Exposed:

The Private Equity Scam of Continuation Vehicles

By the Curmudgeon with Victor

Sperandeo

Introduction:

The

original idea of using Private Equity (PE) to finance fledgling

companies was a valid one. It offered a

crucial source of capital and operational expertise at a stage in a company's

life cycle where traditional financing was often unavailable.

However, PE has turned into a huge scam due to inherent conflicts of

interest, lack of transparency, and most of all - PE firms “selling” portfolio

companies to themselves in circular funding deals. When the controlling PE firm

(i.e. the General Partner or GP) acts as both the buyer and seller of

the same company, it raises questions about valuation fairness, self-dealing,

and potential fraud.

Private equity is one of the biggest parts of the global economy, with more

than $7 trillion in investors’ money, and some of those investors are getting

increasingly worried that strategies like “continuation vehicles” are

putting off a very painful day of reckoning.

The

Rise of Continuation Vehicles:

Private

equity firms are increasingly utilizing “continuation vehicles” to sell

portfolio companies from one fund to another they also manage. This strategy

provides a temporary solution to a backlog of over 31,000 unsold

companies caused by high interest rates and other factors making traditional

buyouts too expensive.

While this approach provides a necessary temporary fix, it

has intensified scrutiny regarding conflicts of interest, valuation

methodologies, and overall industry transparency. According to investment

bank Evercore, the dollar value of these transactions is projected to

reach or exceed $100 billion by the end of 2025, a significant increase from

$35 billion in 2019, highlighting its growing prominence in the $7 trillion

global PE market.

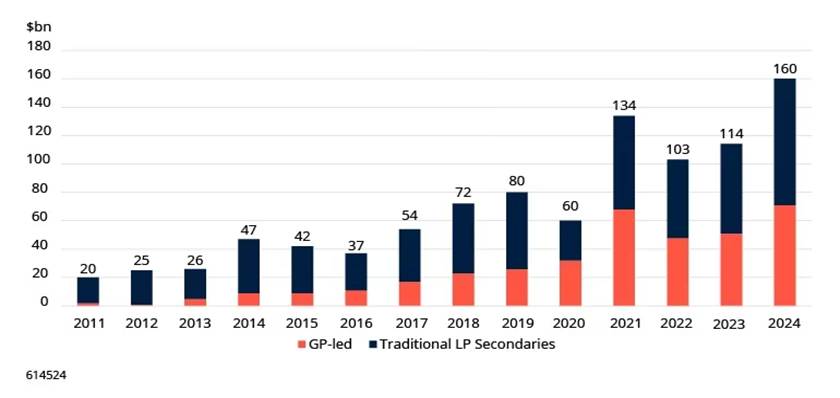

According to Schroeders,

“Continuation funds have become a key growth driver within the secondary market

(where they are known as GP led transactions). They accounted for 45-50% of deal volumes

over the past several years – and similarly recording a record total for

transaction volume in 2024, of more than $70 billion (see chart).”

Source:

Jefferies, Greenhill, Evercore, Lazard, Schroders Capital,

2024. The views shared may not lead to favorable investment outcomes. Forecasts

and estimates may not be realized.

….…………………………………………………………………………………………………………………………

Critics

argue this practice indicates "rot

in private equity" and allows firms to shirk their core purpose of

creating value through external transactions. While the industry asserts

independent vetting and investor consent mitigate conflicts, an increasing

number of investors report a lack of transparency in the process. Later, there

are often markdowns/impairment charges and sometimes even bankruptcy of the

private company that was “sold” to a continuation fund.

The Allure vs. Reality

of Continuation Vehicles:

Persistent high

interest rates have made debt financing prohibitively expensive for many potential

external buyers, leading to a substantial accumulation of unrealized

investments. Continuation vehicles were said to offer a workaround by

facilitating internal sales, allowing firms to recognize fake paper profits and

extend their holding periods until market conditions improve.

But what if they

don’t?

Private equity firms, including notable entities such as Clearlake Capital,

are grappling with challenges to their fundamental business model: acquiring

companies using leverage and divesting them for profit. With over $90B in AUM,

Clearlake is one of the most active users of continuation funds. Let’s examine

one of their ill-fated deals.

In 2022, Clearlake boasted about the success of Wheel Pros, an

auto accessories retailer that it had previously sold to one of its

continuation funds. Yet in September 2024, Wheel Pros declared bankruptcy

because sales slowed after the pandemic as do-it-yourself projects

significantly decreased. The company just couldn’t keep up with its ballooning

debt payments. As a result, every investor, including public employees’ pension

funds from New York, Connecticut and Nevada, was wiped out. (Connecticut

and Nevada had previously sold out of some of their Wheel Pros stake.)

Platinum Equity, another PE firm, has struggled with its investment in United

Site Services, which makes portable toilets. In 2021, Platinum Equity

executives described the sale of United Site Services to a continuation fund it

created as a “win-win.” Now, United Site Services is in the process of turning

the company over to its lenders, and its investors are expected to lose all

their money.

“Continuation vehicles are indicative of rot in private equity,” said

Marcus Frampton, chief investment officer of the Alaska Permanent Fund

Corporation, which manages $83 billion of the state’s money that is derived

from oil revenues and distributed annually to Alaskans. The increased use of

these funds, he said, is one of the reasons the Alaska fund has scaled back

investments with private equity firms. Mr. Frampton said PE firms were shirking

their responsibility to create value for their LPs through legitimate buying

and selling of portfolio companies or IPOs.

