Dow

Theory Bear Market Confirmed

by the Curmudgeon

Introduction:

In a recent

Curmudgeon blog post, Victor noted that a Dow Theory bear market signal

would be confirmed if the DJI closed below its August 25th low of

15,666.44. That's because the DJT had

already closed below its August lows, therefore a DJI new low was needed to

confirm both averages had broken their (significant) reaction/correction lows

which occurred last August.

The Curmudgeon had contacted Dow Theory Letters staff to

confirm our Dow Theory bear market criteria.

However, they didn't agree as they believe the August 2015 DJI and DJT

lows had already confirmed a bear market in Dow Theory terms. Jon Stebler of DTL

wrote in an email:

“My short version reaction is that his (Victor's)

arguments are unconvincing and at least partly based on misunderstanding of

what we earlier wrote and why. Recent

non-confirmation is something we've already addressed and will continue to do.”

In a phone conversation this evening, Victor said that he

thinks the bear market will last longer than the staff of Dow Theory

Letters. I agree with him!

Well, there's no doubt today with the DJI close of

15,660.18 (albeit only 6 points below its August 25, 2015 low). The DJI was off 411 points at its lows today,

but closed down 255 points or 1.6%. More

damage has been done to other US stock indexes which are (incredibly) holding

up better than foreign stock markets.

The S&P 500 declined 23 points or 1.2% to 1,829,

while the Nasdaq tumbled 17 points or 0.4% to 4,267. All three of the major

averages (DJI, S&P, NASDAQ) are now down more than 10% for the year. The Russell 2000 finished at its lowest level

since May 2013, while the S&P Mid-Cap Index finished at its lowest closing

level since October 2013. Declining

stocks led by over 4 to 1 on the NYSE and over 2 to 1 on the NASDAQ.

West Texas Crude Oil March futures dropped below $27 a

barrel today settling at $26.21 which marked the lowest price since May 2003.

It's trading at $27.50 as this article is being written.

Gold jumped almost 5% to a one-year high at $1,247.80. That was its biggest daily increase in more

than seven years. Financial uncertainty,

a lower dollar and tumbling stock prices around the world prompted investors to

seek refuge in bullion. Volume of the most-active U.S. gold futures contract surged

to the highest since late 2014

Daily Recap from Dow Theory Letters:

The following was posted on DTL password protected

website this afternoon:

It’s a “rout” in stock markets

around the world, or at least that’s what many are calling it. Emotional, over-blown panic selling is what

I’d call it. Asian, European, N.

American equities – all sharply lower today.

The culprit(s) remain the same:

Fear over recession and deflation, in the form of new lows in oil prices

and reaction to Fed Chairwoman Yellen’s recent comments.

Again, there’s not really

anything new, just continued nervousness and concern about the degree of the

developing recession and how that will impact the financial system. 2007-2009 was very ugly and avoided a full

financial meltdown by the hair of its chinny-chin-chin. Folks are worried that this time it may not

dodge the big bullet.

That, in turn, is prompting an

accelerating run to safe haven investments, most notably gold. It is up $50 today to the highest level in a

year. The precious metals markets, again

mostly gold, are now quite overbought.

But as yesterday’s comments suggested, this may be one of those times

when “overbought” gets redefined.

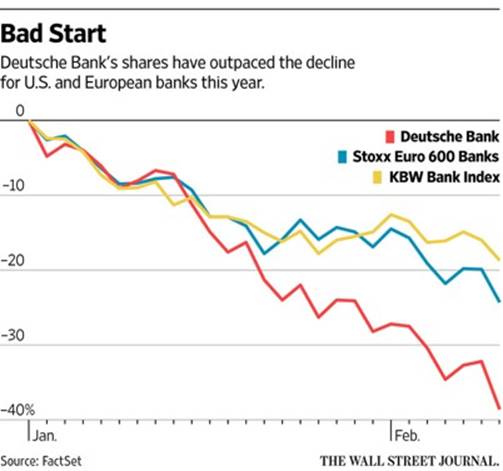

Bank Stocks Get Clobbered:

As noted in the WSJ and NY Times, bank stocks have been

beaten up very badly, as per these two charts:

KBW Nasdaq Bank Index (BKX)

Dennis Slothower wrote in his On the Money comments today:

It looks like the move towards

negative interest rates is really backfiring on the banks, as investors

are growing increasingly fearful that negative interest rates employed by a

growing band of central banks to boost economic growth will undermine the

health of banks around the globe.

