Economic Growth Forecasts Lowered; SOGEN Says Profit

Downturn to Cause U.S. Recession

by The Curmudgeon

Introduction:

Amidst

incredible investor complacency, low stock market volatility, overly bullish

investor sentiment, speculative excesses everywhere (e.g. virtual currency),

and an aging/ correction-free bull market, we have a global economy that

continues to tread water or deteriorate.

The CURMUDGEON has repeatedly stated that most of the non-financial

economy has been struggling, while Wall Street fat cats and selected social

media/Internet super-stars are raking in the dough. Meanwhile, global equity markets trend higher

with no fundamental underpinnings. The

great disconnect continues to widen, even as growth forecasts are cut.

In this

article, we provide updated economic growth forecasts, examine the trend in

profits vs. stock prices, and highlight the key messages from a new Societe Generale (SOGEN

investment bank) report that suggests a U.S. recession will occur in 2014.

Victor and I

have previously stated that the odds for an economic contraction have increased

in 2014 due to: higher taxes, excess government regulation on business,

Dodd-Frank's tighter lending standards, and the very costly, problem packed ACA

(ObamaCare) rollout. The SOGEN report

offers much more support for a U.S. recession.

Economic

Forecasts and Reports:

1. A mid-November

Bloomberg survey of 73 economists forecast a median U.S. GDP estimate of

1.7% this year, improving to 2.6% in 2014.

Bloomberg also reported

that confidence among U.S. consumers unexpectedly declined in November to a

seven-month low as Americans grew more pessimistic about the labor-market

outlook.

“The economy

just has not performed very well this year and has been disappointing relative

to what most people were hoping for and expecting through the course of the

year,” said Stephen Stanley, chief economist at Pierpont Securities LLC in

Stamford, Connecticut. “It’s one thing when you have one or two years into the

recovery and things aren’t progressing in the job market, but here we are

four-plus years in.”

2. On November

25th, Reuters reported

that

economists trimmed their forecasts for U.S. economic growth in the final

quarter of the year and the first three months of 2014, but predicted a

slightly higher rate of job growth over the next four quarters. Analysts see the economy growing at an annual

rate of 1.8 percent in the current quarter, down from a previous estimate of

2.3 percent.

3. On November

19th, the OECD stated that world economic output would expand 2.7% this year

("the lowest number since the crisis of 2009") and 3.6% in 2014.

Those figures are down from the group's May forecast of 3.1% growth this year

and 4% next year. In OECD countries,

economic growth is predicted to be only 1.2% this year- half of the world's

growth- improving to 2.3% in 2014.

OECD's forecast for U.S. growth was cut to 1.7% this year from May's

1.8%. The unemployment outlook is bleaker

with an 8% average in the OECD region and 12% unemployment in the Euro

area. Long term, structural unemployment

is considerably worse, according to the OECD spokesman. Readers are encouraged to watch and listen to

the very informative yet sobering OECD video here.

Former Fed

Chair Alan

Greenspan told Bloomberg he's only predicting 2% U.S. growth next year. The

"maestro" said the economy is being held back in part by the banking

system, as some of the largest banks are not operating efficiently. “We’re supporting banking institutions who are not only very large, but not very efficient and they

are using the scarce savings of the society, which is critical for economic

growth,” he said. He declined to identify which banks had become inefficient.

Corporate

Profits are Nothing to Write Home About:

3rd Quarter

U.S. company profits were up only 4.7% Year over Year (Y-o-Y), but that was

almost entirely due to cost cutting and accounting gimmicks. For example, H.P. outperformed diminished

Wall Street expectations for its 3rd quarter profits and HP stock rose strongly

this past week. But revenue was lower in

five of its six business segments, while demand for key products like personal

computers collapsed. Specifically, 4th

Quarter net revenue was $29.1 billion, down 3% from the prior-year period

and down 1% when adjusted for the effects of currency. Is that something to brag about?

