Outlook

for U.S. Government Spending, Inflation, Fed Funds; Bullish on the Markets with

a Note of Caution

By Victor

Sperandeo with the Curmudgeon

Disclaimer: While Victor presents his views of the

markets in the commentary below, he does NOT suggest following his trading

ideas. He is not a registered investment advisor (RIA) and he only trades

futures contracts.

U.S. Government Spending Still Out of Control:

What is still not understood, unless one diligently reads the

bills passed by Congress, is that the prescribed U.S. government spending is

scaled/spread out over 4-to-5 years to keep money constantly flowing into the

real economy. We discussed that in

detail in this June 20, 2023, Curmudgeon post titled, “New

Knowledge of Fiscal Policy Tactics Tables Recession Forecast.”

The $1.2 trillion spending bill passed early Saturday morning

and signed by President Joe Biden the same day, adds to this bloated U.S.

fiscal spending. The Democratic-majority

Senate passed the spending bill with a 74-24 vote. Key federal agencies

including the departments of Homeland Security, Justice, State and Treasury,

which houses the Internal Revenue Service, will remain funded through Sept. 30th.

Biden described the package as investing in Americans as well

as strengthening the economy and national security. Nonetheless, this bill is

loaded with “over the top” pork, e.g. payback and bribes for votes and campaign

funds. As a result, U.S. government discretionary spending for the budget year

will come to about $1.66 trillion. That does not include programs such

as Social Security and Medicare or financing the country’s rising national

debt.

Inflation to Rise for Many Years:

A theme Victor believes in 100% is rising prices and

inflation via expanding the net money supply and financial liquidity. That will continue for many years. Along

with the 1.2 T funding package just signed into law, Biden’s fiscal 2025 budget

of a proposed $7.3 Trillion in government spending is an omen of future price

rises in the U.S.

Fed Funds Outlook:

Last week Fed Chairman Powell reiterated that the U.S.

central bank planned three rate cuts this year.

According to the CME Fed Watch Tool, there is only a 0.4%

probability of NO RATE CUTS this year (5.25% to 5.5% is the current range). At

the end of the December 2024 FOMC meeting, there is a 99.6% chance of one or

more rate cuts with 33. 8% of respondents believe the Fed Funds rate will be at

4.50% to 4.75% (or 75 bps lower than today’s range).

Victor believes that for strictly political reasons, the Fed

will cut rates 25 bps at the June 11-12th FOMC meeting. News from

U.S. government reporting agencies will be the excuse. In particular, the BLS

will show rising unemployment 4.1 to 4.2%, and much lower job payroll growth

which will give the Fed a green light to lower rates by 25 bps.

He expects only two Fed Fund rate cuts from now till the

November elections, with the second rate cut at the July 26th FOMC

meeting and no cuts at the September 17th FOMC meeting.

Bullish on U.S. Equities:

Victor turned bullish on the S&P 500 and U.S. equity

market in late June 2023, and he remains very bullish till the end of

September, unless there’s a deterioration of technical strength before then.

The principal reasons were:

the technical strength in the markets, the 2024 U.S. elections,

increased global liquidity (as outlined by Michael Howell of Cross Border

Capital and discussed here), and U.S. government

spending that is built into the four Congressional bills which started under

Trump in 2020 and continues (more below). The latter is the reason for the huge

budget deficits and super-sized increase in the U.S. national debt.

It’s important to realize that the supply and demand for

equities is heavily weighted to the buy side, mainly due to corporate stock

“buybacks,” the dearth of IPOs and secondary offerings. That has resulted in a declining supply of

equities!

On January 3, 2022, there were 3,521 issues traded on the

NYSE. As of March 22, 2024, there were 2,902 Issues traded. That’s a 17.58% decline in available listed

issues on the NYSE. However, the number of STOCKS traded is actually

much lower than the number of NYSE issues traded. That is because many

of the NYSE issues are actually bond, preferred

stocks, other fixed income securities or the equivalent ETFs.

Lowering the supply of stocks is in part causing the huge

overvaluations in S&P 500 price-to-earnings (P/E) ratios:

·

As of March 21st, the P/E ratio for the S&P 500 was 28.93.

