China Futures Firms Propel Gold Market to All Time

Highs

By the

Curmudgeon

Introduction:

John Maynard Keynes called

the gold standard a barbarous relic, but the yellow metal recently has outshone

far more modern assets. Despite a very

strong U.S. dollar, which is typically inversely correlated to the gold price,

the yellow metal has rallied more than 40% cent since November 2022.

June Comex Gold futures

closed today (April 24th) at $2,329.10 after a big drop on Monday.

Traditionally, the COMEX in NYC and the London Bullion Market Association (LBMA)

are (or were?) the world’s most influential gold markets.

·

COMEX Gold futures trade from 6 pm to 5 pm

EST/EDT Sunday through Friday with a 1:30pm EST/EDT settlement time. [The

Curmudgeon actively traded COMEX gold futures and options in 1984-1985]

·

LBMA sets the price of gold

per troy ounce in US dollars twice a day, at 11 AM and 3 PM UK time.

In addition, foreign

central banks have been big buyers on Gold since 2022 when Russia invaded

Ukraine.

The China Factor:

Gold has a longstanding

history in China as a savings tool, and the country is the top consumer and

leading producer of the yellow metal. That traditional interest has been given

a new lease of life by turmoil in the local property and stock markets, with

imports surging in 2022 and 2023 despite being tightly controlled.

The Financial Times reports

that Chinese speculator bets on rising gold prices helped super-charge the

precious metal’s rally to an all-time high this month. It’s a sign that China traders are beginning

to eclipse their western counterparts in influencing big move in the bullion

market.

Many analysts cite activity

on Shanghai Futures Exchange (SHFE) and the Shanghai Gold Exchange

— where trading volumes on a key contract have doubled in March and April

relative to last year — as a big driver of gold’s strong rally, as Chinese

investors aim to diversify from their crisis-ridden property sector and sagging

stock market.

In a matter of weeks, the

SHFE has gone from a sedate futures venue to a nexus of the global gold market.

While rival centers such as London and New York have also seen activity rise,

the fact that SHFE volumes have spiked from a low base offers a compelling sign

that a newly arrived cohort of Chinese investors has helped drive prices

sharply higher.

Long gold positions held

by futures traders on the SHFE climbed to 295,233 contracts, equivalent to 295 tons of gold.

That marks a rise of almost 50 per cent since late September before

geopolitical tensions flared up in the Middle East. A record bullish position

of 324,857 contracts was hit earlier this month, according to Bloomberg data

going back to 2015.

Indeed, SHFE gold futures volumes

surged to more than five times last year’s average at 1.3mn lots on the peak

day of trading last week. It’s a trading

frenzy that analysts say helps explain the strength of gold’s record-breaking

rally to above $2,400 a troy ounce earlier in April.

The Zhongcai

Futures firm in China has amassed a super bullish position in SHFE gold

futures equal to just over 50 tons of the yellow metal — worth nearly $4bn and

equivalent to more than 2% of the Chinese central bank’s reserves of bullion.

One fund managed by Zhongcai has

recorded a return of more than 160% in 2024, according to Wind, a

Chinese financial information provider.

Other Chinese trading

firms, such as Citic Futures and Guotai Junan Futures, also have very large

long positions in SHFE gold futures.

“Chinese speculators have

really grabbed gold by the throat,” said John Reade, chief market strategist at

the World Gold Council, an industry body. “Emerging markets have been the

biggest end consumers for decades, but they haven’t been able to exert pricing

power because of fast money in the west. Now, we are getting to the stage where

speculative money in emerging markets can exert pricing power,” Reade added.

“Short-term traders in

leveraged futures markets, as we have seen many times over the years, can move

the price quickly higher or lower,” said Reade.

“It’s a bit of a feature

of onshore Chinese markets, albeit a relatively extreme example,” said Marcus

Garvey, head of commodity strategy at Macquarie Group Ltd. There’s “much more

short-term speculative turnover,” he added.

Other Voices:

Not everyone thinks Chinese

investors are the major driver behind gold’s ascent. “It’s not

just mom-and-pop traders and it’s not just China,” said Jeff Christian,

managing director at CPM Group. “It’s really a broad-based thing. There isn’t

all that much difference now in the trading behavior of large institutions

compared to mom-and-pop people.”

Gold may be in favor as

higher-for-longer U.S. interest rates to tame inflation may tip the economy

into recession, according to Christian. “They’re all becoming convinced that

interest rates aren’t going to fall too soon,” he said. “That could be negative

for other assets more than it would be for gold.”

Samson Li, a Hong

Kong-based analyst at Commodity Discovery Fund, sees a more nuanced picture.

Rather than being a direct driver of prices, the frenzied demand in China has

encouraged western speculators to ramp up bets on gains in New York, he said.

The debate about how long

Chinese investors will stick around is tied to the question of what brought

them to SHFE in the first place. Institutional and retail traders on SHFE may

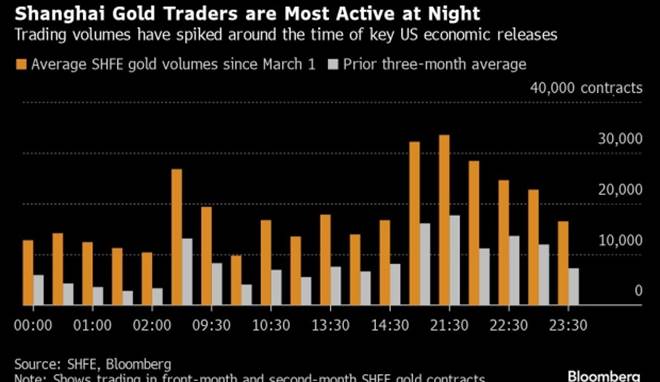

be buying gold to bet on short-term fluctuations in the yuan. This year, the

exchange’s night session has been the most active, just when a raft of hot US

economic data has driven the dollar higher.

Daniel Ghali, a senior

commodity strategist at TD Securities, has also been trying to identify gold’s

mystery buyer(s), and he still thinks that the dominant force is likely to be a

deep-pocketed buyer in the so-called official sector, which covers state-linked

institutions such as central banks

and sovereign wealth funds. But he

says buying activity there has also been closely correlated with weakness in

the yuan, and investors on SHFE may be acting with the same underlying

motivations.

“The trading activity on

the SHFE, it does point to retail speculation and that could be associated with

the currency pressures,” said Ghali. “It’s not just an issue for the central

banks out there – it’s an issue for everyday participants who see that their

currency is depreciating and want to hedge against it.”

Gold Price Outlook:

Imaru Casanova, a portfolio

manager at VanEck, recently told Barrons: “One reason we are so positive is because the

historical driver of prices has been absent. Geopolitical risk is increasing,

the Fed is still expected to cut rates, and Western investors are going to

start looking to hedge their portfolios. When investors look to add protection

and diversification, we expect gold and gold equities to benefit. Gold is at

peak prices, yet investment demand isn’t even close to peak levels. If that

demand comes back, we can easily justify a price of $2,600. That makes me really

bullish.”

End Quotes:

"Gold and Silver is

money, everything else is credit. " J.P Morgan

"Gold, gold -- you're

making me old." Richard Russell in Dow Theory

Letters.

Note: Victor will be commenting on this

topic in Sunday’s Curmudgeon post.

……………………………………………………………………………………………

Be well, success, good

luck and till next time……………..

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).