What Me Worry? Bullish Sentiment and Complacency Reach

All-time Highs

by the Curmudgeon with Victor Sperandeo

Introduction:

In 52 years of watching the U.S. stock market, the

CURMUDGEON has never seen

such over confidence and complacency before.

Of course, there was much more exuberance, over-pricing and public

participation in the 1998-2000 dot com boom.

But the economy was a whole lot stronger at that time and more people

had more money to invest.

Excessively bullish sentiment has been evident for

some time now - from market letter writers, market strategists, and

"investors" in bull vs. bear funds (e.g. "Rydex

Ratio").

We look at the evidence in this article along with

a warning from the Granddaddy of investment newsletter writers. There are several eye popping charts on

market sentiment and the decline in trading volume since 2007. Victor's cogent

comments follow.

Market Strategists are Bullish (SoGEN is the lone exception):

"Stay bullish into year-end," Wall

Street strategist Tom Lee writes in a new 28-page client research note.

"We see multi-year gains ahead for U.S. equities”, he added. Formerly the chief US equity strategist for

JP Morgan, Mr. Lee is now the founder and head of Fundstrat

Global Advisors.

Prominent market strategists who have raised their

estimates include Gina Martin Adams of Wells Fargo Securities, David Bianco of

Deutsche Bank, Barry Bannister of Stifel Nicolaus & Co. and Adam Parker of Morgan Stanley.

In late August 2014, Bannister upped his S&P

500 target to 2300 from 1850 - a massive move that transformed him from one of

Wall Street’s most bearish strategists to its most bullish one. Meanwhile, Parker says the S&P 500 could

reach 3,000 in the next five years.

"When no one's fighting about which way the

market's going to go, it's dangerous. If they turn out to be wrong, everyone

runs for the door at the same time," Jim Cahn, a Minneapolis-based

financial adviser with Wealth Enhancement Group, told The Wall Street

Journal.

Barron's Bullish Bias & Bets:

Feature

articles from the September 22, 2014 issue of Barron’s (on-line

subscription required) were 100% bullish.

Not even one cautionary note!

Here are a few of them:

· Bank of America Could Rise 50% or More

· Genworth Shares Could Surge 80%

· Finding Value in Developed Markets

· International Paper: The Next Big MLP

Play?

· How to Get Shares in Hot IPO’s (video)

· Finding Attractive Stocks Amid Europe’s

Malaise

From MarketWatch.com:

· Why Energy Stocks are Set For a Second

Rally

· Sony Worth More Than the Market Realizes

· 7 reasons to be bullish on Microsoft

(MSFT)

MSFT is a great example of the "great disconnect,"

which we've called attention to for several years. The software giant’s stock has outperformed

the S&P 500 in the past year, surging 40% versus 18% for the benchmark

index. MSFT stock was up +1.8% on

Friday, after announcing the day before that it will shut

down its Mt View, CA based Silicon Valley Research Center and lay off 2,100 employees as part of the

16,000 cuts it announced in July.

This once again proves that the stock market

rewards companies for layoffs and cost cutting, rather than for organic growth

and expanding operations or R&D.

HP is another great example of that illogical

reality of the stock market. In May

2014, the company announced

it would lay off up to 50,000 employees.

It's HP Labs in Palo Alto is a tiny shadow of its former self. Yet HP stock is up sharply since January

2013, despite declines in revenues and profits during that time period.

Charts Illustrate Extreme Bullish Sentiment:

The bullish sentiment is illustrated in a series

of charts below- from the Yardeni Group website:

