The Contrarian's View is published 11 times per year on a mostly-irregular schedule, and the views expressed are those of the author and editor, Nick Chase. Because nobody can predict the future, results of past suggestions or recommendations are no guarantee of future results. Material in this publication may be freely quoted provided proper attribution is given to its source. Subscription rate: Free on the Internet through the World-Wide Web service at Assumption College. Using your favorite Web-browsing program, Open URL http://nick.assumption.edu. Mailed paper subscriptions, one year for $39 to The Contrarian's View, 132 Moreland Street, Worcester, Massachusetts 01609. There is a limit of 50 paid subscribers at one time; please check for availability before sending any money. Sorry, Visa and Mastercard are not available. Overseas subscription rate, U.S. $54. Unsolicited material sent to us by UPS or by courier other than the postal service is refused and returned to sender! Phone: (508) 757-2881

I have always wondered what would have happened if, in 1929, the Federal Reserve had really stepped on the monetary gas to avert a fall crash, rather than raise interest rates in the spring of 1929 and lower them only after the Crash had occurred. Would the Roaring Twenties' bubble have gotten even bigger? Would easier money have softened the Great Depression by giving people the feeling of affluence and keeping their spirits high?

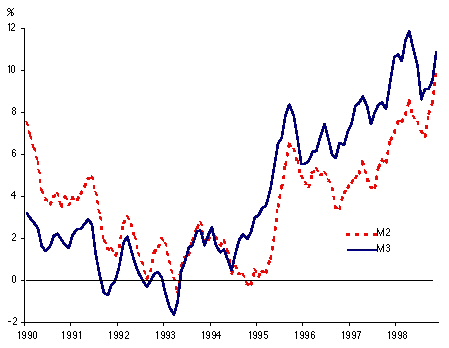

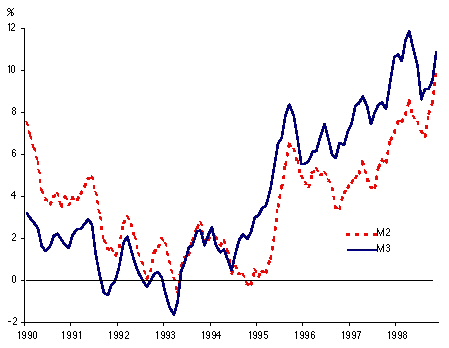

We're about to find out, I think. As the graph shows, the Fed continues to ease at an extraordinary rate, trying to bail out the world as it slips, country by country, into a global ongoing depression - and the funds gravitate to the only show left in town, the U.S. stock market (and, to a lesser extent, some of the European markets). But like the alien plant in "The Little Shop of Horrors", the stock market needs greater and greater infusions of blood.... er, sorry, money..... and even bodies (LTCM, Indonesia, Korea, Russia...) to maintain its "health" and keep growing.

Will the Fed escalate the rate of money creation to keep the market bubble expanding, as long as so-called "inflation" (that is, the government's fudged version of it) doesn't accelerate? Where you do draw the line? What will happen when the Fed finally realizes that the stock-market monster is so big that it cannot continue to feed in increasing amounts of money without creating economic imbalances, and it must stop?

You know my opinion.... meltdown! What will actually happen?

Who knows..... but odds are 99.9999% it won't be pleasant. Stay tuned as

the Federal Reserve attempts to write a different outcome than the Great

Depression and the Japanese collapse.

"For the most part, in the past, if you did not work, you did not eat and therefore, survive. Much of what is 'called' work today, is not. All manner of frivolous occupation is passed off as 'work'. They are not employed in ANY occupation that is directly involved in the things of living. Digging up bones in South Africa is not work. Slapping labels on raspberry mineral water in bottles with hand-pleasing shapes is not work. Playing basketball for the NBA is not work. Starring in a movie is not work. Slathering cream cheese on a six-dollar bagel is not work.

"Only a very tiny percent of our population is involved in the actual work of living, that is, the ESSENTIAL component of agriculture. In 1820, more than 70% of the labor force worked on the farm. By 1900 fewer than 40% were engaged in agriculture. Half a century ago...more than half the population had shifted from the production of goods to the production of services.

"It was the destabilization of the depression that utterly changed the landscape to an interest to ensure the 'consumption' of goods as opposed to a concern for their production. This is the only reason that alleged 'growth' has been so important to what passes for modern 'economics'. Today, over 70% of the population is involved in the production of 'services'. Less than 30% is involved in the production of goods and less than 3% are involved in agriculture.

