Big

Tech, Risky AI Debt Investments, and the Fed in 2026

By Victor Sperandeo with the

Curmudgeon

Markets Week in Review:

Global financial markets rebounded

strongly during the holiday-shortened week ending on

November 28th. Optimism surrounding a potential December interest

rate cut by the Federal Reserve and robust consumer spending during Black

Friday helped to boost market sentiment.

The S&P 500 rose 3.73%, the NASDAQ advanced 4.91%, and the small cap

Russell 2000 leaped 5.82%, as investors seek higher returns by taking on more

risk.

U.S. notes and bonds were mostly higher (yields lower) last week. The key 10-year T-Note yield closed the week

at 4.02% while the 5 year was at 3.59%.

The U.S. dollar index (DXY) was down -0.72%, closing at 99.42 on

November 30th. That was its worst weekly decline in the last four

months. The dollar dropped mostly because

foreign exchange traders concluded that weakening jobs data will lead to more Fed

rate cuts, even as many Fed policymakers express concern about still-elevated

levels of inflation.

Gold prices surged about $150 to $4,220/ounce this week,

while Silver skyrocketed to an all-time high on Friday closing at

$56.67/ounce spot price with a COMEX futures settlement price of $57.163/ounce

and a final trading price of $57.085/ounce.

The last day of the month, with

most everyone gone for the Thanksgiving holiday, resulted in a very thin market

which is subject to manipulation. Rumors attributed Friday’s Silver price jump

to one large hedge fund, which was buying everything including options on

futures to drive up the price. Whoever it was did a very good job, as it caught

everyone by surprise. Next week it will be interesting to watch Silver’s price

action to tell if this was based on anything fundamental or purely technical

trading.

Big Tech and AI Investments

Continue to Propel the U.S. Stock Market:

There seems to be no end to the

steep rise of U.S. mega-cap tech stocks.

That despite everyone and his brother realizing it is being fueled by

spending on AI data centers, debt and circular deals.

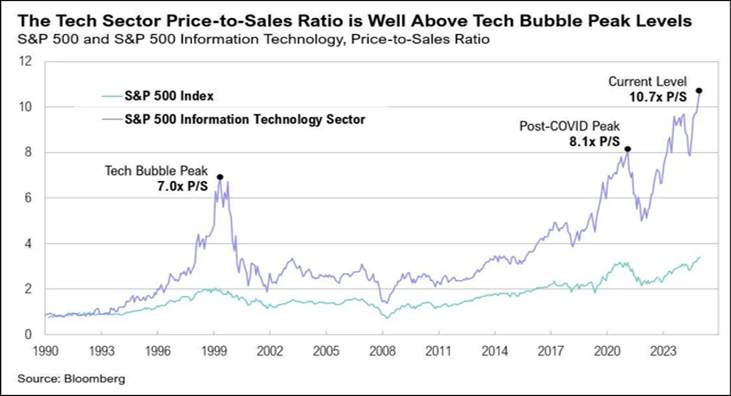

Tech sector valuations have soared

to dot-com era levels - and, based on price-to-sales ratios, are well beyond

them. Some of AI’s biggest proponents acknowledge the fact that valuations are

overinflated, including OpenAI chairman Bret Taylor:

“AI will transform the economy…

and create huge amounts of economic value in the future,” Taylor told The

Verge. “I think we’re also in a bubble, and a lot of people will lose a lot of

money,” he added.

Global AI-related investments

(mostly massive data centers) are projected to exceed $4 trillion by 2030,

reflecting investor zeal to capitalize on a technology that surged in

popularity after ChatGPT was launched three years ago. Record spending by big

tech companies persists despite skepticism about a near-term payoff as many

organizations report zero measurable return

from billions in capital investment.

The top five hyperscalers have

raised a record $108B worth of debt in 2025 - more than 3x the average

over the past nine years, according to data compiled by Bloomberg

Intelligence.

Meta, Google, Microsoft,

Amazon and xAI (Elon Musk’s company) are all using off-balance-sheet vehicles,

including special-purpose vehicles (SPVs) to fund part of their AI

investments. A slowdown in AI demand

could render the debt tied to these SPVs worthless, potentially triggering

another financial crisis.

Alphabet’s (Google’s parent

company) Sundar Pichai sees “elements of irrationality” in the current scale of

AI investing which is much more than excessive investments during the dot-com/fiber optic built-out boom of the late 1990s. If the

AI bubble bursts, Pichai said that no company will be immune, including

Alphabet, despite its breakthrough technology, Gemini, fueling gains in the

company’s stock price.

