U.S. Stock Market Strong while Economy is

Weakening

By Victor Sperandeo with the Curmudgeon

As of

Fridays close, the S&P 500 had increased nine consecutive trading days --

its longest winning streak since 2004. The S &P index jumped 10.2% in that

span2.9% of that in the past weeka remarkable performance given the cloud of

uncertainty hanging over American businesses from President Donald Trumps

chaotic tariff policy and his threats to fire Fed Chairman Jerome Powell. As a

result, the U.S. equity market has retraced its losses since the April 3rd

Liberation Day selloff. Indeed,

the market has climbed a wall of worry with tremendous resiliency in

light of many negative economic reports last week.

The Aden Forecast notes that the NASDAQ is

bouncing up from its 2021 support level, and from the extreme leading indicator

lows. Thats depicted in these two charts:

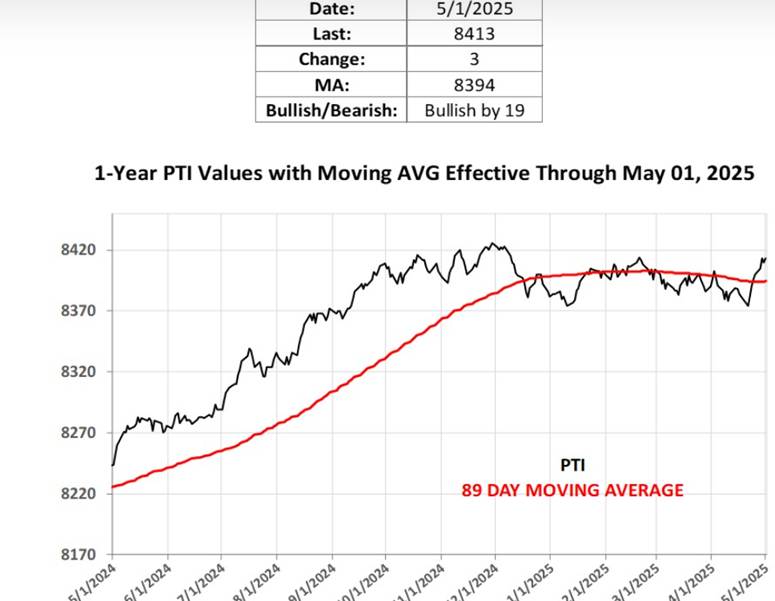

Heres

a chart of the now bullish Primary Trend Index (PTI), courtesy of the Aden

Forecast:

Editors

Note:

In 1969 Richard Russell devised the Primary Trend Index, composed of eight

market indicators that he never publicly divulged as his own secret recipe.

When his index outperformed an 89-day moving average, it was time to buy. When

it underperformed the 89-day moving average, a bear market was at hand. Only the Aden sisters know what those eight

indicators are as they have maintained it since they took over Russell's Dow

Theory website.

.

On

Wednesday, the U.S. Commerce Department reported that GDP declined by

0.3% in the 1st quarter of 2025, marking the first decline since early

2022.

The

report also showed a buildup of inventories, as companies stocked up on

goods in anticipation of future tariff-based price hikes. That gave the economy

a short-term boost, but it could slow things down later if businesses reduce

new orders to clear out inventory.

All

the uncertainty around trade is making companies more hesitant to invest or

hire. The number of Americans filing new claims for unemployment

benefits rose to 241,000 for the week ending April 26th, an increase

from the previous week's 223,000 and above the 225,000 forecasts. This uptick

suggests a potential softening in the labor market.

Consumers

are also being pinched by higher prices, especially for goods made in

China which have been hit with 145% tariffs. the Conference Board's Consumer

Confidence Index falling to a five-year low in April. This decline is

attributed to various factors, including concerns about tariffs, inflation, and

the overall economic outlook. Consumers are also increasingly pessimistic about

their future income and labor market prospects.

The Conference

Board Leading Economic Indexฎ (LEI) for the U.S. declined by 0.7% in March

2025 to 100.5 (2016=100), after a decline of 0.2% (revised up from 0.3%) in

February. The LEI also fell by 1.2% in the six-month period ending in March

2025.