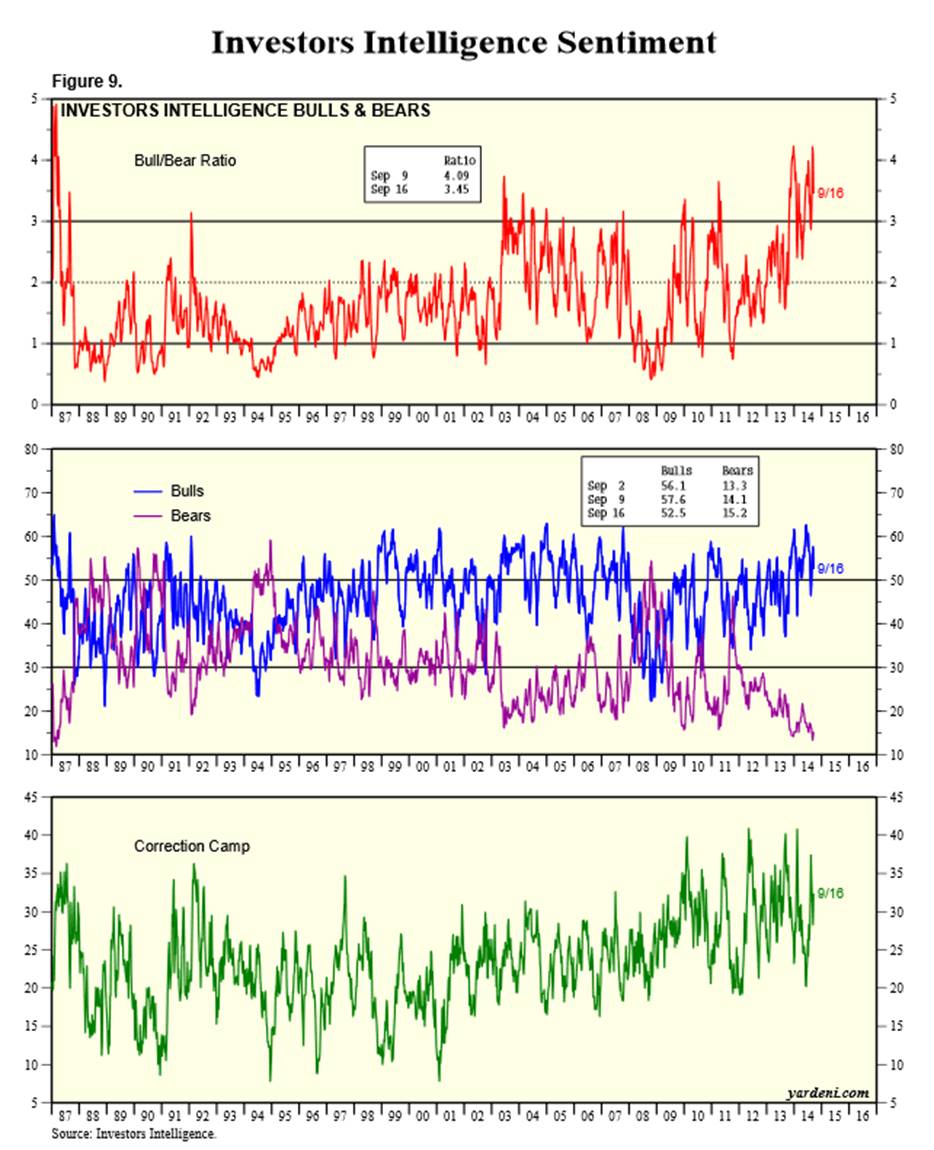

1. Investors Intelligence bull/bear ratio hit

the highest level since 1987 on Sept 9th at 4.09, but dipped to 3.45 on Sept

16th. It has been above the 3.0

"danger zone" since the 4th Quarter of 2013.

