Low Global Yields, Weak Economies, the ECB and “Game

Changer” Elections in Europe

By the Curmudgeon with Victor Sperandeo

Introduction:

Global bond

yields hit multi-month or record lows last week, as Eurozone growth fizzled and

fixed income investors "priced in" a cut in the interest rate the

E.C.B. pays on bank deposits (from zero to a negative 0.1% or 0.2% at their

June 5th meeting). Other fundamental

forces that have driven yields lower include: China’s economic slowdown (check

the price of iron ore), FX intervention by central banks trying to weaken their

currencies (more details below), and falling global inflation (especially in

Europe).

Risk appetite

for fixed income has been voracious.

Investors have flocked to buy debt issued by Europe’s crisis-hit

“periphery” countries in recent months, sending down yields in Italy, Spain,

Portugal, Greece and Ireland. Spain’s benchmark 10-year bond yield currently is

2.93%, down from 7.62% in mid-2012.

Despite higher than anticipated producer price inflation, U.S. note and

bond yields also fell to yearly lows this week.

"Bond

bears have eggs on their faces this year," said Gary Pollack, who helps

oversee $12 billion assets as head of fixed-income trading in New York at

Deutsche Bank AG's private wealth management unit. The CURMUDGEON is one of those bond bears who

got it wrong. I was short 10 year T-Notes till earlier this week.

"For six

or seven years we've heard these (global central bank) monetary policies would

drive rates up, inflation would rise and growth would shoot up, and it hasn't

happened," said David Kotok, chairman and chief

investment officer at Cumberland Advisors in Sarasota, Fla. "We find

ourselves in this position and we don't know what to do as investors. We are

all terrified of rising interest rates and we are watching them fall."

We examine the

Eurozone "economic recovery," the E.C.B.'s likely response, and much

more in this timely article. As usual,

Victor will weigh in with his cogent comments, especially regarding the

importance of next week's elections in Europe.

Eurozone

Economy Disappoints; E.C.B. to Respond:

Central banks

have spent trillions of dollars buttressing financial markets and the global

economy since the 2008 financial crisis.

But that has apparently done little (or nothing) to spark economic

growth or lower stubbornly high unemployment in Europe.

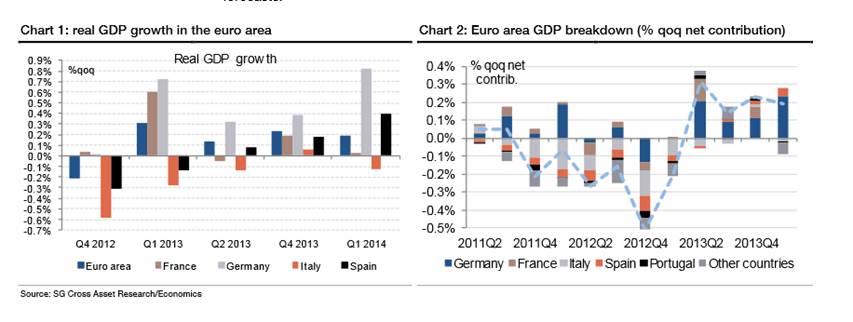

The European

bloc’s economy expanded by just 0.2% in the first quarter and missed consensus

forecasts of a 0.4% rise. Germany led the way with growth of 0.8% while France

was stagnant, Italy contracted slightly and the Netherlands shrank by

1.4%. That uneven growth is depicted in

the two charts below, courtesy of Societe General investment

bank (SOGEN):

In a piece

entitled The Bumpy Recovery Calls for ECB Action (SOGEN clients

only), Michel Martinez wrote: "The European economic recovery is slow

(0.2% quarter over quarter growth in Q1 2014 and Q4 2013), uneven and multi

speed within countries. Once again, we

would caution against excessive optimism, as only Germany has the conditions

for a full cyclical recovery led by corporate investment. All other euro countries still have a large

slack in their economy and therefore investment (construction, capex) are missing engines of growth. The (European) recovery remains fragile,

uneven and heterogeneous between countries."

Indeed, the

persistently sluggish economies in Europe and the U.S. have confounded central

bankers and surprised investors, many of whom anticipated that this year would

see relatively strong economic growth after years of monetary stimulus. In the U.S., despite rock-bottom interest

rates, housing activity remains relatively depressed, companies have yet to

increase hiring. Fewer people are

working than when the recession began and the labor participation rate is at a

37 year low.

"The

global economy hasn't fired up despite the heavy monetary stimulus,'' said Mary

Ann Hurley, vice president of trading at D.A. Davidson & Co. in

Seattle. Do you think that might be

an understatement?

“We believe

today’s weak outcome is another argument for further E.C.B. easing at their

June meeting,” said Apolline Menut,

economist at Barclays. “In our view, a cut in all official rates is the most

likely action at the June meeting, although we do not think this would be

enough to weaken the Euro further.”

