Start-up

Investments Boom While Silicon Valley VCs Turn Cautious

by the Curmudgeon

Introduction:

The venture capital industry is booming, but for how

long? Institutional investors, including

investment banks, hedge and mutual funds have joined the party which is still

going strong.

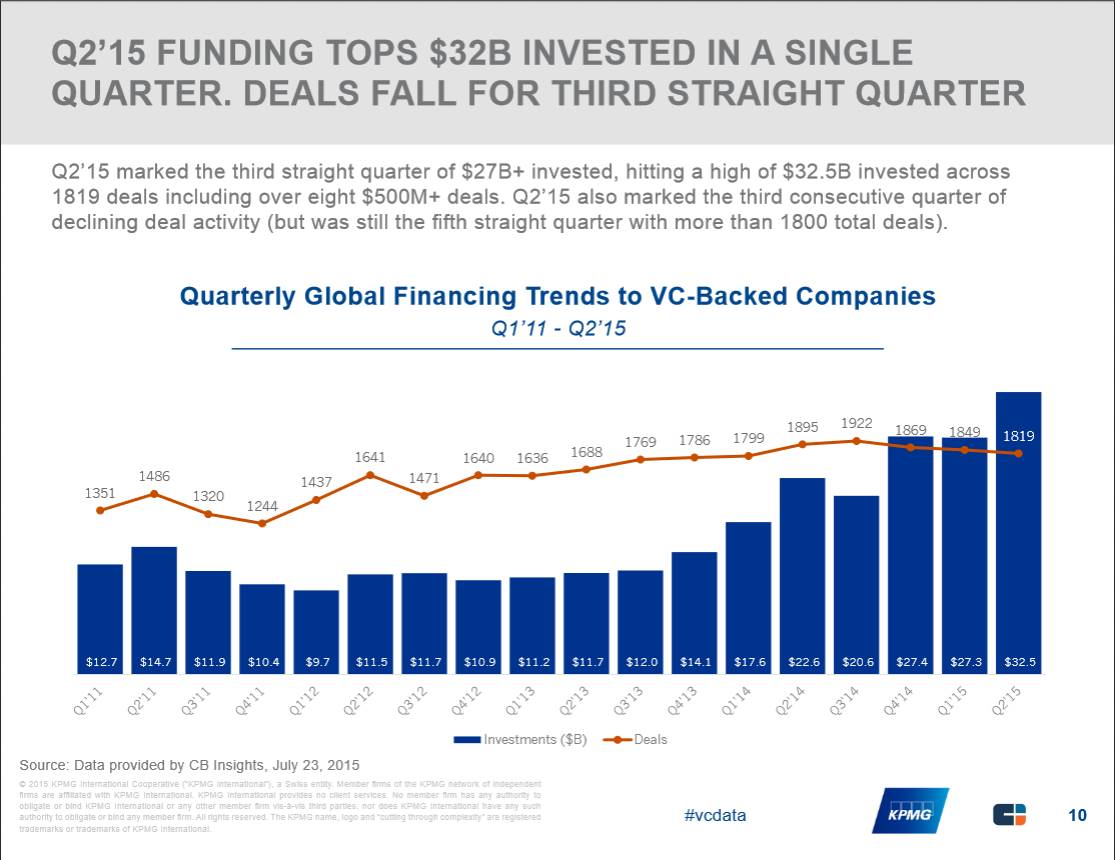

VC backed global companies raked in $32.5B in the 2nd

quarter, spread across 1,819 deals.

That's according to the inaugural edition Venture Pulse report by

KPMG International and CB Insights.

The Q2 VC investment data is as follows:

- North America: $19B in funding |

1180 deals

- Europe: $3.2B in funding | 284

deals

- Asia: $10.1B in funding | 313

deals

Total Global Data: $32.5B in funding | 1819 deals

VC Investments by Market Sector:

Internet and Mobile software continue to account for the

bulk of deals to VC-backed companies, as the two major sectors accounted for

65% of all deals in Q2’15. Mobile

enjoyed significant jumps in Q4’14 and Q1’15 investments, riding on the large

rounds to Snapchat and on-demand ride sharing companies like Uber and Didi Kuaidi. Are those really

tech companies?