According to Bloomberg, the Federal Reserve may not have the legal

authority to set negative interest rates in the US, according to a 2010 staff

memo, but the fact the Fed is even considering negative interest rates suggests

real underlying economic weakness is much deeper than the jerry-rigged

employment and GDP numbers stated.

Views from Leuthold Weeden

Capital Management (well respected Institutional Research firm):

Our work suggests a cyclical

bear market remains in force—and it is worth noting that virtually every global

stock market measure other than the DJIA and S&P 500 tends to confirm that

view (we assume bear market in this context is a decline of at least 20% from

last high in a particular stock market index).

The median stock in the

Leuthold 3000 now trades at 21.1x its 5-Year Normalized EPS estimate—a shade

below its 1986-to-date median of 21.9x. This measure reached a cycle high of

28.3x at the onset of the Fed’s tapering program in January 2014. We don’t

think the valuation adjustment is over, but a 25% haircut is more than a good

start.

Two conditions favor a decent

bear market rally. On the other hand, (as we’ve said at similar market

junctures in the past), the failure of such a rally taking hold in coming days

would itself constitute another bear warning.

In a front

page article in Wednesday's San Francisco Chronicle, Leuthold's CIO

Doug Ramsey was quoted as saying:

“We take the fact that not

just momentum stocks but essentially all of the old leadership (such as

consumer discretionary and health care stocks) are now under pressure as a sign

that the bear market is now fairly well advanced. That being said, we still see

considerable further downside in the S&P 500 — another 10 to 15 percent.”

JP Morgan's David Kelly, PhD says Fundamentals OK, but

not the 4 Year Presidential Cycle:

On a conference call today for registered investment

advisors (RIAs) and institutional investors, Dr. Kelly noted that the forward

P/E of the S&P 500 had declined to 14.7 as of today's close. That's below its historical average implying

that stocks are NOT expensive. He

believes the chance of a US recession is quite low, but two caveats are low

productivity growth and weak U.S. manufacturing (partly due to a strong US

dollar).

Two market bug-a-boos are really not a significant threat

to the global economy, according to Kelly. China worries are overblown. Although declining somewhat, there are

sufficient foreign currency reserves ($3.23T as of January of 2016) to prevent

a run on the Yuan/Renminbi. Also, the

oil price has dropped mainly to oversupply and bulging inventories, rather than

a sharp decrease in demand that might be due to slowing economies. Surprisingly, Kelly said the Eurozone

economies were doing quite well, thank you!

Dr. Kelly said that stocks are a much better investment

than US Treasury notes and bonds. When

comparing earnings yields of US stocks to government bond yields, stocks are

historically cheaper than they have been 92% of the time! Also, the dividend yield on the S&P is

about 2.7% vs the 10-year T-note yield of 1.7%.

The Curmudgeon asked Dr. Kelly this question:

What's happened to the 4 year

Presidential cycle1?

Similarly, the strongest seasonal period for the US stock market has

been from November through April. None of the above is playing out this year--why

is this time different?

Note 1. The US stock

market usually makes a significant low late in the 3rd year and then rallies

strongly through November elections.

From end of WWII to 1999, not a single election year experienced over a

3% decline in the S&P 500 Index. Of

course, that was not the case in 2000 when the dot com bubble popped or in 2008

during the worst part of the financial crisis after Lehman Brothers went

bankrupt.

Dr. Kelly's answer was something like this:

The 4-year cycle is based on

the premise that the current administration does everything in its power to

make the economy stronger within 12 to 18 months of the Presidential

election. However, in this

administration Congress has not gone along with the fiscal policies proposed by

Obama (if any?), so that the US economy is not getting stronger. In fact, there's a growing risk of recession,

according to many economists. Hence,

that cycle (and most other cycles) don't apply this election year.

We certainly can't argue with that reasoning!

Conclusions:

Victor and I agree that this will be a long bear market

for global equities. Of course, it will

be punctuated by sharp rallies which will convince many investors that the bull

is back. Unfortunately, it will be very

difficult to profit from this bear market (as we've many times opined) because

of central bank intervention/talk the talk, HFTs and short term focused hedge

funds buying and short covering. Hence,

an investors goal should be to preserve capital, rather than try to make money

on the short side other than hedging a long stock portfolio to mitigate losses.

Good luck and till next

time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974

bear market), became an SEC Registered Investment Advisor in 1995, and received

the Chartered Financial Analyst designation from AIMR (now CFA Institute) in

1996. He managed hedged equity and alternative (non-correlated)

investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).