Financial Engineering Continues Unchecked – Stocks Love

It!

by the Curmudgeon with Victor Sperandeo

Introduction:

We continue to

maintain that various types of financial engineering are the primary drivers of

the bull market in U.S. equities. This

corporate chicanery is made possible, encouraged, aided and abetted by ultra-low

financing rates and misguided U.S. corporate income tax policies. We've detailed the endless share buybacks,

mergers & acquisitions (especially of start-up companies), hiding profits

off shore to avoid taxes, accounting gimmicks, etc. in many past Curmudgeon

posts.

Let's examine

what happened this past week in this contentious area. We first look at proposed legislation to

curtail corporate "inversions" along with an analyst's comment on the

stock market dismissing that potential threat to end the practice. Next we highlight how a new share buyback

announcement trumped disappointing sales, earnings, and forward guidance at

Polycom. Caterpillar's huge buyback was

cheered by the market, even though sales were flat and have been declining for

19 months (see chart). Expert opinions

are presented on the long term effects of share buybacks. Lastly, Victor weighs in with his comments on

the real purpose of capital markets.

Legislation

Proposed to Stop Corporate Inversions Stalls:

Last week, U.S.

Treasury Secretary Jacob Lew threatened to put an end to the wave of

"inversion" strategies being used by pharmaceutical and other

companies to acquire a foreign company to gain tax benefits. Mr. Lew suggested any new law to end this

practice be made retro-active. While he called for quick action, the NY

Times reported

that "the Obama administration and Congress appear unlikely to take any

action to stem the tide of such deals anytime soon."

The public

focus on corporate inversions began this past April, as the pharmaceutical giant

Pfizer made a bid to merge with a smaller foreign company and then call itself

a foreign corporation for tax purposes. The drug store chain Walgreens

announced that it was considering doing the same. These were followed by the

medical device maker Medtronic and the pharmaceutical companies Mylan and AbbVie.

"This

inversion loophole must be plugged,” Senator Ron Wyden, Democrat of Oregon and

chairman of the Senate Finance Committee, said in a statement. “As the speed of inversions increases, this

will only fuel bipartisan urgency to stop companies from deserting the U.S. I’m

talking with my colleagues and exploring options for addressing this in the

near and long term,” he added.

A Senate

Finance Committee hearing this past Tuesday, Mr. Wyden described inversions

as a “plague,” and called for retroactive legislation that would eliminate

substantial tax benefits of many of the cross-border deals announced over the

last year. Deals including Medtronic’s proposed acquisition of Covidien, and AbbVie’s agreed

deal to acquire Shire, among others, would be affected by retroactive

legislation.

“The inversion

virus now seems to be multiplying every few days,” Mr. Wyden said. “The

underlying sickness continues to gnaw away at the American economy with

increasing intensity.” But there was no

consensus on how to address the issue in Congress.

Paul Macrae Montgomery of Universal Economics notes that the

market has shrugged off Congressional attempts to stop or slow down corporate

inversions.

[That's nothing new! The market seems to

ignore or dismiss any negative news (e.g. GDP revised down to -2.9%) and

threats to corporate earnings (e.g. bad economic reports, geopolitical

hostilities, declining profits, profit

margins and productivity, gridlock in Washington short circuiting any fiscal

policy, etc.)]

In a July 21st

note to subscribers, Mr. Montgomery wrote: "In our experience, if a news

item like this is going to affect the market, it usually does so within 48

hours after its release. The lack of a

market response to this "ham fisted" initiative indicates that the

boom in corporate adventurism is not about to go bust."

"The long

term implications of the current deal activity are bearish, but that's a story

for another day. As of today, corporate

action should continue to have a positive intermediate term effect on stock

prices," he added.

Share

Buyback Magic:

A superb

example of Wall Street's love affair with share buybacks (and how that

"magic" trumps sales or earnings) was illustrated this Thursday July

24th by Polycom Inc. (PLCM) -- a maker of unified communications (mostly

video conferencing) equipment and software.

The company posted disappointing financial results for the second

quarter of 2014 as both the top and the bottom line fell below the respective Zacks consensus

estimates.

·

GAAP

net income in the second quarter of 2014 was $8.6 million or 6 cent per share

compared with $5.3 million or 3 cents per share in the prior-year quarter. That was way below Zacks

consensus estimate of at 14 cents per share.

·

Total

revenue in the second quarter came in at a little over $332 million, down 3.8%

year over year and $8 million below the Zacks

consensus estimate of $340 million.