The typical value range is 19.79–28.11, and the median value is 17.88.

·

The Shiller PE Ratio

for the S&P 500 was 35.71 as of March 1st, according to GuruFocus.

The median value is 15.93 and the typical value range is from 26.25 to

33.25.

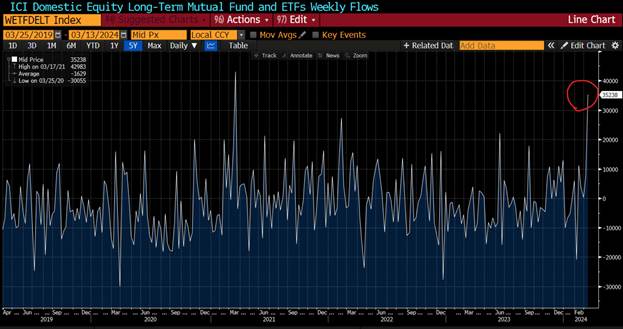

Curmudgeon – Equity Inflows Surge:

Investment Company Institute (ICI) data shows weekly domestic equity mutual fund and ETF

inflows surged, highest since 2021.

According to LSEG data,

investors acquired a net $14.07 billion worth of U.S. equity funds during the

week ending March 20th, logging their largest net weekly purchase

since mid-June 2023. U.S. large cap funds in particular, attracted a significant $15.31 billion,

the largest amount since March 22, 2023.

-->These huge equity inflows could be a warning sign, as

it indicates public investors are chasing stocks as they move higher. This

suggests that investors are very optimistic about future stock market returns,

which is often a contrary indicator.

Two additional reasons for caution are discussed below.

Curmudgeon - Goldman Sachs Says “This Time is Different”:

In a recent LinkedIn post, David Kostin, Partner &

Chief U.S. Equity Strategist at Goldman Sachs wrote:

“The recent rally has driven the market cap share in stocks

with extremely high valuations to levels similar to

those reached during the euphoria of 2021.

However, the prevalence of extreme valuations today looks far less

widespread than in 2021 after adjusting for market concentration. In contrast with 2021, the cost of capital

(WACC) is much higher today and investors are focused on margins rather than

“growth at any cost.”

“This time is different,” Kostin told BNN Bloomberg. “Unlike the

broad-based ‘growth at any cost’ in 2021, investors are mostly paying high

valuations for the largest growth stocks in the index. We believe the valuation

of the Magnificent 7 is currently supported by their fundamentals.”

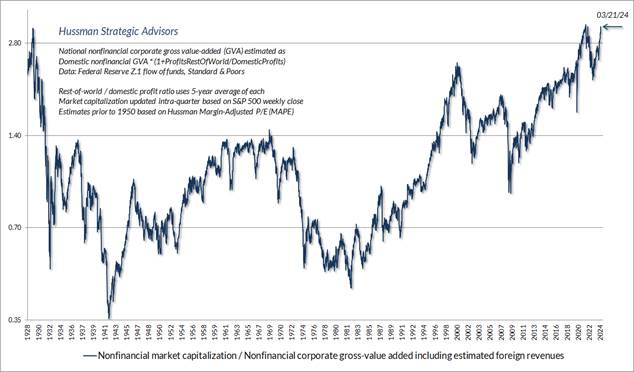

Curmudgeon - John Hussman of Hussman Investment Trust:

According to

John Hussman, “Based on the valuation

measures we find best-correlated with actual subsequent S&P 500 total

returns across a century of market cycles, the U.S. stock market presently

stands at valuation extremes matched only twice in U.S. financial history: the week

ended December 31, 2021, and the week ended August 26, 1929. My impression is

that investors are presently enjoying the double-top of the most extreme

speculative bubble in U.S. financial history.”

The chart below shows Hussman’s most reliable equity measure,

the ratio of non-financial market capitalization to gross value-added,

including estimated foreign revenues (see the chart text for calculation

details).

John concludes that “Nothing prevents valuations from

exceeding those two extremes, particularly in the short run. A defensive

position can feel excruciating, and investors can experience enormous

psychological pressure to “get in” on the rally in order to

obtain a feeling of relief.”

