Central Bank Digital Currency’s (CBDC’s) Won’t

Happen!

By Victor

Sperandeo with the Curmudgeon

Backgrounder:

A special chapter of the new Bank for International Settlements

(BIS) Annual Economic Report (June 20, 2023) details a blueprint for the

future by rethinking the existing pillars of the current world monetary system.

A proposed “unified digital ledger” would combine a Central

Bank Digital Currency (CBDC) [1.] with tokenized [2.] bank deposits

and other tokenized claims, opening up a new

era in the joint development of the monetary system and the economy.

Note 1. A CBDC is generally defined as a

digital liability of a central bank that is widely available to the general public.

Note 2. Tokenization is

the process of representing monetary claims digitally on a programmable

platform. The BIS says that

“tokenization could dramatically enhance the capabilities of the monetary and

financial system by harnessing new ways for intermediaries to interact in

serving end users, removing the traditional separation of messaging,

reconciliation and settlement.”

….………………………………………………………………………………

Financial sanctions on Russia have led several countries to

consider payment systems that avoid the dollar.

Also, the International

Monetary Fund (IMF) says that “Latin America and the Caribbean are at the

forefront of digital money adoption.”

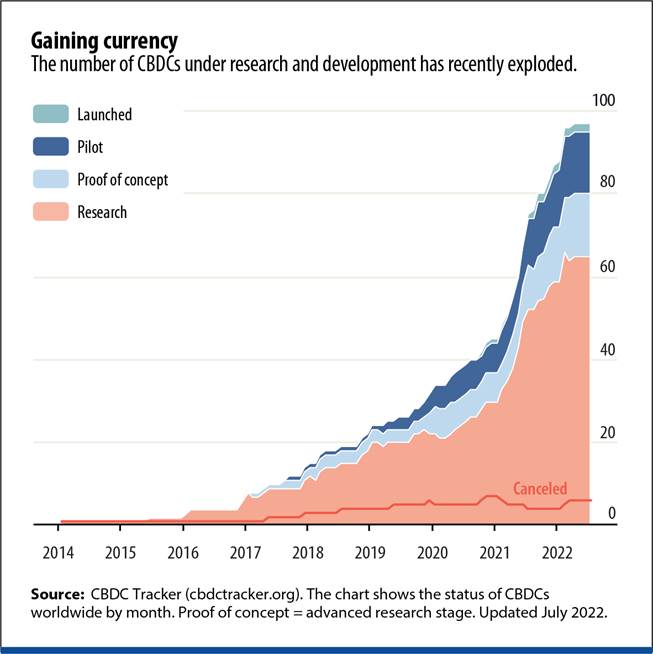

There is considerable interest in CBDC’s (see chart

below). According to the Atlantic Council, 114

countries (representing over 95% of global GDP) are exploring a CBDC. That’s a

big jump from May 2020, when only 35 countries were considering a CBDC. In 2023, over 20 countries will take

significant steps towards piloting a CBDC. Australia, Thailand, Brazil, India,

South Korea, and Russia intend to continue or begin pilot testing this year.

The apparent goal here is to transform the world’s fiat

currency system to a tokenized system promoted and controlled by global Central

Banks. We don’t think that will happen

anytime soon. We will explain why in

this post.

IMF Position on CBDCs:

The IMF wants global Central Banks to agree on a

common regulatory framework for digital currencies that will allow global

interoperability. Failure to agree on a common platform would create a vacuum

that would likely be filled by cryptocurrencies.

"CBDCs should not be fragmented national propositions...

To have more efficient and fairer transactions we need systems that connect

countries: we need interoperability,” IMF Managing Director Kristalina

Georgieva told a conference attended by African central banks in Rabat, Morocco

on Monday. "For this reason, at the

IMF, we are working on the concept of a global CBDC platform. If countries develop CDBCs only for domestic

deployment we are underutilizing their capacity," she added.

Ms. Georgieva stressed that CBDCs should be backed by assets

and added that cryptocurrencies are an investment opportunity when backed by

assets, but when they are not, they are a “speculative investment.”

