Has Fed Tightening Since 2022 Accomplished

Its Objective?

By the Curmudgeon

with Victor Sperandeo

Introduction:

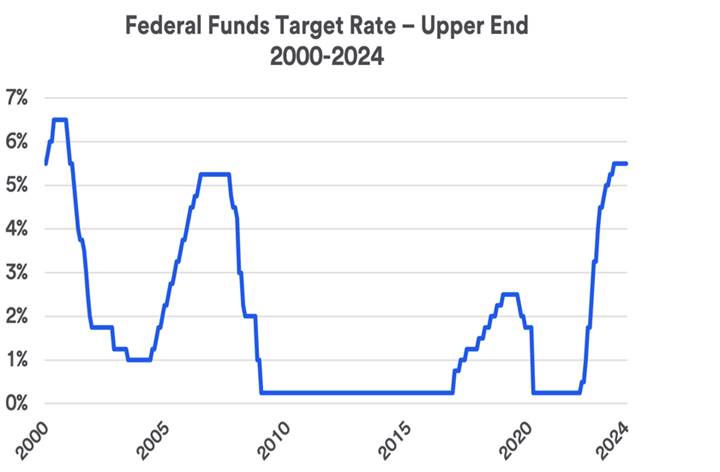

The Fed’s “higher for longer” Fed Funds rate and Quantitative

Tightening (QT) programs were

launched in March and June of 2022, respectively to tighten credit conditions. The purpose was to slow U.S. economic

growth and thereby reduce inflation.

Yet financial liquidity and risk taking have substantially

increased while financial conditions have eased tremendously since 2022. That

has driven bitcoin, gold, and stocks higher in 2024, tightened credit spreads

and lowered volatility (VIX). The

S&P 500 has risen to new all-time highs, fueled by the increase in

liquidity, and is now 14% above its 200-day moving average.

Michael Howell’s latest Global Liquidity Watch report reveals that

“global liquidity is on the rise, reaching a record high of U.S. $171.12 trillion.” That indicates there’s an ocean of money

floating around and looking for a home in the financial system.

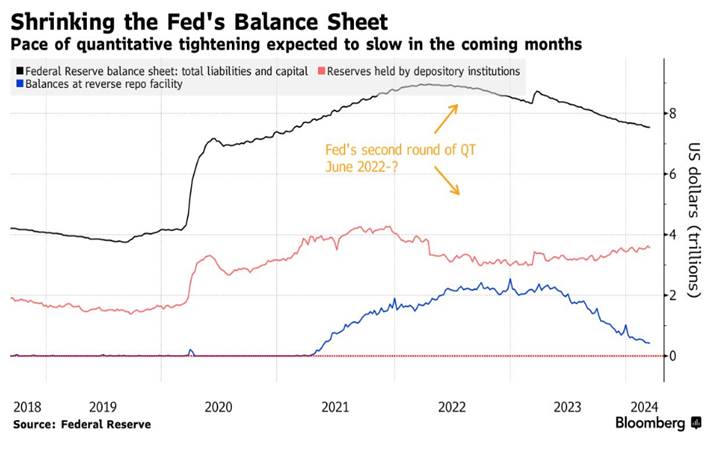

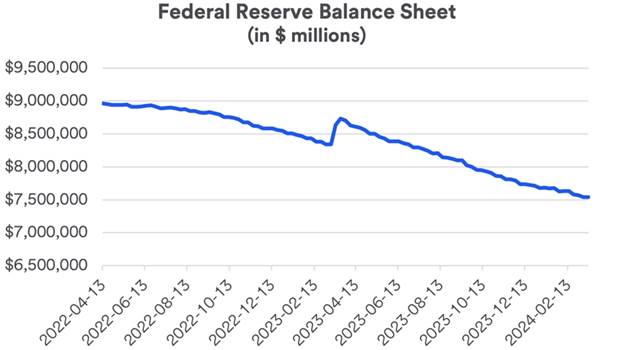

Graphs of Fed Funds,

Fed’s Balance Sheet, and Bank Reserves:

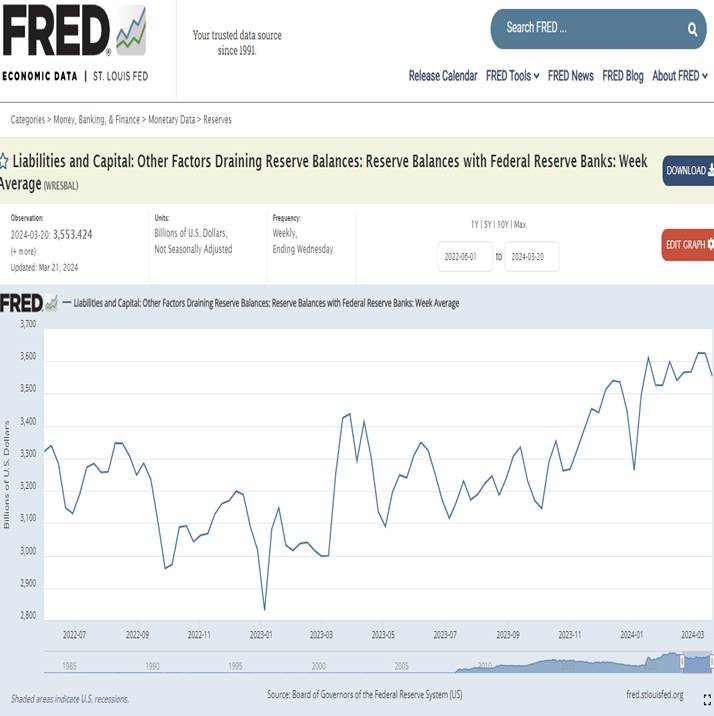

The graphs and commentary below illustrate the rise in Fed

Funds, shrinking of the Fed’s balance sheet, and surprising increase in bank

reserves.