…………………………………………………………………………………………………..

Very Bullish on Gold:

Beyond being a long term large gold

investor, Victor is very bullish on the yellow metal. In part, this is due to a very favorable

supply/demand situation. Central banks

continue to buy gold while only about 0.01% to 0.005% of the public owns Gold

in the U.S. I believe the public will

buy will keep on rising, as more investors want to hedge inflation and world

chaos. I expect Gold to trade ~$2,500 with no cuts in the Fed Fund rate this

year (see Fed Funds Outlook below) and $3,000 if the Fed’s benchmark

rate is lowered in 2024.

Geopolitical tensions will rise

astronomically if Europe sends troops into Ukraine. That would be very bullish for Gold.

·

After a leaders' conference

on support for Kyiv in late February, French president Emmanuel Macron

said that there was "no consensus" on sending ground troops to

Ukraine in an "official manner," but that "nothing was

excluded." The speaker of Russia’s

lower house of parliament then warned Macron against sending troops to Ukraine,

saying they would meet the same fate as Napoleon’s army.

·

Netherlands, Estonia, and

Lithuania are ready to send troops to Ukraine, according to this YouTube

video.

If the West does send troops into Ukraine, Gold’s price will

rise beyond imagination. Unfortunately for the world, Russia will target those

countries that invade Ukraine and not even Gold will save anyone then!

Bitcoin Outlook:

Victor is long term bullish on Bitcoin, but bearish

short term. Bitcoin's supply is cut in

half every four years, or roughly during a halving, which occurs when the

network mines 210,000 blocks. The next halving is estimated to take place on

April 20, 2024, and will reduce the block reward from 6.25 BTC to 3.125 BTC.

This will make mining less profitable and slow the production of new bitcoins.

It is fully discounted in Bitcoin’s current price

($65,392). I expect the world’s leading crypto- currency to decline towards the

$40,000 level where I might consider a moderate allocation.

Neither Victor nor the Curmudgeon has ever owned Bitcoin and

the Curmudgeon never will as it has no intrinsic value in his opinion.

Bond Position:

Victor was bearish on Bonds but is now neutral. He expects to buy intermediate to long term

maturity U.S. debt futures for a trade after the May 1st FOMC

meeting.

However, the supply and demand for U.S. debt is unfavorable –

the opposite that of equities. While unfathomable supply and declining demand

puts long term pressure on US debt, Congress just passed a $1.2 trillion

spending bill. Go figure?

Commodities:

Commodities have bottomed! The CRB

Commodity Index made its low on December 12, 2023, at 258.09 without interest

included (i.e. just price return). Victor would be a buyer after a correction

of 5%.

The best commodities (x-Gold) are: Oil,

Silver, and the Grains. I would be a buyer of June

Crude Oil at $78 on any further weakness before the May 1st FOMC

meeting.

U.S. Dollar:

The Invesco U.S. Dollar Index Bullish ETF (UUP) closed at a

2024 yearly high Friday at $28.32 and is up 4.54% YTD. It is a better US $

index than the DXY which is +3.12% YTD.

Be aware whenever gold approaches a new high some unknown

entity buys the Dollar Index and Gold retreats. My speculation is that it’s the

Exchange Stabilization Fund [1.].

-->The last

thing the U.S. government collectivists wants is gold rising which creates

momentum to spur more buyers.

Note 1. The U.S. Treasury Dept.

Exchange Stabilization Fund consists of three types of assets: U.S. dollars, foreign currencies, and Special

Drawing Rights (SDRs), which is an international reserve asset created by the

International Monetary Fund.

End Quote:

This quote should be pondered deeply as it overwhelms all of our economic problems!

“I know not with what

weapons World War III will be fought, but World War IV will be fought with

sticks and stones.”

Albert Einstein was a

German-born theoretical physicist who is widely held to be one of the greatest

and most influential scientists of all time. Best known for developing the

theory of relativity, Einstein also made important contributions to quantum

mechanics, and was thus a central figure in the revolutionary reshaping of the

scientific understanding of nature that modern physics accomplished in the

first decades of the twentieth century.………………………………………………………………………………………………….

Stay healthy, success, good luck and till next

time……………………...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).