U.S. Personal Consumption and Income Down While

Inequality Widens Sharply

By the Curmudgeon with Victor Sperandeo

Introduction:

Economic recovery for whom? While "fat cats" on Wall

Street, VC's and overpaid CEOs rake in the dough, the rest of the country is

struggling to make ends meet with a raft of problems we identify in this

article. We look at consumer liquidity,

decelerating consumer spending (vs GDP) and declining incomes and then state

the implications of these negative factors.

Next, we examine income inequality before ending with Victor's

insightful closing comments.

Consumer

Liquidity Problems Continue to Restrain Consumption:

That was a

subheading in the latest ShadowStats report (paid

subscribers only). John Williams wrote:

"Serious,

structural liquidity problems continue to constrain consumer activity. Without real, inflation-adjusted, growth in

income, and without the ability or willingness to take on meaningful new debt,

the consumer simply cannot sustain real growth in retail sales or in the

personal consumption activity that dominates the headline growth in GDP."

Courtesy of www.ShadowStats.com

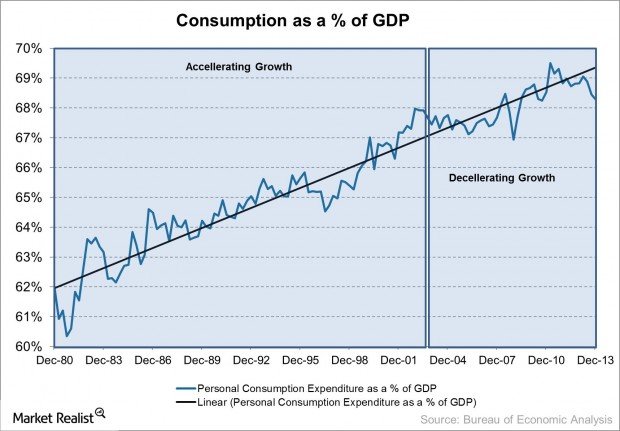

A March 20,

2014 blog

post by Marc Wiersum, MBA underscores the problem

of declining consumption in the U.S. The

graph below reflects the trend in U.S. personal consumption as a percent of

gross domestic product (GDP) since 1980.

Note the sharp decline in trend growth since December 2010.

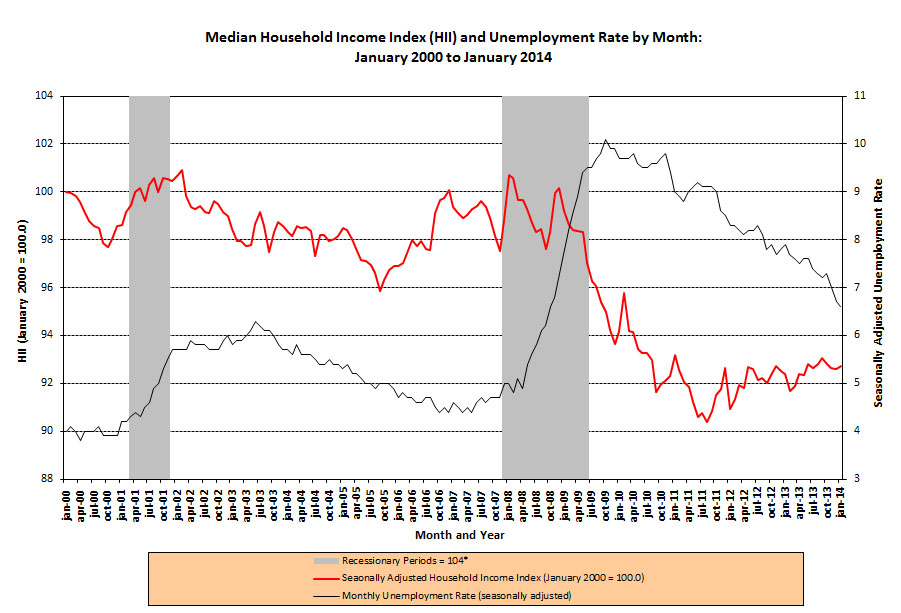

That

decelerating growth pales in comparison to the precipitous drop in household income

since late 2009, as depicted in the graph below:

Chart: Courtesy

of Sentier Research LLC

Implications

of Decelerating Spending and Declining Incomes:

The bottom line

is that for a very large number of American households, there has been no

economic recovery at all, just as the Curmudgeon has been stating for years

now! The overwhelming majority of

Americans have been caught in a vice of chronic unemployment and falling wages

with the fear of prolonged unemployment if they lose their current job. In tech la-la land, social media/chat

start-ups fetch billions of dollars with no revenue or monetization models. But

why is it that established tech companies like IBM, Intel, Cisco and Sprint

have recently announced large layoffs, AKA reductions in work force (RIF)? Is

that a symptom of a healthy economic recovery?

