China’s

Unstoppable Economy Hits Brick Wall

By the

Curmudgeon

China’s GDP to Surpass that of U.S.?

For much of the past four decades, China’s economy seemed

like an unstoppable force, the engine behind the country’s rise to a global

superpower. The Global Times, a

mouthpiece for the Chinese Communist Party, declared in 2022 that China was the

“unstoppable miracle.”

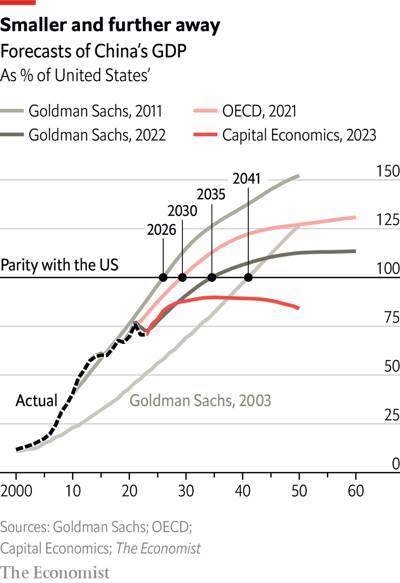

In 2010, China’s GDP was 40% the size of U.S. GDP. At that

time:

l Goldman Sachs forecast

that China’s GDP would overtake America’s by the late 2020s.

Those optimistic forecasts don’t look so good now. Capital Economics, a research firm, now

predicts it will never happen.

China’s Financial Markets Slump Badly:

In the past few weeks, investors have pulled more than $10

billion out of China’s stock markets. Foreign investors sold mainland China

stocks on a net basis for 13 consecutive sessions through Wednesday, the

longest stretch ever, according to data compiled by Bloomberg.

Last week, stocks in Hong Kong (mostly doing business in

China) fell into a bear market, down more than 20% from their high in January.

Cob Liu, founder of an education start-up in a big city in

southwestern China, sold all his positions in mainland China stocks this year

and said he would not touch shares of any Chinese companies, even if they were

traded in New York or Hong Kong. Mr. Liu believes that the decline in the

Chinese economy could drag on for years.

On Thursday, China’s top securities regulator summoned

executives at the country’s national pension funds, top banks

and insurers to pressure them to invest more in Chinese stocks, according to Caixin, an economics magazine

focused on China.

On Sunday, China lowered the stamp duty on stock trades for

the first time since 2008, marking a major attempt to restore confidence in the

world’s second-largest equity market.

The levy charged on stock trades will be halved effective August 28, the

government said in a statement.

What Derailed China’s Express Train Economy?

After nearly three years of paralyzing COVID lock downs,

China lifted its restrictions in late 2022 and its economy seemed poised to

return to strong growth. Surprisingly,

that did not happen. Instead, China’s

economy is now plagued by a series of crises.

Let’s look at what went wrong:

A real estate crisis

born from years of overbuilding and excessive borrowing is running alongside a

larger debt crisis, while young people are struggling with record joblessness.

1. China’s Evergrande

Group, the poster child for China’s real estate crisis, is the world's

most-indebted property developer. Since

late 2021, Evergrande has experienced a string of debt defaults, unfinished

homes, and unpaid suppliers, shattering consumer confidence in the world's

second-largest economy.

2. Local governments

are fundamental to China's economy, with Beijing tasking provincial and

city officials with meeting ambitious growth targets. But after years of

over-investment in infrastructure, plummeting returns from land sales and

soaring COVID costs, economists say debt-laden municipalities now represent

a major risk to China's economy.

3. Local government

debt reached 92 trillion yuan ($12.8 trillion), or 76% of economic output

in 2022, up from 62.2% in 2019. Part of it is debt issued by local government

finance vehicles (LGFVs), which cities use to raise money for infrastructure

projects.

The International Monetary Fund expects LGFV debt to

reach $9 trillion this year. China’s

central government, which has repeatedly warned about "hidden debt

risks" worries the numbers are even higher when accounting for any debt

issued outside municipal balance sheets.

It is an unsustainable situation that puts Beijing in a bind:

provide no help and the economic model unravels with severe consequences on

growth and social stability, or step in at the risk of encouraging more

reckless spending. China has become too

indebted to pump up the economy like it did 15 years ago, during the global

financial crisis.

