Was Friday’s Job Report Bullish, Bearish, or Irrelevant

for the U.S. Economy?

By the Curmudgeon with Victor Sperandeo

Introduction:

Bullish or Bearish?

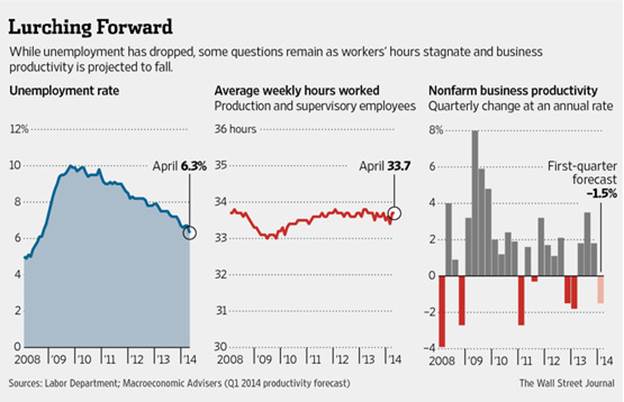

The jury is

still out....Total nonfarm payroll employment rose by 288,000 and the unemployment

rate fell by 0.4 percentage point to 6.3 percent in April, the U.S. Bureau

of Labor Statistics reported

on Friday. In addition, the number of

jobs added in February and March were revised upward, suggesting the economy

was stronger than first assumed. But is that really the case?

The newspaper

headlines were all very bullish:

·

US jobs report exceeds expectations - Staff hired at

fastest pace in over two years, Financial Times (FT)

·

Jump in Payrolls Is Seen as a Sign of New Optimism, New York Times (NYT)

·

Job Growth Gathers Strength - April Sees 288,000 Jump;

Earlier Estimates Raised, Wall Street Journal (WSJ)

Here's how each

of these iconic newspapers led off their jobs report stories:

FT:

U.S. employers hired new staff at the fastest pace in more than two

years in April, offering fresh signs of gathering momentum in the world’s

largest economy. The economy added

288,000 jobs last month, the most since 2012 and much more than the 218,000

expected by economists. The jobs report also contained upward revisions for

February and March, worth a combined 36,000 jobs, while the unemployment rate

fell to 6.3 per cent.

NYT:

After a frustrating series of false starts since the economic recovery

began five years ago, American businesses appear to be increasingly confident

about hiring new workers. In the best

monthly showing in more than two years...(that's)

three consecutive months in which payrolls grew by more than 200,000. The

report, combined with other recent data, suggests the economy is poised to

expand at a faster pace in the coming months, after a slow start in the depths

of winter.

WSJ:

The report offered a sense of relief just days after the government said

the U.S. economy nearly stalled in the first quarter, expanding at an annual

pace of just 0.1%. It also helps put to rest doubts about the durability of the

recovery more broadly, coming after harsh winter weather slowed job growth and

other economic indicators.

"The economy

was frozen at the beginning of the year and it has thawed out," said

Stuart Hoffman, chief economist at PNC Financial Services Group. There were many more optimistic quotes

like that in all three newspapers.

A Look Behind the Headlines:

But when we look

beyond the surface, the job related numbers don't look all that good. There are actually two BLS job surveys- the

household survey and the payroll survey.

It was the latter survey that accounted for all the cheers.

“The payroll

numbers suggest that the economy is recovering from a weather-induced

slowdown,” said Ethan Harris, co-head of global economics at Bank of America

Merrill Lynch. But, he said, “We still have not reached the point where workers

have any negotiating power.”

