What, Me Worry? – The Alfred E. Neuman Fiscal

Strategy

By the Curmudgeon with Victor

Sperandeo

Introduction:

In last week’s column - Curmudgeon: Yielding to

Reality: The Bond Market Rejects Tariff Optimism and Wall Street Euphoria -

we described the problems facing the U.S. government bond market, most notably

the ever increasing budget deficits which have created a supply/demand

imbalance and an increasing risk premium.

While the S&P and other stock

indexes had a terrific week, U.S. bonds remained in the doldrums. That’s

despite very bullish news for bonds and five

consecutive day advances for the S&P 500:

1. The CPI and PPI prints

are coming in well below analyst forecasts:

A] The Consumer Price Index (CPI)

for All Urban Consumers rose 0.2% seasonally adjusted and rose 2.3% over the

last 12 months.

B] The Producer Price Index (PPI)

for final demand fell -0.5% in April, seasonally adjusted. Final demand prices

were unchanged in March and increased 0.2% in February.

2. The University of Michigan’s consumer confidence

index was at a multi-year low at 50.2 (down from 52.2 in April and now at

the second lowest level ever recorded).

Lower consumer confidence augurs for a weakening economy and lower

interest rates.

3. Consumer spending is

~68.5% of GDP as per Q1-2025. In

this month’s survey, 38% of consumers are prepared to forgo purchases due to

tariff induced price increases. That share rises to nearly half (46%) among

those living paycheck to paycheck.

Decreased consumer spending increases the probability of a recession

which has always lowered interest rates across the board.

U.S. Treasury yields ignored that

news and rose past significant undesirable milestones last week as the 10-year Treasury

note topped 4.5% and the 30-year bond yield hit 5% intra-day before settling at

4.954% on Friday, May 16th.

The 5% mark on the U.S. long bond was briefly breached in October 2023

before the Treasury backed away from plans to boost longer-term borrowing. It hasn’t been seen on a sustained basis

since before the financial crisis in 2008-2009.

U.S. Debt Downgraded by

Moody’s:

Late Friday, Moody’s Investors became

the last of the major raters to strip U.S. government bonds of its AAA rating

to Aa1. The downgrade was “driven mainly

by increased interest payments on debt, rising entitlement spending, and

relatively low revenue generation.” Moody’s

wrote in a statement:

“This one-notch downgrade on our

21-notch rating scale reflects the increase over more than a decade in

government debt and interest payment ratios to levels that are significantly

higher than similarly rated sovereigns.”

“Successive U.S. administrations

and Congress have failed to agree on measures to reverse the trend of large

annual fiscal deficits and growing interest costs. We do not believe that

material multi-year reductions in mandatory spending and deficits will result

from current fiscal proposals under consideration.”

Moody’s said it expects deficits

to reach nearly 9% of GDP by 2035, up from 6.4% in 2024. Does anyone think

that is sustainable? Note that Standard

& Poor’s and Fitch Ratings previously demoted Uncle Sam’s debt by one notch,

so there are no credit rating agencies that award the U.S. with a AAA rating.

Speaking on NBC’s Meet the

Press with Kristen Welker, U.S. Treasury Secretary Scott Bessent

addressed the Moody’s Ratings downgrade of the U.S. credit outlook: “Moody’s is

a lagging indicator. That’s what everyone thinks of credit agencies. We didn’t get here in the past 100 days. It’s the Biden

administration and the spending that we have seen over the past four years that

we inherited. We are determined to bring

the spending down and grow the economy.”

FAT CHANCE!!!

Deutsche Bank economists wrote, “In short, there appears to be no

serious effort at reining in historically elevated deficits, which remain on

track to exceed over 6% of GDP in the coming years.”

Tax Bill Would Increase

Deficits; Worsen Supply/Demand Imbalance:

President Trump’s “big,

beautiful tax bill” to extend the 2017 tax cuts, due to expire at year-end,

would make the federal budget deficits much, much worse. That proposed bill

from the tax-writing House Ways and Means Committee was rejected by five House

Republicans who were holding out for a bigger expansion of the state and local

tax deduction, otherwise known as SALT.

Of course, the U.S. bond market has to fund those sky-high budget deficits via the Treasury

Department auctions of government securities.

-->That’s the essence of the supply/demand imbalance.

The Joint Committee on Taxation

estimated that the bill, including the renewal of the Tax Cut and Jobs Act

of 2017, would increase U.S. budget deficits by $3.8 trillion through 2034,

equal to 1.1% of GDP. If the bill was

extended, the Bipartisan Policy Center estimated that the deficit would

be $5.3 trillion higher, or 1.5% of GDP, even including some $2 trillion in

spending cuts through 2034.

The Penn Wharton Budget Model says

the bill would increase the “primary” deficit by $6 trillion over 10 years. The

so-called primary deficit excludes interest costs, focusing only on spending on

programs.

The additional red ink would be

added to the current U.S. budget deficit of $2 trillion/year, or close to 7% of

GDP—a level only approached during recessions or wartime!

Senate Minority Leader Chuck

Schumer, said Moody’s action “should be a wake-up call to Trump and

Congressional Republicans to end their reckless pursuit of their

deficit-busting tax giveaway.”

