U.S. Budget Deficits,

Debt and the Return of Bond Vigilantes

By the

Curmudgeon with Victor Sperandeo

Record U.S. Budget Deficit and Interest on National Debt:

The U.S. budget deficit soared by 40% in the 1st quarter of

the governments fiscal year. Between October and December 2024, U.S. federal

government spending exceeded revenues by $711 billion and set a record.

Spending soared by more than 10% to ~ $176 billion.

Interest on the national debt was $20 billion or a little

over 13% of total government spending.

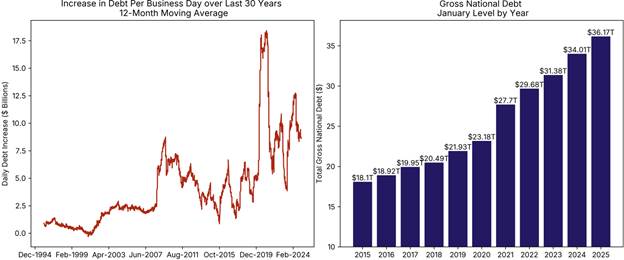

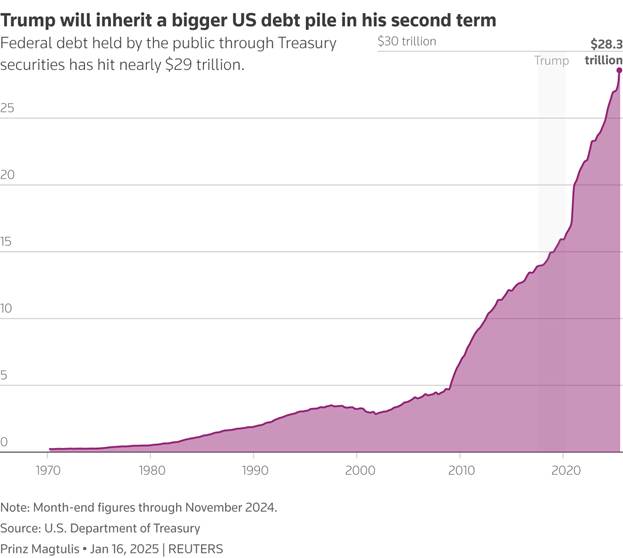

At $36 trillion, the stated U.S. debt easily exceeds the size of the

U.S. economy. In 2024, the debt is

projected to be $29.167 trillion and is climbing parabolically as per this

chart):

What stock market pundits dont seem to realize is that with

interest rates on U.S. notes and bonds on the rise and approaching 5%, and

possibly headed higher, the debt service costs will increase tremendously. That will make it even more difficult to

reduce sky high U.S. budget deficits and debt servicing costs.

The Return of Bond Vigilantes:

Martin Barnes, a former chief economist at BCA Research, told

Barrons

this week that he expects bond vigilantes [1.] to return, forcing

the U.S. government to pay a fiscal risk premium on its debt. Its unknown when

they will exact that price, even though U.S. total government debt exceeds 120%

of GDP which hasnt set off alarm bells yet.

.

Note 1. The term bond vigilantes

refers to investors who discipline excessive government spending by going on a

buyers strike, thereby demanding higher U.S. debt yields. In the early

1980s, when strategist Ed Yardeni coined the term, bond vigilantes surfaced

when U.S. budget deficits increased.

Since then, episodes of fiscal excess regularly gave rise to questions

about when those vigilantes might return.

.

The bond market is likely to price in more uncertainty

because of the inherent contradictions among many of Trumps policies, the

volatility around their application (for example tariffs), and still-too-large

budget deficits, according to Steven Blitz, chief U.S. economist of TS

Lombard.

Blitz thinks 10-year Treasury yields could climb to 6%,

a level not seen since mid-2000. Thats especially true if the Fed ends its

rate cuts and lifts the fed-funds rate to 5% to 5.25% in two years, from the

current target range of 4.25% to 4.5%.

U.S. note and bond markets are waiting to see the impact of

Trump's tariff, immigration policies, spending cuts and tax reductions. Disappointments in any of those could trigger

the vigilantes. Persistent wrangling over the U.S. debt ceiling, further

downgrades to the U.S. credit rating or a fall in foreign demand for U.S.

Treasuries due to reasons like sanctions and wars could make matters worse.

"There are many possible sparks," said Ray Dalio,

the founder of macro hedge fund firm Bridgewater Associates, in an email to Reuters.

.

..

Victors Comments on U.S. Note and Bond Yields:

In my opinion, U.S. Note and Bond yields are far too low considering

the level of U.S debt to be auctioned continued gargantuan government spending.

The net result is likely to be declining Treasury note/bond prices and higher

yields.

Several factors point to 7%-to 8% yields on 10-year T-Notes this

year and certainly beyond. Thats largely based on the Trump

administrations stated fiscal policies, which would increase inflation and

the budget deficit. However, President

Trumps pronouncements are either exaggerated, wrong, or he is intentional not

telling the truth when talking to the public. Also, he may change very quickly,

and Congress may not approve his agenda (it cant be all based on Executive

Orders).