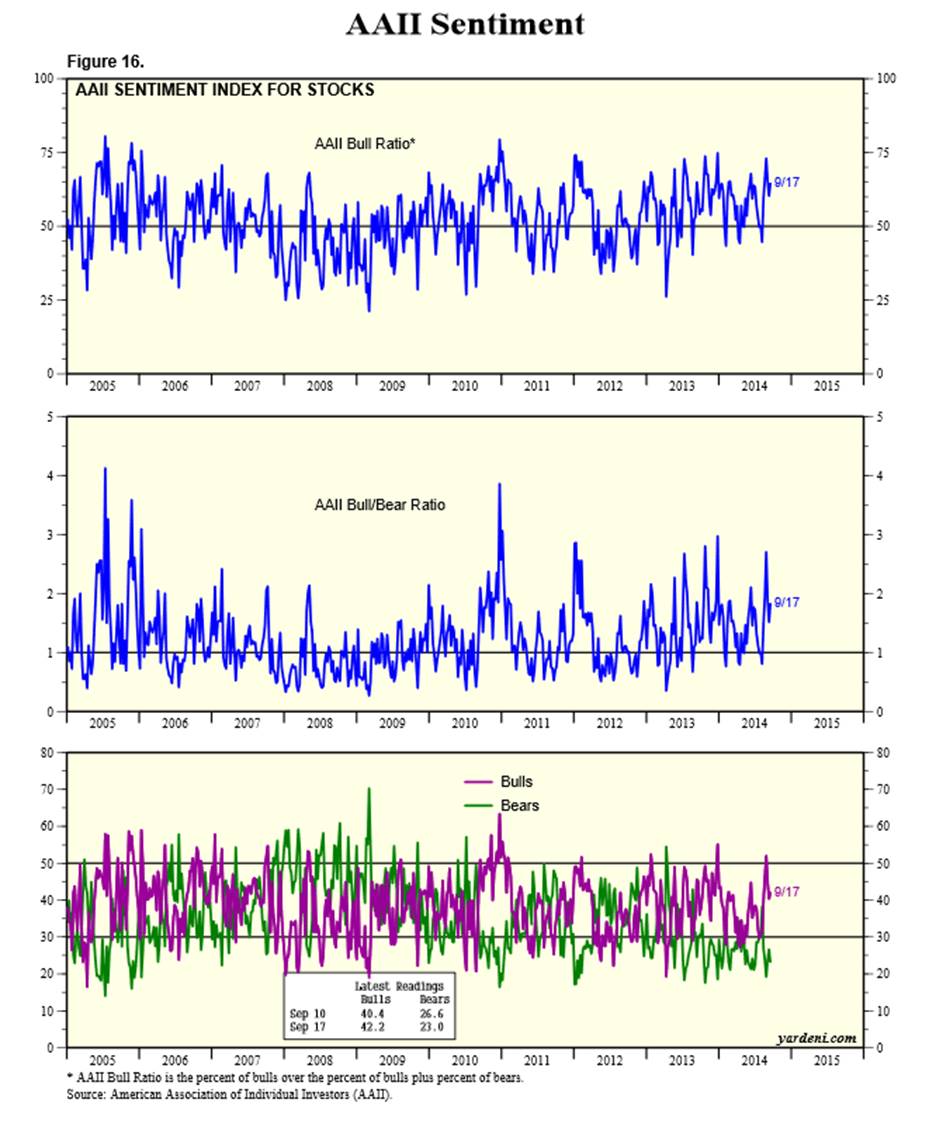

2. The AAII

bullish % has only dipped below 50% three times since mid-2013, while the

bull/bear ratio has been hovering around 2.0 for most of this year. As of Sept 17, 2014, AAII reported that 42% (+1.9% from last week) of its

members polled were bullish, while 23% (-3.6% from last week) were

bearish. For reference, the Long-Term

Average is Bullish: 39.0%, Neutral: 30.5%, and Bearish: 30.5%.