"When times get really bad, we will have no use whatsoever for the 'services'. There are countless millions and millions and millions of people, in this country alone, who do no essential work of any kind at all. They are employed in the 'services'. When the technology fails and people have to resort to actual work, they will find they are skill-less. Intuitively, you understand this. Many pollyannas have even come out and said that the third-world countries will be less affected by the consequences of Y2K. Why? Because they have a much higher proportion of people who actually do work.

"When the companies begin to go belly-up, millions will be displaced. They will find that for every available 'real' job there will be hundreds of takers. People who have skills like plumbing, welding, carpentry will have a high demand for their services while the frivolous 'laborers' like advertising executives, tax lawyers, movie moguls, employees of Disneyland and Sea World, antique store owners and interior decorators, personal shoppers, fashion models, party planners and data entry operators will be shit out of luck. Multiple millions will find themselves 'unemployed' as if they were 'really' employed in the first place in anything other than the production of 'whatever' for mere growth-oriented consumption; production for consumption's sake alone, not because any of it is integral to or necessary for living."

Milne notwithstanding, frankly, I'm a lot happier being the world's oldest webmaster and living a technology-aided lifestyle than I think I would be tending backyard crops with a hoe and ox, and I don't begrudge people whose 'work' helps me lead a more comfortable way of life. But his point is well-taken: The division of labor, greatly accelerated by the development and implementation of complex computer systems, has created a great many interesting (and unnecessary to survival) jobs that would become useless if the technology that supports them fails.

The mathematics of probabilities tell us that the probability for failure of the whole is greater than the failure of a single part. The formula for the probability of a "system" failure is:

Alan Greenspan has said that 99% Y2K compliance for the U.S. banking system is not sufficient; the banks must be 100% compliant. (Not likely, but that's what he said.) Greenspan understands math: Let's assume that there are 20 "too-big-to-fail" banks, banks the Fed must keep open at any price.... only the Federal Reserve knows the precise number, but this is a fair assumption. If we assume these 20 banks have equal influence on the viability of the monetary system (probably not too far from the truth), along with an equal influence by the Federal Reserve System itself, then if each component (bank or Fed) has a 99% chance of becoming fully Y2K-compliant (a 1% chance of failure), the odds of a failure in the banking system are:

For the banking system to reach what we might consider an acceptable systemic risk, odds of failure of less than 1%, the odds for each component achieving full Y2K compliance would have to be greater than 99.953%. Well, maybe the nation's "too-big-to-fail" banks will all be able to achieve this level of perfection before the century date arrives - I look forward to their issuance of warranties. My bank, which is in the "small-enough-to-fail" category, has yet to issue ATM cards with an expiration date later than 12/99. How's your bank doing?

The math also works for individual organizations. If a business has six "mission-critical" systems - and by mission-critical, I mean that if the system dies it kills the company's cash flow and will force the firm out of business in short order if not fixed or worked around - and we take Capers Jones' figure that Y2K in private industry in the U.S. will be 85% fixed by January 1, 2000, and use that percentage for our hypothetical business, then the odds that the business will fail in 2000 are:

As a business increases in size and complexity, its odds for experiencing failures grow dramatically. A company with 100 "mission-critical" systems (think fond thoughts of the Internal Revenue Service here) and a 95% chance of being Y2K-bug-free in each, has a 99% chance of going belly-up. Not good odds (for something you'd like to have around, anyway). If you think the math is bogus, recall General Motors, where shutdowns at a handful of its 10,000 parts suppliers will force the assembly lines to a halt

You can also do the math on the "system" we call "modern living". What is "mission-critical" in your life? I would say: Food, water, shelter, energy (to keep you warm if you live in a frigid climate), safety, sanitation. Well, maybe you could exclude "sanitation" if you don't mind getting a little smelly, or digging a hole in the back yard by chopping through the frozen earth, in the middle of winter, to put up an outhouse should the sewers back up; but city-dwellers don't have this option, so I'll leave it in. Let's leave out "shelter", since Y2K is unlikely to dissolve your home; then, using the same 85% success-odds as mentioned previously for the other "components", the odds for failure in your "lifestyle" are:

Obviously, you can tip the odds much more in your favor by estimating

the duration of any failure and stockpiling what you need until things

are fixed. Even the "experts" of the PR-flak type, such as Koskinen, Bennett

and utility spokespeople, recommend storing a few weeks' worth of food,

water, toilet paper, medicines, cash for living expenses, etc. to see you

through any short-term interruptions in services we have come to consider

essential. For people in cold climates, a generator is also suggested.

