China

Update: South China Sea Expansion, Economic War, Market Reaction

and Failures of Communism

by Victor Sperandeo with the Curmudgeon

Introduction:

A respected hedge fund manager told the Curmudgeon last week that the rally in

risk assets (off the mid-February 2016 lows) was due to global central banks

expansion of their extraordinary “easy money” policies, such as more QE and

negative interest rates (e.g. ECB and Bank of Japan, Australia, etc.). The global central bank actions were intended

to prevent China's economic weakness from dragging the global economy into a

severe recession.

In this post, Victor provides his perspective on China's

territorial expansion in the South China Sea, a possible economic war as a

result, and the markets possible reaction to it. China's debt bomb is explained in the

context of its economy and Communist political framework. Victor concludes by demonstrating why

Communism anywhere, but especially in China, can't succeed.

As usual, all opinions expressed herein are those of Victor

Sperandeo.

China's Territorial Expansion & Why it Matters:

China's "expansion" is focused on the manmade islands

they built in the South China Sea1. While they claim it's China's

territory, many South East Asian nations disagree. This effects "1.4 million square miles

of ocean" and "more than 10% of the worlds fishing," in what had

been previously considered international waters.

Note 1. The disputed territories are located between

Brunei, China, Malaysia, Philippines, Taiwan, and Vietnam. The islands built in

the South China Sea, include the Paracel Islands, the Pratas Islands,

Scarborough Shoal and the Spratly Islands.

According to a resent NY Times article:

"China has

placed runways and radar facilities on new islets in the South China Sea, built

by piling huge amounts of sand onto reefs. The construction is straining

already taut geopolitical tensions.

China’s activity

in the Spratlys is a major point of contention

between China and the United States, and has prompted the White House to send

Navy destroyers to patrol near the islands twice in recent months.”

Curmudgeon Note: All the radar systems, lighthouses, barracks, ports and

airfields that China has constructed on its newly built islands in the South

China Sea require tremendous amounts of electricity, which is hard to come by hundreds

of miles from the country’s power grid.

China is considering

floating nuclear reactors to provide such electrical power.

Victor's Opinion: China's island building is similar to

Russia's annexation of Crimea, but it's actually far worse because it effects

most of the world (not just the people of Ukraine). Yet almost no world leader has said a word

about it!

…………………………………………………………………………………………...

From a May 19th CNBC article:

"The

so-called "nine-dash line" that China has drawn over most of the

South China Sea — a gargantuan territorial claim that stretches about 1,200

miles from its shores — would give Beijing control over a zone that's estimated

to handle about half of global merchant shipping, a third of the planet's oil

shipping, two-thirds of global liquid natural gas shipments, and more than a

10th of Earth's fish catch. The Obama administration, backed by several Asian

governments and entities such as the Brookings Institution, argues that such

massive ocean claims at great distance from land are "inconsistent with international

law."

"The Chinese

people do not want to have war, so we will be opposed to [the] U.S. if it stirs

up any conflict," said Liu Zhenmin, vice

minister of the Ministry of Foreign Affairs. "Of course, if the Korean War

or Vietnam War are replayed, then we will have to defend ourselves."

Economic War with China?

Liu Zhenmin's above statement against

the US and the many other Asia countries in the region is truly incredible.

President Obama would never go to war with China, and most likely would

apologize for questioning them, but perhaps some form of economic retaliation

against China could occur.

At a minimum, a huge import tax on Chinese products by the US,

Europe, and Japan might be put into effect.

That would cause chaos, mayhem and recession/depression virtually everywhere.

How would China handle the economic pain of US and/or European

economic retaliation, and what would it mean to the world economies?

Xi Jinping, President of the People's Republic of China &

Head of the Communist Party, is now trying to eliminate "corruption” that

resulted in wealth creation, not the corruption that facilitated the ease of

doing business by the elites in China.

Xi Jinping is also a Mao admirer.

Who knows what he'll do if the US stands up to China's takeover of

the South China Seas.

Curmudgeon Comments:

Now more than ever before, the global economy is dependent on a

strong Chinese economy, such that a decline in China's exports (via a newly

imposed import tax) would result in a commensurate decline in China's imports

of raw materials and spending. That

would be a huge economic blow to countries like South Korea, Australia, Canada,

Brazil, Chile, and other developing nations.

As Victor points out below, China's economy continues to slow

and is likely weaker than the government reports. That's not likely to change anytime

soon. Consider a May 22, 2016 South

China Morning Post on-line article “Corporate

insolvencies in China seen to rise by a fifth this year as economy slows.” It states that a wave of corporate collapses

is expected in both China and Hong Kong as insolvency cases look set to spike

in a slowing Chinese economy.

“In mainland China, the growing number of company insolvencies

is caused by the economic slowdown and deflationary pressures, which undermine

companies’ profitability. We should also pay attention to the high level of

corporate debt, which had increased to 166 per cent of the GDP in the third

quarter of last year, compared with 124 per cent in 2014,” said Fabrice Desnos, head of Asia-Pacific of credit insurer Euler

Hermes.

