Has Russia Sold US Dollars to Prepare For Sanctions?

By the Curmudgeon with Victor Sperandeo

Observations

and Speculation:

In preparation

for Crimea's succession from Ukraine and Russian troops in that region, some

observers think that Russia has taken pre-emptive action to circumvent

sanctions (i.e. the U.S. from freezing Russian financial assets in this

country). The Russian central bank may

have either sold U.S. dollar holdings on deposit with the Federal Reserve or

transferred them overseas.

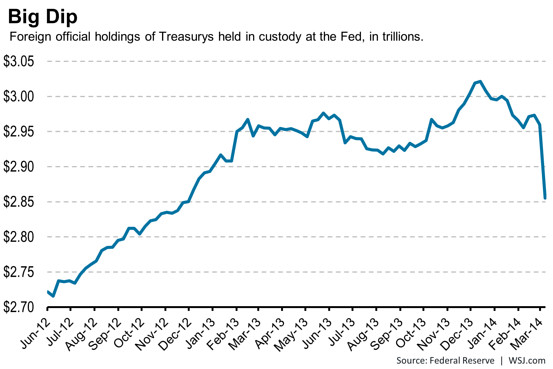

There was more

than a $106 billion decline in the Federal Reserve’s custody holdings for

foreign central banks for the week ending March 12, 2014, according to Reuters.

That's by far a

record drop. The previous biggest drop in Fed custody holdings was $32 billion

in June 2013. With last week's huge

drop, the Fed's holdings of U.S. marketable securities” has fallen to the

lowest level since December 2012.

Reuters said

the Fed's holdings of U.S. securities kept for overseas central banks sank by

$106.142 billion in the week ended March 12th to $3.206 trillion. The breakdown of custody holdings showed

overseas central banks' holdings of Treasury debt fell by $104.535 billion in

the week to $2.855 trillion. Foreign

institutions' holdings of securities issued or guaranteed by the biggest U.S.

mortgage financing agencies, including Fannie Mae and Freddie Mac, slipped by

$797 million to $306.301 billion. The

Fed said its holdings of "other" securities held in custody fell by

$809 million to stand at $44.609 billion. These securities include

non-marketable U.S. Treasury securities, supranationals,

corporate bonds, asset-backed securities and commercial paper.

Author's

Note: The statistics

above were obtained from the Fed report Factors Affecting

Reserve Balances. Please note

that line item 1a only shows a $47.579 billion decline for the week and a $17.444

billion drop from one year ago to $3,206,307 million (=$3.206 trillion) as of

March 12, 2014.

As expected,

neither the Fed nor any foreign central bank is saying which entities made the

custody withdrawals from the Fed. Andrea

Priest, a spokeswoman for the Fed Bank of New York, declined to comment when

asked to do so by Bloomberg.

This record

drop in U.S. government securities held in custody at the Federal Reserve is

fueling speculation that Russia may have shifted its U.S. dollar holdings out

of the U.S. as Western nations threaten sanctions over its military involvement

in Ukraine.

“The timing of

the drop in custody holdings makes Russia a more likely suspect,” said Marc

Chandler, global head of currency strategy in New York at Brown Brothers

Harriman & Co. in a Bloomberg telephone interview. “If Russia did it, then

they may have transferred the holdings to another bank outside of the U.S.”

“This is only

speculation on our part, but it seems likely that the Russian authorities had

more than $100 billion of Treasury debt in custody at the Fed, and it doesn’t

seem implausible that they moved it to a jurisdiction where it would be less

vulnerable to a U.S. asset freeze,” said Lou Crandall at Wrightson

ICAP LLC.

Foreign central

banks can park their U.S. Treasury bond and note holdings at the Fed or other

banks that offer custody services. Putting Treasury holdings at the Fed makes

it easy to buy or sell dollar-denominated assets. This is critically important as the U.S.

dollar remains as the world's reserve currency.

