Market Now Unconcerned About Fiscal Cliff Fallout As

Fed Pumping Accelerates

by The Curmudgeon

This Thursday,

the U.S. Congress passed a continuing resolution to fund the government until September

30, 2013. The vote of 318-109 in the House of Representatives and 73-26 in the

Senate was sufficient to avoid a government shutdown on March 27. The House passed the bill as amended by the

Senate. It reflects the $85 billion sequester (forced U.S. government spending

cuts) for the rest of year. But this

stop-gap bill really just "kicks the can down the road" with hard

decisions and comprises required in a few months.

Congress faces very serious budget issues for fiscal year

2014 (which begins October 1st). In addition to discussing and agreeing on the

2014 budget, the federal debt limit will be reached in late May and a new

budget bill must be passed by July or August. There could be very contentious

negotiations again later this summer.

What puzzles

the CURMUDGEON is that the market sold off immediately after Obama's

re-election in November 2012 due to potential negative economic impact of going

over the Fiscal Cliff. But since late

November, the market has rallied strongly- even though we've gone over two

cliffs already- the payroll tax was raised on January 1st and the automatic

federal government spending cuts (sequestration) kicked in on March 1st and

will remain in effect for the rest of the 2013 calendar year. And we really do NOT have Congressional

agreement on a sustainable federal government budget (beyond the next few

months). So one must assume the market has cast aside its concerns over the

negative economic consequences of falling over the fiscal cliff(s), which will

surely reduce GDP and corporate profits.

Meanwhile, few

in the mainstream media have called attention to the harmful consequences of

Fed debt monetization.

1. The

ballooning balance sheet

of the Fed stands at $3,208,553,000 Million as of March 20, 2013.

If the Fed

keeps up its $85B a month purchases of debt securities its balance sheet will

be at $4T by year end. How long can this

Ponzi scheme continue? If other major

currencies weren't so weak, we think the U.S. $ would have collapsed quite some

time ago! And there's the possibility of

hyperinflation if the Fed doesn't sell the securities it has purchased as money

velocity and loan demand pick up (as they should in any true economic

recovery). At that point monetary

inflation will become real headline inflation.

The CURMUDGEON

has written several articles

about the many dangers the Fed's exponentially increasing balance sheet poses

for the U.S. economy. We've referred to

this as a "no win scenario." But the stock market is ignoring those

dangers.

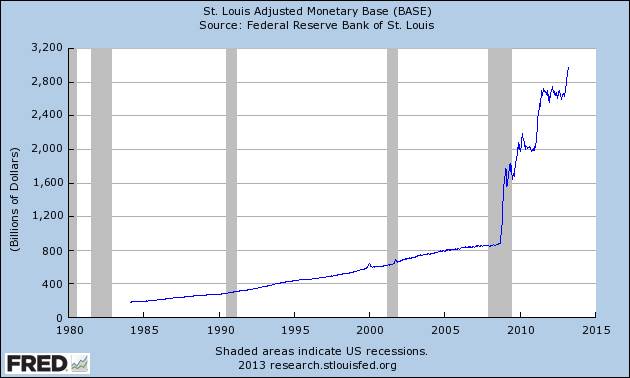

2. Meanwhile, the Adjusted Monetary Base (high

powered money that can multiply when there's strong loan demand) has recently exploded

higher and has reached $2,976.579B as of March 20th! Again, this excess liquidity has potential

inflationary consequences when money velocity and loan demand pick up.

The Adjusted

Monetary Base is the sum of currency (including coin) in circulation outside

Federal Reserve Banks and the U.S. Treasury, plus deposits held by depository

institutions at Federal Reserve Banks. These data are adjusted for the effects

of changes in statutory reserve requirements on the quantity of base money held

by depositories.

Again, the

market ignores this monetary inflation. What

me worry? That's the day after tomorrow's problem. It seems the market only cares about today -or

maybe just the last few minutes of trading, e.g. 20% of SPY volume on Friday

March 22th occurred in the last minute of trading as the granddaddy ETF spiked

sharply higher as the market close).

Michael Pento seems to agree with the Curmudgeon' position on the

reckless Fed and overvalued stock prices (based on future corporate earnings

which we think will be drastically less than forecast).

Here are a few

quotes from his latest blog post titled: Equity Bubble is Based on Unsustainable Earnings

"To believe that stock prices are now fairly

valued investors must also be convinced that massive deficits, free money and

central bank debt monetization can be reversed without affecting the economy and

corporate earnings."

"Whenever the Fed finally backs away from all

its money printing, equity prices will suffer, as investors begin to receive a

real rate of return on fixed income and their bank deposits. Rising interest

rates will send service payments on corporate, private and government debt

skyrocketing and that will severely hamper economic growth. The economic

fallout from the end of artificial stimuli cannot (in the short term) be

supportive of the level of corporate profits."

"If market forces were allowed to prevail and

the government permitted the economy to deleverage, earnings of U.S.

corporations would be in a depression. And the price to earnings ratio would

reveal that stock prices are already in a bubble. A bubble

that is only becoming more dangerous with each day of the Fed's money

printing."

That's a lot to

think about!

Till next time.....................................

The Curmudgeon

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.