…………………………………………………………………………………………...

Sidebar -- War and the Stock Market:

Equity markets virtually never discount war. Let's use World War II as an example of how

markets have reacted to war, by considering Germany's annexation of Austria in

March 1938.

Annexing Austria caused the Dow Jones Industrials (DJI) to

initially decline 26.4%, but it recovered by June and then rallied another

17.9% to new highs by November 1938.

In March 1939 Germany annexed Czechoslovakia and the Dow dropped

another 23.3%, and again came back by September, when Germany attacked

Poland. That caused England and France

to declare war on Germany, while the markets yawned! In March 1940 Germany

invaded the Low Countries and then France in May, which caused a 26.1% DJI

decline in a matter of weeks.

Click here for

an old Fiendbear article on the bear market of 1939-1942.

…………………………………………………………………………………………...

Possible Stock Market Reaction to an “Economic War” with China:

In my view, this controversy, caused by China's territorial

expansionism is going to end badly. An

"economic war" over these South China Sea islands would not be

controllable by the Fed (put) so a "minimum" 20% stock market drop is

a given.

China's economic position today is in a weak state. Recent

economic reports from China continue to be disappointing (e.g. factory orders,

investment, industrial production, retail sales, etc.). That economic weakness is reflected by the

Shanghai Composite. It's only (-6.62%)

from the low of the year set on 1/27/16.

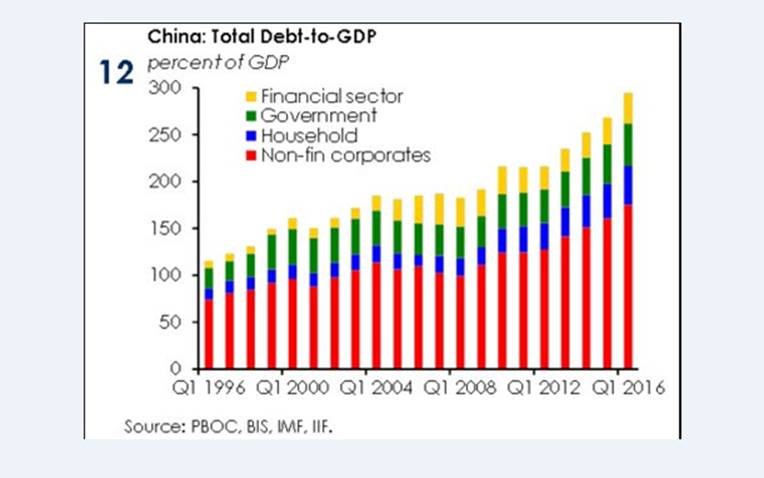

China’s Debt Bomb Getting Bigger:

According to a recent CNBC article

and video:

“China has a debt

problem, and it's likely much worse than most statistics demonstrate... China's total debt-to-GDP ratio is 240 to 270

percent, depending whom you ask, and that's a sizable increase from the roughly

150 percent of a decade ago. And that jump has occurred while China's GDP has

grown strongly — meaning the debt is ballooning wildly.”

The UK Telegraph stated

that China's debt is approaching $30 trillion. The fresh credit created in

China since 2007 is greater than the outstanding liabilities of the US,

Japanese, German, and Indian commercial banking systems combined!

Chart Courtesy of the Telegraph (UK)

Moody's warned this month that China's state-owned entities

(SOEs) have alone racked up debts of 115 % of GDP, and a fifth may require

restructuring. The defaults are already spreading up the ladder from local

State Owned Enterprises (SOE's) to the bigger state behemoths, once thought

(wrongly) to have a sovereign guarantee.

“We all have to

be worried” about China’s mounting debt amid slowing growth, said Blackrock CEO

Lawrence Fink in a Bloomberg Television interview.

“You can’t grow

at 6 percent and have your balance sheets grow faster… In the future, I would

prefer seeing the economy growing 6 percent with some form of de-leveraging,”

Fink added.

Capital Flight from China – Threat to China's FOREX Reserves:

The Indian Express reports

that capital flight, at a rate of about $100 billion a month, threatens to

deplete China’s hoard of $3.23 trillion in foreign exchange reserves in a

couple of years.

Among the factors

responsible for China’s economic woes, the most important ones are domestic.

Cyclically, the Chinese economy has just experienced one of the world’s largest

credit bubbles. The massive creation of credit since 2008 took China’s

debt-to-GDP ratio from 125 per cent in 2008 to around 280 percent. Based on

data provided by the Bank of International Settlements (BIS), non-financial

private-sector debt as of mid-2015 was 200 per cent of GDP. If one adds

sovereign debt (about 40 per cent of GDP) and local government debt (another 30

per cent of GDP, according to Beijing’s estimate in early 2015), China’s total

debt-to-GDP is at least 270 per cent, making China the most highly indebted

emerging market economy. Had China used its capital more efficiently during its

debt binge, the country would not have been in its current plight. But like all

other countries that gorged on credit during boom, China wasted a substantial

chunk of its capital by shoveling investments into real estate, coal mines,

infrastructure, steel mills, automobile plants and other capital-intensive

industries.