So far in 2015, Internet investment share has increased such

that it accounts for more than half of total investment dollars into VC-backed

companies in 2nd

quarter of 2015.

All other sectors remained fairly range-bound with Healthcare

accounting for 12%, Software 5%, and Consumer Products & Services 3%.

The U.S. VC Environment:

U.S. funding is on track for a stunning $70B year: After a

high of $56.4B in 2014, 2015 is on track to reach five-year highs with $36.9B

already invested in the first half of the year.

California dominates VC investments in start-ups. While deal

activity in California has slowed down for the last few quarters, deals

continue to top 400 per quarter, more than Massachusetts and New York combined!

Six mega-rounds account for one-fifth of all North American

funding: These deals were all $275M or larger, including a $1.5B growth equity

round to AirBnB. Q2’15 also saw four exits larger

than $1B.

However, U.S. deal flow shows some signs of fatigue:

- US deals in Q1’15 dropped to their

lowest point since Q1’13 at 1102, but saw an uptick in Q2’15.

- However, this was the first

quarterly rise in deals since Q2’14.

- On an annual basis, deal count is

tracking below 2014 levels.

- There have been 2231 deals in the

first six months of 2015. That's less than half the amount seen in

full-year 2014.

The Rise of the Unicorns & Late Stage Deals:

It's been a banner year for Unicorns – VC backed companies

with valuations in excess of $1 billion. The 2nd quarter of 2015 saw

24 new billion-dollar companies compared to just 9 in the same quarter a year prior. Those include 12 in the U.S. and 9 in Asia.

Among the newest Unicorns were Zenefits, Oscar Health

Insurance and MarkLogic.

The explosive growth of Unicorns is being spurred by the

continued availability of late-stage deals – in particular, new capital sources

including hedge funds, mutual funds and sovereign wealth funds. More on

this later in the article.

The availability of late-stage mega-deals continues to delay

potential IPO exits. During Q2-2015,

global late-stage deal size averaged $72.6 million and included more than

thirty $100M+ deals globally.

If companies can raise similar amounts of money through private financing, many companies will opt for it. Under private financing agreements, companies have more latitude to grow and shape their business and can avoid more substantive public reporting requirements. Going public comes with a strategic decision making process that can be far more complex and highly driven by shareholders.

Looking forward, indicators prompt the report authors to

suggest that Unicorn investing will only continue to rise as more and more

investors chase these opportunities.

-->There is real fear among many institutional

investors that they will be left out if they don’t have a number of unicorns in

their portfolio. That's even if the unicorns they're investing in have

indicated they don't plan to turn a profit for years, if ever! Many are 1 trick ponies, which we discussed

in the post titled: In Search of Unicorns and

One-Trick Ponies: Bubble in Private Tech Start-Ups

Confidence of Silicon Valley’s VC's Hits 2 Year Low:

With all the excitement and big bucks going into so many

unproved start-ups, VCs have turned more cautious. Venture Beat reports:

“Amid the frenzied fund-raising and soaring valuations for

startups, Silicon Valley’s venture capital community is starting to get a

little bummed out.”

For the second straight quarter, the Silicon Valley

Venture Capitalist Confidence Index fell, hitting its lowest point in two

years. The index, measured by the University of San Francisco School of

Management, has fallen four of the past five quarters.

The survey is in its 11th year and includes feedback from

well-known valley VCs such as Tim Draper of DFJ, Venky

Ganesan of Menlo Ventures and Shomit

Ghose of Onset Ventures.

The 28 VCs surveyed reported a confidence level of 3.73 on a

5-point scale, down from 3.81 in the 1st quarter. The survey asks

VCs to rate their confidence in the high-growth venture investing market over

the next six to 18 months.

The waning confidence was attributed to increasing concerns

about the high valuations of startups, a surge of investing from hedge

funds and big institutional investors (e.g. Goldman Sachs, Fidelity, TRowe Price, Black Rock, etc.) that is driving up funding

rounds, the rising cost of doing business in Silicon Valley and potential

fallout of global economic issues like the free falling stock market in China.