In addition to

a negative rate on bank deposits, E.C.B. officials have suggested several

additional stimulus measures that include: extension of loans to commercial banks

at very low fixed rates for three or even five years, purchases by the E.C.B.

of bank loans to small and midsize enterprises packaged into asset-backed

securities, and concessional lending to European banks on condition that they

pass on these funds to those businesses.

As bond yields

in Italy and Spain fell to record lows, the euro touched an 11-week low as the

prospect of E.C.B. easing increased.

Following a herd mentality, the Euro bond buying frenzy spread to the

U.S. On May14th, interest rates on U.S.

Treasury notes and bonds fell to their lowest levels in six months, despite

wholesale inflation1 being reported much higher than expected. The 10 year note interest rate, briefly

traded below 2.5% after closing 2013 at a 3.03% yield.

[Note 1:

The U.S. producer-price index rose a seasonally adjusted 0.6% in April from a

month earlier. That marked the biggest jump since September 2012. Producer

prices rose 0.5% in March. April's rise

was more than double what economists surveyed by The Wall Street Journal had

forecast and reflected price increases for a broad range of goods and services,

from warehousing to meat prices.]

At 0.7%,

European inflation is around one-third of the E.C.B.'s targets of just

below 2%, which it defines as price stability.

“There is a developing view that the E.C.B. is behind the curve and we

are seeing investors demand high-quality government bonds and it’s causing a

lot of pain for people who thought yields would not continue falling,” said

John Brady, RJ O’Brien managing director.

While many have

called for E.C.B. quantitative easing (QE) -printing money to buy government

bonds- it is still ruled out for Europe by German opposition, as Jens Weidmann, the Bundesbank President, confirmed this past

week. Mr. Weidmann

is against QE in Europe unless and until the other measures now planned by the

E.C.B. have been tried and found wanting.

Anatole Kaletsky, chief economist of Gavekal

Dragonomics, wrote:

"The problem with the step-by-step approach favored by the E.C.B.

under pressure from the Bundesbank is that every step taken becomes an excuse

for delaying the next step. Experience suggests that E.C.B. economists may well

spend months “analyzing” and “studying” the consequences of negative deposit

rates before they decide to move onto other measures such as purchasing small

and midsize enterprise loans."

Victor's

Assessment of Low European Bond Yields:

Most incredible

to me is that Italy's 10 year note is only yielding 2.9%, while the country's

debt to GDP ratio is 132%. Other yields

of weak Eurozone countries are low and don't reflect a risk of default on their

debt. In particular, Spain yields 2.95%,

Portugal is at 3.74%, Ireland is at 2.69% and Greece (which is technically bankrupt) is at

6.86%. Meanwhile, unemployment in Italy

is 12.7%, Spain 26.0%, Greece 26.0%, Ireland 11.0% and Portugal 15.0%.

In my view, the

E.C.B. monetary easing and stimulus in June is fully discounted. But the European election outcomes are not

(reflected in European bond prices).

Therefore, being long debt is highly risky, in my opinion. Please see my comments below for my

assessment of the importance of next week's European elections.

Will E.C.B.

Easing Spur Eurozone Growth?

Gavekal's Anatole Kaletsky doesn't think so:

"Sadly,

investors may be overexcited about the E.C.B.’s plans. Even assuming all the

reports about the plans turn out to be true — and several times recently the

E.C.B. has not followed through on similar rumors — it is far from clear that

these policies would have much impact on the big economic problems facing the

euro zone: feeble economic growth and mass unemployment, a continuing credit

crunch for small and midsize enterprises in southern Europe, huge imbalances in

competitiveness between Germany and the rest of the euro zone, and deflationary

pressures that create debt traps and balance-sheet recessions in the peripheral

economies."

Meanwhile, 70%

of business executives questioned as part of the latest FT/Economist Global

Business Barometer survey rejected the idea that the Eurozone crisis was

over, with 38%concerned the region would fall into deflation this year. The quarterly survey of more than 1,500

business people also saw a drop in the number of executives expecting the

global economy to improve over the next six months, down from 49%to 44%.

José Manuel Barroso, outgoing European Commission president, told the Financial

Times that action by business was particularly important given the

impending European elections next week. He added that the high levels of

unemployment in Europe were fuelling extremism and populism.

Anatole Kaletsky: "The upshot is that E.C.B. action will

probably prove just sufficient to prevent the euro zone economy from deteriorating

any further, and the attainment of this stability will be offered as a reason

not to do anything more ambitious, either by way of monetary stimulus or the

easing of fiscal and regulatory constraints. A continuation of Japanese-style

stagnation thus seems the most likely prospect for most of Europe despite, or

perhaps because of, the half-hearted action that can now be expected from the

E.C.B."

