Is

the Correction Over or is it a Primary Bear Market?

by the Curmudgeon with Victor Sperandeo

Introduction:

Ever since the last great

bear market ended in March 2009, investors and traders have been buying the dips,

believing a bull market was in effect such that they'd be rewarded with higher

stock prices. Has that bullish scenario

now ended? Is this a genuine bear market

or another fake out where the dippers beat the bears?

The Curmudgeon thought for

sure that last August was the first leg down in a primary bear market which

would ultimately take the popular averages down somewhere between 25%

and 40%. However, the sharp rally off

the September 28, 2015 interim low resulted in the NASDAQ and NASDAQ 100 (QQQ

ETF) making new all-time highs and the S&P 500 coming within 1% of its

all-time high on November 3, 2015 (2,116.48 intraday with a 2,109.07

close). The shorts got their heads

handed to them (yet again) as most were forced to cover with a loss after they

were confident they were on the right side of the market.

Whipsaw!

One of the most highly

respective market timers- Dan Sullivan of the Chartist- sold out on the

August lows but went to 100% invested on November 3rd- the exact

date of the stock market recovery highs!

A steep sell-off has occurred since the December 29th interim high

close, with global stock markets “falling off a cliff” to start 2016. [The Chartist liquidated all long positions

as per its January 7th hotline].

The sharp decline has been followed by a two-day relief rally on

Thursday and Friday, which was long overdue in our humble opinion.

Investors have taken $24

billion (net) out of U.S. equity mutual funds since January 4, 2016. That's

likely a sign of excessive fear that's currently gripping the market.

So is the correction over or

is this just a bear market bounce? We

provided some insight into this in our January 11th post.

Let's now look at the bear market/correction issue from a Dow Theory

perspective.

Please see Victor's incisive

comments which are inserted in multiple sections of this article. We think his comments in this post are

remarkable for independent thinking and a unique historical perspective!

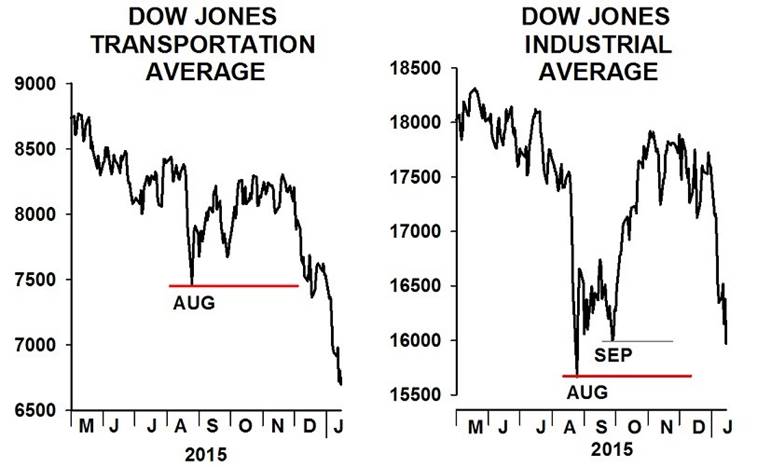

Is a Dow Theory Primary

Bear Market in Effect?

Victor provided his

assessment of the market in last

weekend's Curmudgeon post. It mostly

referenced the S&P 500, but noted that the DJI needed to close below its

August low to confirm a Dow Theory bear market.

On Wednesday, January 20,

2016, the S&P 500 hit an intraday low of 1,812.29 and closed at 1,859.33,

which is below its August 25, 2015 closing low of 1,867.61. However, the DJI did NOT close below

its August 25th low of 15,666.44, so a Dow Theory primary bear

market signal has not yet been officially given.

Victor added the following

market comments this weekend:

On

December 16, 2015 the Fed did raise rates, while the IMF announced that China's

Renminbi/Yuan reserve status would not have any meaning till October 2016. The

U.S. stock market went back to a decline (bear market mode) soon after – on

December 30th. Meanwhile,

virtually every stock index/average in the world confirmed a bear market by

closing below their August 2015 lows.