Seems like sound advice to me.

Has anyone noticed that the reported earnings for the S&P500 are now $38.10? They were $38.73 at the end of 1996 when the S&P500 stood at 740.74. The S&P500 is now at 1170 [in early December 1998]. What happened to the growth in earnings that supposedly justified the high P/Es of late 1996? - Wayne Crimi

So basically now everybody knows we're having a bubble, and a lot of people understand that we've got excess capacity. And yet everyone thinks that we can party on, dude, because nothing will go wrong. This is just remarkable. In past manias, people denied there was a mania and therefore everything was OK. Now we have people openly acknowledging that we have a mania and still no one cares. - Bill Fleckenstein

A massive amount of institutional money is being invested by professional managers whose sum total of bear market experience consists of the sharp but temporary market correction of 1987. Felix Rohatyn, one of the industry's most respected stock market observers, put it concisely when he noted that Wall Street is now in the hands of a bunch of 26-year-old kids with computers.... creating a financial hydrogen bomb. - John Pugsley

Our individual and collective fortunes have become so inextricably linked to the Dow's performance that its very performance has become an obsessive mania -- a common passion -- that has become so big and fascinating that it has relegated every other important national endeavor to relative obscurity. Religion, politics, military questions -- all of these have taken the proverbial backseat to the Dow and have in large measure been completely obliterated from the national psyche. When this happens, speculative activity has reached a climax and is destined to implode of its own weight. - Clif Droke

When the public finds out it has been tricked into putting their life savings into the top of a bubble, they will want to know who to blame. My advice? Blame Greenspan and the investment industry. - Michael Belkin

In studying previous market crashes, I have noticed one dominant correlation. The greater the leveraging, the greater the subsequent crash. Because the amount of leveraging is more extreme than either 1928 or 1987, the coming crash should be the most severe of this century. - Steve Puetz

What scares me the most is that the only thing we're counting on for the world to get out of this [crisis] is for the American consumer to keep on buying and, for this, to have the value of their portfolios get bigger and the bubble go on. - Lawrence Lindsey [former Federal Reserve governor]

For evidence of how extremely loose credit in America really is, all one has to do is watch cable television where former star athletes with toll free numbers pitch home equity and used-auto loans. Bordering on the unbelievable, lending companies now advertise toll free phone numbers to provide credit for hair transplants, plastic surgery, and home equity loans to poor credit risks up to 125 percent of equity. When selling furniture, computers, exercise equipment, etc., retailers now routinely offer credit with no money down and no payments for up to twelve months. Lending and borrowing are reckless as never before. - Kurt Richebacher

Make no mistake about it, a debt-driven consumption boom in conjunction with a credit-driven speculative boom can explode like a double-barreled shotgun next to your ear. Will it happen? Who knows? The point is that it can happen. It's no way a remote possibility. Something like it is happening in Japan and the U.S. is committing most of the same economic sins. A shrewd handful of contrary souls recognize that liquidity is paramount. - James Cook

There is no change in monetary policy that can stop this economy from crashing. None whatsoever. And with Y2K pouring gasoline on the fire, it is a stone cold certainty that the depression of the thirties will look like a week at Disneyland.... The debt situation is so far out of hand that the consequences are absolutely unavoidable. It would take an unheard-of political will to stanch the bleeding. It is not going to happen. The result will be that the Federal government will have no choice but to print money.... on a scale that would make Weimar Republic legislators swoon. - Paul Milne

The present [world economic] crisis is not the result of market failure. Rather, it is the result of governments intervening in or seeking to supersede the market, both internally via loans, subsidies, or taxes and other handicaps, and externally via the IMF, the World Bank and other international agencies. We do not need more government agencies spending still more of the taxpayers' money, with limited or nonexistent accountability. That would simply be throwing good money after bad. We need government, both with the nations and internationally, to get out of the way and let the market work. - Milton Friedman

The disintegration of the global capitalist system will prevent a recovery, turning a recession into a depression. - George Soros [in The Crisis of Global Capitalism]

I believe that before this is all through, central banks, the IMF and the World Bank could easily be held in the same low regard as other centrally-managed bureaucracies, like the government of the former Soviet Union. - David W. Tice

