New Highs as Great Disconnect Widens: Part II

by The Curmudgeon

Disclaimer: We

originally planned to site corroborating evidence from the NY Times, Financial

Times, WSJ, and USA Today that the Fed's monetary stimulus has greatly benefited

financial markets, but not the real economy.

But since that has been so well publicized, we've decided to devote Part

II of this series to what Prof. Robert Reich said about the U.S. and global

economy during his 2013 IDC Directions keynote last week and to look a bit

deeper at U.S. corporate earnings.

Robert

Reich's Key Points at 2013 IDC Directions, March 5th, Santa Clara, CA

·

U.S.

government sequestration (automatic government spending cuts) will continue at

least till the remainder of this fiscal year (Sept 30, 2013). It's likely to reduce U.S. GDP by ~0.5%.

·

The

U.S. government will shut down on March 27th (when current funding

authorization ends) unless Congress agrees on new funding levels. Both parties in Congress say that they wish

to avoid a government shutdown, but doing so will require cooperation that's

not occurred in a very long time.

·

Austerity

economics results in reduced government deficits, but also slows economic

growth dramatically.

·

U.S.

GDP growth of only 1.5% to 2% will result in continued high unemployment.

·

Median

real wage is 8% lower than in 2000. As

an example, the median wage of the largest U.S. company,

Wal-Mart, is only $8.36 per hour.

·

8.3%

of new college graduates are unemployed (higher than the overall U.S. unemployment

rate of 7.6%). Many that have jobs are

"underemployed" or not working full time.

·

Despite

ultra-low interest rates, consumers have not been able to borrow as much as

they'd like. That's because banks don't

want to take on any more bad debt and many consumers don't have a good credit

rating.

·

Housing

has been buoyed by investors buying property to rent out, rather than by owners

occupying the homes they've bought.

·

No

growth in Eurozone this year; most countries will be in a contraction or

recession.

·

Especially

with new government leaders taking over, China's economic data is probably not

accurate. It probably overstates growth

and other economic activities.

·

(In

response to a question) Corporate profits have been very high because

"companies are doing more with less."

They lay off workers and cut costs to reduce expenses, but their top

line is not growing very rapidly at all.

Corporate profits are not likely to rise from here until GDP picks up,

according to Prof. Reich.

Corporate

Earnings are not so hot anymore!

The Curmudgeon

has been pounding the table for some time, stating that corporate profits

cannot grow significantly more than GDP or worker productivity. That's from Economics 101!

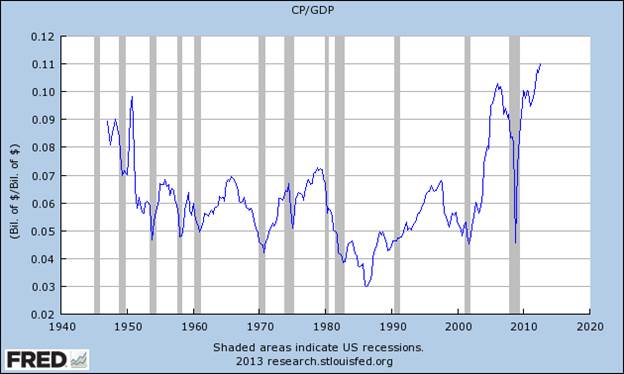

The graph above

shows that profits as a percent of GDP are at an all-time high- significantly

higher than during the sixty year period from 1947-2007. That implies that the theme of "doing

more with less" has been played out and that future earnings growth will

be subdued in the current low global growth environment.

Let's look at

4th quarter corporate earnings. By most

measures, they turned out to be reasonably good, but not great. They were better relative to Wall Street

analyst expectations immediately before the reporting season started in early

January 2013, but significantly lower compared to expectations in early October

(4thQ 2012). However, earnings growth

was significantly lower compared to the average of the preceding four quarters

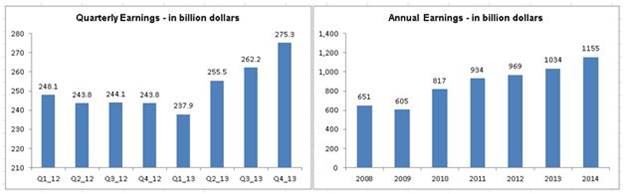

as per the chart below.

Source: Zacks Investment Research

The chart on

the left shows absolute dollar levels of earnings for eight quarters (four

previous quarter and estimates for the next four). The chart on the right shows

earnings for seven years (five actual and two based on consensus analyst

estimates).

The chart on

the left clearly shows earnings have not grown in the last three quarters. They

are expected to bottom out in the current quarter and then are forecast to grow

smartly for the next three quarters.

Specifically,

expectations are for flat earnings growth (up only +0.3%) in the first half of

the year, but a ramp up in the second half to an earnings growth pace of

+10.2%. Earnings growth momentum is

expected to carry into 2014, with forecast earnings growth of +11.7% that year

after the +6.8% gain in 2013 and +3.8% growth in 2012.

Will those

earnings expectations be met? We don't

think so. Earnings increase through

either top line revenue growth and/or profit margin expansion. Margins have

peaked already and at best can be expected to stabilize around current

levels. More importantly, it's not

possible to have significant revenue growth in the current growth-constrained

environment, with U.S. GDP not likely to rise more than 1.5% to 2% (as we've

been saying ad nauseam).

We believe that

current earnings estimates are way too high and they need to come down quite a

lot. One could reasonably project that

earnings growth could turn negative this year, especially for the retail sector

as consumer spending is likely to be pinched by a variety of factors (as noted

in previous Curmudgeon posts). If

earnings growth flattens - out as Prof. Reich thinks (with the absolute level

of earnings in 2013 and 2014 about the same as in 2012)-

than stocks appear to be overvalued. In

other words, actual earnings growth will be substantially lower than what is

currently imbedded in stocks prices. That could potentially serve as a major

headwind for the market once it becomes apparent that earnings expectations

won't be met.

Note: The current S&P500 P/E ratio is 17.93

[http://www.multpl.com/], while the

Schiller P/E ratio (divisor based on the average inflation-adjusted earnings

from the previous 10 years) is 23.98 [http://www.multpl.com/shiller-pe/]. The forward P/E ratio (based on earnings

growth expectations) is significantly lower, depending on who's

earnings estimates are used.

Second Thoughts?

But maybe the

entire analysis above is irrelevant?

Some pundits believe that as long as the Fed keeps its "pedal to

the mettle" by printing money (currently $85B per month) that goes into

the financial markets, there won't be any large stock market corrections or

(heaven forbid) a cyclical bear market.

That thinking would imply that the equity market does NOT want

unemployment to ever drop below 6.5% which might end QE infinity and take away

the prop that's artificially boosted stock prices so much faster than

underlying economic growth.

Till next time.....................................

The Curmudgeon

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.