There were only a few exceptions such as the NDX 100, and the DJI, which

traded intraday below their August and 12-month lows, but did not close below

them.

→See Victor's closing comments

for more insight on the extent and cause of the current global stock market

decline.

On January 15, 2016 the Dow

Theory Letters (subscription required) Team wrote something different

regarding a Dow Theory primary bear market signal:

A

Dow Theory primary bear market confirmation was triggered last August when the

Dow Jones Industrials and the Transports both hit new lows.

The

Transports reconfirmed this new bear market last month when it broke below its

August low.

This

bear market will be fully reconfirmed once the Dow Jones Industrials (DJI)

closes below its August low at 15666.44. That's the most important number we're

currently watching.

Although, the DJI traded below

15666.44 on Wednesday, the close was 15,766.74.

Therefore, no Dow Theory Bear Market reconfirmation, according to the

Dow Theory Letters (DTL) Staff.

Victor's Rebuttal:

Some Dow Theorists (e.g. DTL

Staff) assume the decline in August "confirmed "a bear market rather

than a first down leg which did not confirm anything. That implies that the previous lows (which

were broken in August) were significant.

I beg to differ.

Let's use the S&P 500 as

a proxy for the market. It's decline

from its all-time high on 5/21/15 of 2,130.82 to its 7/8/15 low of 2,046.68 was

only (-3.95%). Also note that volume on

the NYSE was an extremely low 442 million shares on 7/8/15. This was a minor move in my view.

The DJI high was on May 19th

at 18,312.39. It declined to "minor

low" on July 8th at 17,515.42 (-4.35%). So all highs on the DJI were

non-confirmations and part of a massive nine-month top as I described in last

week's post. The Dow Transports topped

earlier - on 12/29/14 at 9,217.44.

…………………………………………………………………………………...

Bear Market or Correction:

Is the Decline Over?

Consider what Richard

Russell, the great Dow Theorist and DTL founder/writer (who died last

November), wrote about bear market bottoms:

Primary

bear markets, like bull markets, end in exhaustion. The traders, the pros, the

retail buyers, the day-traders have been totally defeated. The stock market is

smashed to smithereens. Nobody wants to play anymore.

Deadness

reigns. Great stocks lie at their lows, waiting to be picked off or

accumulated. An atmosphere of depression reigns. The stock market is a monster,

never to be fooled with again. Falling price/earnings have defeated the best

stocks and the best stock-pickers. A

few great corporations are still doing well. Those who hold these stocks are

puzzled or aghast. How could their carefully-picked great stocks collapse? At

their high these stocks sold for 15 or 20 times earnings. Collapsing P/E ratios

have killed them.

The above conditions certainly

don't seem to be in place today! Let's

look at what other market professionals are saying.

Other Voices:

Michael Every of Rabobank

Asia Pacific research wrote in a note to clients this week: “Is this all a

turning point at last, or is it the epitome of a ‘dead-cat bounce’? From

a fundamentals perspective the answer is ‘weeeee . .

. splat . . . boing’, or whatever a dead cat sounds like.”

Neil Woodford, founder of

Woodford Investment Management, says: “There are excessive credit bubbles as a

result of quantitative easing, which have left a legacy of debt and a shortage

of demand, which has become known as secular stagnation. This will probably

hold back the markets, which have had an unsettled start to the year.”

Doug Ramsey of Leuthold Weeden research wrote: “The Major Trend Index fell 0.06

points to a ratio of 0.73, using last week’s data (week ended Friday, January

15th). Essentially all of our trend-following work is now confirming that a

cyclical bear market is underway. In fact, the new closing low this week,

on January 20th, confirmed our suspicion that the S&P 500 decline from its

high close on November 3rd represented the second leg of the bear market

decline from the bull market high May 21st.”