One of the last new issues to be floated at the peak in 1929 was Mausoleum Incorporated. The next time you fly into JFK, take a look at the graveyards on the way into the city. That was the property of Mausoleum Inc. Now when you can take a graveyard and turn it into a public offering, you have reached the peak in insane new issues. - Martin A. Armstrong

In 1980, at the peak of the silver boom, I paid a visit to my parents. Several years earlier they had purchased 3 bags of silver coins from me at $1,700 a bag. On this particular day silver had reached $48 an ounce. They asked if they should sell their bags of coins. I was shocked by the question. Nobody was thinking about selling silver. It was going straight up. Some said it would soon hit $100 an ounce. My parents had a profit of $75,000. This was a lot of money for them and would really help their retirement. After some thought, I agreed that they should sell. The next morning I went in to my bullion trader and sold their silver, along with some that I had. All the traders looked at me like I was crazy. My managers heard about my sale and they questioned my decision. This was heresy. Why did I sell? Everyone, including me, expected silver to keep rising. I had grave second thoughts and questioned my own reasoning. However, I had looked at the money and how much it really would help my parents. It was a lot of money for them. That's how every investor should look at their stock gains. If it's a lot of money, take it. - James Cook

Wall Street research is a perfect oxymoron and it gets worse every year. - Bill Fleckenstein

The new slaves are linked together by vast electronic chains of television that imprison not their bodies but their minds. Their desires are programmed, their tastes manipulated, their values set for them. Whereas the black slave was chained to a living master, the new slave has become a digit, a mere item of production that is expended by an invisible master without heart or soul. - Gerry Spence [in From Freedom to Slavery]

My job is not so much to report the news as it is to mold public opinion. - Peter Jennings [1988]

Did you know that 99.76% of all sex deviates have eaten tomatoes?

Most even admit they have eaten them on a regular basis! The tomato growers

even try to get kids hooked on tomatoes - they hide the awful things in

sauces, pizzas and even slip tomatoes into the innocent hamburger. Most

killers have eaten tomatoes! Every juvenile delinquent interviewed by me

has eaten tomatoes! As for proof that tomatoes are damaging - just crush

a few tomatoes and them drop a worm into the juicy pulp - it will die in

seconds!!! And if even this does not convince you - prepare a 5-gallon

bucket of the pulp, take a person by the hair (I recommend those who support

censorship, especially censors) and immerse their head completely in the

mess for about 5 minutes. Every such person this has been tried on - has

died!!! That alone should be proof that tomatoes are deadly! - Paul

Davis

As the House was passing the first article of impeachment, Bill Clinton munched a sandwich in the Oval Office. At the same moment, the men, women and children of Baghdad again rushed for cover from his Cruise missiles. The schizophrenic Clintonian tragedy was thus manifested for the world to see. The American television networks could not decide which event to show, and decided to split their screens to show both simultaneously. They needn't have worried too much: either way, Clinton was bombing. - Steve Myers

What [chief U.N. weapons inspector] Richard Butler did last week with the inspections was a set-up.... This was designed to generate a conflict that would justify a bombing.... the two considerations on the horizon were Ramadan and impeachment. You have no choice but to interpret this as 'Wag the Dog.' You have no choice. - Scott Ritter [formerly a U.N. weapons inspector in Iraq]

Lie under oath -- bad. Lie under oath about sex or to facilitate your sex life -- fine. Steal a car -- bad. Steal a car to have sex in, or get to your sex -- fine. Rob a bank -- bad. Rob a bank and use the proceeds to assist with sex -- fine. .... Do anything you want illegal; but ensure that at some point in the process you have some sex; you are then off the hook. - Christopher Horner

Even if he did what he's alleged to have done, what's the big deal? - Betty Friedan

Here it is in a nutshell: If Clinton can break the law and get away with it, then I do not have to obey any federal law either. - Bob Clarke

You are not dealing with a normal person when you are dealing with Clinton. He is not controlled by character and truth, but by cunning instincts for survival and political expediency. Give him and inch and he will beat your brains out! He is capable of causing a Third World War, martial law, or whatever to maintain his position of power. - Jim Johnson [former Arkansas Supreme Court justice]

He told me Mrs. Clinton hired him. - Linda Tripp, on Craig Livingstone

One.... of the biggest changes that has occurred since our revered

founders were about their business has been the rise of the propaganda

state. If you regularly lie to the public or withhold information from

it, then polls will reflect not a generic popular will so much as an index

of the public's victimization. - Sam Smith

Within the business programming community, the conventional wisdom is that a minimum of 12 months testing of the remediated software would be necessary before putting it into production. That makes December 1998 the last possible month to finish remediation and commence testing. If that's true, then the next few weeks starting mid-December 1998 should be marked by several thousand new press releases per day from corporations proudly announcing on-time achievement of the planned milestones. If you do not see such press releases, then it should be safe to presume that the Y2K project is behind schedule. - Dick Mills