Negative

Fallout- Currency Wars:

There may be

unwanted currency depreciations if the E.C.B. aggressively eases monetary

policy in June. Pundits warn that the

Swiss National Bank could take further action to weaken the Swiss Franc– either

by raising the minimum exchange rate from the current SFr1.20 per euro, or by

cutting interest rates. While some central

banks are explicit about their wish for a weaker currency to boost exports, the

reason others are concerned is the risk of deflation spreading to their

country.

“In a

disinflationary environment a weak currency would be advantageous,” says Jane

Foley at Rabobank. “The problem is that just about

everyone has got disinflation . . . and therefore they all want a weaker

currency. Not everybody can be successful.”

“It may not be

a currency war, but it . . . looks like a currency cold war to us,” say analysts

at Bank of America Merrill Lynch. Such

a "beggar thy neighbor" policy would surely decrease global trade and

thereby weaken global economic growth.

European

Election Timeline:

·

May

22: European Parliament election in the

UK and the Netherlands. Local elections

in the UK.

·

May

23: European Parliament election in

Ireland and the Czech Republic.

·

May

24: European Parliament election in Latvia, Malta, Slovakia and Italy.

·

May

25: European Parliament election in

Austria, Belgium, Bulgaria, Croatia, Cyprus, Denmark, Estonia, Finland, France,

Germany, Greece, Italy, Lithuania, Luxembourg, Poland, Portugal, Romania,

Slovenia, Spain and Sweden. General

election and regional election in Belgium. Presidential elections in Lithuania

and Slovenia.

·

May

27: EU national leaders meet in Brussels to discuss Commission presidency.

Leaders of the political groups in the European Parliament meet to discuss

European Commission presidency.

Victor's

Closing Comments:

The elections

next week in Europe point to "enough is enough" of the heavy doses of

government power versus ensuring the people's freedom. The Irish Times reports

that Europeans frustrated by economic hardship are likely to vote to give one

in four of the European Parliament’s 751 seats to euro-sceptics and

protest parties of both left and right.

The newspaper states: "A far-left group could gain critical mass,

possibly winning positions on the more than 20 committees that forge the

parliament’s position on legislation or trade."

Indeed, the

more extreme left or right wing voters in Europe seem like their "hope and

change" view of the economy will prevail.

That perspective is radically different from the European Union

"Troika" bureaucracy of technocrats, which haven't been able to

stimulate economic growth, lower unemployment or increase the standard of

living for the overwhelming majority of Europeans.

“There are

going to be very vocal personalities ranting against the EU,” said Derk Jan Eppinck, a Dutch member

of the current parliament that draws its members from 28 European countries

from Sweden to Romania. “These groups are anti-globalization. It’s contagious.

This will be implanted in parliament. The end effect of this is anti-business,”

he said.

Dutch MP Geert

Wilders, the leader of the Netherlands Freedom Party

(PPV), said: "The E.U. will burst at the seams after European

Parliament elections." In addition,

his comments about wanting to leave the E.U. are obvious by saying he is hoping

to destroy from within what he calls the "monster of Brussels." The PPV is the fourth-largest political party

in the Netherlands, but they are number one in the election polls, according to

FrontPage Magazine.

Among

euro-sceptics are lawmakers led by French National Front leader Marine

Le Pen and the Netherlands’ right-wing politician Geert Wilders (quoted above).

A separate Europe of Freedom & Democracy group may be dominated by the United

Kingdom Independence Party (UKIP). Left-wing radicals will likely also win

further seats in the European Parliament.

As I have

stated many times - Socialism and the economics of this impotent

ideology is the major problem of Europe.

Will the people vote to change this ideology... or not?

One stand-out

example is France, where the avowed Socialist in power (President

Francois Hollande) is leading the country to ruin. Look no further than France's anemic economic

growth and sky high unemployment to see that's the case. The French election issues also include

immigration reform, as low skilled workers from Islamic countries work for less

than local residents of France. Note

that the May 22-25 election in France will NOT result in regime change. It is for the election of the delegation from

France to the European Parliament.

The European

elections may change the culture of the voting countries that take pride in their

historical traditions. I strongly

believe the voters will be logical and vote for: less government, lower taxes,

less regulation, and NOT for leaders like Jose Manuel Barroso

(also an avowed Socialist). The election

results might usher in an era of change which would be the opposite of what we

have seen in Europe during the last five years (i.e. stagnation).

Moreover, if

these elections accomplish change, and it occurs on a large scale, it will more

than likely end the Euro as the single currency of the Eurozone. That would cause huge disruptions worldwide.

Let me say in

full disclosure that I'm not an expert in predicting what a mass population of

voters is going to do, or what they believe is in their best interest. So the elections in Europe next week may be

less than expected in my view. But if it

is a windfall voting change -- the recognition will be awesome.

Summing up, the

European elections are very possibly a "game changer" for the

economies of Europe and the global financial markets. Nothing is more important that I know of,

which will affect the markets in the short run, then the outcome of those

elections.

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by The Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted

article(s).