Why Hasn’t Central Bank Monetary Stimulus Caused

Inflation?

By Victor Sperandeo with the Curmudgeon

Victor's

Thoughts:

Almost all

economists expected robust economic growth accompanied by higher inflation

starting with the "monetary stimulus" in 2008 and continuing to this

day. Why is it different this time and why was almost everyone wrong on their

growth and inflation forecasts? Let's review

some of this “stimulus" and the effect it's had.

The world is

awash in money, due to the ultra-easy monetary policies in the U.S., U.K.,

Japan, China, and the European Union.

There's been a never before seen array of programs including QE,

Operation Twist, guaranteed loans,

"moral suasion" (by ECB head Mario Draghi) of "doing whatever it

takes," and virtually zero interest rates that have been ongoing for the

last six years and projected well into the future.

The Fed's

balance sheet has ballooned. It went

from $800 Billion to an estimated $4.25 Trillion today--a 35.2% compounded

growth rate due to all the bonds it's purchased with money created out of thin

air. The Fed's balance sheet is

estimated to be at $4.5 trillion by the end of this year. Consumer credit has also expanded

rapidly. Led by student loans, it is now

at an all-time high of $1.2 Trillion.

Not to be

outdone, U.S. federal government deficit spending has increased markedly,

starting with President Obama's original stimulus of $787 billion in 2009. The U.S. national debt went from $10,699,804,864,612.13

to $17,536,614,238,239.15 during the period from 12/31/08 to 6/12/14--a

compounded rate of increase of 9.46%!

All that "free money" has propelled the S&P 500 substantially

higher--comfortably above 1900 and up over 40% without a correction since the

last intermediate low on November 15, 2012 when the index was at 1353.33.

However, it's done little or nothing to increase economic growth and

inflation. The "official stated CPI"

is compounding at 2.28% from 12/31/08 to 4/30/14.

This begs the

question "why is it different this time?" The obvious answer is fiscal

policy is not in sync with monetary policy.

John Maynard Keynes would agree with all the printing and debt creation....but

not with raising taxes, which in Europe is politely called

"austerity." The latter is

akin to the ideology of Marx, whose propaganda slogan is shouted daily in the

press as “income inequality."

Tax increases

have been accompanied by burdensome government regulations and a push to literally

control all aspects of social and economic life in the U.S. Our federal government now controls 18% of

the U.S. economy in just healthcare.

That's due almost entirely to Obama Care (ACA). Add more government control due to Dodd Frank

rules for banking and numerous regulations on industry. Note that regulatory burdens prevent

entrepreneurs from spending more time and money on running their businesses due

to compliance with many regulations.

This trend of

creeping socialism has led to the hoarding of money by both companies and

individuals. That is primarily

responsible for the low velocity of money (i.e. turnover) -independent

of how much money is being created for the banks to loan out. The result is that - few people are

borrowing, spending, or investing in job intensive businesses.

Instead,

"investors" are buying existing companies i.e. publicly traded

stocks. Meanwhile, companies are using

technology that requires fewer employees.

For example, the private car company "Uber”

has 550 employees with a $17 billion market valuation. You literally can't call a human at Uber as

it's all done by smart phone apps.

Also, think

about Facebook and Twitter. They don't build things or even sell products. Their services are "free" (ad

sponsored) and used for social networking purposes....for “chit chat"

among people via the Internet. Social

networking services only require sophisticated web software and data

centers-not an ecosystem of new infrastructure.

Economists

conclude there must be a lack of "aggregate demand." That is the standard Keynesian answer to why

there's little economic growth or inflation despite enormous stimulus. The Austrian School of Economics has a different

answer, which is called "Originary Interest." That is the ratio of value assigned to

existing products, and future products or the subjective judgment to save or

spend.

There is a

major difference in economic beliefs. Keynesian's say people don't have

enough money to spend and Austrian's say--look at all the money in the

system--it is because of a lack of confidence that people don't invest

in new businesses, create jobs, or spend.

The much used one word answer to why there's low confidence is

"uncertainty" (of future government policies).

History shows

that when spending occurs, inflation and (far worse) hyperinflation can come

very quickly. In 1920 Germany, the velocity of the money supply was 1.5 (in the

U.S. it's 1.62 for M2). Three years

later (in 1923 Germany), money velocity went to 12.0. In other words, money that turned over at 1.5

times per year in 1920 then went to turning over once a month in 1923. As a result, the inflation rate in Germany

from 1920 -1923 was 29,525.71% in one month. [Source: Peter Bernholtz

retired Professor from Basil Switzerland from his book "Monetary Regimes

and Inflation."]

The conclusion

is simple: "the why" is

based on ideology and economic misconceptions of the people in power today. Also the game is not over--it's just

beginning!

The question

that must be asked--even by those who promote the polices killing jobs and are setting

up for future inflation--can anyone realistically assume printing and debt

can go on forever and carry the real economy?

Today, the government

controls more of the economy and politicians do whatever they wish to create a

Socialistic state in the name of "helping the people." President Francois Hollande has tried to do

that in France and it hasn't worked.