CBDC’s and the Fed:

The Federal Reserve Board has not yet committed to

CBDC’s. They’ve issued a discussion

paper that examines the pros and cons of a potential U.S. CBDC. As part of this

process, the Fed sought public feedback on a range of topics related to CBDC.

In the U.S., Federal Reserve notes (i.e., physical currency)

are the only type of central bank money available to the general

public. Like existing forms of money, a CBDC would enable the general public to make digital payments.

“As a liability of the Federal

Reserve, a CBDC would be the safest digital asset available to the general

public, with no associated credit or liquidity risk.”

The Fed has made no decision on issuing a CBDC and would only

proceed with the issuance of a CBDC with an authorizing law.

Victor’s Opinion:

I strongly believe that “unelected” Central Bankers cannot transform

their CBDC ideas into U.S. laws, which would require deliberation and

legislation within Congress.

None of the patriot/conservative CBDC commentaries I’ve heard

or read ever mention the legality of CBDC’s [Here’s one from the

Rebel Capitalist.]. Instead, they accept it as a given - a done deal! They all discuss the threats of CBDC’s, but

without considering the legalities.

These speakers paint a bleak picture of this monetary

takeover and thereby overturning the Constitution, as if the “law of the land”

has no meaning.

CBDC’s Violate the U.S. Constitution:

I want to briefly speak to the illegality of CBDC’s to

show how outside the law these discussed proclamations are. I’ve discussed this

with a friend who is an expert on U.S. constitutional law. He says that CBDC’s

would require an amendment to the Constitution.

All three types of money specified in the Constitution –

bills of credit (U.S. dollars), foreign gold and silver coins, and domestic

gold and silver coins – were (and remain) physical bearer instruments. A CBDC is none of those.

In particular, Article I, Section 10 of the

Constitution says that "no state shall... coin Money; emit Bills of

Credit; make any Thing but gold and silver Coin a Tender in Payment of

Debts."

CBDC’s would eliminate privacy (see Curmudgeon Comments

below) and are therefore in violation of the 4th amendment of the Constitution

(part of the Bill of Rights) which prohibits unreasonable searches and seizures.

Furthermore, all U.S. debt is issued and paid in U.S.

dollars, NOT CBDC’s or digitized tokens! If paid in tokens one cannot

physically take possession of that money.

Most importantly, a CBDC cannot be withdrawn and it’s programmable. A

deduction from a deposit or capital account would apply to all holders of the digital

tokens.

Curmudgeon Comments:

The concept of a global digital currency is being promoted by

the BIS and IMF as a “unified digital ledger.”

Do they actually think that will replace the

U.S. dollar as the world’s reserve currency?

With the required confidence and safety?

CBDC’s raise severe concerns about financial privacy,

surveillance and control, financial stability, cybersecurity, and commercial

bank dis-intermediation.

A recent Cato

study identified the risks in CBDC’s:

“Put simply, a CBDC would most likely be the single largest assault to

financial privacy since the creation of the Bank Secrecy Act and the

establishment of the third‐party doctrine. The threat to freedom that a

CBDC could pose is closely related to its threat to privacy. With so much data

in hand, a CBDC would provide COUNTLESS PPORTUNITIES for the government to

control citizens’ financial activity.”

Can the U.S. government say that CBDC is now money and

confiscate Federal Reserve Notes and bank deposits like it confiscated gold

during the New Deal?

No, not lawfully! Who’s kidding whom here?

Victor’s Conclusions:

Let me stress this IMF/BIS led attempt at a monetary takeover

is complete tyranny and the opposite of liberty within the current U.S.

political system and laws.

If you consider all the rights and effects that will

disappear in executing the change to CBDC’s, the current monetary system we

have would be history. It creates the

impression that whatever the IMF or global Central Banks want will happen?

That’s a false impression! Please do not assume CBDC’s are

going to happen!

Cartoon of the Week:

….……………………………………………………………………………..

Success, good luck and till next time…………………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).