Is

a Bear Market in Place Now? China’s Impact and Influence Reviewed

by the Curmudgeon with Victor Sperandeo

Introduction:

A Bear is on this week's Barron's cover with a “Bear Scare” notation. But is it just a “Bear Scare” or the real

thing? We really don't know if a bear

market is underway until the popular stock market averages have registered (at

least) a 20% of decline from this year’s bull market high. We could then conclude that a bear market

started the day after the 2015 high(s) were made in each average.

In my opinion, the bear will

be in control if the August 2015 lows are taken out. If that's the case, then we can safely say

we're in the second down leg of a bear market that will likely last for years

due to stock market overvaluation (see Victor's comments in last week's

Curmudgeon post) and excesses that have built up from years of central bank

ultra-easy monetary policies.

Take Forecasts with a

Grain of Salt:

The reader should not place

faith in any financial market forecasts.

Not even mine. Why? Because

they're almost always wrong!

A Bespoke report, noted in the

January 10, 2016 NY Times, reviewed the recent history of Wall Street

predictions and found them very inaccurate. Since 2000, it found, the consensus

has called for an average yearly increase in the S&P 500 of about

9.5%. The actual average annual change

was less than 4%, while consensus predictions were inaccurate in every

single year - sometimes by outrageous margins. In 2001, the consensus

called for a gain of 20.7%. But the index fell by 13%. In the horrible year of

2008, the consensus was that the market would rise 11.1%. As many investors may

recall, it fell by 38.5%. Not once since 2000 has Wall Street predicted that

the market would decline in a calendar year. Yet the market actually fell in

five of those years.

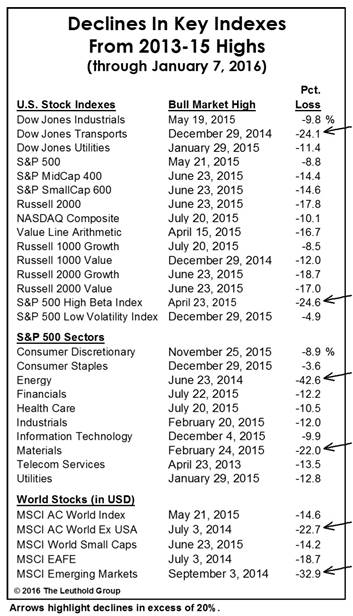

Expert Opinion - Leuthold Weeden's Doug Ramsey:

From the January 8, 2016

Green Book: Not A “Stealth” Decline Any Longer...:

We’re

assuming the decline that’s kicked off the new year is the second down-leg

of a cyclical bear market that dates back to the S&P 500’s record

closing high on May 21, 2015. Ironically, the most compelling evidence that a

bear market is underway may not be what’s been punished (Transportation stocks,

Small Caps), but what hasn’t. The accompanying table shows the enormous

performance gap between the S&P High Beta Index (down almost 25% through

January 7th) and its counterpart Low Volatility Index (which is off a mere

–4.9% from a high made less than two weeks ago, December 29, 2015). Consumer

Staples reached a new all-time high on the same day, and we suspect those highs

will be the last bull market highs recorded by any composite or sector index.

The irony is that the highs in these supposed safe havens were made exactly one

year after the bull market peak in the Dow Jones Transports, which ultimately

became the bear’s first victim. We expect more victims ahead, including

(eventually) the “safe haven” stocks.

Importance of China to

World Economy and Global Equities:

Our last two Curmudgeon posts

highlighted why China was the key to world economies and global equities in

2016. You can review them here and here.

Many experts say this past

week's global stock market route was almost entirely due to China's inept policy

on circuit breakers and attempts to stabilize their stock market.

"I just think there's an

underlying nervousness that we're going to see further turbulence out of

China," said David Lefkowitz, senior equity

strategist at UBS Wealth Management Americas. Performance in U.S. stocks

depends "on willingness to believe the expansion is intact and the U.S. is

going to remain relatively unaffected."