The Washington

Post reports

that real median household income (excluding capital gains and losses but

including cash government benefits) has declined 4.4% since the “recovery”

began in 2009. For many households, the drop has been more severe. For African-American households, it is

10.9%. For those under 25 years old, it

is 9.6%. For single females with

children, it is 7.5%. Indeed, the only households to experience an increase in

real income are those 65 to 74 years old.

Sheila Barr,

former Chair of the Federal Deposit Insurance Corporation (FDIC) wrote: "In 2014, let’s face up to the

ineffectiveness of monetary policy to help them and the desperate need for

fiscal leadership to generate real, sustainable growth."

Income

Inequality Continues to Widen; Findings from Several Studies:

1. Last month, the Brookings Institution published

a research study that was highlighted

in the NY Times. The study found that

inequality is sharply higher in economically vibrant cities like New York and

San Francisco than in less dynamic ones like Columbus, Ohio, and Wichita,

Kansas.

Many U.S.

cities are trying to remedy income inequality and expand opportunity through

measures like increasing the minimum wage and increasing taxes on the

wealthy. In no city is the effort more

prominent than in New York, where Mayor Bill de Blasio

has promised higher taxes for rich families and better services for poor ones,

including expanded early-childhood education and affordable-housing

developments.

In some cases,

higher income inequality might go hand in hand with economic vibrancy, the

study found. “These more equal cities — they’re not home to the sectors driving

economic growth, like technology and finance,” said its author, Alan Berube. “These are places that are home to sectors like

transportation, logistics, warehousing. In terms of actual per capita income

growth, these are not places that would be high up the list,” he added.

The study

confirms what many others have shown:

that the country’s big cities tend to have higher income inequality than

the country as a whole. For instance, in the 50 biggest American cities in

2012, a high-income household — which the study measured at the 95th earnings

percentile, putting it just into the top 5 percent — earned about 11 times as

much as a low-income household, at the 20th percentile. Nationally, that ratio

was 9 to 1.

2. It’s not surprising that another study

of income inequality- this one by real estate firm Trulia

- found that the gap between the rich and poor has increased in 94 of the

100 largest metropolitan areas since 1990. And that growth gap has accelerated

in the past few years. The Trulia report has very interesting tables of where income

inequality is highest and lowest. It

stated that Fairfield County, Connecticut - home to hedge fund titans living in

Greenwich as well as the impoverished city of Bridgeport - has the sharpest

inequality, when comparing the 90th and 10th income percentiles. It should come

as no surprise that New York City and San Francisco are in that same quadrant.

Income

inequality has grown in nearly all of the 100 largest metros. Between 1990 and

2012, the 90/10 ratio increased in 94 of the 100 largest metros – above all in

San Francisco, Fairfield County, and San Jose. The 10 metros where inequality

increased most include four in California and five in New England, as well as

Honolulu.

At the other

extreme, the least unequal metros in America include three in Florida that are

popular with retirees: Lakeland-Winter Haven; Cape Coral-Fort Myers; and Palm

Bay-Melbourne-Titusville. But equality isn’t just for places with lots of older

folks: Salt Lake City and Raleigh are also among the least unequal metros

despite having relatively young populations.

The report also

took a close look at the relationship between housing costs and income

inequality, given that high rents and prices can drive out middle-income

workers and put significant burdens on the poor.

3. The NY Times did its own study

this month. It compared income

inequality in two nearby counties in Virginia- not too far from Washington

DC: Fairfax County, VA, and McDowell

County, West VA., are separated by 350 miles, about a half-day’s drive.

Fairfax is a

place of the haves, and McDowell of the have-nots. Just outside of Washington,

fat government contracts and a growing technology sector buoy the median

household income in Fairfax County up to $107,000, one of the highest in the

nation. McDowell, with the decline of coal, has little in the way of industry.

Unemployment is high. Drug abuse is rampant. Median household income is about

one-fifth that of Fairfax.

One of the

starkest consequences of that great income divide is seen in the life

expectancies of the people that live there. Residents of Fairfax County are

among the longest-lived in the country: Men have an average life expectancy of

82 years and women, 85, about the same as in Sweden. In McDowell, the averages

are 64 and 73, about the same as in Iraq.

“Poverty is a

thief,” said Michael Reisch, a professor of social

justice at the University of Maryland, testifying before a Senate panel on the

issue. “Poverty not only diminishes a person’s life chances, it steals years

from one’s life.”