Robert Rubin, Bill Clinton's Treasury

Secretary and a former co-chairman of Goldman Sachs, said the bond market

"could very quickly make it very difficult" for Trump to do what he

wants if a steep rise in interest rates triggered a recession or financial crisis.

"Unsound conditions can continue for a long time until they correct,

rapidly and savagely. When the tipping point might come, I have no idea,"

he said.

While a recession would certainly lower U.S. yields, the

Congressional Budget Office (CBO) assumes no recessions in the coming

decade. Not counting the 2-month COVID

caused GDP decline in 2020, there has not been a recession since the last one

ended in June 2009. One might ask if

the business cycle has been repealed?

Comparison of U.S. Note/Bond Total Returns:

Until recently, the total return on 5-year T-Notes did

not suffer an annual loss from 1970 to 1994 (and then again in 1999).

Total returns on the U.S. notes during the great inflation from

1968 to 1981 were positive due to the yields being high enough to offset the

declines in price.

The 30 year bond total

returns from 1977-1980 were: -0.69%, -1.10%, -1.23%, and -3.95%, according

to Ibbotson Associates, which has discontinued publishing this data in

2023. Sad as they had compiled those results since 1926.

In comparison, the iShares 3-7 Year Treasury Bond ETF (IEI)

declined in price from 12/1/20 to 12/1/24.

According to Blackrock,

its 3 and 5 year total returns through 12/31/2024 were -1.31% and +.003%,

respectively.

Moreover, the % of yearly note 5-year T-Note futures prices

declined four consecutive years from 2021-2024. Futures are a much

better guide than using spot prices, as they take into

account inflation and the maximum tax rate of federal income taxes paid

on yield.

Using the iShares 20+ Year Treasury Bond ETF (TLT)

for a guide to U.S. Treasury bond declines ...in the last four years TLTs

price decline was -42.23%! The 5-year

chart of TLT below shows the price is testing a bottom it made in November

2023:

.

..

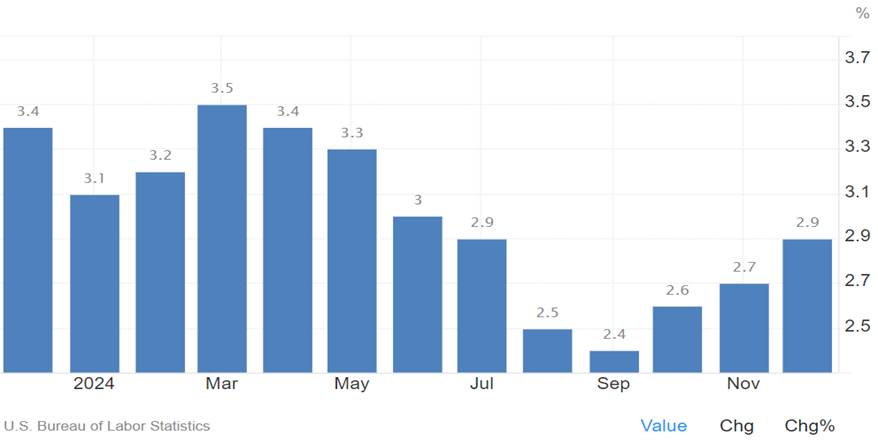

U.S. Inflation Trending Higher Since Sept 2024 Jumbo

Fed Rate Cut:

In an apparent slap in the face to Fed Chair Jerome Powell,

U.S. inflation has risen in each of the last three months since the September

2024 50bps rate cut which we opined was not needed. Heres a one-year CPI chart courtesy of Trading

Economics:

Its hard to believe the Fed will achieve its 2% inflation

target any time soon and therefore will likely be on hold for the foreseeable future.

.

..

Victors Conclusions:

From June 1971 to June 2024, U.S. debt grew at a compounded annual

rate of 8.81%. At that rate, the national debt will rise from $36.3 trillion to

$84.5 trillion in 10 years!!!

The CBO says it will be +$60 trillion without a recession or

tax cuts! A year ago, CBO projected it at

$54 trillion.

Until we see significantly less government spending -not just

proposals and amorphous talk - U.S. debt markets will continue to erode as the bond

vigilantes return.

End Quote:

After Trump was elected President in November, market

sentiment is implicitly related to a song from the 1987 movie Mannequin

by Jefferson Starships great singer Grace Slick with Mickey Thomas. Its

titled, NOTHING GONNA

STOP US NOW. The lyrics have a strange association today:

l Looking

in your eyes I see a paradise

l This

world that I've found is too good to be true

l Standing

here beside you, want so much to give you

l This

love in my heart that I'm feeling for you

l Let 'em say we're crazy, I don't care about that

l Put

your hand in my hand baby, don't ever look back

l Let

the world around us just fall apart

l Baby,

we can make it if we're heart to heart

l And

we can build this thing together

l Standing

strong forever

l Nothing's

gonna stop us now

.

Stay healthy, success and good luck.

Till next time

..

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2025 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).