On that same theme, Andrew

Browne wrote in the January 9, 2016 WSJ (on-line subscription required):

Investors

have a right to feel concerned about the mishandling of the markets, given the

magnitude of China’s long-term economic problems and the knowledge that when it

comes to fixing them nothing short of flawless execution will do. All the big

drivers of growth are running out of steam at the same time, including what had

seemed an endless stream of rural labor and insatiable overseas demand for

Chinese manufactures. China must upgrade its entire manufacturing sector while

grappling with the legacy problems of the old growth model, including a

despoiled environment and massive debt.

Instead,

we’ve seen almost comical ineptitude, the most recent example being the

introduction of circuit breakers to reduce volatility in the stock market.

The

measure had been fast-tracked by the securities regulator after the

stock-market wobbles made Mr. Xi look more vulnerable than at any time since

coming to power in 2012. But the circuit breakers had to be abandoned after

only four days—because they made volatility much worse.

“It’s

Amateur Hour!” writes the Shanghai-based economist Jonathan Anderson of the

Emerging Advisors Group.

The

irony is that the real economy is actually looking up a bit after appearing to

go into free fall earlier last year. Crucially, the residential real-estate

market is rebounding.

Investors

seem to be spooked more by policy muddles than economic data. Some suspect that

policy makers must have lost their once-steady touch because they’ve been so

rattled by problems only they can see.

In a January 11, 2016 FT

column (on-line subscription required), former U.S. Treasury Secretary and

Harvard President wrote:

Over

the past year, about 20% of China’s growth as reported in its official

statistics has come from its financial services sector, which is now about as

large relative to gross domestic product as in Britain, and Chinese debt levels

are extraordinarily high. This is hardly a case of healthy or sustainable

growth. In recent years, China’s growth

has come heavily from massive infrastructure investment; China poured more

cement and concrete between 2011 and 2013 than the US did in the whole of the

20th century. This too is unsustainable. Even if it is replaced by domestic

services, China’s contribution to demand for global commodities will fall.

Experience

suggests that the best indicator of a country’s future economic prospects is

the decisions its citizens make about keeping capital at home or exporting it

abroad. The renminbi is under pressure because Chinese citizens are eager to

move their money overseas. Were it not for the substantial recent depletion of

China’s reserves, the renminbi would have fallen further. (one paragraph

skipped)

Because

of China’s scale, its potential volatility and the limited room for

conventional monetary maneuvers, the global risk to domestic economic

performance in the US, Europe and many emerging markets is as great as any time

I can remember. Policymakers should hope for the best and plan for the worst.

The Difficulty of Short

Selling- Even in a Bear Market:

Even if we are in a

full-fledged bear market, it has and will be very difficult to make money on

the short side. That's largely because

of violent, counter trend rallies that will shake out the shorts. We attribute that to the dominance of computerized,

algorithmic and high frequency trading.

Then there's the matter of surreptitious buying of stock index futures

and/or ETFs by the Fed or its surrogates.

We've called attention to that tactic by providing anecdotal evidence in

many previous Curmudgeon posts.

Here's what Victor has

to say about that now:

Last week, The S&P 500

and Dow Industrials posted their worst

5-day start to a year on record. The

S&P 500 dropped ~6% on the week. But

that was nothing like a 10% decline in a single day, as happened in China last

week.

The Fed and global central

banks (especially the ECB and BoJ) have done anything and everything to keep

the markets up. As Mario Draghi put it "we'll do whatever it

takes!" Indeed, central banks,

virtually all over the world have been telling the financial markets by their

actions that they wanted higher markets.

This has made selling short a losing trading strategy.

However, with QE ended, and

interest rates rising, I believe this has now changed. The Fed seems willing to

allow the equity markets to decline in a steady, but “reasonable” fashion.

Curmudgeon: Perhaps, that's because of the recently stronger than

expected employment reports? Therefore, the saying: "Never fight the

Fed" is temporarily not in play as the sentiment of the day. The Fed is

out to lunch for now.

Bottom line: It's time to consider shorting if you are a

trader.

Good luck and till next

time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).