At the WDC Y2K meetings, VPs from NY financial organizations have reported that during the 1987 stock market meltdown, the trading volume was too large for their systems to process. After several weeks of analysis, several companies decided to write off the anomalies, "You may owe us millions or we may owe you millions but neither of us can reconstruct what happened." This is one reason that the meetings are attended by executives from NY and the buffet is so lavish. They (I'm not naming names) are running scared (taking Y2K seriously). WDC Y2K is their way to get the word out, to communicate with the Fedgov that Y2K is a serious matter. Overall, it has been a noble effort but not the success I'd hoped it would be. I have met some interesting people at WDC Y2K, heard some incredible stories... I have shared all I can but the comments before and after the meetings are the most shocking. - Cory Hamasaki

I'm back in NY doing a Y2K consulting gig at a Wall Street brokerage. I was here briefly in July and August. What a difference four months make. In every office now, every hallway, every elevator, coffee shop, restaurant, and street corner in the financial district, all you hear is Y2K this, Y2K that, Y2K blah blah blah, and it's all problems, troubles, and surprises. The brokerage I'm in now is slipping schedules.... My former Y2K colleagues across the street, at a very large bank currently involved in takeover rumors, tell me that all of the schedules are slipping there as well, and that testing is not getting done on time, or at all. A very nasty testing problem that I discovered in August, involving aging the data on a whole bunch of client-server databases, has been ignored, because nobody knows what to do about it. I talked to a fellow college alum at a party this weekend, who is now a corporate attorney involved in writing SEC Y2K disclosures. She told me that she's being pressured to ignore the international operations of multinational operations, and focus on domestic operations, where the news is better.... The most obvious question to me is this: when are all of the securities analysts who work in this neighborhood going to start tuning in to the same conversations that I'm hearing, which after all, are right in the buildings where they work? ....Stand by for mass realization, fear, loathing, and chaos. Like every other group-think movement on Wall Street, this massive school of fish will turn on a dime, and then turn on each other. The water won't be safe until all the blood is gone, and I gotta tell you, some of these fish are fat. - Internet post, anonymous at her/his request

I have a cousin that is in mid to upper management in a fairly large bank here in the South. He told me over Thanksgiving that they were within 8 weeks of being through with their remediation. Hardware has been changed out in most locations, etc., etc. In other words, good news. I made the comment that at least he didn't have to worry then. His reply was that even though they would have a good amount of time to test (almost all of 1999), you could bet they were in for lots of nasty surprises as the testing moved forward. Furthermore, he said that even if this went great, with few problems, when they "went live" they were going to have a mess because of all the interconnections. Now while this is nothing new to what we've all been hearing, I did find it interesting to hear it from someone this high up in a bank. Sorry I can't give the name of the bank, but he would obviously like to keep his job! - Greg Sugg

I have two cousins and a friend who all work for different hospitals in L.A. County and each has been told they will not be able to take vacations around the turn of the millennium until deep into 2000. - Michael Taylor

Some of the Fortune 5000 are doing well. Some have their code renovated and will finish their testing in the next few months. Most will go Chevron.... What if 4,000 of the Fortune 5000 suffer months of IT outages? There are 50,000 S/390 style mainframes in the world, suppose 40,000 of them have Y2K application problems that disrupt production for weeks or months? ....Maybe there is something that can be done in the little time left. Based on discussions with programmers who live and breathe enterprise computing, I'm not encouraged. - Cory Hamasaki

Serious testing -- end-to-end testing, and integration testing involving multiple firms, and multiple combinations of "supply chain" interfaces -- has not yet begun in any of the key industry sectors. All we know for sure is that 1999 will be The Year of Testing Dangerously. - Ed Yourdon

[Australian] December 1999 futures bills are priced over 30 basis points higher than the average of the September 1999 and the March 2000 bill. Somebody has already priced in a short-term market-induced interest rate rise at that time. I can't think of another explanation other than the Y2K bug. - Chris Caton

