What if Taxes and

Interest Rates were included in U.S. Inflation Metrics?

By Victor

Sperandeo with the Curmudgeon

Introduction:

Knowledgeable people have understood that INFLATION is

a hidden tax. In a January 2023 report, Kentucky

Senator Rand Paul explained:

“As the Nobel Laureate,

Milton Friedman, suggested in a speech amidst the period of rising prices in

the 1980s, inflation can be thought of as a hidden tax for rampant

government action. Though the U.S. government has not levied taxes to pay for

the $4.9 trillion spent on COVID relief, the American public must still pay a

hidden tax.”

Most people grasp this concept, but few if any ask why actual

tax increases and interest rates are not included in U.S. inflation indexes

(e.g. the CPI, PPI, PCE index and GDP deflator)?

The answer is obvious -inflation gauges/metrics are 100%

caused and controlled by the U.S. government. Let’s examine this issue in

detail.

Inflation Defined:

A correct definition of inflation will not come from the

mainstream media, most economists, political leaders, reporters, or academics.

What is taught at all levels of education is that inflation is a “condition of

rising prices,” with little or no mention that inflation is actually

a monetary phenomenon (more on that below).

The Chat GPT definition mimics previous articles

written by Keynesian proponents:

“Inflation is an

increase in the general price level of the goods and services that households

buy. When prices rise, each unit of currency buys fewer goods and services;

consequently, inflation reflects a reduction in the purchasing power of money —

a loss of real value in the medium of exchange and unit of account within an

economy. A chief measure of price inflation is the inflation rate, the

annualized percentage change in a general price index (normally the consumer

price index) over time.”

The reality is that rising prices are the direct

RESULT of an increase in money over and above goods being produced! Milton

Friedman explained it well:

“Inflation is always and

everywhere a monetary phenomenon in the sense that it is and can be

produced only by a more rapid increase in the quantity of money than in output.

… A steady rate of monetary growth at a moderate level can provide a framework

under which a country can have little inflation and much growth. It will not

produce perfect stability; it will not produce heaven on earth; but it can make

an important contribution to a stable economic society.”

John Birch Society says

inflation is theft:

“Inflation

is a cleaver form of thievery that steals the value of EXISTING money by

flooding the nation with (ADDITIONAL) pieces of paper that have nothing of

worth backing them.”

Inflation is Theft

……………………………………………………………………………………………………………

Cost-Push

and Demand-Pull Inflation:

Cost-push and demand-pull are said to be different causes of

inflation. Cost-push inflation is due to supply-side factors, while demand-pull

inflation is caused by demand-side factors.

Yet from an Austrian School and monetarist perspective, they

really do not exist. They are purely Keynesian terms that try to misdirect the

reader away from the real reason for inflation…excessive growth of the money

supply.

According to the Federal Reserve Bank of St. Louis, the cost-push

argument is a fallacy because the ultimate cause of inflation is excessive

growth in aggregate demand, which comes from excessive growth in the money

supply.

PCE Price Index Explained:

The PCE price index is the Fed’s favorite inflation

gauge. It’s released each month in the BLS Personal Income and Outlays

report, reflecting changes in the prices of goods and services purchased by

consumers in the United States. Quarterly and annual data are included in the

GDP release.

On Friday, the BLS reported that the PCE price index

increased 0.3% from January to February 2024.. Excluding food and energy, the

core PCE price index also increased 0.3% month to month.

PCE Change From Same Month One Year

Ago:

- February 2024 +2.5%

- January 2024 +2.4%

- December 2023 +2.6%

- November 2023 +2.7%

Core PCE Change From Same Month One

Year Ago:

- February 2024 +2.8%

- January 2024 +2.9%

- December 2023 +2.9%

- November 2023 +3.2%

Inflation Lessons from History:

1. In 1910, the average annual salary in the U.S. was $574

dollars. Few women worked while the average household had 4.54 people, so that

salary was earned by one worker per household. In 1910 there was no income tax

so 100% of wages went to workers.

2. In 1912, before the

income tax was signed into law via the 16th amendment, the highest paid workers

were sewing machine operators, earning $669 dollars per year. Henry Ford

offered his two seat “Model T Torpedo Runabout” for $590.00 in 1912. (At an

auction on March 22, 2023, a Model T sold for $30,050).

3. In 1913 a single worker paid a maximum of 1% tax rate with

earnings from 0 to $20,000. There was

also a $4,000 tax deduction. That $4,000 exemption would be worth

$127,788.21, adjusted for the CPI today!