These words of

Alexis de Tocqueville come to mind: "Democracy

and socialism have nothing in common but one word, equality. But notice the

difference: while democracy seeks equality in liberty, socialism seeks equality

in restraint and servitude."

So much for "the why…What is the endgame?

Writing in

dissent of "Julliard vs Greenman" in 1884,

Supreme Court Justice Stephan J. Field: "...From the decision of the court

(It is legal to print money) I see only evil likely to follow. There have been times within the memory of all

of us when the legal-tender notes of the United States were not exchangeable

for more than one-half of their nominal value. The possibility of such

depreciation will always attend paper money. This inborn infirmity no mere

legislative declaration can cure. If congress has the power to make the notes a

legal tender and to pass as money or its equivalent, why should not a

sufficient amount be issued to pay the bonds of the

United States as they nature? Why pay interest on the millions of dollars of

bonds now due when congress can in one day make the money to pay the principal?

And why should there be any restraint upon unlimited appropriations by the

government for all imaginary schemes of public improvement, if the

printing-press can furnish the money that is needed for them?"

Janet Yellen

et-al - please take notice...It's time to get the government in the program of

saving the golden goose not cooking and eating it!

Curmudgeon

Comments: Low Inflation Expectations

Persist!

Inflation

expectations remain very low in the U.S. and are a huge concern of the ECB in

Europe.

How high is

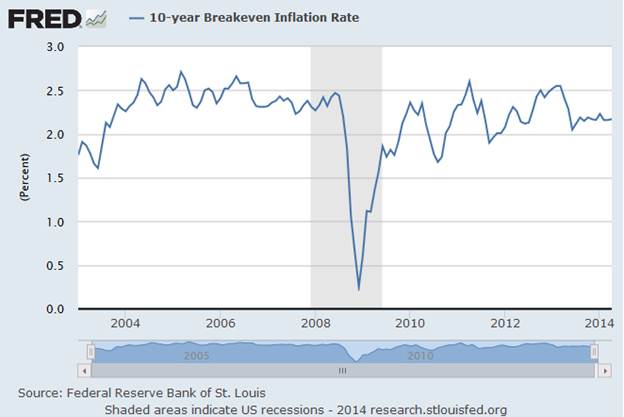

inflation going to be in the U.S. over the next 10 years? The St. Louis Fed measure of 10-year

inflation expectations is shown in the chart below.

From the look

of the graph, it doesn’t appear that markets believe any significant inflation

will occur over the next 10 years. In fact, the graph suggests that no

significant inflation has been expected since these inflation-indexed

securities were introduced.

Low inflation

will feature as a topic for discussion among policy makers at this week’s Federal

Reserve meeting. The Fed committee

members will almost certainly not talk about any interest rate hikes while

inflation expectations are this low.

The ECB is

worried about low inflation in Europe turning into deflation. Speaking at an economic conference in

Brussels last week, ECB Executive Board member Yves Mersch

said: "What we see is (that a)

prolonged period of very low inflation could lead to de-anchoring of

inflationary expectations, which then themselves would fuel into a spiral that

would have a more downward direction."

Let's now look

on the effect low inflation expectations has had on bonds and stocks. Interest rates on longer term bonds are highly

sensitive to inflation expectations, but that's not been a concern for fixed

income "investors" this year. According

to the Financial Times (FT), global

sales of corporate bonds maturing in 50 years have jumped to record levels this

year as investors are flocking to the securities. There has been no shortage of buyers for

50-year dollar bonds sold in 2014 by companies such as Caterpillar, South

Carolina Electric & Gas, Volkswagen, Johnson Controls, and EDF.

Long term bond

"investors" are dismissing concerns about duration exposure–a measure

of the sensitivity of bond prices to changes in interest rate--in their bond

portfolios. Note that long term

interest rates rise and fall depending on inflation expectations.

“For people who

are comfortable with some duration exposure, these bonds offer a good

opportunity to capture 20 or sometimes even 30 basis points in additional

yield,” said Adrian Miller, director of fixed income strategy at GMP

Securities. The CURMUDGEON thinks it's

incredible that such investor are willing to take on huge duration risk to

"capture" only 20 or 30 basis points of additional yield!

Low inflation

has often been used as an excuse to justify high stock market valuations. Scott Minerd, Chief

Investment Officer at Guggenheim Partners, told the FT that past periods of

inflation running below 2% have been accompanied by the average price to

earnings ratio being about 19.6 times, versus the current ratio of 17

times.

"Investors"

evidently haven't noticed the rise of oil prices lately. U.S. crude oil prices have touched their

highest level since last September.

Currently at $106 a barrel, oil prices are up $15 from this January’s

low. That is not good news for consumers’ wallets and ultimately for company

sales. Yet it hasn't caused bond or

stock prices to fall.

In the current

"risk is ignored" investment environment, why worry about rising

inflation expectations? We repeat what Victor wrote in last week's Curmudgeon

post: "What can possibly go

wrong?"

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by The Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted

article(s).