Russia, known to some as Bangladesh With Missiles, has an official Y2K budget of zero. The country has no money for Y2K; it has no money for anything these days. Reports in late October 1998 indicate that food supplies have fallen to approximately a 2-3 week level, and that fuel stockpiles are also falling; chances are that Russian bureaucrats, business leaders, and citizens are far more concerned about the lack of food and fuel, as winter approaches, than they are about fixing a pesky computer bug whose consequences won't be felt for another 14 months (by which time they may be dead anyway). Similar problems confront the governments and businesses throughout several Asian countries; it doesn't give me much hope that Y2K projects will be given a high priority throughout the region. - Ed Yourdon

Be aware of the Millennium Bug, but don't do anything about it.... There's nowhere to hide. - Ric Edelman

Plan for the worst, and hope for the best. - Ed Yardeni

I know it's not a good idea to "fight the Fed", and the Fed is currently aggressively goosing the money supply, as I showed earlier. In normal times this would mean clear sailing ahead, enjoy the bull. But as we enter 1999, the exceedingly weak technical strength of the market, the probably of at least some minimal Y2K related failures, and the introduction of the Euro, which I think will be "messy", make holding stocks over the year-change interval very risky. (Normally, you would want to be positioned to take advantage of the cessation of tax-loss selling, and the traditional "bounce" in small-cap stocks that usually occurs in the first two weeks of January.)

I continue to see arguments that demographics.... that is, the baby-boomers piling money into their 401(k)s and the like.... will keep propelling stocks forever upward. First, recall that the stock market is an auction market - when you put in cash (buy), someone else pulls it out (sells). Even so, added cash will tend to push prices upward, at the expense of some other area where prices drift lower.... bank CDs, bonds, gold, whatever. So a look at the figures might be instructive.

Since January 1991, when the current bullish jag (excluding 1994) took off and when, by the way, I was bullish.... I am not a perpetual bear.... the valuation of stocks has increased about $8 trillion. Cash added to stocks through mutual funds (these are the baby-boomers, presumably) was $1.1 trillion. Thus, 14% of the valuation increase was from buying pressure, and 86% cannot be accounted for other than by increased expectations - that is, stocks will go up forever, there will be no recession, the Fed won't let stocks go down, blah, blah, blah....

If I were a boomer (or anybody up to eyeballs in stocks), I would be

deathly afraid of a paradigm shift in expectations. Let's see, anything

on the horizon that might cause such a shift? Creeping global depression?

Derivatives failures? Recession? Y2K? Euro? Nope, don't see anything, clear

sailing ahead, say the incognoscenti. You (I hope) and I know better. When

blood flows in the streets, it's time to buy stocks; when the streets appear

to be paved with gold, you know it's a mirage and it's time to sell or

stay away.

A. "Phoenix" -real portfolio, begun on October 1, 1995.

SUMMARY - "Phoenix":

Original cost: $ 8,090.45 Present value: $ 6,470.16 Increase: $-1,620.29 [-20.03%]The performance of this portfolio and its predecessors ("Hedger's Delight", "Present and Future Income", "Crapshooter's Folly") from January 1987 to the present is -9.32%, for a compound annual rate of return of -0.81%.

COMMENT on "Phoenix": No change from the last issue. (Cash balance is not up to date.)

B. "Professors' Investment Group (PIG)" - investment club portfolio.

SUMMARY - "PIG":

Original cost: $ 8,575.00 Present value: $ 7,418.37 Increase: $-1,156.63 [-13.49%]COMMENT on "PIG": The PIGs' Web page is at http://www.assumption.edu/HTML/Faculty/Kantar/WPigs.html

C. Roth rollover IRA - real portfolio, includes commissions:

SUMMARY - IRA:

Original (1983-86) cost: $ 8,326.19 Present value: $11,407.57 Increase: $ 3,081.38 [+37.01%]The performance of this portfolio (including its predecessors) from January 1, 1987 to the present is +4.02%, for a compound annual rate of return of 0.32%.

COMMENT on IRA: There is no change from the last issue, other than New Germany Fund distribution.