“Our view is that the

risk-reward for equities has worsened materially. In contrast to the past seven

years, when we advocated using the dips as buying opportunities, we believe the

regime has transitioned to one of selling any rally,” Mislav

Matejka, an equity strategist at J.P. Morgan, wrote

in a report.

Aside from technical

indicators, expectations of anemic corporate earnings combined with the

downward trajectory in U.S. manufacturing activity and a continued weakness in

commodities are raising red flags.

“We fear that the incoming

fourth-quarter reporting season won’t be able to provide much reassurance for

stocks,” Matejka said. The positive correlation between oil prices

and earnings on top of the sustained gains in the U.S. dollar — which has an

inverse correlation to results — will also weigh on the market, he added.

Tim Edwards, a strategist for

S&P Dow Jones Indices, told the Financial Times (FT): “Crude oil’s journey

from over $100 a barrel to today’s sub-$30 levels began only the summer before

last. With the end of sanctions in Iran

heralding a further glut of supply, oil shows few signs of recovery.”

John Stopford, co-head of

multi-assets at Investec Asset Management, told the FT: “The markets have hit a

tough spot, with investor flight to the safety of government bonds. It is

certainly a difficult time, with China, oil and monetary policy destabilizing

markets. It could get worse before it gets better.”

Quoted in a well-illustrated Zero

Hedge post, BofA-ML chief strategist Michael

Hartnett wrote: “Lacking true positioning shake-out, lacking catalysts for

profit turnaround and lacking visible policy panic, we remain sellers into

strength of risk assets.”

From a January 21st

report emailed to the Curmudgeon titled “Recessionary Bond Flows,” BofA-ML research wrote:

- Bond

flows recessionary: largest inflows to government bond funds in 12 months

- ($5bn), 2nd largest outflow from HY funds

in 12 months ($4.9bn - HY outflows over past 7 weeks = 5% AUM =

capitulation), and chunky outflows from EM debt ($2.3bn).

- Equity

flows not recessionary: modest weekly equity redemptions of $3.5bn; equity

outflows past 3 weeks = $24bn outflows (= 0.3% AUM) …this pales in

comparison to $36bn during Aug'15 sell-off, $90bn during Aug'11 debt

ceiling sell-off, $85bn during '08 GFC; flows mirror Jan FMS

findings…positioning yet to reveal Full Capitulation.

TD Securities Global

Strategy- Market Musings, January 22nd: “Risky assets appear to have

found a near-term floor this week as the ECB signaled further easing may come

at its March meeting. This week’s FOMC meeting presents a clear threat to this

view, but the bounce in equities and other risky assets may extend for a few

more days…We have been watching price action in the S&P 500 carefully, this

week. Both the cash index and futures have tested technically-important lows

established over the last two years and snapped back sharply since. We remain cautious but open-minded to the

idea that the bounce in risky assets could extend a bit further over the next several

days. Next week’s FOMC meeting is a key focus for establishing broader

sentiment, but we can see equities and other risky assets remaining on a firm

footing into that event.”

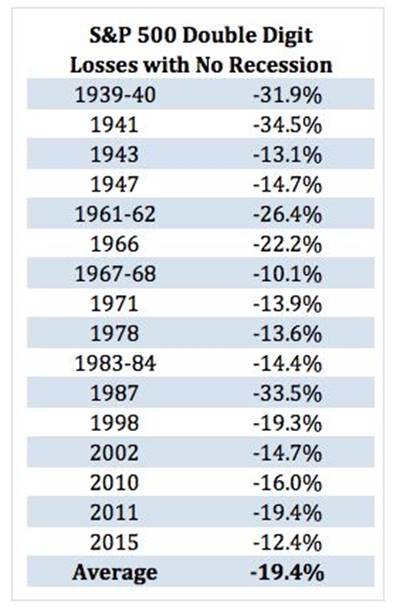

Is a Bear Market Possible

without a Recession?