4. Since the start of

2023, a new crisis is emerging: a decline in private-sector confidence. It was brought on by arbitrary government

intervention, which has intensified since the pandemic began over three years

ago.

The results have slowed China’s economy to a crawl. Consumers are not spending, businesses are

reluctant to invest and create jobs, and would-be entrepreneurs are not

starting new businesses. Here are a few data points:

l Consumer prices in China fell last month for the first time

in more than two years.

l Chinese banks extended $47.5 billion of new renminbi loans,

tumbling 89% from June — and half the amount of a year earlier.

l Housing sales in terms of footage fell 6.5 percent in the

first seven months of the year, after shrinking by nearly a quarter last year.

In a country where three-fifths of the household assets are tied up in real

estate, that decline is alarming.

China’s Crisis of Confidence Explained:

“Low confidence is a major issue in the Chinese economy now,”

said Larry Hu, chief China economist for Macquarie Group, an Australian

financial services firm. Mr. Hu said the

erosion of confidence was fueling a downward spiral that fed on itself. Chinese

consumers aren’t spending because they are worried about job prospects, while

companies are cutting costs and holding back on hiring because consumers aren’t

spending.

One factor contributing to the current confidence decline is

that China’s policymakers have fewer good options to fight the downturn than in

the past. The private sector is well aware of that so is in a “bunker down” mode.

Government debt is way too high for huge deficit spending,

most of the infrastructure needed has already been built, and the U.S. has

placed severe curbs on exporting technology to Chinese firms for fear of

enhancing China’s military and intelligence gathering capabilities.

U.S. Executive Order Further Restricts Tech Exports to China:

This month, President Biden signed an executive order giving

U.S. Treasury Secretary Janet Yellen the authority to regulate U.S. investment

in three categories of Chinese companies: quantum computing, artificial

intelligence related to military uses, and advanced semiconductors.

“Rapid advancement in semiconductors and microelectronics,

quantum information technologies, and artificial intelligence capabilities by

[China] significantly enhances [its] ability to conduct activities that

threaten the national security of the United States,” the order states.

What Can China’s Government Do Now?

China’s policymakers are also handcuffed because they

introduced many of the measures that precipitated the economic problems. The

“zero Covid” lockdowns brought the economy to a standstill. The real estate

market (see image below) is reeling from the government’s measures from three

years ago to curb heavy borrowing by developers, while crackdowns on the

fast-growing technology industry prompted many tech firms to scale back their

ambitions and the size of their work forces.

Unfinished apartment towers in Shanghai last year. The end of

the housing boom has been a nightmare for Chinese who saw property investment as a way to build wealth.

Image Credit...Qilai Shen for The

New York Times

….……………………………………………………………………………………….

China Stops Releasing Economic Data:

Confronted with dwindling confidence, the government has

fallen back on a familiar pattern and stopped announcing troubling economic

data.

China’s National Bureau of Statistics said this month that it would stop releasing youth

unemployment figures, a closely watched indicator of the country’s economic

troubles. After six straight months of rising joblessness among the country’s

16- to 24-year-olds, the agency said the collection of those figures needed “to

be further improved and optimized.”

The Bureau has also stopped releasing surveys of consumer

confidence, among the best barometers of households’ willingness to spend.

Confidence rebounded modestly at the start of the year but started to plummet

in the spring. The government’s statistics office last announced the survey

results for April, discontinuing a series it began 33 years ago.

The sudden removal of closely followed data has left some on

Chinese social media wondering what they might be missing. That has only added

to the anxiety and loss of confidence in China’s economy.

Closing Quotes:

“Whether you have confidence in the Chinese economy is

actually whether you have confidence in the Chinese government,” said Kim Yuan,

who lost his job in the home decoration industry last year. He has struggled to

find another job, but he said the economy was unlikely to worsen significantly

as long as the government-maintained control.

“The most terrifying thing is that everyone around me is at a

loss of what to do next,” said Richard Li, the owner of an auto parts wholesale

business. “I used to believe that our country would become better and better.”

….…………………………………………………………………………………………

Be well, success, good luck and till next time………………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).