D. CREF Pension plan; I switch between indexed stock/bond/money funds:

Date Sold Bought 13Mar92 stock @ 56.65 MM @ 13.41 29Apr92 MM @ 13.48 bond @ 31.19 19Jun92 bond @ 32.14 MM @ 13.55 29Jun92 MM @ 13.57 stock @ 56.74 24Jul92 stock @ 56.76 MM @ 13.61 29Oct92 MM @ 13.72 stock @ 58.61 23Dec92 stock @ 61.48 MM @ 13.78 16Jan95 MM @ 14.83 equity-index @ 26.44 20Jan95 eq-index @ 26.19 MM @ 14.84 30Oct97 MM@ 17.24 bond@47.56 (27.17%) 30Oct97 MM@ 17.24 i-i bond@26.12 (27.17%) 11Feb98 bond@ 48.84 MM@17.52 (27.17%) 11Feb98 I-I bond@ 26.23 MM@17.52(27.17%) 16Jun98 MM@ 17.84 TIAA Traditional (45.87%) Values, 23Dec98: stock, 167.77; MM, 18.33; bond, 51.95; inflation-indexed bond, 27.06; TIAA current yield in SRA, 5.75%Gain, 1988: 18.91%; 1989: 14.48%; 1990: 8.28%; 1991: 27.93%; 1992: 10.20%; 1993: 3.08%; 1994: 4.07%; 1995: 4.80%; 1996: 5.28%; 1997: 5.38%

E. Current unfilled portfolio good-til-cancelled orders: None.

COMMENT on "Timer's Trend": We're still on the SELL signal from December 11. New highs in the popular averages are possible.... as is a meltdown with virtually no warning. This is a mania..... watch the "computer warmline".... treat all sell signals with the greatest respect.

______________________________ TIMER'S TREND _________________________________

Tue 1 Sep 98 .# I . | 7827.43 @|~.~~~~-~~~~~~~~~~~~~~~~~~~~~~~~*

Wed 2 Sep 98 #. I . | 7782.37 @| . - *

Thu 3 Sep 98 # . I . | 7682.22 @|~.~~~-~~~~~~~~~~~~~~~~~~~~~~

Fri 4 Sep 98 # . I . | 7640.25 @*~.~~~-~~~~~~~~~~~~~~~~~~~~~~

Tue 8 Sep 98 . I# . | 8020.78 |~.~-~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Wed 9 Sep 98 # . I . | 7865.02 |~.~~-~~~~~~~~~~~~~~~~~~~~~~~

Thu 10 Sep 98 # . I . | 7615.54 @|~.~~~-~~~~~~~~~~~~~~~~~~~~~~

Fri 11 Sep 98 . #I . | 7795.50 |~.~~-~~~~~~~~~~~~~~~~~~~~~~~~~~*

Mon 14 Sep 98 . #I . | 7945.35 |~.~-~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Tue 15 Sep 98 # I . | 8024.39 |~.~-~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Wed 16 Sep 98 .# I . | 8089.78 |~.-~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Thu 17 Sep 98 # . I *. | 7873.77 |~.-~~~~~~~~~~~~~~~~~~~~~~~~~

Fri 18 Sep 98 # I . | 7895.66 | . - *

Mon 21 Sep 98 #. I . | 7933.25 | . - *

Tue 22 Sep 98 .# I . | 7897.20 | . - *

Wed 23 Sep 98 . | .# | 8154.41 |~.-~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Thu 24 Sep 98 # . I . | 8001.99 |~-~~~~~~~~~~~~~~~~~~~~~~~~~~

Fri 25 Sep 98 #. I . | 8028.77 | .- *

Mon 28 Sep 98 .# | . | 8108.84 | - *

Tue 29 Sep 98 # | . | 8080.52 | - *

Wed 30 Sep 98 # . *I . | 7842.62 |~.~-~~~~~~~~~~~~~~~~~~~~~~~~

Thu 1 Oct 98* # . I . | 7632.53 |~.~-~~~~~~~~~~~~~~~~~~~~~~~~

Fri 2 Oct 98 . #I . | 7784.69 |~.~-~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Mon 5 Oct 98 # . I . | 7726.24 | . - *

Tue 6 Oct 98 #. I . | 7683.51 |~.*~-~~~~~~~~~~~~~~~~~~~~~~~

Wed 7 Oct 98 # . I . | 7741.69 | . - *

Thu 8 Oct 98 # . I . | 7731.91 | . - *

Fri 9 Oct 98 .# I . | 7899.52 |~.~~-~~~~~~~~~~~~~~~~~~~~~~~~~~*

Mon 12 Oct 98 .# I . | 8001.47 |~.~~-~~~~~~~~~~~~~~~~~~~~~~~~~~*

Tue 13 Oct 98 # . I . | 7938.14 | . - *

Wed 14 Oct 98 # I . | 7968.78 | . - *

Thu 15 Oct 98 . |# . | 8299.36 |~.-~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Fri 16 Oct 98 . | #. | 8416.76 |~-~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Mon 19 Oct 98 . | #. | 8466.45 |-.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Tue 20 Oct 98 . | # | 8505.85 |+. *

