Japan’s Sharp Drop in 2nd Quarter GDP

Proves Abenomics Has Failed

by the Curmudgeon with Victor Sperandeo

Introduction:

We report and

analyze the sharp drop in Japan's second quarter GDP followed with scenarios for

what the Japanese government might do if economic growth remains weak. Next are excerpts from David Stockman's blog

post on the huge failure of Japan's expansionary monetary and fiscal policies. Victor wraps up with his unique perspective

on Japan's misguided economic policies and a suggestion they follow the Hong

Kong model of ultra-low taxes.

Steep

Decline in Japan's Economy Blamed on Sales Tax Increase:

Without much

U.S. press coverage, Japan's Cabinet Office on Wednesday reported

that GDP declined at a 6.8% annual rate in the

second quarter. On a quarter-to-quarter

basis, Japan’s economy shrank 1.7% from April till June. That sharp drop was mostly attributed to an

increase in the national sales tax from 5% to 8%, which triggered a sharp fall

in consumer spending. Contrast that

dismal report with the 6.1% growth in the January-March quarter, when Japanese

consumers shopped heavily before the higher tax took effect (see chart below).

Although

Japan's economic contraction was a bit milder than the consensus forecast, it

was still far more severe than most experts had predicted when the sales tax

rise took effect on April 1st. It's Japan's

worst economic contraction since the earthquake and tsunami more than three

years ago. Consumer and business

confidence remains fragile, despite the bold stimulus program of the Shinzo Abe government (AKA Abenomics).

The Abe

administration has increased public spending and backed a super aggressive

monetary expansion by the Bank of Japan (BoJ). Approximately 75% of all Japanese government

bonds issued have been purchased by the BoJ. That's essentially a version of debt

monetization/quantitative easing (QE)/money printing on steroids.

Yet Japanese

government fiscal and monetary stimulus programs didn't offset the April 1st

sales tax increase, which took a heavy toll on household spending. Private consumption in the April-June quarter

decreased 5% compared with the previous quarter (which was before the 3% sales

tax increase took effect). Economists

said the sales-tax increase might be squeezing households because they are

paying more for every day goods, but they haven't seen much increase in their

incomes.

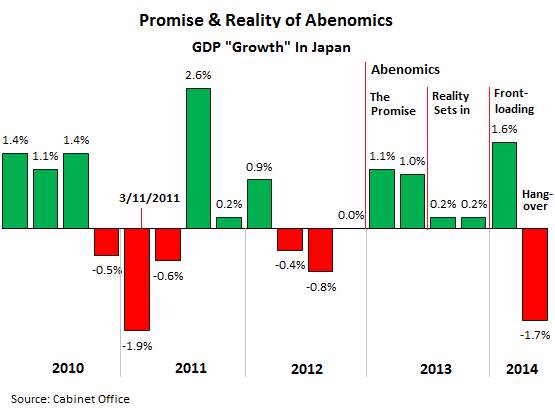

"Note the

sudden impact of the stimulus after the earthquake in 2011, followed by its big

fade that lasted four quarters. That’s how stimulus works. Then, in the first

half of 2013, the beginning of the Abenomics era, the economy got high on

promise, hype, and hope and on money-printing. In the second half, reality set

in, and the economy languished. And so far in 2014, the net effect of

frontloading and hangover is that GDP has actually declined."

Several

economists are worried that exports are not expanding in response to a

weakening of the Yen (through the government policy of money printing). Exports fell 0.4% on quarter in real terms,

through external demand contributed 1.1% to growth in the April-June period as

imports also fell. Another concern is

that consumer prices are increasing much faster than wages. When coupled with the consumption tax

increase, that could depress household spending for quite some time.

The 1% increase

in inventories last quarter is also troubling to economists. "This doesn't bode well for the

July-September quarter," said Yasuo Yamamoto,

senior economist at the Mizuho Research Institute. "Inventory adjustments

will be necessary, meaning production may not grow."

Yasunari Ueno,

Chief Economist at Mizuho Securities thinks the domestic economy might stay

sluggish for longer than expected.

