Lights

On in D.C., Warning Lights in Markets

By the Curmudgeon with Victor

Sperandeo

U.S.

Economic and Market Week in Review:

The U.S. Federal Government reopened this week following a 43-day shutdown

– the longest in modern U.S. history. We will finally start to see Federal

economic data come in as the agencies responsible for each report (BEA, BLS,

Department of the Treasury, Census Bureau, etc.) compile and release them.

Those agencies provide objective, nonpartisan data that is crucial for

policymakers, businesses, and the public to understand and make decisions

regarding the nation's economic health. It’s possible that some releases may be

delayed or skipped all together as the agencies work to get back on schedule.

The National

Federation of Independent Business (NFIB) Small Business Optimism Index

ticked down from 98.8 to 98.2 as owners reported worsening earnings and pointed

to signs of labor market weakness.

U.S.

equity markets grew more volatile this week as sellideng

pressure increased on AI stocks. Despite daily fluctuations, the Dow Jones

Industrial Average (DJIA) and the S&P 500 finished the week ending November

14, 2025, with weekly gains, while the Nasdaq Composite ended the week with a

slight loss. On Wednesday, November 12th,

the DJIA set a new all-time intra-day high of 48,431.57 and a new all-time

closing high of 48,254.82. The index also closed above the 48,000 level for the

first time on that day.

Turbulence

and risk will likely continue to increase in the

coming weeks as markets come to terms with a slew of incoming Federal

data.

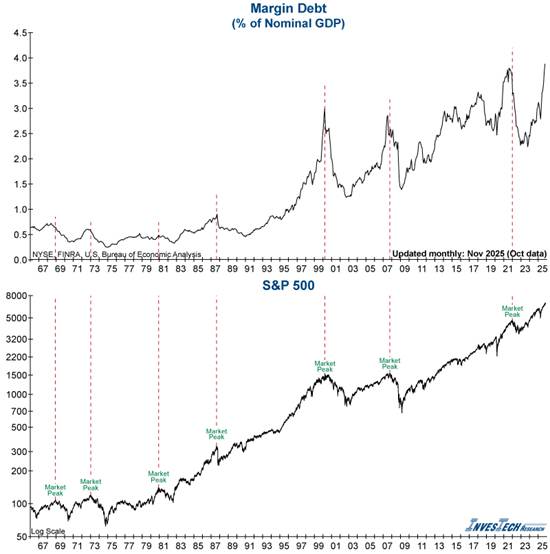

Margin

debt jumped 5% in the latest FINRA release –

lifting margin debt as a percentage of nominal GDP to a new all-time record

high in October (see chart below). In addition to warning of dangerous leverage

in today’s market, this tells us that investor speculation is at a historic

extreme. Margin debt is known as “hot

money” as the funds will head for the exit quickly at the earliest sign of

trouble or when margin calls hit and leveraged positions must be sold. In a

downturn they could gather speed and momentum – likely causing the downward

path to accelerate.

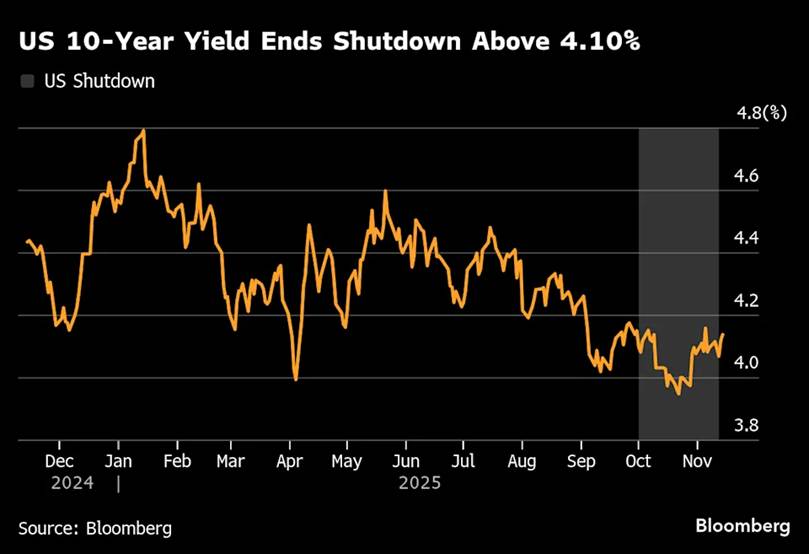

10

Year U.S. T-Note Yield vs. Fed Funds Rate:

Conventional

wisdom suggests that a fixed income investor should lengthen maturities after a

Fed rate cut to lock in higher yields and benefit from potential price

appreciation as rates fall further.

Well, that advice hasn’t worked out too well recently.

Since

Sept 18, 2024, the Fed has lowered the Fed Funds rate by 150 bps via four rate

cuts, while the 10-year U.S. yield has gone from 3.642% on Sept 17, 2024 (one

day prior to the first Fed rate cut) to 4.15% on November 14th.

