by the Curmudgeon

Introduction:

We’ve previously called attention to the decline in S&P 500 earnings for

the last 5 or 6 quarters (depending on the data source), while stock prices

rose sharply: S&P 500 Earnings and

Estimates Decline as Stock Prices Soar

This short post is an update that shows EPS estimates continue to be ratcheted

down from their widely optimistic levels.

That is why we are not a believer in “forward earnings” - the analysts

are almost always wrong!

FactSet

Earnings Insight, Sept 2,

2016:

Negative Earnings Growth: For Q2 2016, the blended

earnings decline for the S&P 500 is -3.2%. The 2nd quarter

marked the first time the index has recorded five consecutive quarters of

year-over-year declines in earnings since Q3 2008 through Q3 2009. For Q3 2016, 78 S&P 500 companies have

issued negative EPS guidance and 33 S&P 500 companies have issued positive

EPS guidance.

During the past year (four quarters), the average

decline in the bottom-up EPS estimate during the first two months of a quarter

has been 3.9%. During the past five years (20 quarters), the average

decline in the bottom-up EPS estimate during the first two months of a quarter

has been 3.4%. During the past 10 years, (40 quarters), the average decline in

the bottom-up EPS estimate during the first two months of a quarter has also

been 3.8%. Thus, the decline in the bottom-up EPS estimate recorded during the

first two months of the third quarter was smaller than the one-year, five-year,

and 10-year averages.

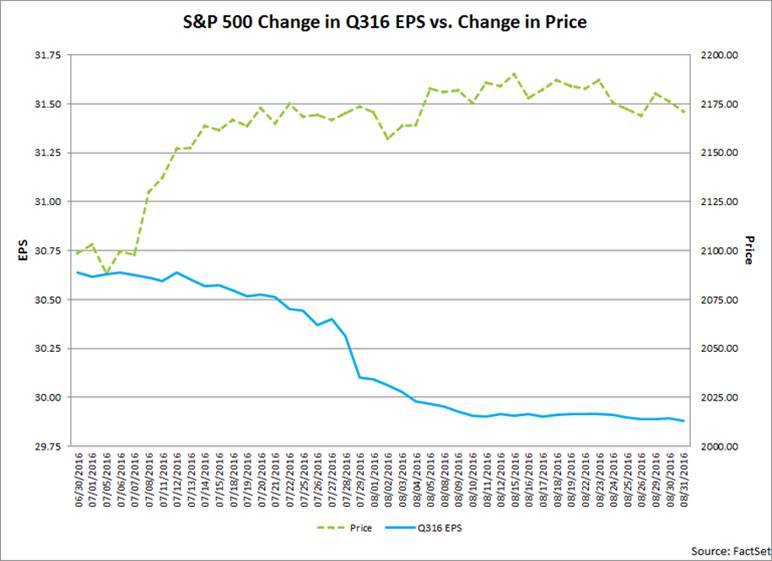

As the bottom-up EPS estimate declined during the first

two months of the quarter, the value of the S&P 500 increased during this

same time frame. From June 30 through August 31, the value of the index

increased by 3.4% (to 2170.95 from 2098.86). This quarter marked the 16th time

in the past 20 quarters in which the bottom-up EPS estimate decreased during

the first two months of the quarter while the value of the index increased

during the first two months of the quarter.

Chart

Courtesy of FactSet

…………………………………………………………………….

Thomson

Reuters I/B/E/S, Sept. 2, 2016 (subscription required):

Second quarter earnings are expected to decline 2.2% from

Q2 2015. In the S&P 500, there have been 73 negative EPS pre-announcements

issued by corporations for Q3 2016 compared to 28 positive EPS

pre-announcements. By dividing 73 by 28 one arrives at a Negative/Positive

ratio of 2.6 for the S&P 500 Index.

That means there are 2.6 times as many negative earnings guidance vs.

positive earnings guidance announcements for Q3 2016.