"The next focal point is how much the economy will rebound in the

July-September period. If the upward pressure is weak, it will likely increase

the chance that Prime Minister Abe decides in December to delay the next

sales-tax hike," he said.

How will the

Japanese Government Respond to Sustained Economic Weakness?

Japan's

economics minister, Akira Amari, signaled the government’s readiness to prepare

a supplemental budget this year if growth in the third-quarter stayed

weak. However, any fiscal stimulus would

probably not be enough to have a major effect on the economy, given Japan’s

troubled government finances (huge budget deficits and humongous debt).

Mr. Abe will

have to address the sales tax issue again soon. The April increase was the

first of two that were approved by parliament before he took office. The next phase – an additional 2% rise, to

10%– is scheduled to take effect in October 2015. Mr. Abe needs to decide by

this December whether to let the tax increase go into effect or cancel it out

of concerns that the economy is too fragile.

“Confirmation

of a return to a clear recovery tone in the third quarter would make a

consumption tax increase likely,” said Tomo

Kinoshita, Head of Japan Economists at Nomura Securities. He added that a “decline in GDP in the second

quarter of 2014 would make strong growth in the third quarter easier.”

Curmudgeon's

Conclusions:

Our conclusion

is that it's extremely doubtful the IMF's 2014 forecast of 1.4% for Japan's GDP

growth will be achieved this year, primarily as a result of the increased sales

tax and lackluster export growth. The

government’s expansionary fiscal and monetary policies have been offset by tax

increases that have resulted in a decline in GDP this year.

For a

comprehensive analysis and expose of Abenomics, we suggest you read Voodoo

Abenomics-Japan's Failed Comeback Plan by Richard Katz, in the

current edition of Foreign Affairs magazine. Please also read the section below and

Victor's comments.

Japan’s

Keynesian Demise: A Cautionary Tale For Our Times:

In a very

revealing August 15th blog

post, David Stockman (Budget Director during Reagan's first term as

President) chronicles the history of Japan's great debt build up and the folly

of Abenomics. He refers to the BoJ’s latest round of QE as "a madcap rate of balance

sheet expansion that would be equivalent to $250 billion per month at the scale

of the U.S. economy."

Stockman writes

that "the BoJ is absorbing almost all of the

available government bond supply and on some days has actually left the

private market bid less. Indeed, it is

monetizing assets at such a frenzied rate that it has now become a major buyer

of ETFs and other equities. In effect, the central bank in Japan no longer

merely runs the casino; it has become the casino."

According to

Stockman, the only thing Abenomics has accomplished was to attract hot

institutional money that drove Japan's Nikkei stock index from 8,000 to 16,000

in a matter of months. "But that

excitement is now over," he says.

"The fact

is, after the most recent quarter’s GDP wipeout, Japan’s real GDP is only 0.8%

larger than it was five quarters ago when Abenomics was installed at the BoJ. And therein lies the frightful future. Were the BoJ to

actually achieve and sustain its 2% inflation target the Japanese government

bond market would either collapse, or need to drastically reprice. The former case

amounts to disaster now; the latter would entail fiscal collapse very soon as

Japan’s revenues would be soon devoured by a surging carry cost on its towering

debt."

Summing up,

Stockman writes: "There is no possibility that Abenomics will result in

“escape velocity” Japan style and that Japan can grow its way out of it

enormous fiscal trap. Instead, nominal and real growth will remain pinned to

the flat line owing to peak debt, soaring retirements, a shrinking tax base and

a tax burden which will rise as far as the eye can see."

Victor's

Comments:

As I've stated

several times in previous

Curmudgeon posts: the biggest problem world economies face today are caused

by an ideological shift towards Socialism. In Mussolini's version it was called Fascism

-or "control" of the means of production - rather than outright

"ownership" of productive property.