That's an INCREASE of 0.508% or 14% in the 10-year yield vs. a DECREASE of 1.5%

in short term rates!

Those

who lengthened U.S. fixed income maturities on or after Sept 18th have an

unrealized LOSS in their investments since then. In essence, there was no rush

to extend maturities and barring a serious recession, we don’t see that

changing soon.

There

are three main reasons for this which we’ve noted in several previous Curmudgeon/Sperandeo

blog posts:

1. Increase in term premium due to a

supply/demand imbalance in new U.S. Treasury debt. Due to huge budget deficits, the Treasury

must issue a high volume of new debt to finance its operations. This increased

supply of Treasuries has put downward pressure on bond prices and upward

pressure on yields, as higher returns are needed to attract sufficient demand from

investors.

2. Inflation has

remained persistently above the Fed’s 2% target, hovering around 3%. Bond

investors require a higher return (yield) on long-term bonds to offset the risk

of future inflation eroding the value of the fixed payments. The market

perception is that the Fed might tolerate higher inflation (we think it’s

abandoned its 2% target) or may not be able to cut rates as quickly as

previously assumed.

3. The Economic Policy

Research (CEPR) reports that foreign-official dollar reserves

custodied at the Federal Reserve declined by around US$ 113 billion since the

September 18, 2024, meeting of the Federal Open Market Committee. That figure

covers U.S. dollar reserves custodied at the Fed, which is a related but not

identical concept to purchases of U.S. Treasury bonds and notes by foreign

central banks.

As of

July 2025, the largest

foreign central bank holdings of U.S. Treasuries are: Japan (1151.4B), UK

(899.3B), China (730.7B). China, in particular, has been consistently

cutting its holdings of U.S. Treasuries over recent periods.

Bond

Supply to Increase Substantially in 2026:

The

supply/demand imbalance will only get worse next year.

l The U.S.

Treasury is expected to auction approximately $1.5 trillion in net new

notes and bonds (coupon securities) in calendar year 2026. The Treasury

announces specific auction amounts quarterly, with the next update expected in

early February 2026. The Treasury is projected to rely heavily on increasing

the issuance of short-term Treasury bills (T-bills) to meet its financing needs

and manage its cash balance, rather than increasing longer-term debt sales

which are seen as less cost-effective at current high rates. Net T-bill

issuance is expected to increase significantly in 2026.

l J.P.

Morgan credit strategists project investment-grade

corporate-bond borrowing to rise to a record $1.81 trillion in 2026, topping

the previous peak of $1.76 trillion in 2020, Bloomberg reported. Tech

companies are seen boosting borrowings to $252 billion, 61% over what they've

raised so far this year.

l The

furious push by hyper-scalers to build out AI data centers will need about $1.5

trillion of investment-grade bonds over the next five years and extensive

funding from every other corner of the market, according to an analysis by JP Morgan

Chase. “The question is not ‘which market will

finance the AI-boom? Rather, the question is how will financings be structured

to access every capital market?” according to the bank strategists.

l Warning

signs that investor exuberance about AI data centers may

be approaching irrational levels have been flashing brighter in recent weeks.

More than half of data industry executives are worried about future industry

distress in a recent poll, and others on Wall Street have expressed concern

about the complex private debt instruments hyper-scalers are using to keep AI

funding off their balance sheets.

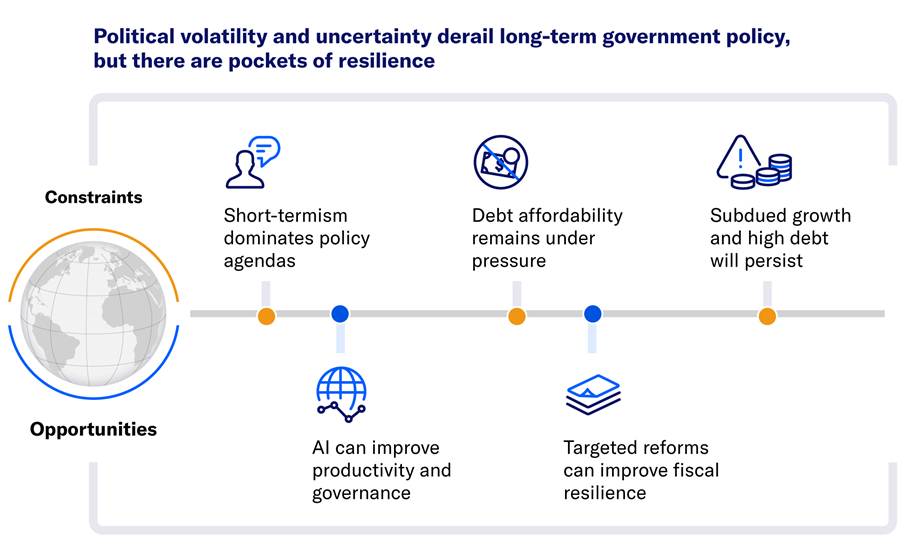

Moody’s

2026 Negative Credit Outlook:

The global sovereign outlook for 2026 is negative

(see Exhibit 2.). While AI and reforms can lead to positive credit developments,

the overall balance is weighed down by short-term policymaking, debt

affordability pressures, and subdued growth coupled with high debt burdens.

