A

Combustible Mix: Hidden Leverage, Global Liquidity Downtrend and Low Stock

Market Volatility

By the

Curmudgeon

Financial Stability Board Report:

The Wall

Street Journal reported on Thursday that global financial regulators are

warning against hidden leverage in the financial system, cautioning

that a build-up of borrowed money among non-bank institutions could leave

markets vulnerable to widespread stress and financial disruption.

The Financial Stability Board (FSB), a global body

that coordinates financial regulation

for the G20 countries, stated

in a September 6th report that hedge funds are operating with

high levels of synthetic leverage, which is when derivatives are used to

create exposure to certain assets.

In the week ending September 8th, 2023, the FSB warned that

leverage is now very high in parts of the $7 trillion hedge fund sector, while

noting that significant data gaps make it very difficult to get a full picture

of vulnerabilities among "non-banks."

That opaqueness is because hedge funds spread their borrowing

across banks that provide them prime-brokerage services, making it difficult to

assess a fund's full leverage. The small concentration of prime brokers that

lend to hedge funds could amplify shocks in the financial system, the report

said.

If not properly managed, the build-up of leverage creates a

vulnerability that, when acted upon by a shock, can propagate strains through

the financial system, amplify stress and lead to systemic disruption.

This has been previously demonstrated by a series of

financial incidents, stretching back to the 1998 collapse of Long-Term Capital

Management, the 2008 global financial crisis, the March 2020 market turmoil,

the 2021 Archegos failure, and the September 2022 dislocation in the UK gilt

market.

Leverage is a two-edged sword which amplifies both rises and

falls in financial assets. Hence, hedge

fund leverage needs to be watched closely.

.

Leverage Effect on Equity Markets:

Hedge fund leverage may explain why global equity markets

have been so strong this year with low volatility (more below). Thats despite net redemptions from mutual

funds, insider selling, interest rate increases across the entire yield curve,

and the Feds QT (which has reduced its balance sheet from $8.734 trillion on

March 23rd to $8.11 trillion last week).

Global Liquidity Update:

We noted in an earlier Curmudgeon post

that global liquidity had flat lined. In

a September 6th update, Cross Border Capital noted a

small uptick in global liquidity to $164 trillion, but a short-term downtrend

is still evident. That should constrain

world risk assets, the firm added, noting that global liquidity drives financial

markets.

The chart below, courtesy of Cross

Border Capital, depicts the MSCI World equity index vs. Global liquidity:

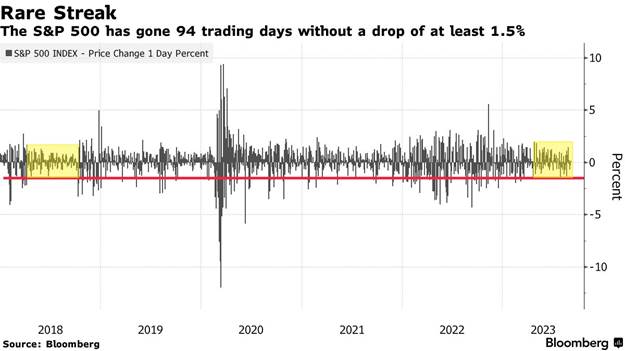

U.S. Stock Market Volatility Remains Low:

After big gains for the first seven months of the year, the

U.S. stock market has wobbled since August.

Volatility has collapsed with the VIX well below its long-term moving

average of 21.4. It closed at 13.84 on Friday, not much above its 52-week low

of 12.73. High levels of the VIX

(normally when it is above 30) can point to increased volatility and fear in

the market. Thats certainly not the

case now.

In particular, there havent been any big selloffs this year (unlike 2022).

Through September 8th, theres not been a single loss of at least

1.5% in the S&P 500 in the 94 trading sessions since late April. Thats the longest streak since 2018, as

depicted in this chart:

End Quote:

Peter Cecchini, director of research at Axonic Capital said,

Enough people were wrong about this years rally that they got tired of

spending money to protect against future losses. But we dont know how much

longer the AI narrative will be able to carry stocks broadly higher.

.

Be well, success, good luck and till next time

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).