Fed in Massive Denial of Bubble Creation with No Plan

to Deal with Aftershocks

by the Curmudgeon and Victor Sperandeo

Introduction:

We learned

this week that the Fed is (only now) looking for asset bubbles, yet they don't

see one yet. Nor do they have any plan

to either pop the bubble(s) or manage the negative aftershocks when the bubble

ultimately bursts (as they always do).

In the minutes

of the December 2013 Federal Open Market Committee meeting (released January 8,

2014), some FMOC members expressed concern that QE3 -- which they decided to

trim back by $10 billion a month, to $75 billion, starting this month -- was

beginning to inflate asset prices. But

that's it! No discussion of what

steps to take from potential bubble trouble.

What

the FOMC said at their December 2013 meeting:

Here's the

applicable text (emphasis added via bold font):

"Participants

also reviewed indicators of financial vulnerabilities that could pose risks to

financial stability and the broader economy. These indicators generally

suggested that such risks were moderate, in part because of the reduction in

leverage and maturity transformation that has occurred in the financial

sector since the onset of the financial crisis. In their discussion of

potential risks, several participants commented on the rise in forward

price-to-earnings ratios for some small cap stocks, the increased level of

equity repurchases, or the rise in margin credit. One pointed to the increase

in issuance of leveraged loans this year and the apparent decline in the

average quality of such loans.

A couple

of participants offered views on the role of financial stability in monetary

policy decision-making more broadly. One proposed that the Committee

analyze more explicitly the potential consequences of specific risks to the

financial system for its dual-mandate objectives and take account of the

possible effects of monetary policy on such risks in its assessment of

appropriate policy.

Another

suggested that the importance of financial stability considerations in

the Committee’s deliberations would likely increase over time as progress is

made toward the Committee’s objectives, and that such considerations should be

incorporated into forward guidance for the federal funds rate and asset

purchases."

Other

Views:

1. Fed Governor Jeremy Stein had

previously said that the Fed's policies have induced investors to reach for

higher returns while the Fed has pushed down Treasury yields, with potentially

destabilizing effects. Really?

2. John Williams, President of

the Federal Reserve Bank of San Francisco, said in an interview with the

WSJ: "Right now the situation is

not one where we are seeing broad indicators of a lot of excesses in

financial markets that pose a lot of dangers to the financial system or the

economy," Mr. Williams said. Still, he said he was watching warily. Whoopi!

3. "The minutes conveyed little sense of

contentiousness, as apparently the game plan was easily agreed upon to ratchet

down asset purchases," said Michael Feroli,

chief U.S. economist for J.P. Morgan Chase Bank NA, in an email to clients. But

nothing was discussed to guarantee financial stability resulting from Fed

distorted asset prices.

4. Zerohedge reports

that Richmond Fed President Jeffrey Lacker responded

to a question following a speech by saying the Fed was reluctant to

"prick" asset-price bubbles.

Tyler

Durden wrote: "Lacker - who has been anti-QE to

some extent - knows that if the Fed moves to actually do anything about it

(other than jawbone), it's all over. Perhaps as more realize the transition

from a Bernanke Put to a Yellen Collar has occurred, there will be no need to

jawbone any longer. But jawbone on they

will as open-mouth operations try to persuade investors that strong forward

guidance is just as effective as printing 100s of billions of USDs...."

Comment

and Analysis:

We find it astonishing that only now has the FOMC started to consider the

distorting effects on financial markets of their QE and ZIRP policies. The

irony is that Bernanke indicated back in 2010, that was the monetary authorities'

intent. But nothing has been done to stop that distortion and soaring asset

prices have become decoupled from the lackluster, real economy (which we've

called "the great disconnect").

For example, stock prices (e.g. S&P 500) were up 30% from a year ago

(the Russell 2000 was up close to 40%) and home prices have risen at

double-digit rates.

It's not

clear from the FOMC minutes how many of the panel's members

worry the Fed is blowing bubbles. But it is evident the Fed's bond purchases

have been more successful in boosting asset prices than jobs. Let's examine the

effect of QE3 on stock prices last year.

Using

trailing earnings — those accrued over the preceding 12 months — bespoke

analysts noted that the market's P/E ratio soared 23% - from 14.64 at the

beginning of the 2013 - to 18.01 by the end of the year. That valuation shift

accounted for almost of the market’s gains for the year since there was only a

miniscule rise in earnings. What’s more,

the historical average P/E was only 15.3.

So at the beginning of the year, the market was cheaper than average,

but by year-end it had become overvalued.

What is

the Fed going to do? No forward guidance

was given in the December meeting minutes.

It isn't clear that the Fed will alter its presumed policy course of

gradual reductions in its bond purchases, most likely with cuts of $10 billion

per month announced at each FOMC meeting.

Nor do we know when ZIRP will end, even as the (reported) U.S.

unemployment rate nears the targeted 6.5%.

Will the

Fed recognize its actions feed into inflation of asset prices more than

employment and wages? How will the

incoming Fed head Janet Yellen deal with this problem?