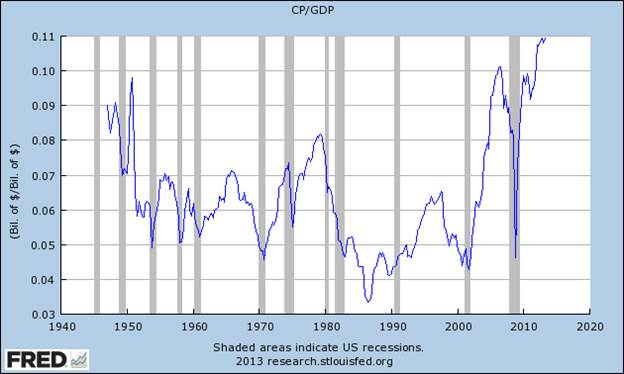

After tax

corporate profits as a percentage of GDP are at an all-time high (see graph

below), without much (if any) top line growth. How long can that continue?

European stock

markets have done very well this year (e.g. the DAX -Germany's stock market

index- is up 22% YTD). But that's not because of increasing corporate

profits. 3rd

Quarter profits in Europe were down 5.1% Y-o-Y!

And the future

doesn't look any better on "the other side of the pond." ECB

data released on November 28th showed loans to the private sector shrank by

2.1 % in October from the same month a year ago, equaling the biggest fall

on record! "Even though the ECB

just cut its refi rate, the pressure to do more will

build, especially on the back of faltering credit supply," said Peter Vanden Houte, economist at ING. That certainly doesn't augur well for future

European economic growth or profits, which depend on credit expansion-not

contraction!

SOGEN's

Albert Edwards Stunning Report:

In his latest

note to clients, SOGEN's long term bearish strategist Albert Edwards hints that

a recession in the U.S. is coming sooner, rather than later. "U.S. equity participants continue to

enjoy the intoxicating effects of the elixir of QE. This blow-off phase can go

on for quite a while longer...."

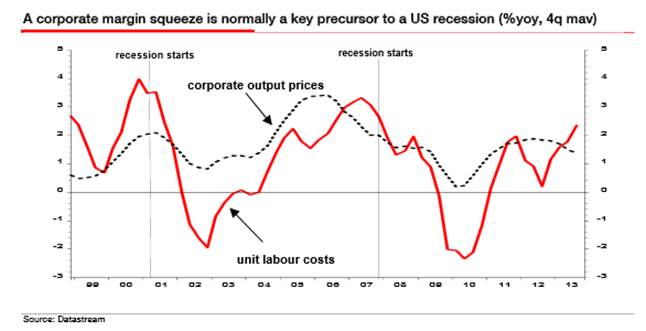

"Despite

investors enjoying this equity cyclical bull market, I continue to firmly believe

we are locked in a structural valuation bear market. We know from both the

U.S.'s own history and Japan's lost decade that these secular bear markets take

many economic cycles to fully play out. In the Ice Age, with equity and bond

yields inversely correlated, recessions are the catalyst that brings each round

of de-rating to lower lows. But a recession seems a distant prospect in the

minds of most investors. Yet one key precursor for a recession has now

fallen into place. Slowing productivity growth means that unit labour costs are now running well ahead of output price

inflation (see chart below). This means a margin and profits downturn is now

about to unfold. That typically is a key precursor of recession."

Edwards

continues, "I have never ever seen the sell-side predict a recession.

There are a number of reasons for that, but key among them is the personal

career risk of calling a recession and being wrong. Both the sell-side and the

buy-side tend to do much better when the economy and the markets are doing

well, so who wants to be a party pooper. That is the nature of the beast....

many feel the current US S&P forward PE of 15x is

fair value as it is just below the average PE of the past 25 years. But 15x can only be considered cheap in the shadow of the Nasdaq

bubble. But to those who work in the markets now, it still does not feel

expensive, whereas any long-term analysis suggests it is."

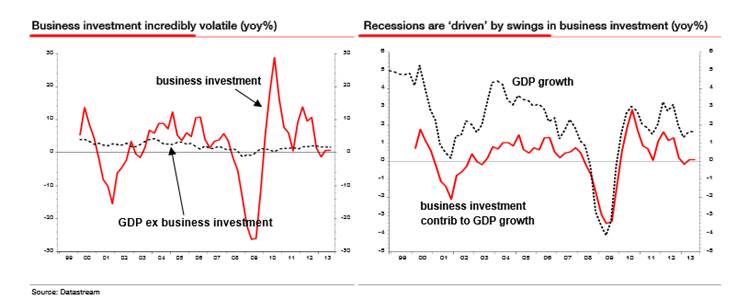

Edwards writes

that corporate profits should be watched closely, not for their direct impact

on equity valuations, but their impact on the economic cycle. They are a key

driver of the economic cycle. He states,

"Growth in profits determines the growth of investment, inventories and

employment....Over the years I have tended to focus on U.S. pre-tax domestic

non-financial profits as a best lead indicator for US-based company

business spending. Profits typically lead

investment spending."

