Analysis of BLS, Gold Sell-off, U.S. Stocks and Bonds

By Victor

Sperandeo with the Curmudgeon

Disclaimer: Victor is NOT a reporter and needs no evidence to

substantiate his opinions. He is a trader speculating on the future via market

calls.

Important Note: The Curmudgeon provided a recap of the BLS May

Job Report in our companion

post today. You may want to read that before this article.

Victor’s

Opinion on the BLS May Job Numbers:

The BLS employment

reports are like a “Touting Broadway show” with lots of hype, but the show

means nothing in reality. The purpose is to manipulate

the markets to what the Fed wishes to accomplish to achieve their goals.

Politicians, the press, and many economists know this, but remain silent as it

benefits them.

The BLS reported numbers are completely bogus as we’ve

noted in dozens of previous Sperandeo/Curmudgeon posts.

This past March

we wrote:

"Evidently, the game is for the BLS to make the job

numbers look better than forecast, then revise them down the following month.

This chicanery has been going on for over one year now with only one exception.

The bottom line is that the Fed does not want to lower the Fed Funds rate too

soon. While not provable, it appears the Fed has influenced the BLS to distort

the job report numbers."

Here’s more proof that the BLS May jobs report is

bogus:

1. The Seasonally

Adjusted (SA) jobs show an average monthly increase of 247,800 new jobs added so far in 2024, while the ACTUAL (not SA) average monthly is 129,800. That’s a huge difference!

I

understand the statistically smoothing of the monthly numbers, but there is no

explanation or even a Footnote on SA vs NSA jobs added. In my opinion, the BLS is basically

committing a fraud. People that know this keep silent, as it benefits them.

2. As we’ve noted in many

past Curmudgeon/Sperandeo posts over many years, the Birth/Death model (BDM) job additions, make the jobs numbers appear

stronger than they actually are. Those are the assumed

(100% estimated) new jobs created by start-up businesses not counted in

surveys.

In May, the BDM added +231K

jobs to the non-farm payroll number. Without the BDM included, there would’ve

only been 41,000 jobs added in May. That is NOT at all consistent with the

reality of surging business closures and falling start-up company formation.

-->The people that

understand this BLS deception/subterfuge don’t say much, because they use the

system to make money in the markets.

-->The BLS reports allows the Fed to keep interest

rates high and keep the markets down until next month (in my strong opinion).

It also figures into an increased

Atlanta Fed GDP NOW projection of 3.1% annualized GDP -up from 1.8% on

6/3/24!

-->I believe this BLS chicanery will be a huge help

for Joe Biden’s Presidential re-election campaign.

Victor on

Friday’s Gold Sell-off:

Gold sold off on Friday with the GLD ETF closing off

-7.83 at 211.60 or -3.57%. August Gold futures also lost ~3% on Friday.

There were two reasons for the gold sell-off:

1.] The seemingly strong BLS jobs report and

2.] A report that China’s central bank did not buy gold

in May as they have for the previous year and a half.

Dillion Gage, a bullion dealer, said: “Gold pressured in

early morning trading by news that the Chinese central bank is halting buying

gold and slipped again on the latest jobs data showing remarkably higher growth

than expected. Before these unexpected reports, the bullion’s rally had flirted

with $2,400 an ounce. Gold prices fell more than 1% on Friday after data showed

The People’s Bank of China (PBOC) paused gold purchases in May after 18

consecutive months of buying.”

Curmudgeon: Another reason for Friday’s

gold sell-off: The U.S. dollar index (DXY) rose by +0.75% and posted a 1-week

high. The gold price is inversely correlated to the dollar.

The one-year gold price chart below shows a clear

uptrend:

Source: https://goldprice.org/gold-price-chart.html

.........................................................................................................

Victor on

U.S. Equities:

The S&P500 and the NDX100 had almost no response to

the May jobs report, closing down -0.11 bps on Friday.

Money is flowing into U.S. stocks from debt, because

deficit spending benefits corporate earnings (and thereby stock prices) while

adding to price increases.

Its obvious equity holders/donors have captured Congress!

In the 1950’s corporations paid an estimated 6% of GDP in federal taxes. Yet

today, the annual corporate tax rate is a pittance at 1.57% or $477 billion,

while GDP is $28.4 trillion. The average tax rate for U.S. individuals is

14.9%, or 9.5 times the largest American companies on average pay in taxes.

-->I remain bullish on Gold and Stocks since June

2023.

Victor on

U.S. Bonds:

The Fed and our Congressional Representatives are forcing

bond holders to fund the spending programs that get them (re) elected.

Bonds were sold heavily on Friday as noted above by the

Curmudgeon. As we’ve repeatedly stated, there is a huge supply/demand imbalance. The U.S. Treasury will auction about

$10 trillion of debt this year, much of it having an interest rate of between

4.5% to 5%. This will cost $500 billion annually to service. Meanwhile, the

biggest buyers of U.S. debt - the Fed, China and Japan -out of the market,

leaving institutions and the public as the primary buyers.

Therefore,

buying U.S. bonds for a long-term investment (not a trade) is like buying the

water flowing over Niagara Falls. However, bonds will rally when the Fed

eventually cuts rates before the elections to help Biden win

U.S.

Budget Deficits and National Debt Spiral:

As of April 2024, it costs $624 billion to maintain the

U.S. national debt, which is 16% of the total federal spending in fiscal year

2024. The stated U.S. national debt is

currently $34,670,632,654,267 (~$34.7 trillion) as per the chart below.

Source: U.S. Treasury Dept.

Source: U.S. Treasury Dept.

............................................................................................

According to the CBO’s

February 2024 report, U.S. budget deficits (which add to the

national debt) are projected to be $20,016 Trillion over the 2025–2034 period.

And that’s with no recessions projected! Federal debt held by the public will

increase to 116% of GDP. The CBO forecasts that U.S. economic growth will slow

to 1.5% in 2024 and then continue at a moderate pace.

If the business cycle reasserts itself, the U.S. will

have a serious recession sometime in 2025 or later (the last real recession

ended in June 2009 or 15 years ago). That would cause budget deficits and total

debt to soar way more than CBO projections over the forecast period.

Debt service costs could then easily top 20% or more of

U.S. government spending and impossible to control unless the Fed re-initiated

QE on even a grandeur scale than ever before.

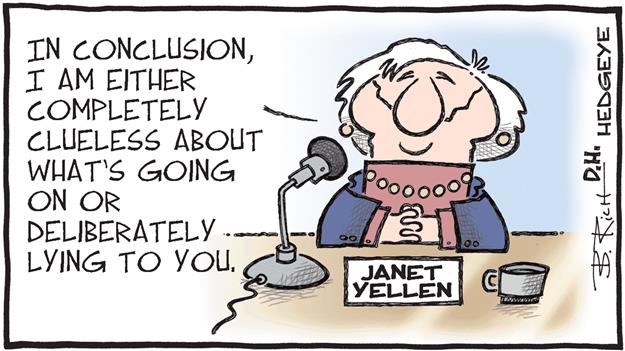

Whose Kidding Whom:

Image Credit: Hedgeye

...................................................................................................

End

Quote:

“It is well enough that people of the nation do not

understand our banking and monetary system, for if they did, I believe there

would be a revolution before tomorrow morning.” Henry Ford

………………………………………………………………………..

Be well, stay safe, success and good luck. Till next

time......

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).