What’s Driving

Stocks to New All-Time Highs? Fed Watch and Recession Odds

By Victor Sperandeo

with the Curmudgeon

Introduction:

The S&P 500, Nasdaq 100, and DJI all closed at record new

highs on Friday January 19th.

The U.S. equity markets have been driven higher the last few months by

anticipation of as many as six interest-rate cuts this year, yet the Fed has

forecast only three. In fact, several

Fed officials this week tried to tamper down expectations of a rate cut in

March (more below).

Meanwhile, intermediate, and long-term interest rates have

risen this year. The yield on the 10-year U.S. Treasury Note—a benchmark

for borrowing costs from mortgages to corporate loans—rose to 4.145% on Friday,

after starting the year at 3.860%. See Victor’s market comments below for more.

Also, there’s been continued pressure on the U.S. housing

market, which often leads the economy. Existing home sales, which make up

most of the housing market, slid 19% in 2023 from the prior year to 4.09

million, the lowest full-year level since 1995, the National Association of

Realtors reported.

Fed Funds Watch:

In December, the Fed said there would likely be three rate

cuts in 2024. Last week, there was a

better than 70% chance rates would be cut by a quarter percentage point in

March, according to the CME

Fed Watch Tool. As of this writing

(Jan 21, 2024) that number is 46.2%, with 52.9% forecasting no rate cut in

March. As noted in the Introduction above,

there were several cautious rate cut comments by Fed officials last week:

·

Federal Reserve Governor

Christopher Waller acknowledged Tuesday that Fed interest rate cuts are

likely this year, but said the central bank should take its time relaxing

monetary policy. “When the time is right to begin lowering rates, I believe it

can and should be lowered methodically and carefully,” he added. “In many

previous cycles ... the FOMC cut rates reactively and did so quickly and often

by large amounts. This cycle, however, I see no reason to move as quickly or

cut as rapidly as in the past.”

·

On Thursday, Atlanta Federal

Reserve President (and FOMC voting member) Raphael

Bostic said he expects policymakers to start cutting rates in the third quarter

of this year. Bostic said he’s not

dead set against cutting earlier than the third quarter, implying a move in

July at the earliest, but said the bar will be high.

·

Chicago

Federal Reserve President Austan Goolsbee on Friday declined to say when he

thinks the central bank will cut interest rates, but he said reductions could

be expected this year “if we continue to make surprising progress on inflation.

We don’t want to commit ourselves before the job is done,” Goolsbee said in an

interview on CNBC. “As inflation comes

down, that opens the door to a reduction in restrictiveness.”

The current Fed Funds target rate is 500-525 bps

(5.0-to-5.25%). By the end of 2024, the CME Fed Watch tool assigns a 33.6%

probability of the Fed Funds target rate at 400-425 bps, a 33% chance of it

being 375-400 bps, and 16.3% at 425-450 bps.

What’s Driving Stocks Higher?

Some pundits attribute this week’s rally to improving

corporate earnings reports, which “took the leash off the bull,” according to

Jeff Kilburg, founder and CEO of KKM Financial. “All we needed was a spark to

get the S&P 500 back into positive territory.” Others are skeptical. “The market is still looking for proof to

justify the rally over the past three months,” said Scott Duba, chief

investment officer at Prime Capital Investment Advisors.

“Clearly, the consensus is that inflation is under control

and we’re heading for a soft landing,” said Doug Fincher, a portfolio manager

at New York City-based hedge fund Ionic Capital Management. “It’s certainly

possible—but a lot of that is priced in (the equity markets).”

Victor has a different opinion. He says the impetus

for stock indexes making all time new highs this week was a January 6th

speech

by Dallas Fed President Lorie Logan.

She explained how contracting liquidity in money markets may prompt the

Fed to reduce its rate of Quantitative Tightening (QT):

"In my view, we should slow the pace of runoff (QT) as

ON RRP (Reverse Repo) balances approach a low level,” Logan said. “Normalizing

the balance sheet more slowly can actually help get to a more efficient balance

sheet in the long run" by making it easier for financial firms to adjust

their individual liquidity levels, she added and noted that there are signs

liquidity is getting tighter for banks.

Victor thinks it’s too early to allow financial easing

because it has to be tied to the November U.S. elections. The Democrats

dominate the FOMC committee and desperately want to help their party candidates

win elections in 2024.

Victor on the Markets:

As previously stated, I believe stocks are a

new form of savings accounts, especially the Magnificent Seven, and that

valuations are no longer relevant.