The

U.S. LEI for March pointed to slowing economic activity ahead, said Justyna

Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The

Conference Board.

Finally,

the CRB Commodity Index shows economic weakness. It was 313.56 on 4/2/25, but closed Friday at

290.30 for a loss of -7.42%. Energy is

39% of the index, which accounts for 2.9% of the current CRB decline which is

certainly NOT inflationary.

Victors

Stock Market Comments:

According

to the long-term indicators I have discussed in past Curmudgeon/Sperandeo posts

(like this one), U.S.

stocks remain in a Bear Market. This must always be kept in mind when trading

and/or investing.

About

135 years ago, Charles Dow observed that there are three distinct trends always

working in the stock markets:

l The long-term

trend which is months to years;

l The intermediate

trend that is weeks to months; and

l The short-term

trend is days to weeks.

Currently,

the long-term trend is still DOWN, while the intermediate and

short-term trends have turned UP.

The last Primary Movement - according to Dow Theory and the 200 day

MA- is down and that should persist

unless there is a change of the long term trend. Also, the volume was heavy on

the downside and light to moderate on the upside of the recent rally.

The

question almost always asked is the current intermediate trend a new leg of a

Bull Market, or a correction in the Bear Market:

l Using

the S&P 500, a new Bull Market would make the Bear Market from

2/19/25 to 4/8/25 only 48 days.

l Using

the Dow Jones Industrial (DJI) average, the high was 1/29/25 making for

a 69-day Bear Market.

l Under

the Dow Theory, the Dow Transports must also be measured, and

they are not even in an intermediate uptrend yet.

Dating

back to 1896, there have been no U.S. equity Bear Markets that have had this

short a duration (i.e. before a change from Bear to Bull)!

.

Curmudgeon

on the Bond Market:

Long

term U.S. bonds remain in a multi-year Bear Market. The iShares

20-year U.S. Treasury bond ETF (TLT) had Total Returns (%)

for 1 yr, 3r, 5 yr, 10 yrs of 0.17,

-8.65, -8.96, and -1.07, respectively.

And that is BEFORE inflation and income taxes! Compare the TLT total returns vs

S&P 500 over same period!

.

Whats

Driving the Equity Markets:

Perhaps,

if the Fed injected a trillion+ dollars into the economy as it did in March

2009, or in March 2020 (which was NOT a Bear Market by my indicators) one could

make the case that this is a fundamental reason for a long-term trend change,

but that is not the case right now.

President

Donald Trumps contradictory talk and erratic social media posts created the

current market movements, not permanent actions. His words can change by whim

after a Fox TV program. Despite Trumps

repeated call for lower short-term interest rates, the Fed is on the

sidelines. Historically, that is quite

unique when markets are crashing with the economy weak and slowing.

U.S.

Treasury Secretary Scott Bessent has convinced Trump to stop the ridiculous

threats of firing Jerome Powell (which he cannot do) as it is causing the

markets to panic. Moreover, Bessent indicated that the U.S. trade policy

(tariffs and export restrictions) with

China was NOT SUSTAINABLE. That

effectively canceling the Make America First Investment Memo issued 2/21/25

which we discussed in this

post. All that talk stimulated the

strong stock rally of the past nine days.

Victor

on the Uncertain Outcome of Trumps Tariffs:

The

markets continue to be focused on tariffs.

To reiterate, tariffs are a tax thats aimed at foreign governments and

their producers of goods and services exported to the U.S. While most analysts believe that American

companies importing items subject to tariffs will pass the cost on to consumers

or other companies,

It is

possible, but not probable, that Trumps tariff policies could result in lower

prices. For example, if Trump negotiates a deal with the European Union for

ZERO bilateral tariffs, prices will likely decline in both regions. Also, if

tariffs are set too high such that imported goods become unaffordable, prices

might decline as people stop buying those products.

-->No

one knows (or even has a clue) what will be the result of tariffs on the U.S.

economy and markets.