On the other

hand, the household survey shows employment declined by 73,000. Here's a summary of April BLS Jobs

Statistics, emphasizing the smaller Household Survey:

· Nonfarm Payroll: +288,000 – Payroll Survey

· Employment: -73,000 – Household Survey

· Unemployment: -733,000 – Household Survey

· Involuntary Part-Time Work: +54,000 – Household Survey

· Voluntary Part-Time Work: -330,000 – Household Survey

· Baseline Unemployment Rate: -0.4 at 6.3% – Household Survey

· U-6 unemployment: -0.4 to 12.3% – Household Survey

· Civilian Non-institutional Population: +181,000

· Civilian Labor Force: -806,000 – Household Survey

· Not in Labor Force: +988,000 – Household Survey

· Participation Rate: +0.2 at 62.8 – Household Survey (36 year low)

In the past year the population rose by 2,260,000, while the labor force rose

by 62,000. Americans “not” in the labor

force rose by 2,203,000. The labor

force participation rate dropped from 63.2% in March to 62.8%, matching a

36-year low hit in December. In other

words, it was people dropping out of the work force that accounted for most of

the declining unemployment rate.

There were other significant underlying weaknesses in the data. Despite the big jump in payrolls, wages did not grow at all in April. The average wage remained at $24.31 in April - up only 1.9% from a year ago. The flat hourly wage reading partly reflects the mix of jobs—with more hiring taking place in lower-paying industries like retail and hospitality compared to high-wage manufacturing.

Temporary employment has accounted for much of the job gains. Five years into this economic "recovery," temp-slots continue to account for an over-sized share of private payroll growth. Over the past year, temporary jobs have generated 10% of new private positions, although they account for only about 2.5% of private payrolls.

This is why so many Americans remain doubtful that they will benefit from

what both the Federal Reserve and the White House see as evidence of a

resurgent economy. Simply put, their

standard of living is not improving as many have to take lower paying jobs or

temporary positions to make a living.

Stagnant

worker productivity is another worrisome trend. Macroeconomic Advisers LLC, an economic-research

firm, estimates workers' output per hour, a standard measure of productivity, declined

at a 1.5% annual rate in the first quarter. The firm preliminarily projects

it will rise just 1% this year. More hiring plus slow economic growth equals

less productive workers. That is an understated problem.

The WSJ's Jon Hilsenrath wrote: "Wage growth and corporate profits

are an outgrowth of productivity. Productivity growth is the lifeblood of

rising living standards. Without it, prosperity languishes."

There's also

the issue of revisions. The BLS uses a

methodology of reporting job numbers using incomplete data, and then for months

following the initial release continues to revise the data.

In a Seeking

Alpha piece titled "One

New Reason To Ignore The BLS Jobs Report,"

Steven Hanson wrote: "I have no confidence this report is accurate in real

time (i.e. revisions are likely), but more importantly - employment is a

lagging indicator reacting to economic events which have ALREADY occurred.

Employment, in general, cannot be used as a forward indicator (of the

economy)."

“While the numbers

are better than expected, they are long on sizzle and low on steak,” said Guy LeBas, chief fixed-income strategist at Janney

Montgomery Scott.

In his weekend

"Long View" column (on line subscription required), the FT's

John Authors wrote: "Those in work are not feeling any better off.

Inequality is much discussed at present in the wake of Thomas Piketty’s book Capital in the 21st Century. This finding

shows why so many feel they are falling off what is already being dubbed the “Piketty fence.” As for the US jobs market, it is palpably

improving – but not fast enough to create much sense of wellbeing in the US, or

to correct deepening inequality that is causing ever greater resentment."

Expert

Opinion:

John Williams

of Shadow Stats was even more pessimistic. Here's his quick take on the April jobs

report:

• April Unemployment Numbers

Showed Deepening Economic Disaster

• Unemployed Dropped by

733,000, but Employed Dropped by 73,000, and Labor Force Fell by 806,000

• February-to-April Payroll

Jobs Gains Were Bloated Heavily by Concealed and Constantly-Shifting Seasonal

Adjustments

• April Unemployment: 6.3%

(U.3), 12.3% (U.6), 23.2% (Shadow Stats)

• Revised Retail Sales Growth

Was Slower 2011-to-Date; Downside Corrections to Prior GDP Reporting Loom in

July

• Construction Spending

Remained Stagnant

• Year-to-Year M3 Growth Rose

to 4.0% in April

In an email to the CURMUDGEON, Mr. Williams wrote: "Reporting inconsistencies distort the

headline jobs reporting and leave most of the jobs and unemployment numbers not

comparable on a month-to-month basis. To

the extent they are comparable; the decline in April unemployment was a

disaster. All the so-called reduction in

unemployment reflected people giving up looking work because there were no jobs

to be had."