PE firms have been sitting on mounds of “dry powder,” or funds committed by

investors that haven’t yet been deployed. That’s because exits have been

declining since sales peaked in 2021.

PE Investor Concerns

and Conflicts of Interest:

The insular nature of these self-directed sales, where the PE

firm acts as both the buyer and the seller, has raised significant concerns

among PE Limited Partners (LPs). Key issues include:

·

Valuation Methodology: The

inherent conflict of interest may lead to "questionable valuations and

unrealistic projections," potentially exposing investors to "painful

surprises" when companies are eventually marketed to external buyers.

·

Performance Risk: While

PE firms maintain they only transition their highest-performing assets into

these vehicles, specific cases have demonstrated considerable risk.

·

Transparency and Vetting: Despite

industry assurances of independent vetting and investor consent, some LPs

report a lack of transparency. As a result, the Alaska Permanent Fund has

reduced its investment in PE firms. Scott Ramsower of the Teacher Retirement

System of Texas also noted inherent conflicts of interest, stating, “We’d

be happier if a private equity firm never did any of these (continuation

vehicles).”

Legal Challenges:

The PE vetting process has faced legal challenges. A recent

lawsuit filed by Abu Dhabi’s sovereign wealth fund in the Delaware Court

of Chancery alleges that Energy & Minerals Group attempted to "reap a

massive benefit for themselves" at the expense of LPs through a

continuation vehicle sale. The suit claims the firm provided disparate data to

different investors and imposed unrealistic timelines for consent.

Outlook and Warnings:

The increased reliance on continuation vehicles in PE funds

intensifies scrutiny over governance, valuation integrity, and alignment of

interests between GPs and LPs. While Nigel Dawn, global head of private capital

advisory at Evercore, notes that continuation fund bankruptcies are currently

below the rates of traditional buyout funds, the long-term ramifications of

this trend warrant continued monitoring by financial analysts, pension funds

and other potential PE investors.

Victor’s Opinions:

Corruption in America has turned into a

growth business for both PE owners and politicians, who get a piece of the

action and permit this kind of circular accounting to continue. In essence,

continuation vehicles/funds are a way to get out of the losing

PE portfolio companies and distribute them to investors in their PE funds. It

should be a “Scarlet Letter” with a Skull and Bones symbol on the

offering letterhead.

And it gets worse

as direct investments in private equity firms may soon be allowed in 401(k) and

other retirement plans. President Trump's August 2025 Executive Order, "Democratizing

Access to Alternative Assets" directs the U.S. Department of Labor to

create rules for including assets like PE, real estate, and crypto into

retirement accounts.

Direct PE investments were previously inaccessible to typical 401(k)

participants, reserved for "accredited investors" (high net

worth/income of over $1 Million). PE is currently only allowed within

diversified funds (like target-date funds) as part of a prudent mix, not as a

direct investment option, fearing fiduciary risk.

-->Making PE an investment option for retirement plans should stand out

as a gross deception and an attempt to fool investors into a false sense of

security.

I have a good friend who has “20 PE companies” and needs liquidity but cannot

sell one or part of them in this environment!

The way PE investments are being sold to unsophisticated investors is like the Road

to Hell - It seems good or well-intentioned on the surface,

but often leads to negative or disastrous consequences.

Victor’s Conclusions:

1. Remember the 2008

housing scam, where the three most prestigious rating agencies (Moody’s,

S&P, Fitch Ratings) gave AAA ratings to parts of the tranches of worthless

real estate packaged as a security? This fooled even pension fund trustees….until the mortgage meltdown and great recession which

followed.

-->Why wasn’t

that a wake-up call for U.S. politicians who are doing nothing to stop the PE

scam?

2. What are we really talking about here? Market

manipulation, which distorts the true market value of an asset, creating a false perception of valuations. Here’s an analogy to consider:

The

buying of stocks to really sell them was

the way stocks were distributed in the early 1900’s. There’s a well know story,

written in older books, of the “Silver Fox” - a professional stock

manipulator- that is well worth repeating. The Silver Fox was a floor trader on

the NYSE who offered a “Have Gun Will Travel” deal for his services of

distributing stocks from insiders to the public. He was asked to sell a large

block of insider stock, which for example, was $100. His answer was, “I cannot

sell this stock for anything near the current price, but I can drive it up to

120 and sell it down to 110!”

That is the moral

conclusion of the current practice of selling PE portfolio companies to the

same owners. It’s the same as “painting

the tape.” If someone offers this deal in 2026 - RUN!

End Quotes:

“Private equity walks so much in the shadows,”

said Yaron Nili, a professor of corporate law at Duke Law School who

wrote a paper recently on continuation funds.

Remember the words of stock manipulator Ivan Boesky: “I

think greed is healthy. You can be greedy and still feel good about yourself.”

Ivan Boesky was a notorious 1980s Wall Street financier and stock trader,

famous for his huge profits in risk arbitrage but infamous for his conviction

for insider trading, leading to a record $100 million fine, prison time, and

becoming a symbol of financial greed.

….………………………………………………………………………….

Wishing you good

health, success, good luck and HAPPY NEW YEAR! Till next

time…………………………………………………………..

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever-changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2025 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).