As of December

2013, Russia held $138.6 billion of U.S. Treasuries, making it the ninth

largest country holder, according to Bloomberg which also noted that Russia’s

holdings are about 1% of the $12.3 trillion in marketable U.S. Treasuries

outstanding. In contrast, China, the

biggest foreign U.S. creditor, held $1.27 trillion of U.S. government bonds as

of December. Japan is the second-largest holder at $1.18 trillion.

A spokeswoman

for Russia’s central bank said it hasn’t disclosed changes in its foreign-asset

holdings. “Bank Rossii

publishes data on managing foreign-currency assets not earlier than six months

after the given period because of the high sensitivity of prices on global

financial markets to the actions of largest market participants, including the

Russian central bank,” Anna Granik, a spokeswoman for

Moscow-based central bank, said in an e-mailed response to questions from

Bloomberg.

Pundits note

that Russia would not have to sell their holdings in U.S. treasuries, but could

simply remove them from U.S. control by transferring them from the U.S. Fed to

a custodian bank outside of the U.S.

Moreover, U.S. Treasuries rallied strongly last week, which likely

wouldn't have occurred if there was massive selling by foreign central banks.

“If central

banks were selling that much Treasuries, the bond market would have noticed and

would not have traded as well as it has this week,” said Anthony Cronin, a

Treasury bond trader at Société Générale

SA. “If they did transfer these assets

out of the Fed, they could have gone to Russian banks or any other offshore

bank that provides custodian services,” he added.

Meanwhile, the

Russian ruble has declined over 10 % against the dollar this year and 16% in

the past 52 weeks. It has just hit a

record low of 36.66 per dollar as this article is being written on March 16th.

Perhaps, the

Russian Central Bank has actually sold U.S. dollars to buttress its currency or

its cratering stock market, which has plunged 33% since it topped out last

October.

Victor's

Closing Comments:

It must be

understood and learned by President Obama that "sanctions" against

Russia is a losing game. The U.S. has

had an embargo against Cuba for 53 years and they aren't any different than

they were when Castro first took power.

Sanctions have never worked on any country that I know of (maybe Iran?).

Russia, under

Comrade Putin (who was a KGB Lieutenant Colonel) seems to be in a stronger

position than the U.S. under President Obama (who was a "Community

Organizer" in Chicago before he ran for political office). That's a

ridiculous match-up.

Perhaps, a bit

of history in trying to change strong leaders is relevant now. The leader of 1941 Japan was Emperor

Hirohito. The U.S. warned Japan of its creation of an atomic bomb, yet Japan

did not surrender. On August 6th 1945, the U.S. dropped "Little Boy"

nuclear bomb on Hiroshima and 80-90,000 people died instantly. An estimated 150,000 died within six months.

Now a normal human being would surrender, but not the great leader

Hirohito. So the "Fat Man"

atomic bomb was dropped on Nagasaki on August 9th 1945 and another

60,000-90,000 died (in total that was 41% of the population of both Japanese

cities).

If sanctions

are imposed on Russia, the U.S. and European Union will be at "economic

war" with the former super power.

If that's the case, it is likely that China and Russia (comrades in

arms) will team up to destroy the U.S. dollar.

Through its oil and natural gas exports, Russia controls a vast amount

of the EU's energy needs. With important

European elections in two months and with austerity programs being very

unpopular, can you imagine the results if there are electricity shortages? Now, tell me that sanctions will change

Putin's mind about intervening in Ukraine? Check the odds in Las Vegas first!

Sanctions

against Russia are not going to end well.

If the U.S. and E.U. choose to fight with Putin- a man whose KGB motto is" Loyalty to the

Motherland" - we can expect economic and political aftershocks.

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo

is a historian, economist and financial innovator who has re-invented himself

and the companies he's owned (since 1979) to profit in the ever changing and

arcane world of markets, economies and government policies. As President

and CEO of Alpha Financial Technologies LLC, Sperandeo overseas the firm's

research and development platform, which is used to create innovative solutions

for different futures markets, risk parameters and other factors.

Copyright © 2014 by The

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted

article(s).