Curmudgeon: Many economists predict slightly above 3% global economic

growth in 2016. That certainly doesn't

qualify as a recession (which is nominally defined as two consecutive quarters

of negative economic growth). However, a

high double digit stock market decline is certainly possible without an ensuing

recession. If a bear market is defined

as a declined in excess of 20% in the popular averages, the 1987 crash was the

last bear that was NOT followed by a recession. Please refer to the table below.

Victor: I repeatedly

hear from economists that declining markets don't imply a recession will

follow. Economist and Professor Paul Samuelson said that "Wall Street

indices predicted nine out of the last 5 recessions." That cliché is very misleading. Sadly, it's used as an excuse by economists

to tell investors to not sell stocks.

Of course, not all

"important stock market declines" are caused by recessions. The most

common other reason is war. But most of the time declines are halted, as the

Fed changes its mind in tightening before the NBER classifies the period as a

recession. That occurred in 1966 and 1987, to name two examples. Then there are

the stupid comments by Presidents and other politicians. The best example was

the comment by President John F Kennedy on April 11, 1962 in critiquing

(threatening) the steel companies and their CEO's against raising prices of

steel by $6 per ton (you can see it on YouTube). Kennedy's speech was seen as a move towards

"socialism" and cost the market 26%.

According to my historical

studies dating back to 1885, every example of a serious stock market decline

not coupled with a concurrent recession, had a good reason. Yet Prof. Samuelson never bothered to mention

that the market reflects, or discounts important potential threats, short term

changes of Fed policy (as I'm sure we will see again soon), wars, as well as

recessions.

In this current decline, the

markets are reflecting a global economic slowdown, (possible) deflation, and a

forthcoming recession/depression, but it has not arrived yet.

Chart courtesy of Dow

Theory Letters

…………………………………………………………………………………...

Victor's Closing Comments:

Despite the absence of a

confirmed Dow Theory bear market signal, I believe we can reasonably assume the

PRIMARY TREND of the stock market is DOWN.

Some of the important indexes around the world that made 12-month

closing lows last week include: the S&P 500,

Russell 2000, Value Line Geometric Index, FTSE 100, CAC 40, DAX, IBEX-35, HANG

SENG, NIKKEI & TOPIX (Japan) indexes, Singapore Straits Times Index (STI),

Shanghai Composite Index, iBovespa (Brazil), Toronto

S&P/TSX index.

Curmudgeon Note: all other

asset classes except Treasuries and physical gold have been down this

year. That includes: high grade

corporate bonds, junk bonds, bank loan/credit funds, REITs, preferred stocks,

gold shares, etc. They're all down in

2016. Bottom line -there was no place to

hide!

[Curmudgeon questions the

validity of asset allocation and a highly diversified (long only) portfolio if

it doesn't protect you on the downside when you need it most!]

It might be worthy to note

that based on Friday's S&P 500 closing price of 1906.90 you have to go back

to May 27, 2013 to find lower S&P closing prices. This means anyone who

owned stocks, in general, had a capital loss in the last 1 ½ years!

The reason I think we are in

a bear market is the death of many energy companies, which is on its way. All the loans made by banks to

oil/drilling/energy firms are based on "Recoverable Reserves" not the

oil in the ground. Therefore, if oil is $100 per barrel and you have an

estimate of 1 million barrels, but the cost of getting those oil reserves is

only $40 per barrel, then your reserves are worth $60 million. However, at $32

per barrel, oil reserves are worth ZERO!

What the banks that have

loans outstanding to drillers, frackers etc. will do,

and or, how many problems there are due to this metric is unknown. The losses

and bankruptcies due to this type of accounting is another reason why this

market maybe a dead man walking.

As the well-known accountant Abraham J. Briloff once said: "Accounting (measuring

financial data with depreciating currency) is much like looking at a bikini on

a beautiful girl. What it reveals is

interesting, but what it conceals is vital."

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).