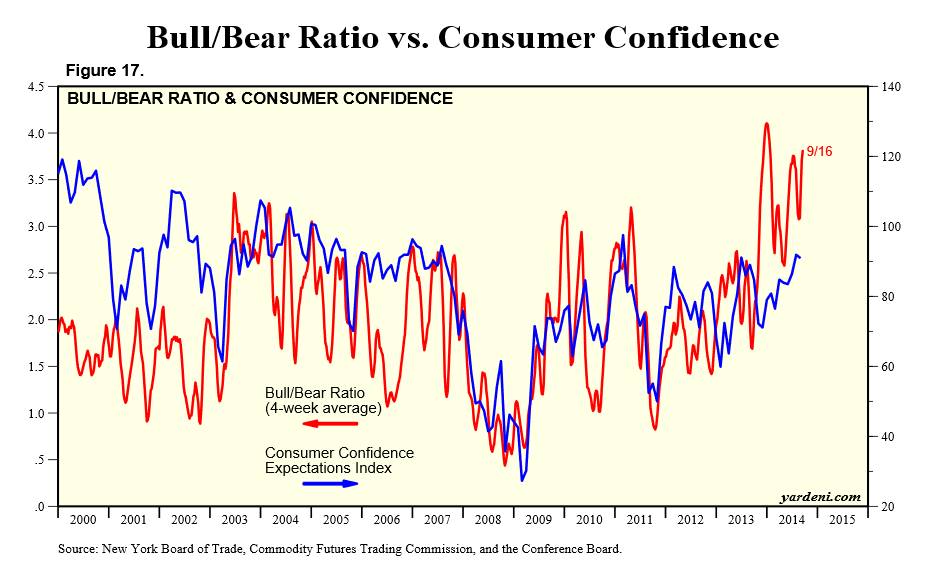

3. The AAII

bull/bear ratio four week moving average has consistently been above the

consumer confidence future expectations index, which decisively shows

"investors" are more bullish than the public at large.

The Alibaba IPO:

No doubt the successful Alibaba (ticker: BABA) IPO

has stirred up animal spirits amongst market players. BABA soared 38% Friday in its first day of

trading after being priced at the top end of the underwriters'

already-increased expected range. That makes Alibaba

a $231 billion company - more valuable than Amazon and eBay combined!

About a quarter-billion Alibaba shares changed

hands in its first day of trading.

That's an indication that many of the shares were flipped, rather than

bought and held for a long term investment.

Granddaddy of Investment Newsletter Industry

Speaks Out:

In a note to subscribers this week, 90 year old

Richard Russell, author of Dow Theory Letters since 1958, wrote:

"Confidence and complacency are more acute

now than any time I’ve seen before. All expressions of overvaluation are at

historical extremes. Despite this, most money managers remain in the

market. The thesis is “if it’s going up, regardless of anything else, I want to

be in it.” Perhaps the best indicator of complacency is the VIX which at its

current level of 13 tells us that investors see no reason to protect their

positions. Every minor decline is seen as a buying opportunity. The rationale

is that the Fed would not allow anything worse than a 10% decline. If the stock

market starts sinking between now and October 1st, I will be most interested to

see if the Fed eliminates QE."

"The Fed with its Keynesian vision believes it can

hold off a correction forever. In the history of the stock market, that’s never

been done."

Curmudgeon's Conclusion:

Stock market bears have been an endangered species

for some time. Many like David Rosenberg

and David Bianco have capitulated

and became

bulls. Others have backed away, not

willing to have their views ridiculed by all that are sure that the market can

only move ever higher. Have

corrections and bear markets become a thing of the past?

In his Sept 17, 2014 Street Smart Report,

Sy Harding wrote:

"A 20% correction from here would take the

Dow down to about 13,704, wiping out all of this year's gain (3.3%) and most of

last year's. Not likely? We think the history and the evidence says it is. It's

a shocking, not ridiculous, thought to euphoric investors who haven't seen such

a move since the 19% plunge in 2011, or even a 10% pullback since then."

Victor's Comments:

This market is truly different than anything I

have witnessed since the mid-1960s. That's because everything is manipulated to

the ultimate degree without concern or opposition. CEO’s (of public companies),

insiders, money managers and traders love this "5.75 year zero interest rate"

market. It's complemented by the Fed

printing excessive quantities of paper money which few object to.

Only savers, who receive negligible interest

rates, object to the Fed's monetary policies.

Those who are now retired, or soon will be, don't earn enough interest

to pay their bills (especially medical/health insurance). They are worried about having a 2008-like

financial wipeout hit them when they need the money and can't make it up by

earning more.