Assets on the Fed's balance sheet reached an historic peak of

$8.96 trillion in April 2022 (36% of GDP) but are now $7.5 trillion – a decline

of almost $1.5 trillion!

Despite the shrinking of Fed’s balance sheet, bank reserve

balances have increased since June 2022 when QT started! That’s not

supposed to happen, because the Fed debits bank reserves each month by the

amount of its matured securities (currently $75 billion/month).

Financial Conditions,

Credit Spreads & the VIX:

As of March 2024, various measures indicate that U.S.

financial conditions are easier than they were before the Federal

Reserve started raising interest rates in March 2022!

The Chicago Fed's

National Financial Conditions Index (NFCI) fell to its lowest level since

before the Fed started raising interest rates, reflecting easier conditions.

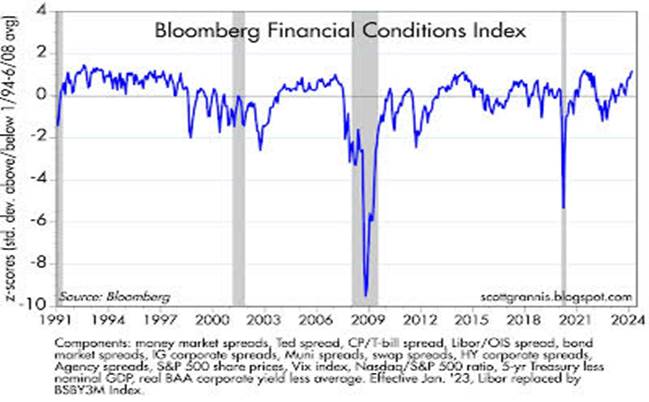

The Bloomberg U.S.

Financial Conditions Index (BFICUS) is approaching an all-time high.

BIFOCUS is a daily statistical measure of the relative strength of the U.S.

bond, money, and equity markets. It's considered an accurate gauge of the

overall conditions in U.S. financial and credit markets. The BFICUS uses

Z-scores to calculate its values, and a positive level is a sign that financial

markets are back on solid ground. A positive value indicates accommodative

financial conditions, while a negative value indicates tighter conditions.

Victor’s Assessment:

Please take a very hard look at the Bloomberg Financial Conditions Index below. Do

financial conditions now look tight to you? I can’t

find any time in financial history, for any country, where credit was TIGHT and

equity markets continued to make new all-time highs month after month. Even lesser variations between the two have never

occurred.

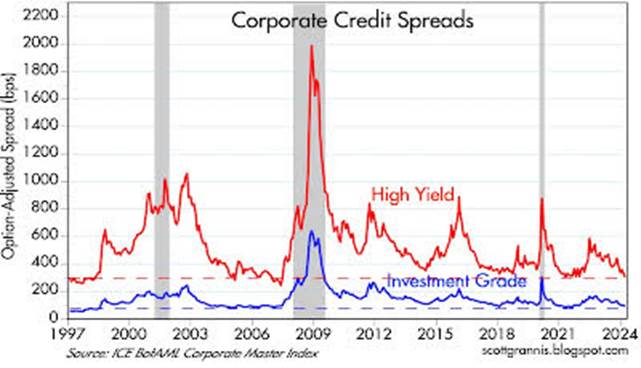

Corporate credit spreads, the difference between the yield on corporate bonds of

different quality and Treasury yields of comparable maturity, have rarely been

tighter than they are right now.

Measures of equity market volatility have fallen to

levels last seen in 2018, while the S&P 500 is up 9.4% in 2024 and has set

20 closing records. The CBOE VIX has closed below 16 for 99

consecutive trading days, the longest such streak since 2018, according to Dow

Jones Market Data. It’s currently at

12.95 and has declined over 36% in the last year, as per this chart:

Victor’s Conclusions:

Many market pundits and talking heads ignore the first

axiomatic principle of markets… they are always right… until something changes

that makes them go in the opposite direction.

The assumption that stock market valuations are extremely

high is relative to U.S. federal government spending trillions of fiat money in

an election year. The $1.2 Trillion spending bill Congress passed last weekend

shows there is no political constituency for fiscal restraint, especially in an

election year!

The Fed stressing they’re lowering their balance sheet to

tighten financial conditions is like watching the “illusionist” David

Copperfield (who is very rich)!

In my opinion, it is far more intelligent to follow the

sentiments of illusionists, fantasy writers, and magicians than the “talk the

talk” of the Chairman of the Federal Reserve board!

End Quotes:

“We’re a different sort of thief here, Lamora. Deception and

misdirection are our tools. We don’t believe in hard work when a false face and

a good line of bullshit can do so much more.”

Scott Lynch, The Lies of Locke Lamora.

“Magic consists of creating, by misdirection of the senses,

the mental impression of supernatural agency at work. That, and only that, is

what modern magic really is, and that meaning alone is now assignable to the

term.”

John Nevil Maskelyne, Our

Magic, 1911.

Be well, stay health,

success, good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).