Record Margin Debt and Undocumented Additional

Leverage in the Market

by the Curmudgeon

Margin Debt

Rises while Credit Balances Contract:

Today’s

ballooning NYSE margin debt (which is used by "investors" to buy

equities on credit) is a record $423.7 billion, as of Nov 30, 2013. That's up from $327B over the year ago month

in Nov 2012. During that same one year time period, credit balances in margin

accounts have dropped from $173.5B to $167.5B. That means the net leverage (and associated

risk) is greater than ever!

A table showing

monthly margin debt along with credit balances in margin accounts from 1959-to

date is at this link.

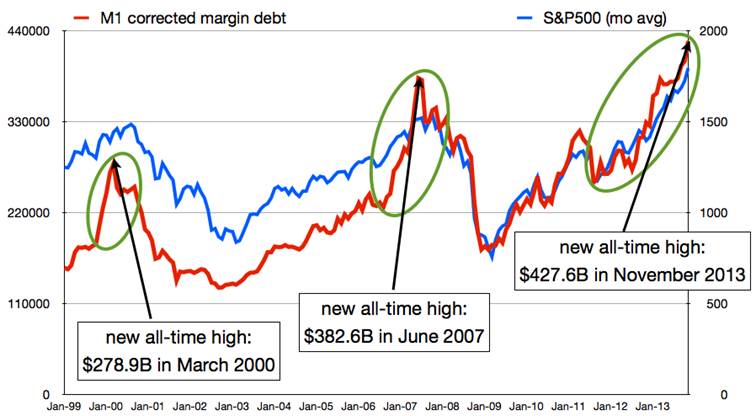

A very

interesting chart of margin debt from Jan 1999 to present can be viewed below:

The creator of

that chart concludes facetiously, "Nope. No bubble here."

Tim Quast of

ModernIR

wrote in the Dec 20, 2013

WellingonWallSt (subscribers only):

"The Fed's

easy money policies have depressed the cost of capital to effectively zero,

which distort asset prices and increase risk

taking. Saving money at zero interest

rates offers a negative reward (unless there is outright deflation, cash in

bank accounts will buy less next year than it does today). With overnight

interest rates at 0.2% today, borrowing is rampant." Enough

said!

Much More

Leverage than Reported:

Yet there is a

lot more leverage at work in the U.S. stock market then just NYSE reported

margin debt. First and foremost are the

highly leveraged derivatives, the most well-known of which are futures and

options. A recent U.S. government OCC

report states that the notional amount of derivatives held by insured U.S.

commercial banks rose $6.2 trillion, or 3%, from the second quarter to $240

trillion, the third consecutive increase in notionals.

Many analysts

have called these derivatives "a ticking time bomb" as they may very

well "blow up" during a steep stock market decline.

Of course,

there are other sources of leverage in the stock market, like 2X and 3X equity

index ETFs. More importantly, there are

other types of leverage at work that are not reported or documented. According to Tim Quast:

"Short volume for shares borrowed for a single day constitute 40%

of the 6.2B shares trading daily in U.S. equity markets. That's 2.5B shares per day that are largely

missed in short interest statistics reported.

Shares are borrowed through margin accounts. (However, daily borrowed

shares are not counted in NYSE margin debt). The providers of shares are the Fed's primary

dealers (the too big to fail banks)."

The Fed's

primary dealers that sell the Fed mortgage backed or U.S. Treasury securities

deposit the proceeds in a "reserve account" held at the Fed. Those bank reserves are intended to be used

for inter-bank or commercial loans.

However, during the QE time period, the newly created bank reserves have

mostly NOT been used for that purpose.

Dennis

Slothower of Alpine Capital wrote in an email to the CURMUDGEON: "There is a provision for

reserves kept at the Fed which allows the Fed dealer banks to collateralize

their reserve amounts. This means they can essentially create a “deposit” based

on reserve collateral at the Fed. They can then use that “deposit” asset to

loan out or buy anything, particularly securities (stocks, U.S. Treasuries,

commodities or even positions in the futures markets)."

Hence, much of

the $85B per month in QE has flowed through the Fed's primary dealers into

stocks, bonds, and futures markets. That's

newly created money out of thin air that's not going into the real economy, but

instead into proprietary trading desks at the big investment banks. [That will end in 2015 when the Volker

Rule takes effect].

Quast sums up

the Fed's influence on money and markets:

"The Fed is the ultimate planetary middle man. We don't know the real value of money, let

alone the assets money denominates."

Stock Market

Liquidity Concentrated in Very Few Players:

When one thinks

of "cash on the sidelines" or "oceans of liquidity," they

are usually referring to cash in brokerage accounts (free credit balances),

money market funds, checking and savings accounts and possibly even short term

time deposits at banks. Much of that will never go into the equity market. The real liquidity is being created by the

too big to fail banks, HFT firms and hedge funds.

Tim Quast

wrote: "Nearly 90% of stock market volume - 5.5B shares- flows through

only 30 firms. Half of them are big

investment banks like Morgan Stanley, JP Morgan and Goldman Sachs. The other half are

high frequency traders like Hudson River Trading and Quantum Financial."

The question

we've repeatedly asked is: "What happens to the equity market when that

liquidity dries up?"

Closing Comment from John Hussman:

"What

concerns us is this parabolic (rise in the stock market) is attended by so many

additional and historically regular hallmarks of late-phase speculative

advances. Aside from strenuously

overvalued, overbought, over bullish, rising-yield conditions, speculators

are using record amounts of borrowed money to speculate in equities, with

NYSE margin debt now close to 2.5% of GDP. This is a level seen only twice in

history, briefly at the 2000 and 2007 market peaks. Margin debt is now at an

amount equal to 26% of all commercial and industrial loans in the U.S. banking

system."

Caveat Emptor!

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo

is a historian, economist and financial innovator who has re-invented

himself and the companies he's owned (since 1979) to profit in the ever

changing and arcane world of markets, economies and government policies.

As President and CEO of Alpha Financial Technologies LLC, Sperandeo overseas

the firm's research and development platform, which is used to create

innovative solutions for different futures markets, risk parameters and other

factors.