After intensive research going back to the late

1800's and the personal experience of trading, as a market maker and managing

money for 50 years: you can't

"judge" a market that has not completed a full bull/bear cycle. While the current bull market so far looks

terrific, it hasn't completed a full cycle.

It remains to be seen whether it will be good for most people or a

disaster when it does.

The 1920's were something like this market, but

far more real fundamentally than today. When the Dow Averages declined an

average of 95% from Oct 1929 -to- July 1932, I'm sure the feeling of a market

that "only went up" in the 1920's was forgotten!

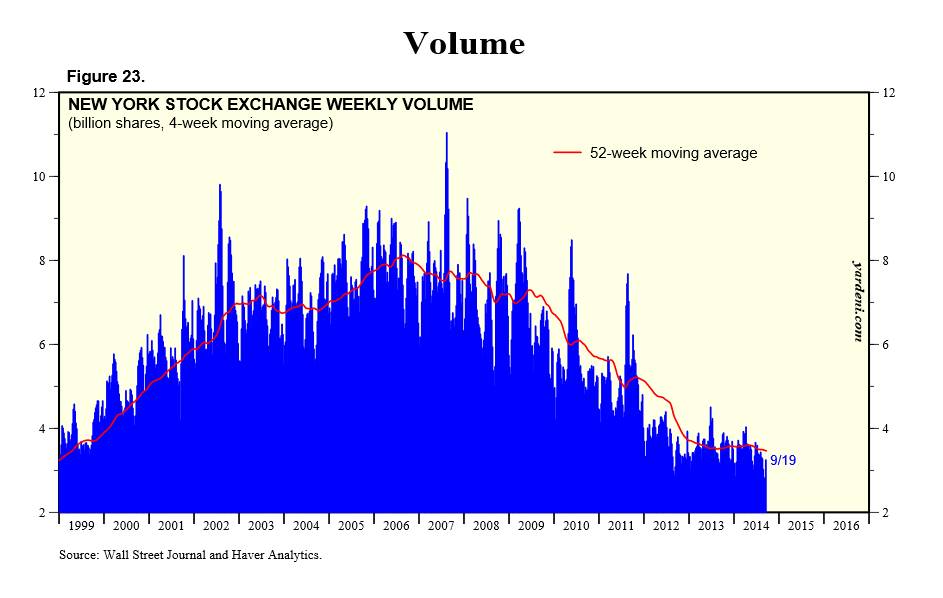

The most telling problem of today is the low

volume (see eye opener chart below) and that there is no longer a

specialist system obligated to make a market in individual stocks. It's likely that flash traders (i.e. former

market makers) will be selling in front of "investors" when the

market seriously turns down. That could

turn a market correction into a rout.

Also, if a problem occurs from an outside source

or there's an unanticipated negative event, what ammo does the Fed really

have left? Of course, they could announce that they are buying stocks, but

would the public accept a bailout of those who have benefited the most since

the bull market began in March 2009?

[This week, the House passed a bill overwhelmingly

(333 for and 92 against with support from 106 Democrats) to "Audit

the Fed." However,

U.S. Senate Majority Leader Harry Reid will not allow it to go to the floor of

the Senate. If the Republicans gain

control over the Senate in this November's elections, it will likely come to a

vote. If the bill only gets 67% of the

Senators votes (not 78.4% as in the House) the bill will pass and be immune to President

Obama’s veto. That could cause quite a

bit of anxiety for financial market participants who are concerned their easy

money gravy train may come to an abrupt halt.]

Taking it step by step, the next known news that

could affect markets is the final second quarter GDP revision coming out next

week. Next will be the Friday

employment/jobs report. That will be

followed by third quarter estimates on GDP in late October and the midterm Congressional

election in November.

In conclusion, this bull can only be judged after

the bear appears and runs its course. For now the punch bowl is getting filled

and spiked with 160 proof moonshine by the Fed. Enjoy it while it lasts!

Till next

time......

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by The Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted

article(s).