What to Expect from the Fed

in 2026:

The key to future Fed monetary

policy will be the Supreme Court’s decision on whether President Trump has

legal authority to fire Fed Governor Lisa Cook. The court is scheduled to hear

oral arguments on Jan 21, 2026, with a decision by late Spring. In my opinion,

the court will rule in Trump’s favor to fire her as she did

commit fraud and never denied it. That will enable Trump to control the

majority (4 of 7) appointees on the FOMC.

White House economic

adviser Kevin Hassett is the odds-on favorite to be appointed Fed Chairman when

Jerome Powell term ends on May 15, 2026. He has emerged as the leading

candidate due to his close relationship with Trump and will bring the

administration's preference for interest rate cuts to the Fed. On Sunday’s Fox

News' "Fox and Friends" program, he said he’d be happy to serve as

the next Fed Chair.

What will happen then? The answer

is given in a song titled, “MONEY FOR NOTHING,” by the well-known

British rock band “Dire Straits.”

Released as a single on June 28, 1985, the song’s theme has been

designated the best in history by one DJ (I would put it in the top 5). The

song is about the perceived gap between the working-class life and the glamorous

rock-star lifestyle, told from the perspective of a delivery man watching MTV.

It is also the title of a book by Thomas Levenson about the South Sea Bubble,

a 1720s financial scandal and speculative mania.

….……………………………………………………………………………………………..

Here's Mark Knopfler playing the

intro of Money for Nothing for about 15 seconds. I think it’s a fair

representation of what Money for Nothing would make you feel like.

….……………………………………………………………………………………………..

Victor’s Market Outlook:

The 5-year March T-Note futures

hit a two-year high last Tuesday (low in yield). This has more to go next year

with Trump in control of the Fed. He has continuously pushed for lower short-term

interest rates. Of course, negative real

rates (Fed Funds below the inflation rate) will increase inflation, but it will

be hidden in the beginning in terms of headline BLS reports.

A 25-bps rate cut by the Fed on

December 10th won’t help the economy. Therefore, the U.S. equity

market will be vulnerable to a decline in the 1st quarter of 2026.

Shorting stocks with rate cuts

coming is very risky, as I’ve previously suggested. Positive momentum and some

outlandish earning projections make it much better to go long short-term dated

U.S. debt. The US debt market is the heart of the U.S. economic system. Without it, the world would descend into

turmoil.

Victor on Trump and the

Decline of the Republican Party:

Trump is doing everything he can

to anger his MAGA voter base.

Republicans are emphasizing “affordability “as an important economic

goal. However, they haven’t addressed

how such initiatives would be paid for or address structural issues.

Trump’s Gallop approval poll

rating dropped 6 points last week to stand at 36%. Mark Mitchell, the head

pollster at Rasmussen Reports (the most conservative pollster) says the

Republican Party has lost more support than the Democratic Party. Mitchell’s

projection for Republicans sounds dire for the mid-term elections next

November.

GOP leaders are feckless

and the Republican party is declining rapidly in popularity, much like Bitcoin

recently did. It’s my view that the GOP is going the way of

the Tory Party in the UK.

The highly respected U.S. General

Michael Flynn has reportedly stated that the U.S. is "involved" in an

"undeclared war" against what he calls the "axis of

autocracy" (Russia and China) and refers to what’s going on as a “coordinated

color revolution.” He has appealed to President Trump to fire Attorney General Pam Bondi and appoint

Sidney Powell to replace her. That demand was made on social media platform X

in late November 2025. To date, Trump has not yet made a public statement

addressing Flynn's explicit request. Finally,

the Department of Justice is in

shambles as FBI Director Kash Patel is a huge disappointment and is also on the

chopping block.

….………………………………………………………………………………………….

End Quote:

Mae West a unique character in American life had this to

say about money:

“Money is of value for what it

buys, and in love it buys time, place, intimacy, comfort, and a private corner

alone.”

Mae West was a celebrated American actress,

playwright, screenwriter, and sex symbol known for her provocative humor and

distinctive persona. Her career spanned seven decades, beginning in vaudeville

and moving to Broadway, where she wrote and starred in her own scandalous plays

like Sex and Diamond Lil. After making a successful transition to Hollywood,

she became a major star in the 1930s, known for her famous one-liners.

….……………………………………………………………………………

Wishing you good health,

peace of mind, success and good luck. Till next time……

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever-changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2025 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).