Wed 21 Oct 98 . #| . }| 8519.23 |+.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Thu 22 Oct 98 . |# . | 8533.14 |+. *

Fri 23 Oct 98 .# | . | 8452.29 + . *

Mon 26 Oct 98 . |# . | 8432.21 +~.~~*~~~~~~~~~~~~~~~~~~~~~~~~

Tue 27 Oct 98 . # . | 8366.04 |-.~~~~~~~~~~~~~~~~~~~~~~~~~~

Wed 28 Oct 98 . |# . | 8371.97 + . *

Thu 29 Oct 98 . | # | 8495.03 +~.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Fri 30 Oct 98 . | # | 8592.10 |+.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Mon 2 Nov 98 . | . # | 8706.15 |~+~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Tue 3 Nov 98 . | # | 8706.15 | .+ *

Wed 4 Nov 98 . | . # | 8783.14 |~.~+~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Thu 5 Nov 98 . | .# | 8915.47 |~.~+~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Fri 6 Nov 98 . | # | 8975.46 |~.~+~~~~~~~~~~~~~~~~~~~~~~~~~~*

Mon 9 Nov 98 . # . | 8897.96 | .+ *

Tue 10 Nov 98 . # . | 8863.98 *~+~~~~~~~~~~~~~~~~~~~~~~~~~~~

Wed 11 Nov 98 . |# . | 8823.82 |*.~~~~~~~~~~~~~~~~~~~~~~~~~~~

Thu 12 Nov 98 . |# . | 8829.74 |+. *

Fri 13 Nov 98 . | # | 8919.59 |+. *

Mon 16 Nov 98 . | # | 9011.25 |+.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Tue 17 Nov 98 . | #. | 8986.28 | + *

Wed 18 Nov 98 . | #. | 9041.11 | + *

Thu 19 Nov 98 . | # | 9056.05 | + *

Fri 20 Nov 98 . | . # | 9159.55 |~.+~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Mon 23 Nov 98 . | . # | 9374.27 |~.+~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Tue 24 Nov 98 . | #. | 9301.15 | .+ *

Wed 25 Nov 98 . | # | 9314.28 | .+ *

Fri 27 Nov 98 . | .# | 9333.08 | .+ *

Mon 30 Nov 98 * . # . | 9116.55 |~+~~~~~~~~~~~~~~~~~~~~~~~~~~~

Tue 1 Dec 98 . |# . | 9133.54 |+. *

Wed 2 Dec 98 . # . | 9064.54* |+.~~~~~~~~~~~~~~~~~~~~~~~~~~~

Thu 3 Dec 98 * . #I . | +.~~~~~~~~~~~~~~~~~~~~

Fri 4 Dec 98 . | . # | 9016.14 +~.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Mon 7 Dec 98 . | # | 9070.47 |+.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Tue 8 Dec 98 . |# . | 9027.98 |+. *

Wed 9 Dec 98 . | #. | 9009.19 | + *

Thu 10 Dec 98 .* I . | 8841.58 |+.~~~~~~~~~~~~~~~~~~~~~~~~~~

Fri 11 Dec 98 # I . {| 8821.76 +~.~*~~~~~~~~~~~~~~~~~~~~~~~~

Mon 14 Dec 98 # . I . * | 8695.60 |~-~~~~~~~~~~~~~~~~~~~~~~~~~~

Tue 15 Dec 98 . #I . | 8823.30 |~-~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Wed 16 Dec 98 . #I . | 8790.60 | .-

Thu 17 Dec 98 . I# . | 8875.82 |~-~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Fri 18 Dec 98 . I# . | 8903.63 | - *

Mon 21 Dec 98 . I # | 8988.85 +~.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Tue 22 Dec 98 . #I . | 9044.46 +~.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

Wed 23 Dec 98 . I .# | 9202.03 |+.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

========================================================================

"Timer's Trend" is based on 4% and 10% exponential moving

averages of the New York Stock Exchange advance/decline line (that is,

the ratio of advancing to declining stocks). There are many symbols shown

above, but the ones that count are the braces: {, } = "Timer's Trend" (4%

exponential confirmed by 10% exponential) SELL ({) or BUY(}) signal.

NEXT ISSUE - will appear about January 30. /Nick Chase