Divergences Galore in U.S. Equity vs. Credit Markets

By the

Curmudgeon

Introduction:

With the possible

exception of

March to October 1987, we have never seen so many divergences between U.S.

equities and U.S. bonds. The latter has

been in a major bear market since June 2020 while the S&P and other popular

stock market indexes have been in a sustained bull market (without a 10%

correction) since the lows on October 12, 2022.

P/E Expansion Drives

S&P 500 YoY Total Return:

The primary driver behind

the resurgence in U.S. equities since the Oct 2022 lows has been P/E ratio

expansion. That usually occurs ONLY when

earnings growth accelerates OR interest rates decline substantially. Neither has been the case since the bull

market started.

The P/E Ratio for the

S&P 500 was 27.567 as of May 24, 2024, with a median value of 17.895,

according to GuruFocus.

Thats 40.15% greater than the S&Ps P/E of 19.17 on September 30, 2022 (Source:

YCharts), which

was just a few trading days before the bull market started.

The S&P 500 P/E has increased

18.65% Year over Year (last 52 weeks) with the index returning 26.14% (including

dividends) over the same time period. Therefore, P/E

expansion accounted for 71.35% of the S&Ps YoY return and most of that P/E

expansion was due to a few large cap tech stocks.

Huge Tech Sector Influence

on S&P 500 Performance:

In the mid-1980s, the tech

sector accounted for 5 to 7% of the S&P 500s market cap. As of May 24, 2024, information technology

(IT) stocks make up 29% of the S&P 500 index's value with 9% in communications

services stocks. Together, these two

groups of tech stocks represent more than 38% of the S&P 500.

The Vanguard Information

Technology ETF (VGT) is the largest technology ETF with $66.45 billion

in assets. VGT YoY return was 31.3% vs 26.14% for the entire S&P YoY

return!

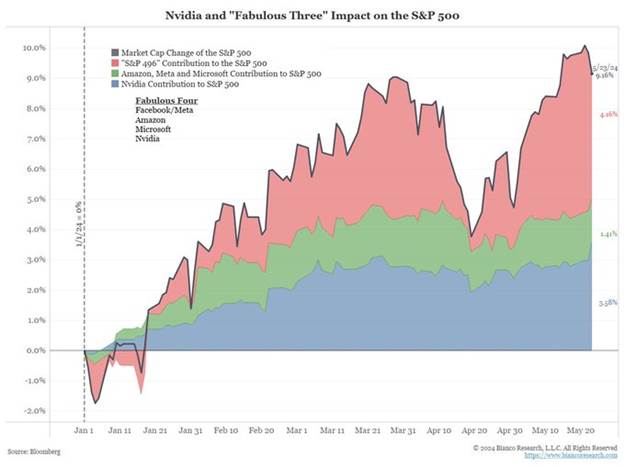

More striking is a Jim Bianco tweet:

The chart shows the change

in the S&P 500's market capitalization, which is a good proxy for the

returns calculated by S&P. This

"simple" market capitalization change is up 9.16% YTD. Incredibly, 3.58%

of this is the gain NVDA. That's 39% of the S&P 500's gain YTD! AMZN, MSFT, and META account for another

1.41% of the S&P 500's gain YTD, or 15%.

Therefore, 54% of the S&P 500's gain YTD is just four stocks!

Dow Theory Divergence:

According to Dow Theory

(popularized by the late Richard Russell), a move in the Dow Jones Industrials

should be confirmed by the Dow Jones Transports (and vice-versa). Yet, while

the DJIA rose to hit the 40,000 level the Friday before last and closed May 24th

at 39,070 (+3.13% YTD), the DJT have declined this year with a -5.13% YTD

return.

Extremely Bullish

Sentiment Rules the Roost:

·

At

12.36 currently, the VIX volatility index is a fraction off its YoY low.

Its long-term average is around 19, a level that essentially prices the S&P

500 index as if it will move about 1.2% each day over the next 30 days. When

the VIX gets really lowas it is right nowthe major

stock indexes tend to reach new highs, and investors get greedy. History

suggests thats a warning sign.

·

Credit spreads (junk bond/U.S. Treasury interest rates) have only been as

tight as they are today twice before in 2000 and 2007 just before major

bear markets in U.S. equities. They are now at the bottom decile of all time. Junk

bonds are priced for no defaults even though business bankruptcies have surged

+35% in the past year to the highest level since Q3-2020. The high yield bond ETF (JNK) is +3% YTD vs U.S.

Treasury ETF (TLT) is -7% YTD.

·

Equity strategists have recently boosted their year-end targets for the S&P

500. The Street-high target has moved up to 5,600 from 5,200 to start the year

too. Deutsche Bank and BMO Capital Markets increased their end-of-year S&P

500 targets this past week to 5,500 points and 5,600 points, respectively.

·

Ed Yardeni of Yardeni Research is calling for the Dow to

hit 60,000 points by 2030, a 50% surge from current levels. He predicts the

S&P 500 could be trading at 8,000 points by that time. "That target could be achieved with a

forward [price-to-earnings multiple] of 20 and forward earnings at $400 per

share, up 60% from an estimated $250 per share this year," Yardeni wrote

in a note to clients earlier this week.

·

According

to YCharts, U.S.

Stock Market Investor Sentiment % Bullish is currently at 47.04%, compared

to 40.86% last week and 22.90% last year.

Compare that to 15.84% bullish on April 14, 2022, in the middle of that

9 1/2-month bear market.

U.S. Stocks Rise Despite

No Fed Rate Cuts:

At the start of 2024,

strategists were calling for five to seven Fed rate cuts this year. After the March

20th FOMC meeting, Fed officials projected three rate reductions in

2024, likely starting in June. But given the persistence of elevated

inflation, financial markets now expect just one rate cut this year,

in November, according to futures prices tracked by CME FedWatch

tool.

Despite no rate cuts yet

and much fewer than expected this year, the equity market has advanced with

only a 5% decline in April. That was way short of the >=10% correction many

expected if inflation remained high along with intermediate and long-term interest

rates.

All of this is incredibly

puzzling to the Curmudgeon who has been watching financial markets for over 60

years!

..

Be well, success, good

luck and till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).