Despite the

earnings and sales misses along with lower

forward guidance, PLCM stock was up 6.2% on Thursday due to a new $200M

share buyback. The company also said it

completed its previously announced $400 million Return of Capital program.

“Today’s

announcement illustrates our confidence in the long-term growth of the company

and our continued commitment to returning capital to shareholders,” said Laura Durr, chief financial officer of Polycom. “We expect to execute this new $200 million

authorization over the next two years, while retaining sufficient capital

capacity to continue making long term investments in our business and to pursue

strategic opportunities that may arise.”

That's all the

market needed for PLCMP stock to pop on July 24th. Polycom has returned $537 million to

shareholders through share repurchase over the last two years. Evidently, the market loves that more than

organic growth in the company's business, which hasn't happened.

Here's another

share buyback smokescreen example:

Caterpillar (CAT) announced

a new plan to buyback approximately $2.5 billion worth of shares during the

third quarter, despite flat sales that are way below Nov 2012 levels.

"After a

sizable drop in sales and revenues in 2013, our ongoing forecasting process

has, since the third quarter of last year, pegged 2014 as a roughly flat year

for sales. That's still the case,"

said Caterpillar CEO Doug Oberhelman. On the huge buyback, he said, "With a

strong balance sheet, positive cash flow, sufficient cash on hand and more

modest needs for capital expenditures, it makes sense to continue to reward

stockholders."

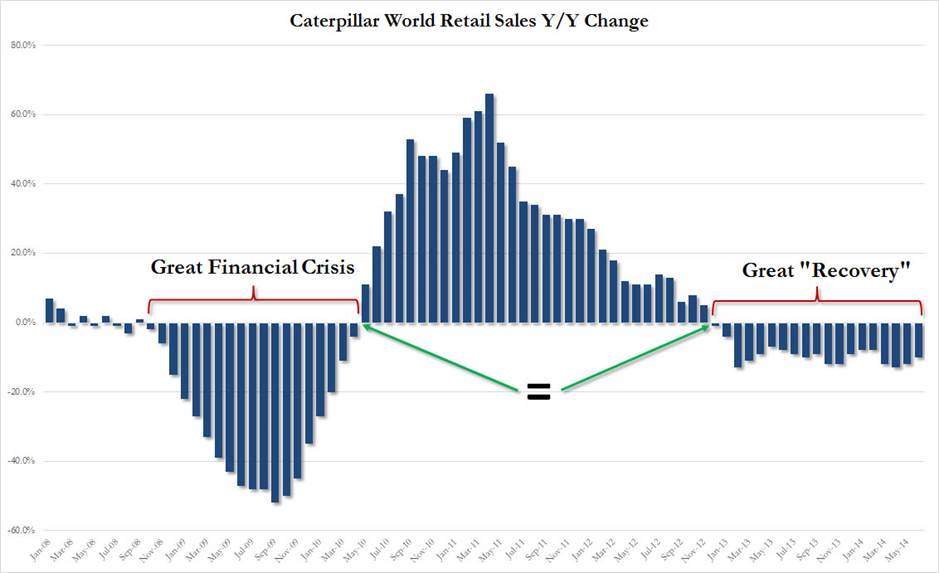

Tyler Durden of

Zero Hedge had a different take on CAT:

“Earlier today,

Caterpillar reported its monthly global OEM retail sales. It didn’t get any

press coverage for one simple reason: Through stock repurchases, Caterpillar

has managed its stock to all-time highs in recent months and hardly wants the

investing public to know the unpleasant truth, a truth which is shown in its

simplest format in the chart below: Starting

in December 2012 and continuing through today, Caterpillar has reported 19

consecutive months of declining global year-over-year retail sales. The last,

and only, time it had 19 consecutive months of such decline? The period

starting in October 2008 is just when Lehman filed for bankruptcy.”

Chart courtesy

of Zero Hedge

Summing up,

Durden wrote: “So if we are to call that first period of 19 consecutive months

of CAT sales decline the "Great Financial Crisis", we are confused:

is the proper name of this identical 19-month period of declines beginning in

December 2012 the Great Recovery?”

Curmudgeon

Comment:

Again, we

ask why don't companies use the $$$'s allocated for share buybacks to instead

expand operations, buy capital equipment and/or hire employees? That would help

the company grow real sales/earnings and aid the economy, which continues to

limp along five plus years into this so called economic recovery. See Victor's

comments for more on this phenomenon.

