The Productivity Paradox – US Economic Long Term Growth

Threatened

by the Curmudgeon

Executive

Summary:

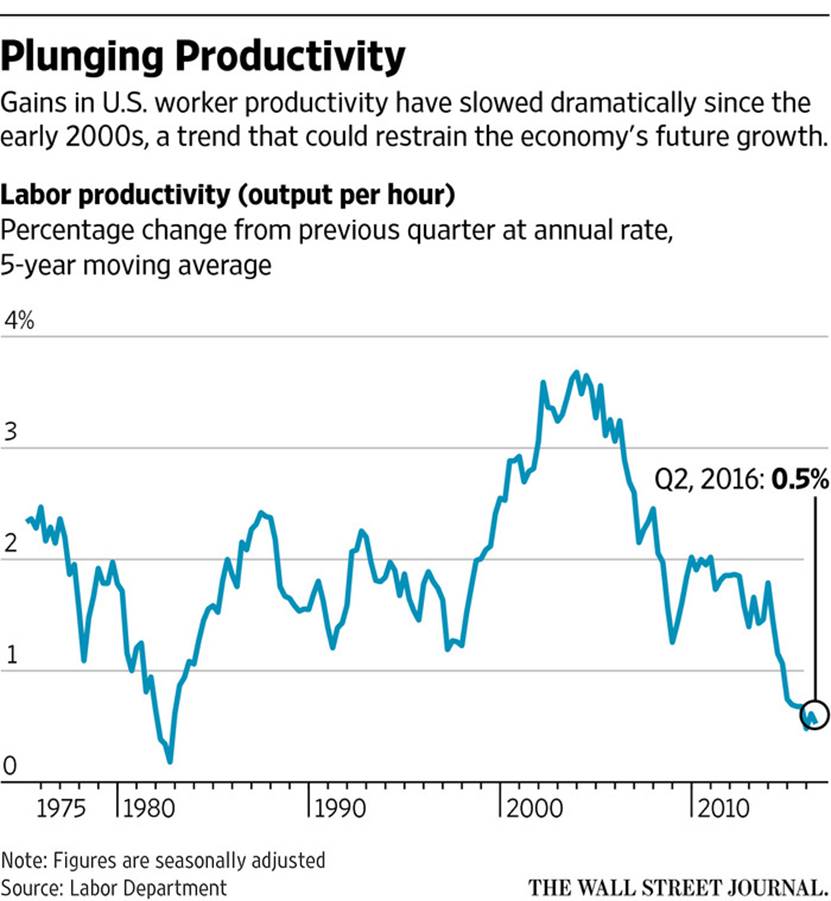

The Labor

Department (BLS) reported

today that Non-farm business productivity—the goods and services produced each

hour by American workers—decreased at a 0.5% seasonally adjusted annual rate in

the 2nd quarter and down 0.4% from a year earlier, the first annual

decline in three years.

Manufacturing

sector labor productivity decreased 0.2% in the 2nd quarter of 2016,

as output and hours worked decreased 0.8 percent and 0.7%, respectively. Output

per hour increased 2.6% in the durable goods manufacturing sector reflecting a

2.0% decline in hours worked and a 0.5% increase in output. Productivity

decreased 4.1% in the non-durable goods sector in the 2nd quarter of

2016, following a 4.0% 1st quarter increase. Over the last four

quarters, manufacturing productivity increased 0.9%, as output increased 0.3%

and hours worked declined 0.6%.

We called

attention to declining productivity growth in Sunday’s Curmudgeon post,

but it appears no one paid attention to that important item as there were no

Twitter comments or emails received. Little

did we know it would get worse, rather than better!

This was the

third consecutive quarter of falling productivity, the longest losing streak

since 1979. That was a further step down from already tepid average annual

productivity growth of 1.3% in 2007 through 2015, itself just half the pace

seen in 2000 through 2007, and the trend shows little sign of reversing.

“In the short

term, it’s hard to be anything other than pessimistic, just because this has

been going on for so long now,” said Paul Ashworth, Chief U.S. Economist at

consultancy Capital Economics.

Comment

and Analysis:

Persistently

weak productivity could weigh on American living standards by restraining the

economy’s ability to grow quickly and generate higher incomes without igniting

inflation. Already, some economists say slow productivity may be restraining

wage growth. More importantly for stock

market participants, stagnant productivity and rising labor costs could further

squeeze corporate profits, which have been under pressure from extremely weak

business investment, financial engineering (see previous Curmudgeon posts), and

the energy sector’s problems.

“It’s a

signal that the economy is not going very fast and interest rates should stay

low,” said IHS Global Insight economist Patrick Newport. “If we see no growth,

which is what we’ve seen over the last year, it would matter a lot.”

The economy’s

potential future growth will be slower than previously expected unless

productivity recovers, and their economic projections suggest Fed officials

“see current policy as less accommodative, the labor market as less tight and

inflationary pressures as more limited,” former Fed Chairman Ben Bernanke said

Monday. The policy implications, Mr.

Bernanke said, “are generally dovish, helping to explain the downward shifts in

recent years in the Fed’s anticipated trajectory of rates.”

Business

investment has been a notable sore spot for the economy in recent months. A

closely watched measure of business spending, fixed nonresidential investment,

has declined for the past three quarters, according to Commerce Department

data. A proxy for spending on new equipment—new orders for non-defense capital

goods excluding aircraft—has declined on a year-over-year basis almost

continuously for the past year and a half.

Reference: Is the Fed Responsible for Declining

Productivity Growth?

Our esteemed

colleague Tim Quast of Modernir (big data/analytics

for the stock market) was interviewed by CNBC’s Rick Santelli today about the

BLS reported decline in US productivity. You can watch the short video clip of

the interview here.

One of many

key points Tim made was that “the Fed is diminishing the value of capital,

which is undermining productivity growth.”

There were many other profound and relevant comments.

Rick

Santelli’s closing response:

"Central bankers are certainly not considering Tim's arguments

(that Fed is undermining productivity)."

We ask WHY NOT?

In a follow

up email, Tim wrote: “Fed (monetary policy) is core to our productivity

problem, which I don’t think we can solve until Congress absolves the Fed of

its dual mandate and instead vests it with simply sustaining a stable

currency.” We couldn’t agree more!

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian,

economist and financial innovator who has re-invented himself and the companies

he's owned (since 1971) to profit in the ever changing and arcane world of

markets, economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters and

other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).