The consequence

is costly. A colossal real-estate bubble has left ghost cities around the

country while massive investment has created overcapacity in most manufacturing

sectors at a time when domestic and external demands are both falling.

Victor's Opinion: This is very ominous indeed. Understand this

is not like you can separate government and corporate debt as in most western

nations. The debt and credit are all provided by the Chinese government

directly, or indirectly, through the Bank of China.

Also, China's GDP growth, estimated at 6.5% In 2016 (as reported

by the government), is suspect. Virtually no one believes that number. Few,

if any professionals believe that China will have a "soft landing."

Corroboration from Wells Fargo daily market letter:

According to

author Gordon Chang, the Chinese economy is acting like a scene from the

Phantom as it has drifted past “the point of no return.” He goes on to say: “It is no coincidence that

Chinese leaders are now pressuring analysts and others to brighten their

forecasts and not report dour news, to show zhengnengliang

(positive energy).” That's a sure sign

that Beijing has run out of real options.

China Politics – Why Communism and Central Planning Fail:

Astonishingly, it is rarely stressed that China is still a

"Communist Country." That's

despite China's current leader Xi Jinping has been the “General Secretary of

the Communist Party of China” since November 15, 2012.

China's government permits a limited amount of market capitalism

in order to feed its 1.4 billion million people. (Mao planned to starve 30-45

million people in the 1959-1961 period called the "Great Leap Forward

Famine.")

The Communist writings of Karl Marx can only be implemented by

force. As Mao once said "Political

power grows out of the barrel of a gun.”

I believe that Marxism is a failed philosophy in theory and in

practice, unless force is applied. But even then, it never lasts. For example, the USSR lasted only 72 years

and most were total misery for the people.

As a Communist centrally planned economy, China can never have

continuous and steady growth. The

government desperately wants to avoid even short intermittent recessions for

fear it would increase unemployment and public unrest. With a totally planned economy, China does

not have proper guidance, through market prices, on what is in demand and

therefore what should be produced.

Planning is substituted for free markets and COMPETITION in

China. The latter makes prices of goods

cheaper, and better for all people i.e. consumers and creates real wealth.

The primary ingredient needed for the success of Communism and

Socialism (rarely talked about) is KNOWLEDGE.

However, a Communist Czar can never have the knowledge of a market made

up of 100's of millions of people. To know what is "demanded" and at

what "price" cannot be done.

They cannot know all there is to know!

As F.A. Hayek stated in "The Fatal

Conceit- The Errors of Socialism:"

"Thus

socialist aims and programs are factually impossible to achieve or

execute. And they also happen into the

bargain as it were, to be logically impossible."

This is why Socialism and Communism can never ever work, and

must end (die) - sooner or later. The

czars/rulers in charge have no incentive to innovate, change or adjust what's

not working. Instead, they grant or sell

special favors for money (bribes or other forms of corruption) to get

themselves rich.

The Reality of Communism:

Not often stated or emphasized, is that Communism (and/or

Socialism) cannot cause prosperity, but only a miserable survival. Most people under Communist rule live in

poverty; effectively as slaves for an elite group of dictators who make

themselves obnoxiously rich. (See Cuba,

Venezuela, Russia examples below).

- Fidel

Castro's net worth was estimated

at over $900M by USA Today in 2006 and is probably more now.

- While

Cubans living on the island have an average salary of only $20 a month and

cannot buy enough food to feed their families, Antonio Castro, one of

Fidel Castro's sons spent several weeks in June of 2015 cruising the

Aegean Sea on a multi-million-dollar vacation. You can see the stunning vacation pics here.

- Nicolas

Maduro (a bus driver before he became President of Venezuela) says he is

the highest paid politician in the world at $96 million in 2015 and

2016. The Financial Times calls

him “Venezuela’s lord of misrule.”

- The

late Hugo Chavez' had a daughter - Maria Gabriela Chavez- who is now the

richest person in Venezuela at $4.2 BILLION. She is only 35 years old!

- But no

one beats Russia's Vladimir Putin net worth of $200 billion. (In February,

2015 Bill Browder, formerly Russia's largest foreign investor told CNN's

Fareed Zakaria that he believes Putin's net worth is $200 billion.)

As Mao

stated so well: "Communism is

not love. Communism is a hammer which is used to crush the enemy."

The "enemy"- are the people who want liberty and

freedom.

Victor's Conclusions:

China has vast economic problems, aggravated by an immense

amount of debt that is almost impossible to fix, especially considering the precarious

position of debt laden SOEs.

By creating Islands in international waters and/or disputed

territories and continuing to build infrastructure there, China threatens trade

with most of the world's most powerful nations.

That puts China in a position that can be critical to its own stability.

Now compound all that with China being a Communist country,

which (as explained above) limits its ability to cure itself. One has to conclude China is going to have

some very bad times ahead. Unfortunately, that will affect us all.

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).