Bond

Market Analysis; Outlook for U.S. Dollar, Stocks and Bonds

By the

Curmudgeon with Victor Sperandeo

U.S. Aggregate Bonds Turn Positive in 2023:

The U.S. bond market is on track to avoid a third consecutive

year of losses, which by some accounts would have been the worst performance

since the 18th century.

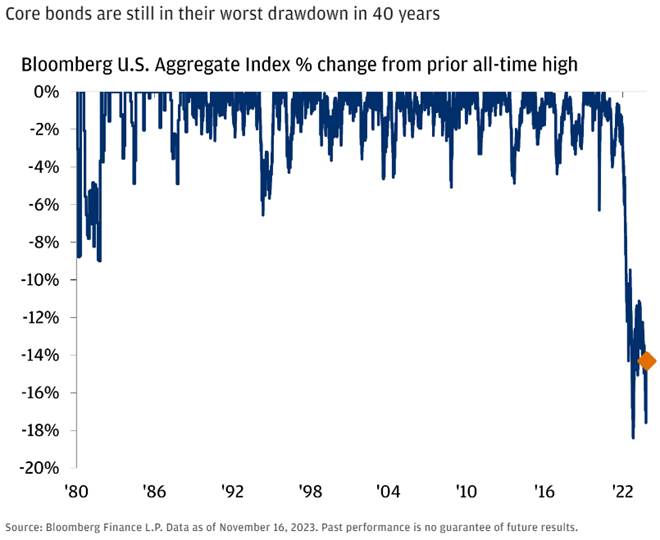

Following a softer-than-expected inflation report, the Bloomberg

US Aggregate index (includes U.S. Treasury securities, investment grade

corporate bonds, mortgage-backed securities (MBS), asset-backed securities

(ABS), and municipal bonds) gained 1.2% this week through Thursday and is now

up 0.4% for the year on a total return basis. The nearly equivalent iShares

Core U.S. Aggregate Bond ETF (AGG) has a 0.82% YTD Daily Total Return in 2023,

but its NAV has declined from 98.10 (close) on January 4th to 95.25

(close) on Friday November 17th.

The benchmark US bond index, which tracks $25 trillion of debt, posted a record loss of 13% in 2022 and

declined 1.5% the previous year, again on a total return basis. The index has

never declined for three straight years.

U.S. Treasury Bond Outlook:

U.S. government bonds have a serious supply-demand problem. The U.S. federal government ran a deficit of

$1.7 trillion in its fiscal 2023, which ended on September 30th. Thats

more than the entire national debt in 1985!

As a result, the U.S. Treasury must auction a lot more bonds,

notes, and bills to finance the debt. The U.S. Treasury has issued a net $2

trillion in new debt this year, a record when excluding the pandemic borrowing

spree of 2020.

Yet that additional Treasury borrowing comes as the two

biggest buyers of the past decade are out of the marketthe Fed is doing QT at

a rate of about $60 billion a month, while foreign buyers (e.g., China and

Japan) have largely pulled back.

Foreigners, including private investors and central banks,

now own about 30% of all outstanding U.S. Treasury securities, down from

roughly 43% a decade ago, according to data from the Securities Industry and

Financial Markets Association.

Overseas investors sold a

net $2.4 billion in long-term Treasurys in September, bringing their holdings

to $6.5 trillion, according to data from the U.S. Treasury Department released

Thursday. On a rolling 12-month basis, which helps to smooth out volatility in

monthly data, the pace of foreign buying has eased to around $300 billion in

recent months from levels above $400 billion for much of last year, according

to data from the Council on Foreign Relations that also adjusts for

changes in valuation.

U.S. issuance is way up, and foreign demand hasnt gone up,

said Brad Setser, senior fellow at the Council on Foreign Relations. And in

some key categoriesnotably Japan and Chinathey dont seem likely to be net

buyers going forward.

.

..

To make matters worse, most forecasters are calling for a recession

next year which would markedly increase the budget deficit (to ~$4-6

trillion in a major recession). That would lead to even more Treasury

borrowing, increasing the supply of U.S. debt.