"The unprecedented fundraising and valuations

associated with so-called 'unicorns' ... gives reason for substantial

pause," said Bob Ackerman, founder and managing director of Allegis

Capital. "Expectations are beginning to outpace reality."

Mark Cannice, Professor of Entrepreneurship & Innovation

at USF, conducts the research study each quarter. He said VCs expect overall conditions for

IPOs and acquisitions to remain strong.

"As VC confidence tends to be forward-looking, this disparity is

not unusual," Cannice wrote in the report. But, he added, “Increasing

concern about high valuations of venture-backed firms restrained sentiment.”

Risks of Mutual/Hedge Fund Investments in Start-Ups

Many believe that public market investors (like hedge/mutual

funds or investment banks) are taking on too much risk when they invest in

private companies, the majority of which fail and return nothing to investors

(i.e. 100% loss).

In our opinion, a bigger risk is to the start-ups

themselves, because there’s a big difference in the way that investments from

VC firms and public funds are structured.

The former are illiquid, while the latter have either monthly (hedge

funds) or daily (mutual funds) liquidity via redemptions.

During the dot-com crash 15 years ago, “many hedge and

mutual funds faced massive redemptions when the market cratered and they had to

find a way out of their [private company] positions,” said Glenn Solomon, a

partner with the venture firm GGV Capital.

That fire sale caused a secondary market for venture

positions tied to those fund positions to spring up, and the shares were often

sold at a deep discount -- driving down the overall value of the start-ups.

“It was tough on management teams, which were often facing

challenges in their companies, to all of a sudden face shareholder pressure,

too,” Solomon said.

We saw a similar and dangerous mismatch between long-term

investments and short-term funding during the 2008-2009 financial crisis. Many financial service companies, including

investment banks, bond insurers, General Electric, AIG, etc. took short-term

money and invested it in securities that turned out to be risky and

illiquid. The same thing could happen

again with start-up investments, particularly by paying a higher price in late

stage rounds.

“Founders should ask questions about the objectives and

intentions of their potential investors and also about the source of and

permanency of the capital being provided,” Solomon said. If they don’t have a

clear sense of what they’re agreeing to when they take money from public

investors, they could get burned.

Of course, the biggest risk, is that most of these now high

flying start-ups will fail and go belly up.

That's exactly what happened during the DOT com bust and telecom/fiber

optic buildout crash. Every month we see

one or more of such hot companies that seem to be pie in the sky. Let's look at one of them, appropriately

named JET.com Inc.

Despite steep losses and looming competition with

Amazon.com, online retailer JET.com (AKA Jet) is in talks for capital infusion

that could value the company at $3 billion!

A July 19, 2015 WSJ article states:

“Online marketplace Jet.com Inc. has almost no revenue,

years of likely losses in its future and a strategy that includes underpricing

mighty Amazon.com Inc. on millions of items. Jet also has perhaps the highest

valuation ever among e-commerce startups before their official launch.”

“That is no contradiction in Silicon Valley, where investors

keep pouring money into audacious business experiments filled with big-splash

potential. Jet is the buzziest e-commerce arrival of the current boom, with

$225 million in capital raised in the past year.”

On July 29th, the NY Times chimed in with

their own assessment

of Jet and similar e-commerce start-ups:

“On a venture-capital high, tech start-ups are burning

through vast cash reserves to offer rock-bottom prices, and to sign up new

customers with discounts, giveaways and other deals that may sound too good to

be true. Jet, a Costco-like members-only discount company that has raised more

than $225 million from investors before opening its doors, is only the largest

such example.”

Marc Lore, Jet’s chief executive, predicts that it will take

the company five years to grow to a point where it is not losing money on

every shipment — a threshold it says it will cross once it has signed up about

15 million members and is selling about $20 billion in goods annually.

The NY Times reporter found that Jet was vastly undercutting

Amazon, and The Wall Street Journal recently ordered a basket of goods from the

site for which it calculated that Jet lost nearly $243 on a single order. In an

interview, Mr. Lore was unfazed by these numbers, because, he said, they were

already built into his projections.

Good luck to Jet and to all readers of this column!

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).