To reinforce that equity valuations are “out the window,”

note that Germany’s DAX stock index hit an all-time high on 12/13/23 at

16,794.43 while the country is in a 2-year recession due to higher energy costs

and weaker industrial demand. The German

national statistics office said “multiple crises” affecting the economy had

contributed to a 0.3% fall in gross domestic product (GDP) in 2023, compared

with the previous year, as higher interest rates and elevated living costs took

their toll.

Bonds will be subject to

rising inflation pressures due to huge deficit spending by the U.S. federal

government. For example, TLT iShares 20+

Year Treasury Bond ETF has recently declined 6.69% from 100.51 on 12/27/23 to 94.09

on 1/19/24 (with a low of 93.79 on 1/18/24).

Meanwhile, June Gold Futures declined only -1.68% from

its recent high on 12/28/23 to Friday’s close.

I am bullish on stocks and gold, neutral on commodities (due

to China’s economic weakness), and short term bearish on long duration bonds.

Recession in 2024?

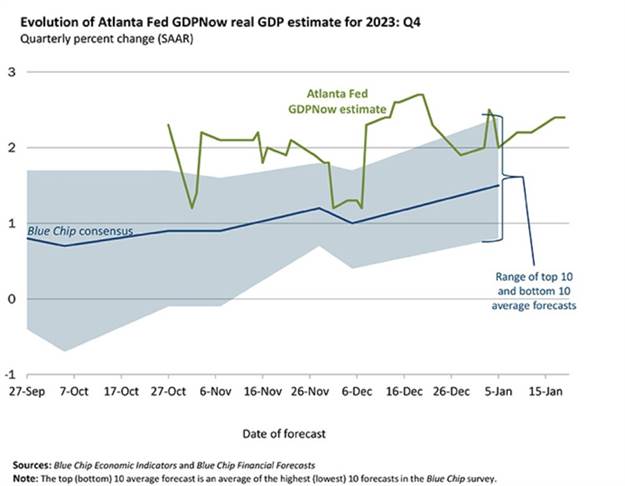

Real U.S. GDP is now estimated at +2.4% (annualized) by the

Atlanta Fed GDP Now tool for the 4th quarter of 2023. That’s higher than the Blue-Chip consensus as

shown in this chart:

Overwhelmingly, economic experts and executives privately

said they don’t expect a U.S. recession in 2024. The Fed’s potential interest

rate cuts in the coming months, combined with rising consumer confidence, have

led to optimism about the health of the economy – barring another major

geopolitical crisis.

Yet one large brokerage and mutual fund firm is bearish on

the U.S. economy. Vanguard

forecasts full-year 2024 real (inflation-adjusted) U.S. GDP growth of

0.25%–0.75% and a year-end unemployment rate of 4.8%, higher than the 4.1%

envisioned in the Fed’s SEP.

For a recession to occur in 2024 (a U.S. election year), we’d

have to have negative real GDP for both the 1st and 2nd

quarters, sticky inflation, a huge drop in consumer spending and a rising

unemployment rate. That does not appear

likely!

Curmudgeon Comments:

The big economic risk is geopolitical fallout from the

widening war in the Middle East. Also,

the war in Ukraine if it expanded to Eastern Europe.

Also, there’s a huge potential risk if the Fed doesn’t lower

rates as much as the markets expect.

“People tried to front-run the rate cuts by buying

long-duration assets, like tech stocks and bonds,” said Nancy Davis, founder of

asset management firm Quadratic Capital Management. “What if the Fed doesn’t

cut that much or that quickly? Those people get hung out to dry.”

Victor’s Conclusions:

Expect bullish Fed talk AFTER the March or May 1st FOMC

meeting to make things look good going into the November elections. I believe that the markets have all this

figured out. It is the forecasters that are bearish on the economy, not the

markets. U.S. government deficit

spending (and increased national debt) helps stocks but hurts bonds.

End Quote:

“Liberty may be endangered by the abuse of liberty, but also

by the abuse of power. The essence of

Government is power; and power, lodged as it must be in human hands, will ever

be liable to abuse.”

James Madison was an

American statesman, diplomat, and Founding Father who served as the fourth

president of the United States from 1809 to 1817. Madison was popularly

acclaimed the "Father of the Constitution" for his pivotal role in

drafting and promoting the Constitution of the United States and the Bill of

Rights.

………………………………………………………………………………………………………………………………

Success, good health, and good luck. Till next time………………………………………….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).