What Causes Productivity Growth; Are Taxes Critical to

the Result?

by Victor Sperandeo with the Curmudgeon

Disclaimer (Curmudgeon):

All opinions expressed herein are those of Victor Sperandeo,

unless otherwise noted. Many of the bolder ones are in italics font.

Introduction (Curmudgeon):

The recent downturn in productivity has been remarkable! On September 1st, the WSJ reported

that US Productivity Drop in Second Quarter Revised to 0.6% Rate. It’s been the longest stretch of falling

worker productivity since the end of the 1970s as per the above referenced WSJ

article and this

Bloomberg video.

The Curmudgeon’s views on the US productivity problem have been

detailed in this previous post. With the exception of bringing back high tech manufacturing and

hardware engineering, we have no strong suggestions to increase US productivity

growth.

Background (Victor):

I wrote about where the world is headed in last weekend’s blog post, because of the

worldwide move towards higher taxes and regulation, coupled with a reckless,

distorted monetary policy (which has never been used before in the history of

mankind).

Extraordinary monetary policy has been and continues to be a

failed experiment to stimulate economic growth in lieu of traditional

Capitalism. This “Frankenstein”

monetary policy has negatively impacted the growth in productivity to a large

degree, perhaps never seen in the 240 year history of

the US.

Productivity is so important that its continued decline will

cause negative economic growth. Without growing productivity, the US as a

nation will go backwards into the 18th century!

Productivity definition (Victor):

“A measure of the efficiency of a person, machine, factory,

system, etc., in converting inputs into useful outputs. Productivity is

computed by dividing average output per period by the total costs incurred or

resources (capital, energy, material, personnel) consumed in that period.

Productivity is a critical determinant of cost efficiency."

A Flawed Prescription for Increasing Productivity (Victor):

A recent Financial Times

article titled: The US productivity puzzle: what policies are needed, by

Sam Fleming (on line subscription required) makes some contradictory points on

productivity, which I would like to address and refute in this article.

Mr. Fleming’s sources include the very progressive “think tank” Brookings Institute. The crux of his

argument is the following text:

"The

justification for taking action on business taxes is the U.S. has the highest

statutory rate among advanced economies, which may at the margin be deterring

companies from investing here, according to Martin Neil Baily, a former

chairman of the Council of Economic Advisers under Bill Clinton who is now at

the Brookings think-tank. He advocates lowering the headline rate while

broadening the tax base.

The problem with

focusing too much on corporate tax, however, is that America’s rates are in

effect lower than the headline rate appears. What is more, countries with

extremely low rates — such as Ireland — have also seen ebbing productivity

growth, says Mr. Duke. “There is no statistically significant relationship

between corporate tax cuts and the size of the productivity slowdown,” he

wrote in a report last week.

He argues instead

that more needs to be done to stimulate aggregate demand, which will induce

companies to spend more, and that wages need to be pushed up to encourage

business leaders to invest more and substitute capital for labor."

The Proposition

(Victor):

Economics is a complex subject. Whatever someone wants to say

can be twisted, manipulated, distorted, misrepresented, and exaggerated, to fit

one’s narrative.

This is what Martin Neil Bailey attempted to do by saying:

"What is more, countries with extremely low tax rates - such as Ireland

-have also seen ebbing productivity growth."

Using Ireland as an example is not the reality of "ebbing

productivity!"

It is about

trying to sell a Keynesian ideology of "stimulating aggregate demand"

by printing money and borrowing to make government bigger and the people

poorer.

The Answers

(Victor):

Productivity

has to do with investing in machinery and manufacturing, while having

access to the lowest labor costs possible along with low (or at

least reasonable) corporate taxes to manufacture something

tangible. Where do you find such

factors? China, Vietnam, and Mexico.

Companies go to Ireland for low taxes true, BUT NOT for

manufacturing, which is what creates productivity. Ireland's minimum wage is

9.15 Euros or $10.34 an hour (at today exchange rates). Mexico's minimum wage

is $ 4.25 PER DAY (which can be 12 hours+).

Therefore, Ireland attracts Social Media companies like

Facebook, Google, Microsoft, and Apple.

The latter consumer electronics behemoth produces its parts in many

countries, including: Japan, South Korea, Taiwan, China, and other nations. The

iPhone is "made in China" where most of it is put together. That’s due to low wages and a low tax rate of

15%-25%.

Low corporate tax rates are a MAJOR FACTOR that creates the

incentive to manufacture, and produce, as it INCREASES the RATE OF RETURN on

investments- period!

Without the expected high return on these risk/reward

investments -nothing, or little, gets manufactured (see the USA)!

Achieving Higher Productivity (Victor):

To get to higher productivity you need SEVERAL important

attributes:

1- Manufacturing (Tangible Products)- see Mexico sidebar

below

2- Competitive wage rates

3- Low (competitive) corporate tax rates

4-A stable currency

5- Very few or virtually no regulations (which raise costs and

discourage manufacturing)

Lower tax rates are one MAJOR FACTOR, but would be negated with

relatively high wage rates. In the US, which was the target for raising

productivity, you can't lower wages to compete with Mexico. But you can lower

taxes! What Donald Trump suggested was a 15% corporate tax rate. For reference,

Mexico’s is 30%.

That would be a big offset to bring manufacturing back to the

US. It would be far better to make the corporate tax zero for manufactured (and

all) goods.

Moreover, my economic recommendations are not rogue thoughts!

I’d now like to refute and retort the "Bottom Line" on Mr. Baily's

point, which is: "The problem with focusing too much on corporate

tax...There is no statistically significant relationship between corporate tax

cuts and the size of the productivity slowdown.”

Respected

Source on Negative Effects of Taxes on Economic Growth:

In contrast to the progressive Brookings Institute, let’s

look at what the prestigious non-partisan "Tax Foundation” wrote in

an article titled: What

Is the Evidence on Taxes and Growth?