When I replied

to John with a bullish quote from the NY Times (referenced above) and a recent

David Rosenberg piece on "employment conditions improving, labor market

tightening and wage growth firming," he wrote back:

"With a

liquidity-starved consumer unable to fuel a rebound in consumption, there can

be no recovery, irrespective of any political hype to the contrary." That underscores the lack of wage increases,

prevalence of lower paying jobs and most importantly discouraged workers

leaving the labor force.

Victor's

Closing Comments:

These monthly

employment reports are not usable for economic forecasting purposes. On the surface, the April numbers were mixed

as detailed above. I'm a big fan of Shadow

Stats analysis, i.e. John Williams, and strongly support his "behind

the numbers" comments.

Moreover, my

abstract thinking (without John Williams' input) is this BLS report is propaganda

to maintain the consistency of the Fed taper. Why? Its manufactured numbers to make the economy

look better than it really is so that the taper can continue. That's needed because the continued buying of

U.S. notes/bonds and mortgage debt (previously at $85 Billion a month - now $45

billion) is becoming too great a proportion of the total U.S. debt outstanding.

Due to the tax

increases and budget cuts at the end of 2012, the "stated deficit"

for the fiscal year ended on 9/30/13 was $680 Billion. As a percent of government spending and GDP,

it has declined, but the percentage the Fed is buying has increased. That's because the government issues less

debt as a result of the reduced deficit, but the Fed buys the same or slightly

less quantity, which means they are buying more of the debt being issued and outstanding. It appears that the Fed buying $1 Trillion

per year (2013) and now $540 Billion per year of debt is drying up the fixed

income markets! Simply put, the

Fed is eating up the liquidity of the debt market and has to stop or else there

will not be a market (or there will be a buyer's strike).

In my humble

opinion, the

U.S. government has become unbelievable (or untrustworthy) in just about every

dimension. It's like a bullet train of corruption picking up

speed. For example: James Clapper says (NSA

) says he is not spying under oath, IRS commissioners went to the White House

147 times and can't remember why under oath (except for an Easter Egg hunt),

Benghazi talking points (to avoid

government blame for the massacre there),

fast and furious stalling by the DOJ under oath, affordable healthcare

claims like "you can keep your plan and doctor (?), SEC said they were

investigating HFT flash crash in May 2010 (yet four years later there is still

no definitive response?). To the last

point, "the cat is out of the bag" on HFT front running. Yet it seems to be OK'd by the

regulators. I could go on and on, but

let's stop here.

If you believe

the government reports (without due diligence on anything they put out), you're

the gullible one referred to in the famous PT Barnum quote: "There's a

sucker born every minute."

Lastly, it must

be understood that the non-farm payroll numbers use the "Birth Death

model" to add an estimated 60,000 jobs a month. Yet it actually may be a negative

number! No one really knows. Developed in the 1970's, the Birth Death

model produces the estimated difference in jobs created or lost due to

business' starting and closing, respectively.

I provided a more comprehensive explanation of this flawed model as an

Addendum to a recent Curmudgeon post.

Last year, the

Birth Death "guesstimate" added 624,000 jobs out of thin air (Source:

BLS Current Employment Statistics - Historical Net Birth/ Death

Adjustments). Here's a cute analogy: The Birth Death model

is the BLS version of inflating the jobs numbers, much like Ben Bernanke used

QE to create dollars.

In closing, I

think reading government produced data is like reading Mad Magazine. It's something you might do to amuse yourself

or have fun.....or maybe not?

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by The Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted

article(s).