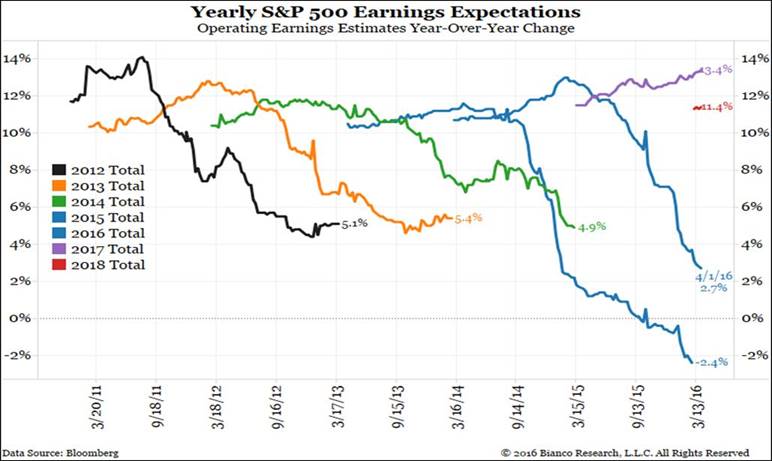

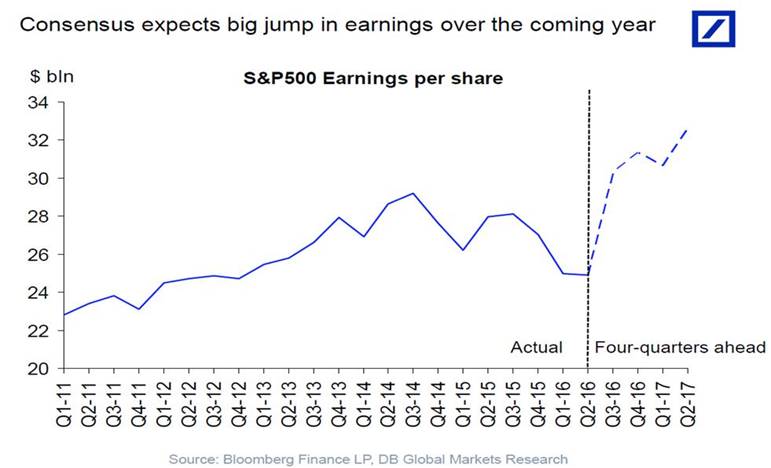

DoubleLine Webcast, by Jeffrey Gundlach on Sept 8, 2016:

Earnings estimate start out at 10% -to- 12% higher each

quarter, but then decrease substantially- lately to NEGATIVE growth as per this

chart:

The trend of analyst earnings estimates way off the mark

continues. It’s a “triumph of hope over

experience” as per this chart (note that earnings peaked in 3Q-2014):

Gundlach

had a couple of gem-like quotes on the webcast:

“When you hear a forecaster say "never," it's

about to happen!”

“Coming to an end:

a world of negative interest rates, QE forever, long term interest rates

in a never ending decline. We are about

to see interest rates rise, albeit gradually.”

Gundlach thinks the US 10-year T Note will be higher

between now and year end, possibly in the low 2% range.

Leuthold Weeden - Perceptions for the Professional, Sept 2016 (subscription

required):

Despite the overall rising numbers of analyst coverage,

accuracy of consensus estimates on EPS hasn’t improved. Deviation of actual

reported earnings from consensus have jumped higher post 2008-2009. Even though it’s much easier for analysts to

get top-line estimates right (judging by the much lower sales-surprise

figures), investors focus more on the bottom line. Again, our data shows that this

phenomenon is more evident among Small Caps, especially since the financial

crisis. Small companies fail to attract analyst coverage, and the quality of

the coverage they do have is declining, leaving them prone to larger price

movements on earnings release day.

Conclusions:

It is truly

unbelievable that despite negative earnings and productivity growth, extremely

weak US and global GDP, various economic gauges declining, etc. US stock prices

could be at or within ½ % of all time high’s.

The NASDAQ 100 (QQQ ETF) has a (past 12 months) P/E ratio of

24 and quietly made two new all-time highs in the three trading days this

week! The Russell 2000 (IWM ETF) also

hit all time high’s this week. It has an

infinite (nil) P/E ratio which was 82.89 one year ago in expectation of much

higher earnings that never materialized.

We are baffled,

flummoxed, and frustrated by this continued “great disconnect” between

levitating stock prices and the real economy/negative earnings growth. While we don’t know when this will end, we

know from over a half century of watching markets that it will end very, very

badly.

End

Quote:

From hedge fund

titan Paul Tudor Jones in a letter

to limited partners obtained by Bloomberg:

“We have to

think outside the box…. I firmly believe the changes we have made put us in a

position to be successful even in this desultory macro environment.”

“This suppression

of rates (by global central banks) is perversely encouraging our government

officials to pursue an ever increasing buildup of sovereign debt in exchange

for the short term stability they so avidly seek."

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).