So what does the

academic literature say about the empirical relationship between taxes and

economic growth? While there are a variety of methods and data sources, the

results consistently point to significant negative effects of taxes on economic

growth even after controlling for various other factors such as government

spending, business cycle conditions, and monetary policy. In this review of the

literature, I find twenty-six such studies going back to 1983, and all but

three of those studies, and every study in the last fifteen years, find a

negative effect of taxes on growth. Of those studies that distinguish between

types of taxes, corporate income taxes are found to be most harmful,

followed by personal income taxes, consumption taxes and property taxes.

Curmudgeon Notes:

In the interest of fairness, balance and full disclosure:

1. The Center on Budget

and Policy Priorities published a rebuttal

to the Tax Foundation paper Victor cites

above. We wonder why it took them 14

months to produce their rebuttal paper?

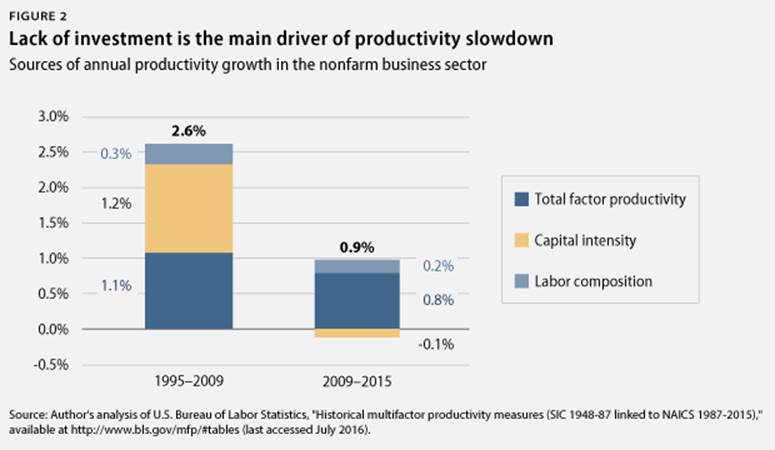

2. In a Sept. 2, 2016 paper,

by the Center for American Progress maintains that the main reason for

slowing productivity is lagging capital investment (CAPEX). That’s documented in this graph:

Chart courtesy of Center for American Progress

The article then states: “Tax cuts will not do the trick.” Instead, they suggest:

“A more promising

way to raise investment is to raise aggregate demand. Businesses are unlikely

to invest in new plants and equipment when they think a weak economy will

translate into weak sales…. increased infrastructure spending—will cause

companies to raise investment as they expect stronger sales as a result of job

and wage growth.”

………………………………………………………………………………………………………….

Sidebar: Increased

Productivity of Mexico’s Manufacturing Sector

Mexico is an important nation that manufactures tangible

goods. That’s because of very low wage

rates, a weak currency, reasonable tax rates of 30%, and it’s on the border of

the US. According to a March 27, 2014 WSJ

article:

“Productivity—or average

hourly output per worker– has increased 5.8% a year in Mexico’s large modern

companies since 1999.”

The top export categories and the percentage share each export

category represents in terms of overall exports from Mexico:

◦

Vehicles: US $90.4

billion (23.7% of total exports),

◦

Electronic equipment:

$81.2 billion (21.3%),

◦

Machines, engines,

pumps: $58.9 billion (15.5%),

◦

Oil: $22.8 billion

(6.0%),

◦

Medical, technical

equipment: $15.2 billion (4.0%), etc.

Mexico has become even more of a manufacturing power house since

then. The story of how that happened is in this

backgrounder article.

When machinery is used for manufacturing, productivity in

Mexico has been very strong. It has

increased from 91.90 Index Points in January of 2009 to 108.40 Index Points in

May of 2016, as noted here.

This March, the Samsung Group inaugurated Samsung Tijuana

Park, a vertically integrated production site that represents total

investments of US$ 200 million. Samsung Electronics, Samsung Display Devices

and Samsung Electron Mechanics started simultaneously producing color TVs and

TVCRS’, color picture tubes and tuners among other products. That's a

testimonial to Mexico’s manufacturing prowess and foreign direct investment!

…………………………………………………………………………………………………………

Victor’s Conclusions:

The US must stop, and retract, the mandated EPA laws, and

mandated health care laws, as none of these exist in Mexico, or in other

manufacturing countries. Lastly, allowing states to determine minimum wage laws

all would make the US competitive, and bring manufacturing back to the US,

which would therefore increase productivity.

The US wage rate is much higher than the world, and the US can't

compete in that area. But it can compete in Taxes, Regulations, and a Stable

Currency. Those are the areas of where the US can achieve greater

productivity.

Once again, it’s crucial to bring back manufacturing

-especially high tech manufacturing- to the US.

That would tremendously help US manufacturing (and hardware

engineering) workers, many of whom have been “thrown under the bus,” as their

jobs were outsourced to China and other Asian countries.

Curmudgeon Notes: The Curmudgeon concurs and believes the key

to achieving higher US productivity is to bring back real engineering and high

tech manufacturing, such that leading edge IT products are designed and made in

the US. Few realize that almost all

computers of every type are now designed and built in China, Taiwan and South

Korea!

Have you seen a smart phone or tablet designed and made in the

US?

End Quotes:

1. Henry Ford II said

something profound related to my comments on how to improve productivity:

"It is worth remembering that output per man in this

country’s as increased, on average, about two per cent a year during this

(20th) century."

That’s not done by selling cosmetics at Macy's, but by

manufacturing the cosmetics.

2. The words of Bernard

Baruch, again echo in my mind:

"Unless each man produces more than he receives, increases

his output (by productivity), there will be less for him and all others."

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).