Edwards focuses

on the business investment, because it is one of the most volatile elements of

GDP (see left-hand chart below). Swings

in business investment almost always determine recessions he claims (see

right-hand chart below).

Many investors

believe a recession will not occur unless the Fed triggers one by monetary

tightening. Edwards response: "That is of course

nonsense. A credit bubble can burst without any monetary tightening and

similarly the profit cycle can turn down due to a variety of factors."

Edwards

concludes, "The margin squeeze that is unfolding as unit labour costs climb above company selling price inflation

leaves the U.S. economy extremely vulnerable to a downturn in the investment

cycle. Business output inflation is measuring a wider basket of goods and

services than the Fed's favoured measure of

inflation- the core personal consumption expenditure (PCE) deflator....Low

pricing power is leaving the US economy more vulnerable than many suppose.

In my view, a full-blown profits and investment downturn is most likely

to be triggered by Asian and EM (Emerging Market) devaluations releasing

surplus capacity onto the West and crushing pricing power even further....Watch

the profit cycle closely. We ignore it at our peril."

CNBC notes that

other investment banks have also released bearish stock market outlooks for

next year. In early November, Nomura strategist Bob Janjuah

said in a client note that he expects a 25-50 percent sell-off over the last

three quarters of 2014 in global stock markets. Steen Jakobsen,

chief economist at Saxo Bank has explained on several

occasions to CNBC in recent weeks that bullish investors are "chasing the

tail" of the recent equity rally, indicating that now is not the time to

be risky. All that plus an enlightening

and refreshing discussion of Mr. Edwards report can be viewed here.

Victor

Sperandeo's Opinion:

Bearish

sentiment for U.S. stocks is at 1987 lows.

It follows that if any unknown event occurs, the large amount of bulls

will sell to very few bears covering shorts, and to those few waiting for a

correction to buy stocks.

While the

bullish move can continue for a while longer, the key point is that it might

end very badly with huge gap downs in stock prices. In October 1987, after Treasury Secretary

James Baker threatened Germany with U.S. dollar devaluation, there was a race

to sell stocks when the opening bell rang.

A retired friend put in an order to sell 500 shares of Polaroid at the

market. The stock was quoted at $26.25, but his order was filled at $18.00 -

down 31.4%. Hedge fund manager George

Soros sold his firm's long position in S&P futures (on the CME) and wound

up suing Shearson due to a similar type of bad execution.

Those that are

long stocks should understand that you are betting on the Fed and the U.S.

federal government to protect your "investments." The economic fundamentals are not going to

help at a 20 trailing P/E (and an even higher Shiller P/E of 25.52). The U.S. stock market is in "weak

hands," which is dramatically illustrated by record high margin debt and

very low relative volume numbers. When

you consider the increased role of HFT's (that have largely replaced the

specialists as market makers), the odds of a very sharp market decline increase

dramatically.

Any type of

geopolitical event could shock the equity markets into a complete

collapse. For example,

China selling U.S. debt if the U.S. invades their airspace or interferes in

their affairs? Or Israel invades

Iran to take out their nuclear plants? Or Saudi supports pricing oil in a

basket of currencies rather than the U.S. dollar? Any such bad news could cause the global

equity markets to return money to its rightful owners... Those

who are prudent to understand the risks of the moment. |

Caveat Emptor

and good luck!

Till next

time........................

The Curmudgeon

ajwdct@sbumail.com

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo

is a historian, economist and financial innovator who has re-invented

himself and the companies he's owned (since 1979) to profit in the ever

changing and arcane world of markets, economies and government policies.

As President and CEO of Alpha Financial Technologies LLC, Sperandeo overseas

the firm's research and development platform, which is used to create

innovative solutions for different futures markets, risk parameters and other

factors.