2023 Year in Review, Market Forecasts and Asset

Allocation for 2024

By Victor Sperandeo

with the Curmudgeon

Far from a Recession in 2023:

Most economists and market analysts called for a recession

last year. Victor thought a recession was forthcoming till the beginning of

July while the Curmudgeon was expecting a recession till October.

There were many reasons for that: Fed rate hikes to the

highest Fed Funds rate in more than two decades, a multi-year bear market in

bonds, inverted yield curve for many months, high and sticky inflation, 20

consecutive months of negative leading economic indicators (LEI), and the

belief that the business cycle was still in effect (the last real recession

ended June 2009 or 14+ years ago).

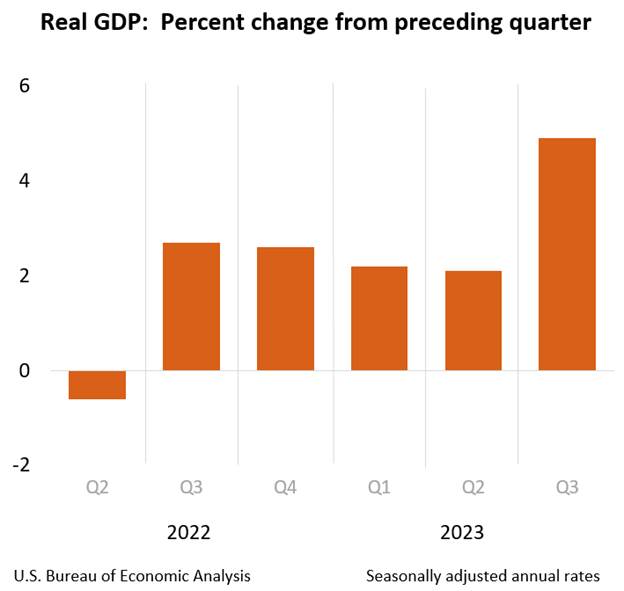

Surprisingly, real U.S. economic growth was positive in all

four quarters:

- BEA’s

quarterly (non-annualized) GDP estimates were as follows: Q1 +0.56, Q2 +0.51, Q3 +1.2, Q4 (Est)

+0.25. Please see the table below.

- As of December 22nd,

the Atlanta Fed’s GDPNow model estimates real 4th

quarter annualized GDP to be 2.3%

- 2023

fiscal year (10/1/2022 to 9/30/2023) real GDP

was +2.93%. The actual GDP at fiscal yearend was $27,623.5 trillion Gross

or 22,491.6 Real.

- 2023

real GDP was above the recent trend.

From 2000 to 2023 annualized real GDP was +2.05%.

- It should be

noted that U.S. economic growth rates have been decreasing for many

decades. According to Trading Economics, in the 1950’s

and 60’s the average U.S. growth rate was above 4%, in the 1970’s and 80’s

it dropped to around 3%.

- According to Trading Economics, the average

annual growth rate of the U.S. GDP has been below 2% for the last ten

years. Since the second quarter of 2000, it has never reached 5%.

Recession in 2024?

Most economists, analysts and pundits are still calling for

recession in 2024. The New York Fed says that there’s a more than a 50/50

chance that the economy will fall into a recession by September 2024.

“The staying power of this growth spurt is questionable going

forward,” says economist Olu Sonola of Fitch

Ratings. “Above trend economic growth cannot sustainably co-exist alongside

an increasingly restrictive interest rate environment.”

A recent Bloomberg

Economics model shows a slightly greater than 50% chance the U.S. will fall

into a recession in 2024. The model factors in consumer spending, employment,

factory output, and certain measures of income to determine

if a recession is likely.

Some people in the forecasting business use the terms

“slowdown, soft landing, or no landing.” However, there’s no real

definition for those terms.

Economic Outlook for 2024 and Influence of Geopolitics:

Victor believes that there will be no recession this year

(the Curmudgeon is not so confident). Knowing nothing else, the 2024 election

year will stimulate the U.S. federal government to “throw the kitchen sink”

at the economy. The Democrats and the Rino Republicians (Republican in Name Only)

in Congress want to retain power and will do so by hook or by crook.

The U.S. economy and domestic politics will be heavily

influenced by international events and geopolitics. First and foremost

is Israel’s war in Gaza to destroy Hamas- an existentialist threat to

the existence of the Jewish state. It’s

important to recognize that Iran is the sponsor not only of Hamas, but

also Hezbollah and Houthis who have attacked Israel since the October 7th

Hamas invasion.

According to U.S. government estimates, Iran has spent

billions of dollars to arm, train and fund Islamic terrorist groups like Hamas,

Hezbollah, Palestinian Islamic Jihad (PIJ), Houthis and others. Those groups

are pawns or proxies and fulcrum for Iran’s foreign and regional geopolitical

policy goals – and to generally destabilize the Middle East and prevent peace

among its warring factions.