In its latest report, BofA Global Research asks,

Could these high (budget) deficits spark the next debt crisis? In the early

2000s, the crisis was in corporate debt and in 2008 it was household mortgage

debt. Jared Woodard suggests it could be governments in the 2020s. U.S.

government spending, currently equal to 44% of the total economy is

unsustainable. Have a look at this

chart:

Source: BofA Global Research, Bloomberg

.

The net interest expense on the U.S. debt further increases

budget deficits yet adds nothing to GDP. Rising debt loads will likely mean:

1) higher trend inflation, with major

consequences for asset allocation; 2) lower productivity growth as

public debt crowds out private investment; and 3) a weaker U.S. dollar

as investors foreign and domestic opt for the stability of real assets.

Jared believes U.S. public sector finances in coming years

will have more impact on asset returns than ever before and suggests investors

rotate to quality small caps, credit, and commodities, as well as other real

assets.

A failed Treasury auction is what really keeps me up, says

Tim Horan, chief investment officer for fixed income at Chilton Trust. It

would certainly be a Minsky moment, using a term that refers to a market

collapse brought on by the sudden unwinding of excessive debt.

Victors Comments:

I have been out of bonds since June, because the Fed

has continued to talk up threats of higher interest rates, saying they will be

higher for longer. Buyers of long-term duration bonds are declining daily as

noted above. Heres what one analyst

thinks:

In the near term, the risk is that yields go

higher, says Adam Abbas, co-head of fixed income at Harris Associates.

Theres a lot of Treasury supply out there, and the deficit narrative is

gaining tractionthere doesnt seem to be a real long-term solution in

Washington.

.

..

On Tuesday, the BLS reported that the CPI for October

was +3.24% on a Year-over-Year (YoY) basis, which is lower than its

long-term average of 3.28%. The October PPI was down -0.46% from last

month and +1.35% YoY. Lower inflation

has led markets to conclude the Fed is done raising rates, which caused bonds

and stocks to rally, while the U.S. dollar declined (it looks like a

technical top for the dollar).

The U.S. effectively weaponized the dollar when it

sanctioned Russia and confiscated $315-$400 billion of its reserves after the

Ukraine invasion. That was perhaps

the greatest financial blunder in the history of the U.S! It caused other countries to worry if they

would be next, so they shifted many of their investments from dollars to other

currencies and gold.

U.S. stock prices have increased partly because share

buy-backs and mergers have lowered the supply (conversely, the supply of U.S.

bonds has increased as noted above). The number of stocks listed on the NYSE is

now under 2,900, which is down from over 3,300 twenty years ago. Corporate earnings have held up, while

deficits are exploding. Stocks also have pricing power in inflationary periods,

while the Fed raises rates.

Victors Conclusions:

Im bullish on gold/silver and stocks, but bearish on U.S.

debt.

I dont think there will be a recession in 2024 because its

an election year as

discussed in this post. However, if

a recession does occur next year the Fed will surely lower its benchmark rate

(e.g., Fed Funds).

The CME

Fed Watch Tool assigns a 48.2% probably of a 25 bps rate cut and a 13.6%

probability of a 50 bps cut by the May 2024 FOMC meeting. After the June 2024

Fed meeting, the Tool assigns a combined 83.9% probability of a rate cut

between 25 bps and 75 bps. Could that

be interpreted as a recession forecast?

Nonetheless, I believe that anticipation of higher inflation

and the increased supply of Treasuries will be a problem for U.S. bonds. That

will offset lower short-term interest rates from the Fed.

End Quote:

Bonds are guaranteed certificates of confiscation -- Franz

Pick, an ardent advocate of gold as world currency.

It seems that was a

correct call. What cost $10,000 in the

U.S. on 12/31/70 now costs $77,425,42 (as of 10/31/23 using the CPI as the

inflation gauge). In other words, the

purchasing power of $10,000 ~53 years ago is only $1,189.56 today!

.

Be well, keep active, and try to be objective in this age of

disinformation and propaganda campaigns.

Till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).