"Abenomics"

(instituted by Japan PM Shinzo Abe) got a shock last

week with the deep decline in second quarter GDP. Abe's policy of "three arrows1"

hit a bump in the road as Japan's GDP declined last quarter (-6.8% annualized

rate). This was largely caused by a 60% increase in sales taxes from 5% to 8%

this April. But that is only phase 1. of sales tax hikes.

As noted by the Curmudgeon above, a phase 2 sales tax increase (to 10%)

is scheduled for October 2015. If it

goes through, that would be a 100% increase (from 5% to 10%) in the national

sales tax!

Note 1. Three

Arrows: Monetary and fiscal stimulus, i.e. public works spending, was

arrows one and two. The third arrow was

structural reform, which really meant changing “union like" job

protections that don't allow companies to fire workers. In a blog

post titled, "Abenomics Hits the Skids, ” Wolf Richter referred to the three arrows as

"promise, hype, and hope."

Somehow tax

increases were not mentioned in the three arrows quiver. Why not? This is exactly what is killing

most major nations.... Tax increases needed as an excuse for debt payments!

Consider the

effects of taxation, on spending by Japanese consumers:

·

The

medium adjusted gross disposal income

(net income adjusted for income

taxes) is $25,066 per year (SOURCE:

OECD Better Life Index),

·

Sales

tax increase of 3% (from 5% to 8%) from April 2014,

·

Moderate

inflation (a hidden tax) projected to be 2% in 2014,

·

Personal

savings at 10% of disposal income (the Japanese are big savers. They saved 20%

of disposable income in the 80's).

Based on a

"back of the envelope" calculation, the total effect of all of the

above is approximately 12% less net, real disposable income for the average

Japanese consumer. That will be reduced

further if the 2nd sales tax increase to 10% goes into effect in October

2015. The key takeaway here is that

Japanese consumers will spend significantly less due to inflation and the sales

tax increases.

One may

conclude that Japan is not a place to build a business. Japanese consumers are not likely to step up

spending with rising inflation, higher priced imports (due to government policy

to weaken the Yen), and increased consumption taxes. That translates into lower domestic demand

for goods and services.

There are other

taxes that reduce aggregate demand and investment. Those include: 40%- 44%

maximum tax on income; 20%

capital gains tax this year; 6% local

taxes; other taxes for the usual prospects of property, liquor, tobacco,

gasoline, vehicles; another separate tax

for business owners (the enterprise tax), plus other miscellaneous taxes.

Japan

government policies are a clear example of the politics of control over

freedom. It leads us to another quote

from Vladimir Lenin: "the surest way to destroy a nation is to debauch its

currency." If Japan wants to

survive economically their "three arrow" policies are in urgent need

of "Seppuku" (Hara-Kiri).

Japan's debt to

GDP stated ratio is headed to 227%, second to Zimbabwe, while Hong Kong (with

much lower taxes) has a debt to GDP ratio of only 33.84%.

In my opinion,

Japan should adopt Hong Kong's mentality for its economy. Hong Kong has a 15%-17% flat tax on income,

no sales tax or VAT, zero gift and capital gains

taxes, and a relatively simple (only 400 page) tax code. This compares to the U.S. tax code of 77,000

pages! Hong Kong's low 16.5% corporate

profits tax rate is the same for foreign and local companies.

With a score of

90.1, Hong Kong was rated #1 in 2013 by the Heritage Foundation's Index

for in Economic Freedom. Hong

Kong has held the #1 position for 19 consecutive years now! In sharp contrast, Japan is ranked #24 and

sinking. [The US is #10 and also

dropping.]

As a result of

Hong Kong's zero capital gains tax rate, Lord William Rees-Mogg said: "There are many middle class people in

Hong Kong with five or ten million dollars to invest." SOURCE: The "Capitalist

Manifesto," Chapter Two. -- A Silly Foreigner, by James D.

Davidson.

An even more powerful

quote from Rees-Mogg -- one that relates to QE/debt monetization in Japan

[and the U.S.]: "The value of

paper money is precisely the value of a politician's promise, as high or low as

you put that; the value of gold is protected by the inability of politicians to

manufacture it."

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by The Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted

article(s).