The reality of

a poverty shortened life is prevalent across the country. For the upper half of

the income spectrum, men who reach the age of 65 are living about six years

longer than they did in the late 1970s. Men in the lower half are living just

1.3 years longer. That's a very sad consequence of income inequality in

America.

Victor's

Comments: The Real Causes of Income

Inequality in the U.S.

Income

inequality is normal and should be expected in a free country under

capitalism. Free market countries like

Singapore, Hong Kong and the U.S. have high Gini

Indices (measures of income inequality).

On the other hand, communist states like Cuba, North Korea, and

Venezuela have virtually perfect equality (extremely low incomes for all-except

the rulers).

The fact is

from January 1971 (when Nixon took the U.S. off the Gold Standard) to January

2014 the official CPI has compounded at a 4.26% annual rate. Now please think of any middle class person -

measured as a group within a quintile - that can earn a raise of 4.26 %

"after taxes," considering the "tax bracket creep" over the

last 43 years? Not many. Hence, wages

have not kept up with inflation and real incomes have fallen over the last

four plus decades.

Note:

The fall in real incomes is actually worse, because reported inflation

is and has been greatly understated. The U.S. government reported that the CPI

was +1.5% last year. Does anyone

seriously believe that number? I

maintain that inflation has been deeply understated - not only in 2013, but

since 1980 (see John Williams inflation calculations

at ShadowStats.com). Therefore, real wages are actually lower than reported,

which exacerbates income inequality.

No one ever

discusses income inequality in terms of the actual cause being directly

associated with the government. In the

U.S. it might be mainly due to the Federal Reserve Board (the Fed). Of course, the Fed's part in income

inequality is only half the equation.

The other half is fiscal policy (free market vs socialism).

The Fed has

kept the Fed Funds rate at zero, has done two "operation twists," and

three QE's in the last 5.25 years. That has directly caused the S&P 500 to

appreciate by 180% from the low March 8, 2009 to date. The top 5 % of the highest quintile income

earners own financial assets, especially equities. So they have profited

greatly, while the remaining 95% of income earners have not. In my opinion, this wealth effect, combined

with inflation eroding real wages, have caused the continuing and expanding

income inequality.

Zero Hedge:

QE

Was A Massive Gift Intended To Boost Wealth, Fed President Admits:

With Bernanke gone, the remaining Fed members knowing full well they

will be crucified, metaphorically of course (if not literally) when it all

inevitably comes crashing down, are finally at liberty with their words... and

the truth is bleeding out courtesy of the president of the Dallas Fed, via

Bloomberg. "FISHER SAYS QE WAS A MASSIVE GIFT INTENDED TO BOOST

WEALTH."

The incredible

moral conclusion is the people in government who claim to care most about

the poor and middle class are causing them to end up in ruin, while rewarding

the highest income sector - all in the name of the "wealth

effect." That stated policy (AKA

"trickle-down economics") is disparaging, false and very bad

economics!

What is never

observed or stated by the "free press" is that the Fed's policies

of the past 5.25 years have failed the public (=main street) miserably, while

making geniuses of ever more wealthy stock holders.

This is visibly

demonstrated in U.S. GDP, which over the last five years is growing at the

lowest rate in 70 years! Even the unemployment rate is bogus as the work force

(labor) participation rate is at lows not seen since the Carter

administration. Yet 6.7% unemployment

rate sounds like victory, even though many discouraged unemployed people have

dropped out of the work force?

Yet the Obama

administration takes credit for a (non-) recovery, while the Fed has saved us

from depression (via the "wealth effect" beneficiaries) by

aggressively printing fiat money. The

truth is that the Fed's monetary policy has not worked. For most people, there has been no economic

recovery.

So would the

Fed dare change policy? Not if it causes equities to decline! I have no issue with the bull market, which

is now a bubble. Money will always

return to its rightful owners over a full market cycle.

However, what I

take extreme umbrage at is the incredibly obnoxious direct attack on

"capitalism" by suggesting income inequality is harmful or

unfair. Again, it is to be expected in a

free capitalist country, but not nearly as extreme as it is now.

The Curmudgeon

and I have written

about the move to socialism, crony capitalism, and "economic control of

property and assets without ownership."

That combined with the Fed's "Central Planning" schemes are

the real, root causes of income inequality in the U.S.

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo

is a historian, economist and financial innovator who has re-invented

himself and the companies he's owned (since 1979) to profit in the ever

changing and arcane world of markets, economies and government policies.

As President and CEO of Alpha Financial Technologies LLC, Sperandeo overseas

the firm's research and development platform, which is used to create

innovative solutions for different futures markets, risk parameters and other

factors.

Copyright © 2014 by The

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted

article(s).