We believe

the Fed is SEVERELY underestimating the financial bubbles caused by QE. The last meeting minutes stated that threats

to financial stability were moderate and that stock market valuations were

"broadly in line with historical norms." We think that statement is ridiculous.

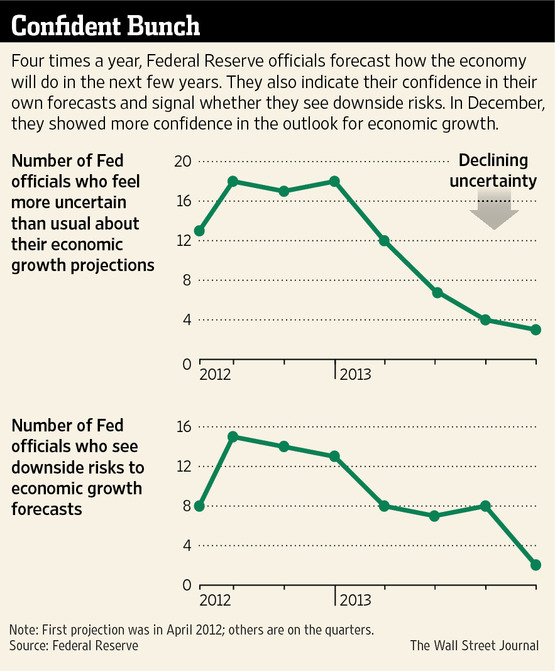

In our

view, the Fed is way too complacent and smug regarding downside risks (e.g.

black swan events) to economic growth forecasts as depicted in the charts

above. They have not accurately or

realistically assessed the negative effects and fallout of a

the current stock and bond market bubbles bursting. And that benign

neglect comes in spite of the reductions in consumer spending and corporate

investment/capital spending after the wealth destruction which occurred after

the 2007 real estate bubble burst and is still ongoing!

Victor's

Closing Comments:

1. It cannot be emphasized enough that listening

to the words of government officials is quite naive. They have proven time and

time again to almost never tell the truth, but to instead say what they think

the public should hear to accomplish their goals. So the Fed does not want to tell the public

that they've caused financial asset bubbles.

Another

example of the U.S. government not being forthright is the reported inflation

rate as measured by the CPI, which is said to average 2.1% over the last five

years of "economic recovery."

Yet, the UK has been in recession for almost all of that time and their

reported inflation rate is higher at 2.47%? Who is telling the truth? You can

decide.

2. It does not take a study or logical proof

that there are bubbles in stocks and bonds.

See point 4 below for additional evidence.

We have

discussed elevated stock prices as being far removed from the real economy many

times in previous Curmudgeon posts. But

let's now analyze some facts on bonds.

In the

last 53 years, the average yield is 6.02%. The average yield today is 1.93%

with TBills at 5 bps and the 30 year TBond yield at 3.80%.

Today's average yield is 68% less than the average modern history

yield!

This means

to trade at the average yield in the last 53 years, the long end of the bond

market would have to drop 38%! The total value of the US debt market is $ 39.9

trillion according to the Securities Industry and Financial Markets Association

(SIFMA)

The U.S.

debt market is composed of: Mortgage bonds, Corporates, Federal Agency,

Municipals, Treasury Related, Debt Securities, Money Markets, and

Asset-Backed. A return to fair yield

would imply a loss of $15 trillion in market value.

The equity

markets can also decline $7.6 trillion with a bear market of 38%. Can you

imagine the fallout on the real economy in that case?

The Fed

has imposed this Armageddon- like risk on the U.S. economy through QE which has

increased its balance sheet by 400% during the last five years. And the result? The lowest GDP recovery

growth (of 2%) since 1945.

3. The Fed represents the banking system. They

will not allow a risk to losing their power and will do whatever it takes to

create profits to itself under the pretense of helping the economy. If the Fed

were truly "independent," cared about the economy and the American

people, its members would tell the administration that they are the

problem. And that the administration

needs to change its anti-business policies.

4. As to the objective evidence that financial

asset bubbles have been created, I quote Larry Summers, Harvard Professor

and former US Treasury Secretary. In a

recent FT editorial titled Washington

Must not Settle for Secular Stagnation he wrote:

"But

a strategy that relies on interest rates significantly below growth rates for

long periods of time virtually guarantees the emergence of substantial

bubbles and dangerous build-ups in leverage. The idea that regulation can

allow the growth benefits of easy credit to come without the costs is a chimera.

It is precisely the increases in asset values and increased ability to borrow

that stimulates the economy and that is the proper concern of prudential

regulation."

Shouldn't

the Fed be more concerned with financial stability, especially after creating

the last two bubbles that burst- the dot com boom/bust followed by the real

estate bubble/mortgage meltdown?

We'll let

the readers think about that as the Fed surely isn't listening to us!

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo

is a historian, economist and financial innovator who has re-invented

himself and the companies he's owned (since 1979) to profit in the ever

changing and arcane world of markets, economies and government policies.

As President and CEO of Alpha Financial Technologies LLC, Sperandeo overseas

the firm's research and development platform, which is used to create

innovative solutions for different futures markets, risk parameters and other

factors.

Copyright © 2014 by The Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

url of the original posted

article(s).