Victor’s Perspective on Debt Ceiling Bill:

The stand-out surprise here

was that there is NO Debt Limit until January 1, 2025. That essentially

gives the Treasury Department the latitude to borrow as much money as it needs

to pay the nation’s bills during that time, plus a few months after the limit

is reached, as the department employs accounting maneuvers to keep up payments.

The complexity of the deal

allows schemes, gimmicks, chicanery, and sleight of hand dealings that keep

advancing to new heights. This bill will result in higher inflation, which will

come from huge federal government spending that will follow a recession which

will begin in earnest later this year.

Curmudgeon - Liquidity Set to Contract:

Bloomberg reports that the U.S. Treasury is about

to unleash a tsunami of new bonds to quickly obtain the money it needs now that

the debt ceiling has been raised. This will be yet another drain on dwindling

liquidity as bank deposits are depleted to pay for the new U.S. Treasury debt.

The Treasury auctions, set to begin Monday, will

rumble through every asset class as they claim an already shrinking supply of

money. JPMorgan estimates a broad

measure of liquidity will fall $1.1 trillion from about $25 trillion at the

start of 2023.

“This is a very big liquidity drain,” said JPMorgan

Chase & Co. strategist Nikolaos Panigirtzoglou. “We have rarely seen

something like that. It’s only in severe crashes like the Lehman crisis where

you see something like that contraction.”

It’s a trend that, together with Fed tightening (QT),

will push the measure of liquidity down at an annual rate of 6%, in contrast to

annualized growth for most of the last decade, JPMorgan estimates.

However, Victor believes that the financial system

can cope with this loss of liquidity, as there’s $2.2 trillion parked in reverse

repos, which we explained in this

Curmudgeon/Sperandeo post.

It would be easy to let 1 trillion mature (they are rolled over

daily) and that trillion would flow to the Treasury General Account (TGA).

Analysis of BLS Non-Farm Payrolls Report:

Friday’s BLS jobs report exhibited the same repeated

pattern of made-up numbers. Economists

have consistently underestimated the U.S. non-farm payroll numbers for the last

two years. They expected an increase of

188,000 non-farm payrolls for the month of May, but instead we got a “made up”

339,000 jobs added. Let’s look behind

the headline jobs numbers.

After accounting for the drop in hours worked, it’s

as if the economy lost 140k jobs in May. For the January-May period, the

index of aggregate hours worked is negative.

Also, the sizable jump in the unemployment rate was a

surprise, rising to 3.7% from 3.4%. The

BLS report showed that it is taking longer for people to find work: The number

of people unemployed for 15 to 26 weeks jumped by 179,000 to 858,000. We’re not done yet!

Once again, the Birth Death Model (BDM)

“created” +231,000 non-seasonally adjusted (fictitious) jobs. Without the BDM non-counted jobs, the BLS

report would state +108K jobs added!

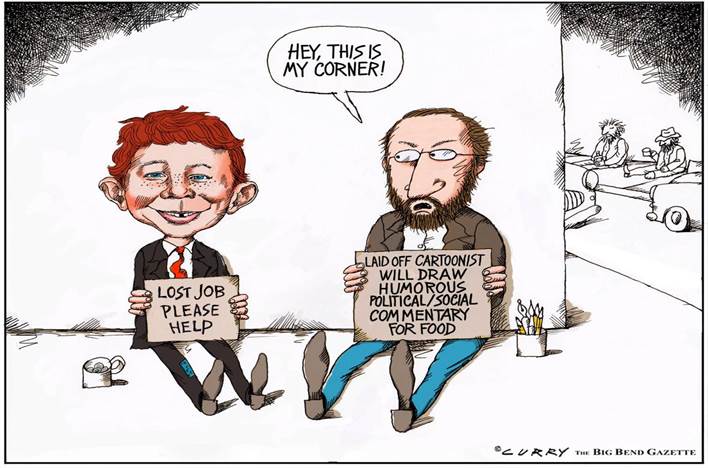

Cartoon of the Week:

Mishtalk summed it up by saying, “The BLS

Wonderland reporting is back with a vengeance today as jobs and employment

head in opposite directions and the unemployment rate jumps.”

The bottom line is that you can’t trust the BLS or

any other U.S. government reported numbers.

They are “shaked and baked” to make the economy appear better than it

actually is. Please see Victor’s

Conclusions for more on this pattern of deception.

Point of Order for the Fed:

If the Fed REALLY cared about the “wealth effect”

resulting from increased stock prices, why do they not simply raise the

REGULATION T initial margin requirement from 50% to 100%? The ability to buy stocks using a 50% margin

(e.g., $100 buys you $200 worth of stock) has been in effect since 1974 and has

never changed! The Fed could

unilaterally raise margin requirements as they control REGULATION T. That would surely dampen speculation in high

flying big tech stocks (NVIDIA, Amazon, Alphabet/Google, Meta/FB, which are all

up 40+% in 2023).

Market Comments:

Stocks are in a bubble and totally disconnected from

the real economy. Workers are

experiencing real declining wages while small businesses are going bankrupt at

a record pace! America is being driven

into a recession by the Fed on a scam that inflation is not declining fast

enough.

However, stocks in some cases are at their highs and

have had the highest valuations in the last two years. In particular, the FANG+ stocks (Meta/FB,

Amazon, Netflix, Alphabet/Google, and Apple) are only 7.8% off their all-time

highs! And FANG+ doesn’t include NVIDIA

which is +169.1% in 2023!

The unchecked speculation continues. Traders have rushed into bullish options bets

on the highflyer s, seeking to amplify their gains if tech shares keep

climbing. Activity in NVIDIA call options hit one of the highest levels

on record in recent sessions, as did the popular Technology Select Sector

SPDR ETF, according to CBOE Global Markets data.

Finally, the market advance in 2023 has been

incredibly narrow. The S&P 500 is up

12% this year, but it would be negative without the contribution of

seven big tech companies, according to S&P Dow Jones Indices data through

the end of May. Shares of the 10 largest

companies in the S&P 500 climbed 8.9%, while the other 490 S&P 500

companies lost 4.3%, according to Bespoke.

Victor’s Conclusions:

To NOT have a debt limit till 2025, along with a

political system that gives money to people using a printing press is like a

free lunch to the 10th power.

It is best stated by George Orwell: "There are some ideas so

absurd that only an intellectual could believe them; no ordinary man could be

such a fool."

Sadly, the U.S. political system represents Corporate America

for money and special interests for votes, and not the citizens of

America.

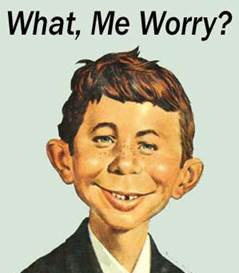

I suggest the markets should embrace the MAD magazine

slogan “What Me Worry” from the comic book character Alfred E Neuman.

According to former MAD editor John Ficarra), “For

seven decades, MAD magazine has gleefully warped generations of adolescent

minds with a simple message: "Everyone is lying to you, including

magazines. Think for yourself!"

This mantra speaks the rare truth which you don’t get

from mainstream media reporting circles these days. It also reflects my sentiments.

End Quotes:

“Elections are when people find out what politicians

stand for, and politicians find out what people will fall for.”

“The dollar will never

fall as low as what some people will do to get it.”

Alfred E. Neuman, MAD Magazine

….………………………………………………………………………………………

Be well, stay healthy, wishing you peace of mind.

Till next time…...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).