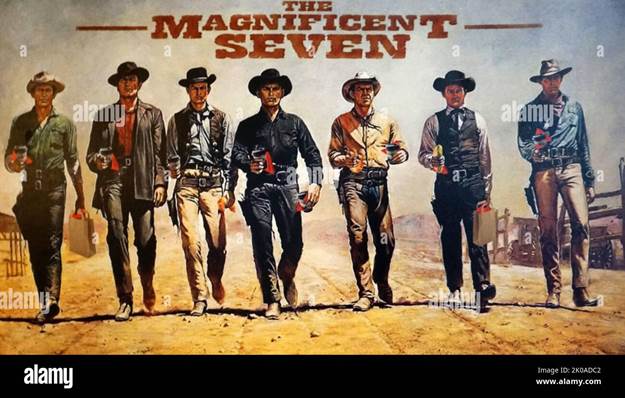

Magnificent

Seven Stocks Fall as Interest Rates Rise

By the

Curmudgeon

U.S. Financial Market Recap:

U.S. stocks closed Friday with their third losing week in a

row. The S&P 500 ended the week with a loss of more than 2%, like other

major U.S. stock indexes.

This August has been quite difficult for the U.S. stock

market, which has given back more than a quarter of the S&P 500s torrid

gains for the years first seven months. Thats largely due to a swift rise in

U.S. intermediate and long-term bond yields to multi-decade highs.

The yield on the 10-year U.S. Treasury note broke out of the

3.5% 4% channel in which it had been trading and closed Thursday at 4.307%,

its highest closing level since 2007. The 30-year U.S. Treasury yield hit a

12-year high, rising to 4.411%.

U.S, mortgage rates are at a level not seen in over 20 years,

a stark difference from a couple of years ago when families were refinancing to

lock in low rates. Obviously, thats not

happening now which will negatively impact new home buying.

Cracks in

the Magnificent Seven:

High

flying mega-cap stocks, known as the Magnificent Seven, [1.]

have been under pressure recently because technology and other high-growth

stocks are seen as some of the biggest

losers of higher

interest rates. Several are down more than 10% from their 2023 highs.

Note 1. The Magnificent Seven consists of:

Facebook parent Meta Platforms Inc. META, Apple Inc. AAPL, Microsoft Corp.

MSFT, Nvidia Corp. NVDA, Amazon. com Inc.

AMZN, Google parent Alphabet Inc. GOOGL and GOOG, and Tesla Inc. TSLA. Collectively, theyve been responsible for

most of the gain in the S&P 500 in

2023.

Four of

the seven moved into correction territory this week, as their stocks have

fallen at least 10% from their recent peaks.

On Thursday, Meta followed Apple, Microsoft and Nvidia into correction

territory, while Tesla stock is in a bear market, meaning its down more than

20% from its recent peak.

.

..

BofA

Global Research Comments & Fund Manager Survey:

According to Bank of America chief investment strategist

Michael Hartnett, the narrative in the stock market may be poised to

flip from buy the dip during the first half of the year to sell the rip

(sell rallies) in the second half of the year.

Hartnett

says that the "Yul Brynner" of the "Magnificent Seven"

is Microsoft

and if the ringleader can't maintain new highs, equity and

credit markets could be in big trouble.

Source: BofA Global Investment Strategy, Bloomberg

The latest

BofA Global Fund Manager Survey (FMS) shows investors are now the least

bearish theyve been since February 2022. Cash levels are at nearly a

2-year low, and 3 out of 4 surveyed expect a soft landing or no landing for the

global economy. Although investors say U.S. fiscal policy is as stimulative now

as it was at the COVID peak, their expectations for lower rates are the highest

since November 2008.

Fund

managers consider Big Tech the most crowded trade and they have

capitulated on REITs, with those overweight Real Estate back down to 2008

levels. While real estate troubles in

China are making headlines, only 15% of FMS investors see China real estate as

the most likely credit event.

Hartnett

expects a further pullback in risk assets and suggests selling the last Fed

rate hike (which means investors need a time machine to go back to the Federal

Open Market Committee (FOMC) meeting of 2023 on July 25 and 26 when the Fed

hiked rates to a target range between 5.25% and 5.50%).

Conclusions:

Higher

interest rates are negative for stocks as companies have to

borrow at higher rates, which reduces earnings.

As we've noted in recent Curmudgeon post, corporate profits for the S&P 500

companies have decreased in each of the last three quarters.

Higher

borrowing costs also erode consumers spending power but are a boon to savers.

Mountains of money moving out of stocks and into bonds is one way that

investors expect higher interest rates to eventually end the rally in stocks

(the S&P 500 is 14% higher this year while the Nasdaq is up 27%).

Also,

higher interest rates make the stock market look more expensive when compared

to U.S. government securities. There Is

No Alternative (TINA) is now a thing of the past.

Even after

their August price declines, major U.S. stock indexes still look expensive,

said Mark Haefele, chief investment officer at UBS Global Wealth Management,

and a wide set of outcomes for markets is still possible.

Scott Chronert, a U.S. equity strategist at Citigroup, said

that the rise in interest rates dents valuations in the stock market and

disrupts the paradigm that has been in place for much of this year.

.

Be well, success, good luck and till next time

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).