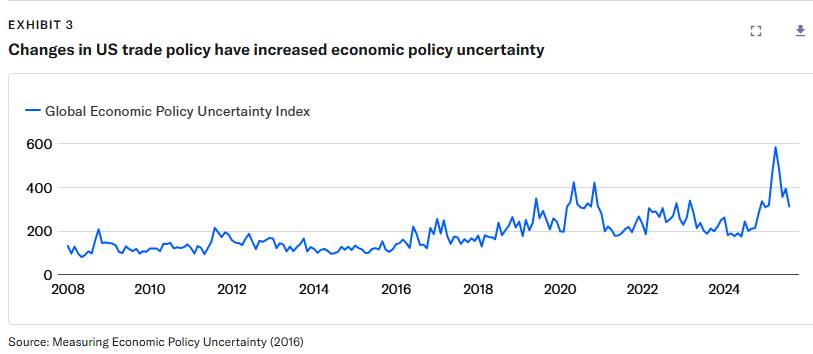

The ongoing overhaul of global trade, driven in

particular by changes in U.S. trade policy, has created significant uncertainty

(see Exhibit 3.). The announcement of U.S. tariffs in 2025 came with frequent

shifts in their levels, scope and implementation timeline. We expect economic activity in 2026 to

reflect changes in trade flows and investment dynamics that are still

constrained by this environment.

.............................................................................................................................

Victor’s

Comments:

November

was a rare month as most asset classes experienced price declines. The only

exceptions were a few select commodities, currencies, and the three Dow Jones

averages.

·

Heating Oil, and Natural Gas along with the

RBOB Gasoline futures rose. The first

two rose due to the cold weather, and the RBOB is based on the crack spread

(the difference between the price of crude oil and the refined products made

from it, like gasoline and diesel fuel).

Coffee, Oats, Corn, Silver, and Gold also advanced.

·

In currencies the Swiss Franc, Brazilian

Real, Mexican Peso, and Euro were plus. But all these were up in a minor way.

Contrast that with Bitcoin futures, which were down by -13.9% - the largest

decline of any tradeable asset class this month to date.

·

3-month Treasury Bill rates saw a slight

increase of 6 basis points, which is highly unusual since the Fed has been

cutting- not raising rates, as noted above by the Curmudgeon.

·

The previously lagging Dow Jones Transports were up (perhaps discounting the end of the

federal government shutdown) as was the AMEX index. The DJIA was +1% while the Dow

Jones Utilities were up a small fraction.

The

upcoming departure of Atlanta Fed President Raphael Bostic, who is set to

retire in February 2026, represents a significant change in the Federal

Reserve's composition. Mr. Bostic has been noted for consistently aligning his

votes with Chair Jerome Powell's policy stance.

However, Bostic is not currently a voting member of the FOMC.

Looking

ahead to post-May 2026, when Chair Powell's current term will expire, the

configuration of the Federal Reserve Board of Governors may shift considerably.

While Powell could conceivably remain a Fed Governor and potentially be

re-nominated for the Chairmanship under specific procedural rules, that is

highly unlikely.

Further

complexity arises from ongoing legal challenges that may redefine the balance

of power and presidential authority over independent agency appointments.

Potential Supreme Court rulings in January could determine the extent of the

executive branch's power to dismiss seated Fed Governors, such as Lisa Cook who President Trump wants to

fire. The outcomes of these legal precedents, alongside the judicial review of

certain executive actions concerning tariffs, will be closely monitored for

their profound implications on the Fed's independence and overall market

stability.

I

predict Ms. Cook will go, but Trump is likely to lose (9-0 in the Supreme

Court) on TARIFFS which he has blatantly misused. What he does is not

Constitutional (the Curmudgeon agrees 100%).

Victor’s Market Outlook:

The

equity markets are topping, while the debt markets seem to be poised to rally.

The U.S. economy is very weak and without lower rates, the NASDAQ 100 will

decline by at least 10%. I am long the 5-year T-note futures, while holding

spot Gold and Silver as investments.

End Quote - A Warning from John Adams:

“There

is danger from all men. The only maxim of a free government ought to be to trust

no man living with power to endanger the public liberty.”

John Adams was

an early advocate of American independence from Great Britain, a major figure

in the Continental Congress (1774–77), the author of the Massachusetts

constitution (1780), a signer of the Treaty of Paris (1783), the first American

ambassador to the Court of St. James (1785–88), and the first vice president

(1789–97) and second president (1797–1801) of the United States.

….………………………………………………………………………………………..

Wishing

you good health, peace of mind, success and good luck. Till next time…

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever-changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2025 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).