4. From 1971 to 2023, U.S. federal income taxes increased at

6.2% per year compounded! Yet the CPI was only 3.95%, because no taxes

were counted. If they were, the CPI

would’ve been +10.15% per year during that period.

Taxes and Interest Rates:

The CPI includes taxes (such as sales and excise taxes) that

are directly associated with the prices of specific goods and services.

However, the CPI excludes taxes (such as income and Social Security taxes) not

directly associated with the purchase of consumer goods and services.

Why not include ALL taxes and interest rates in the CPI and

other inflation indexes/metrics (e.g. the PCE index and GDP deflator)?

That would paint a truer picture of the erosion of people’s

wealth due to rising prices.

One reason is that taxes virtually never fall in aggregate,

although interest rates do. Furthermore, government spending always goes up

which is a direct cause of rising prices.

Cost of Living if Taxes Were Included in the CPI:

Here is an estimate of what the increase in the cost of

living would’ve been if ALL taxes were included in the CPI from 1971 to

date. These are estimated compounded

increases from the existing tax base of the specific category, not the

taxpayer’s income.

Note that we are estimating the actual taxes paid; NOT

the year-to-year difference or change in taxes!

- Federal income

taxes increase from 1971 to 2023 are + 6.2% per year;

- State taxes (e.g.

California the most populous state) +2.27 % a year from 7/01/72 state tax

was 3.75% base rate to currently 12.3%;

- Local income

taxes, if any (e.g. NY City=3.078% to 3.876%);

- Social Security

taxes: 6.2% up to a maximum amount;

- Medicare

tax: 1.45% on all earnings;

- Sales tax (some

may or may not be included in the CPI):

CA +1.25% a year (current CA sales tax rate is 7.25%, but

cities/counties add additional tax, e.g. 9.13% in Santa Clara, CA; 10.25%

in Fremont, CA);

- Real estate +3%

in aggregate for 50 states, estimated yearly from the base rate;

- Miscellaneous

taxes and franchise fees: Pay TV,

Internet, Wireline and Cell phone taxes, Gasoline taxes and other hidden

Federal tax collections.

If all taxes were included in the CPI calculation from 1971,

the estimate would be 18.67% per year!

And that does not include interest rates on mortgages, car payments, and

loans, which are impossible to quantify.

Curmudgeon Comment:

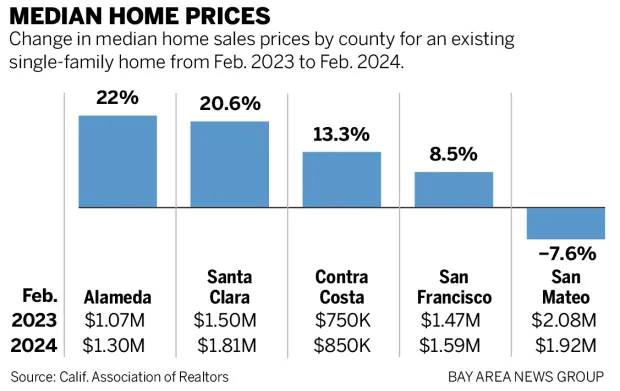

The increase or decrease in home prices is not included in

the CPI. Instead, there is a “hocus pocus” calculation of “owners’ equivalent

rent” which is not correlated with home prices.

In the SF Bay Area, the median price of a single-family home rose 22.6%

from a year earlier, according to the San Jose Mercury.

Victor’s Conclusions:

Taxes and interest rate increases are not included in the CPI

in order to deceive the public as to the real “cost of

living.” They are excluded from

Inflation indexes/gauges so the U.S. government in power can’t be blamed for

rising prices.

The U.S. government defines and refines its inflation gauges

to be flexible in order to make the political party in

power look good.

End Quote:

From Henry Hazlitt’s famous book “Economics in One

Lesson:”

“If a government resorts to inflation, that is, creates money

in order to cover its budget deficits or expands

credit in order to stimulate business, then no power on earth, no gimmick,

device, trick or even indexation can prevent its economic consequences.

The consequences of inflation are malinvestment, waste, a

wanton redistribution of wealth and income, the growth of speculation and

gambling, immorality and corruption, disillusionment, social resentment,

discontent, upheaval and riots, bankruptcy, increased government controls, and

eventual collapse.” Henry

Hazlitt

Be well, stay healthy, success, good luck and till next time…..

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).