“Sadly, I am not holding my breath

— today’s GOP simply does not care about deficits or our nation’s fiscal

health,” he said in a statement. “Republicans are hell-bent on a multi-trillion

tax cut for the ultra-wealthy, leading to nothing but higher prices, more debt,

and fewer jobs.”

According to Mizuho economists

Steven Ricchiuto and Alex Pelle: “The prospects of a large tax cut add to our

view that interest rates at both ends of the yield curve will end the year

decidedly higher than they are today.”

And the risks are rising. “Our

view is that the nation is headed for a fiscal crisis because the economy

cannot sustain budget deficits this big,” writes Carl Weinberg, chief economist

at High Frequency Economics. “At some point, markets will rebel against

unsound fiscal practices, and that includes the wisdom of cutting taxes and

increasing the fiscal deficit when the economy is at full employment already,

especially if it boosts the public sector debt to more than 100% of GDP,” he

added.

Debt Service Expense Will

Rise with Higher Deficit and Rates:

The current U.S. debt service cost

this year includes $579 billion in net interest payments, which puts the United

States on track for the highest annual interest bill in its history.

As of 2024, the U.S. debt service

cost was 3.02% of GDP. This percentage has been rising due to increasing debt

levels and higher interest rates. In 2023, the cost was around 2.5% of GDP, and

projections suggest it could reach 3.9% by 2034. The costs of financing the

U.S. national debt is becoming much more of a problem

now as old U.S. notes and bonds sold during the ultra-low-interest-rate era

following the 2008-09 financial crisis are refinanced with the current 4%

coupons.

As noted in many previous

Curmudgeon/Sperandeo posts, the U.S. government’s interest expense is

the fastest-growing part of the budget and can NOT be cut by DOGE or

Congress! It is now greater than U.S.

defense spending.

Victor’s Comment:

In the 54.33 years since the U.S.

went off the gold standard in 1971, U.S. debt has been trending upwards at a

+8.7% annual rate. Yet GDP is increasing at a 2.5% annual rate during the same period.

This implies that the Debt- to- GDP ratio will go from the current 1.23:1 to

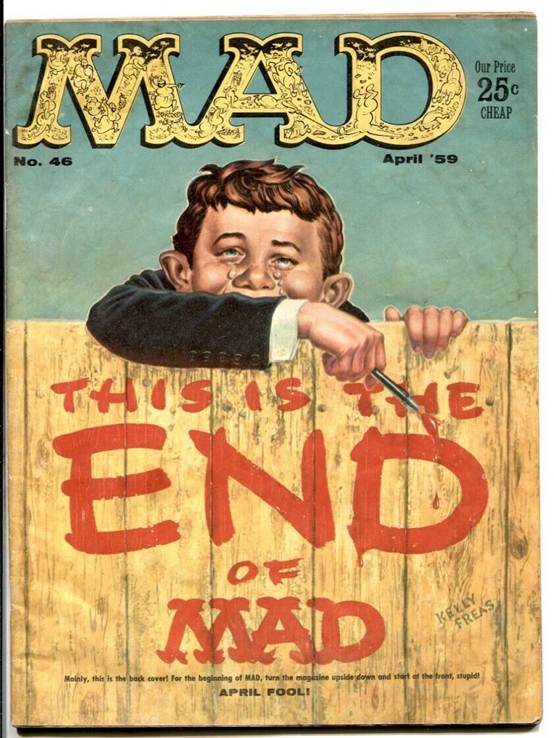

2.:24 to 1 in 10 years.! It appears the U.S. government has adopted Alfred E.

Newman’s “WHAT ME WORRY” as per this MAD magazine cover:

Term Premium Has Increased:

The term premium—the extra yield

demanded by investors to compensate for the risk of holding longer

maturities—has increased as we noted last week and is corroborated by BCA

Research. The increase is due to the

large fiscal deficits and the pullback by overseas investors owing to concern

over Treasuries’ safe-harbor status during the first four months of the Trump

administration.

Blackrock

analysts Simon Wan and Tom Becker write, “Without a larger “term premium”

to compensate investors for bearing longer-term economic risks, it will be

challenging to get Americans to increase the maturity profile of their fixed

income holdings.”

Long-end US Treasuries

offer a meager yield uplift and rising portfolio risk:

Conclusions:

The 22V Research team led

by Dennis DeBusschere says a further rise in longer-term Treasury yields would

pose a “headwind” for risk assets, with 4.7% on the 10-year as a level seen by

investors as “obviously problematic for the economy.”

Raymond James analysts Tavis C. McCourt and David Vargas write

that the 4.5% on the benchmark 10-year Treasury has been an important marker

for the stock market since 2021. Above 4.7% “has been death for equities with

almost nothing working across any index as the equity market starts pricing in

recession.”

Increased supply coupled with

lower demand suggests that the U.S. government will have to pay more to borrow

to cover the current deficit and to roll over older, low-interest rate debt.

That poses a huge problem for fixed income investors like the

Curmudgeon.

Rinse and repeat:

Higher budget deficits → Increased

supply of Treasuries --> Higher interest rates → Higher debt service

costs → More debt issuance → Even higher interest rates.

….……………………………………………………………………………………………………………………..

Good health, success, good

luck and till next time………………………………………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever-changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2025 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).