Other Voices

on Stock Buybacks:

Andrew Smithers wrote

in the Financial Times:

"U.S.

companies have been the key buyers of the stock market and the rate at which

they have been buying shares is unsustainable, because debt cannot continue to

grow at the pace needed to finance the purchases."

He followed

that comment in an interview with Kate Welling on Wall Street (subscribers

only) published on July 25th:

"This

(share buybacks), of course, is destroying value. If you buy assets for paying a lot more than

they're worth, you destroy value. But

again, here's another place where there can be a big difference in shareholder

interests........ If you are a long term shareholder and you're seeing somebody

coming in and destroying the value that remains, you very well might

(object)."

The granddaddy

award comment on share buybacks goes to David Stockman, who wrote in a blog

post:

"Since Q1

2008, the S&P 500 companies have distributed $3.8 trillion in stock

buybacks and dividends out of just $4 trillion in cumulative net income. That’s

right, 95 cents of every dollar they earned—including the huge gains from

restructurings, downsizings and job terminations—was flushed right back into

the Wall Street casino (share buybacks).

"Needless

to say, that is the opposite of the “growth” and “escape velocity” story that

currently excites stock market punters, and is wildly inconsistent with present

capitalization rates in the stock market. That is, in a world of permanent zero

growth and nearly 100% earnings distribution, the S&P 500′s current

19X PE on reported earnings would be wildly too high. The more appropriate P/E

would be in high single digits."

"So the

$3.8 trillion of dividends and buybacks since Q1 2008 reflects not the natural

economics of the market at work, but the artificial regime of monetary central

planning and the tax-advantaged treatment of corporate debt. Corporations are

eating their seed corn because boards and CEO’s function in a Fed-created

financial casino where they are massively incentivized to feed the fast money

beast with ever larger share buyback programs in order to shrink the float and

goose per share earnings. Doing so generates plump stock option gains, and

failure to do so will bring on the black plague of shareholder “activists”

agitating for big stock buybacks with borrowed money, and a new CEO and board,

too. Moreover, this pattern is owing to

the fact that the Greenspan/Bernanke/Yellen “put” under the stock indices has

destroyed two-way markets and the natural short interest that arises in any

honest securities market."

Victor's

Comments:

The purpose of "Capital

Markets" is to raise money ("Equity Capital") to facilitate the

building or adding to a business venture.

This includes brick and mortar projects, hiring employees/contractors,

purchasing machinery, or to build new software products and services like

Google, Amazon, Facebook, and Twitter have done for the Internet/Web 2.0.

What's so

strange about the current "upside down" Capital Markets environment

is that instead of "raising capital" to grow a business, corporate

America is "depleting and spending capital" -- and (in many cases)

borrowing via new debt to buy back shares.

It's apparently an attempt to temporarily raise the price of the stock

by lowering the float -- shares outstanding - and thereby increasing profits

per (fewer) shares. This comes in an environment where there is no real growth,

as business sales and revenue are generally flat. So we have "growing

earnings/share" with little growth in earning or revenues!

If a company

needs to reduce the shares outstanding to increase earnings per share, it seems

impossible for it to be valued at 16-20 times earnings on a fundamental

basis. So

"when" -- not "if" -- a recession occurs and the need for

capital is necessary, the company may need to sell equity to obtain that

capital. But that will be when

they least want to sell -- after the share price has declined in anticipation

of lower earnings.

The bottom line

here is that corporations are buying (back shares) high now and may be selling

low (when they truly need working capital) later. That is not the "Baron Rothschild”

method of making money in the market.

His method says "The time to buy is when there's blood in the

streets." Not after the market has

made a serious of new all-time highs which were not supported by real economic

growth.

The desire to

keep the share price rising is, of course, normal for any corporation's Board

of Director's. However, the current administration's fiscal policies (tax and

regulate) are not conducive to building a business. Therefore, hoarding and buying back shares is

the result for many companies.

The most incredible observation of all this is

that after five plus years since the recession officially ended, stated GDP

growth is lower than any time since the 1930's depression and recovery (1932 -36).

Certainly, it

would be logical to change direction, but the Fed continues to practice its

failed monetary policy, which enables the administration to continue its failed

fiscal policy. Therefore, the game continues until a meaningful geopolitical

event, or a government mistake causes these (high risk) failed policies to come

to the surface and weaken both the economy and the financial markets. Unless a dramatic change (or shock) occurs,

expect more of the same. But when the music

stops, don't expect everyone to find a chair.

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by The Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted

article(s).