If

the Trump administration negotiated an average 16.5% tariff with all countries,

then Trumps hyperbolic statement of ending taxes for all U.S. people paying

taxes of $200K or less could be a reality.

Heres the math: the U.S. taxpayers paid $2.4 trillion last year in

total INCOME TAXES, and bought $4.110 trillion in foreign goods

the 200K or less earning US taxpayers paid 26

% of those taxes or $676 billion (estimated). Therefore, a 16.45% average

tariff would collect $676 billion in taxes, if passed on to those earning $200K

or less. It would completely pay their income taxes

all things being equal,

which they never are! This is not

likely, but possible. Of course, as you

raise the price of something you will alter the supply/demand curves and change

the dynamics.

PhD economist Lacy Hunt explains all this and more in a video

titled, The Five

Recessionary Forces Creating an Economic Interregnum. The key take aways from Dr. Hunt is the U.S.

economy is very weak. Tariffs caused

consumers who are really in poor financial shape, I WOULD SAY WRETCHED

FINANCIAL SHAPE to actually

buy ahead of tariffs. TARIFFS ARE DEFLATIONARY. The economy is in a more frail condition...

Lacy added, I think monetary policy is too restrictive

. The

Fed is again making a policy error

By

letting money supply decline and NOT CHANGING you will NOT have a recovery in

2026.

-->Victor, the Curmudgeon and many analytical economists

think Dr Hunt is the best of breed economists today. The above referenced

Interview with him is priceless in our opinion.

-->Lacy has been a colleague and friend of the Curmudgeon

for over 30 years (since Curmudgeon was a RIA at Jack White Institutional in

1995).

A Look Back at the 1973-1974 Bear Market:

Upsetting

the political system and causing an unknown crisis related to the U.S.

Constitutional order or rule of law was primarily responsible for the 1973-74

MAJOR Bear Market. While the Arab oil

embargo caused gasoline prices and inflation to increase, the uncertainty

caused by Watergate and President Nixons cover-up were the main culprits. The

Watergate hearings captivated the nation while raising grave concerns about

Nixon future as President and the integrity of the U.S. Executive branch of

government. That further destabilized the economy and financial markets leading

to an overall stock market decline of 51.9% during that 2-year Bear

Market.

Victor

opines that the 1974 bear market year was 90% due to Nixon and Watergate - not

higher inflation or the deteriorating U.S. economy. Gold was +66.57% in 1974 as it was (and still

is) a chaos and inflation hedge.

The

DJI hit a low of 577.6 on December 6th, which was -54.96% off

its closing high of 1051on January 11, 1973.

Given the significant market losses and the bleak economic outlook, Wall

Street firms were unlikely to be in a celebratory mood in late 1974. His

company (Ragnar Options Corp) was one of very few Wall Street firms to

have 600 people at a gala Christmas party in December 1974 to celebrate a great

trading year.

Victors

Conclusions:

The

U.S. equity market has risen nine consecutive days, while the FTSE (UK) is up

15 consecutive days. Bear market rallies

are the strongest in history and this one is proving to be unusually robust.

History

suggests that the Bear Market in U.S. stocks could lead to a deeper, longer

recession. When a recession follows a Bear Market, the economic contraction is

typically deeper and lasts longer with the path to recovery is slower. Since

World War II, nine out of the last fourteen bear markets were followed by

economic downturns-usually within about six months.

-->Victor

bought 40% of his desired short position in S&P 500 puts (a little below

the then current market price) on Thursday.

He has approximately 50% spot gold and silver with 50% Cash in T-Bills.

The

conclusion to this saga is completely up in the air. No one knows the outcome

or economic impact of Trumps tariff policies or what deals his administration

will negotiate with other countries.

Meanwhile, the Fed is staying pat on rates, presupposing outcomes like

tariffs are always inflationary, but that is pure speculation! We shall see

End

Quote:

There are known knowns. These are things we know that we know.

There are known unknowns. That is to say, there are things that we know we

don't know. But there are also unknown unknowns. There are things we don't know

we don't know.

.

Good

health, success, good luck and till next time

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever-changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright ฉ 2025 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).