“Not only did the Hamas attack come straight out of the

Hezbollah playbook, but Iran has funded, trained, and armed both Hamas and

Hezbollah for decades, investing billions of dollars over time in these groups

in support of their terrorist activities,” said a speaker at a Congressional hearing on terror

funding. “Ultimately, Iran is fundamentally complicit in Hamas and

Hezbollah’s terrorist acts.”

If Iran gets

close to making a nuclear bomb via uranium enrichment, Israel will have no

choice but to take out the Islamic republic. That would result in the closing

of the Straits of Hormuz and crude oil at more than $200/barrel.

There’s also the looming threat of China taking over

Taiwan, which China believes in an integral part of the world’s second

largest economy. Bloomberg conversations with US-based

security analysts and former administration officials, as well as with members

of the government in Taipei, cast doubt on Taiwan’s ability to deter, let alone

resist an attack from China — with some even questioning Taiwan’s will to do

so.

The U.S. sees important progress being made by the government

in Taipei, “but the administration is also concerned that the threat facing

Taiwan is significant and growing, and as a result more is needed to ensure

Taiwan is keeping pace with that threat,” said Jennifer Welch, chief

geo-economics analyst with Bloomberg Economics, who served as director

for China and Taiwan on the U.S. National Security Council until this year.

Victor strongly believes Russian will be the clear winner

in its war with Ukraine (the Curmudgeon is not so sure), but there’s

a related risk. The U.S. has

proposed that G7 working groups explore ways to seize $300 billion in frozen

Russian assets, as the allies rush to agree a plan in time for the second

anniversary of Moscow’s full-scale invasion of Ukraine. While no decisions have

been taken and the issue remains hotly debated inside European capitals, the

acceleration of work on confiscating Moscow’s assets for Ukraine highlights its

rising importance for the west. Legal scholars and agencies, including the IMF,

are warning Biden not to do this.

Victor opines that just the talk of the U.S./G7 using the $300 billion that the U.S.

“confiscated” from Russia will cause the dollar to decline more than

10% this year. On the other hand, if

President Biden does not use the Russian reserves, then the dollar will fall by

5-10%.

In either case, expect dedollarisation

(foreign countries reducing reliance on the U.S. dollar as the world’s reserve

currency) to continue.

Suggested Asset Allocation for 2024:

As a result of geopolitical risks, a large allocation

to Oil and Gold is a must. Also include

some Silver as part of a balanced portfolio. Stocks should also do well this

year if there is no recession. The major overvaluation of stocks is not

relevant to most traders these days.

The key to all these asset classes is the quantities to

invest. For 2024, Victor suggests 15%

Gold, 5% Silver, 10% Oil, 35% stocks, 30% in 1-year T-bills and 5% in 5 year T-Notes.

Victor’s Assessment of the Biden Administration:

Victor believes that the Biden Administration is the most

lawless in his lifetime and it is destroying the West. Biden is a very weak President, with 53% of Americans

disapproving of him, according to Reuters, as of December 5th. China sees this opportunity to do what it

wants, while Biden is in office. The

risk to the world is very high!

Cartoon courtesy of Hedgeye

……………………………………………………………………………………………………………

Victor’s Conclusions:

The federal government has overshot its powers. It’s been

taking over, in whole or in part, such matters as housing, water, sewers, urban

renewal, depressed areas, the relocation of industries, health, hospitals,

education, police, fire prevention, juvenile delinquency, and even snow

removal.

Sadly, the U.S. Constitution and Bill of Rights seem to be

only historical documents, rather than the “law of the land” like they were

from original publication in September 1787 till several years ago.

James

Madison, the "father" of the Constitution said: "The

accumulation of all powers, legislative, executive, and judiciary, in the same

hands, whether of one, a few, or many… may justly be pronounced the very

definition of tyranny."

All things

considered, the U.S. and the world are in a steep decline as we’ve chronicled

in many past posts. Talk of civil war and revolution are not topics that are

typically discussed, but they are real possibilities now. -->An upheaval in the U.S. has never

been higher since the Civil War.

End Quote:

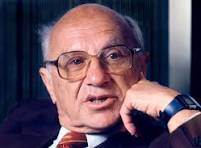

“Government has three primary functions. It should provide

for military defense of the nation. It should enforce contracts between

individuals. It should protect citizens from crimes against themselves or their

property. When the government, in pursuit of good intentions, tries to

rearrange the economy, legislate morality, or help special interests, the cost come in inefficiency, lack of motivation, and loss of

freedom. Government should be a referee, not an active player.”

Milton Friedman was an American economist

and statistician who received the 1976 Nobel Memorial Prize in Economic

Sciences

…………………………………………………………………………………………………………….

We wish you all good luck, good health

and a success in the new year. Till next time………….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).