History of How the U.S. Became Ruled by Elites

By Victor

Sperandeo with the Curmudgeon

Introduction:

It seems that every financial broadcast these days is

about the Fed and what it will do next? Little is said about the economy, other

than what the Fed will do to it by raising or lowering interest rates; or

rounds of QT/QE which reduce/increase its balance sheet and affect financial

market liquidity. Companies are rarely discussed on a fundamental basis, but

rather in relation to the amount of liquidity the Fed will add or extract from

the financial system.

While the Fed is responsible for U.S. monetary policy,

it is not actually a part of the federal government! Rarely is there any

talk about how government fiscal policy or the laws Congress passes will affect

the economy and/or markets. Yet they are critically important for a healthy and

vibrant nation.

In this post, I endeavor to give readers the ESSENCE

of history, from a legal perspective, on how the U.S. -- a country built on

laws of liberty and justice --has descended into a monopoly run by a select few

elites.

Rule by Experts:

What Plato called the Philosopher King [1.]

method of ruling a society by experts is what the U.S. has become. In other words, a rule by experts who are

smarter and know more than the people; who make

decisions and laws on society that are in lieu of who and what the people

elected our representatives for.

Note 1. According to Plato, a Philosopher King

is a ruler who possesses a love of wisdom, as well as intelligence,

reliability, and a willingness to live a simple life. Such are the rulers of

his utopian city Kallipolis.

The rule by experts/elites is the opposite

ideology of the U.S. founding fathers, which is based on natural law, individual

freedom, with free markets, while anchored on the premise of property

rights and enterprise, i.e., capitalism.

Today, the U.S. is not even close to the laws and

ideals the country was founded upon. The difference is so great its

like calling the moon the sun!

This deterioration in liberty and freedom does not

only relate to the Fed and money supply/bank reserves, but more importantly to every

aspect of life using government agencies (EPA, FTC, SEC, CDC, etc.) as the

experts to regulate, rule and dictate to the people. They do so under the guise of protecting

us, whereas that was supposed to be the job of our House and Senate

representatives (in making laws via statutes consistent within the

Constitution). Heres a table

highlighting characteristics of Elites:

Source: Elites in the Making and Breaking of Foreign Policy

.

History of Fiat Money and Progressive Income Tax:

How we got here starts in 1862. The U.S. Congress faced a financial crisis in

1862, as spiraling costs of war rapidly depleted the Unions reserves of gold

and silver coin, the only legal tender of the United States. After intense

debate, Congress authorized the issuance of paper U.S. Notes (popularly called

Greenbacks), declaring them lawful money for all payments except interest on

public debt and import duties.

On February 25, 1862, the U.S. Congress passed the Legal Tender Act, authorizing the use of

fiat paper notes to pay the federal governments bills for the Civil War. That

ended the long-standing Constitutional laws of only using gold or silver in transactions.

It allowed the government to finance

the enormously costly Civil War long after its gold and silver reserves were

depleted.

One of the primary reasons the U.S. only allowed gold

and silver as money was to avoid wars, knowing that a country would be forced

to print fiat paper money to finance wars, or tax the people, rather than be

forced through negotiations for a reasoned peaceful resolution of conflicts.

In addition, the Civil War instituted a direct income

tax that was the first tax paid on individual incomes by residents of the

United States. It was a "progressive tax in that it initially

levied a tax of 3% on annual incomes over $600 but less than $10,000 and a tax

of 5% on any income over $10,000. In 1864 the rates increased, and the ceiling

dropped so that incomes between $600 and $5,000 were taxed at 5%, with a 10%

rate on the excess over $5,000.

Passed as an emergency measure to finance the Unions

cause in the Civil War, the first income tax generated approximately $55

million in government revenues during the war.

The Civil War led President Abraham Lincoln to put

forth two of the greatest threats to liberty --printing fiat money and

direct progressive taxes on individuals. Both were unconstitutional and fundamentally

destructive to liberty in the name of ending slavery.

That led to a Supreme Court case called Legal Tender

Cases.

In Hepburn

v. Griswold (February 7, 1870), a case that involved the constitutionality

of the Legal Tender Act of 1862, the Court ruled by a four-to-three majority

that Congress lacked the power to make the government notes (Greenbacks) legal

tender. Thereby, the court struck down

the Legal Tender Act.

After Ulysses S Grant became President, he packed

the Supreme Court with two justices that agreed the government can print

money. Note that Article 1 Section 8

and 10 of the Constitution says you cant print money!

Two Legal Tender Cases Knox

v. Lee and Parker v. Davisdecided by the U.S. Supreme Court on May

1, 1871, regarding the power of Congress to authorize government notes not

backed by specie (coin) as money that creditors had to accept in payment of

debts. The essence of the two decisions were stated in terms of government

emergencies. Thereby, the government could print money for a special, good

reason.

Juilliard v. Greenman, was a Supreme Court of

the United States case in which issuance of Greenbacks as legal tender in

peacetime was challenged. The Legal Tender Acts of 1862 and 1863 were upheld.

In an 81 decision resting largely on prior court cases, particularly the

jointly-decided cases Knox v. Lee and Parker

v. Davis, the power "of making the notes of the United

States a legal tender in payment of private debts" was interpreted as

"included in the power to borrow money and to PROVIDE a national

currency." This was to be done without interest payments on the printing

of fiat money. In other words, the federal government could now print money

for ANY REASON!

IMHO,

the dissenting opinion from Justice Stephen Johnson Field was far more

correct if one abides by the Constitution. From Fields written opinion, his

predictions of what would happen from this money printing decision were

prescient and right on the mark.

In 1895, the Supreme Court struck down the ability to

create a progressive income tax, which was part of President Lincolns plan

to fund the Civil War or using a direct tax.

It was declared unconstitutional.

On

May 21, 1895, the U.S. Supreme Court ruled that a direct tax on personal income

was unconstitutional as a result of the case of Pollock v. Farmers Loan and Trust Company. The lawsuit had been

precipitated by the 1894 Income Tax Act. This ruling denied Congress the power

to tax disproportionately.

The 16th Amendment: Federal Income Tax (1913) does

not clearly permit the government to tax wages and other income, except income

from a foreign corporation. However, in

most cases that is NOT the way the law is interpreted. It states:

The Congress shall have the power to lay and collect

taxes on incomes, from whatever source derived, without apportionment among the

several States, and without regard to any census or enumeration."

The problem is that incomes are not defined. For example, INCOME on municipal bonds is not

taxed by the federal government. Neither

are child support payments, alimony payments (for divorce decrees finalized

after 2018), inheritances, gifts and bequests, and most health care benefits.

Tax protesters have not fared well trying to

challenge the current view of the income tax by stating the law is not written

in the US tax code.

For those who want more info on this see Theft

By Deception: Deciphering The Federal Income Tax - A

Film by Larken Rose.

Mr. Rose is a tax protester who went to jail for 15

months, as Internal Revenue Code Section 861 [2.] was not allowed to be

shown.

Note 2. Internal Revenue Code section 861, entitled

"Income from sources within the United States," is a provision of

the Internal Revenue Code which delineates that some kinds of income shall be

treated as income from sources within the United States, namely income of

nonresident alien individuals, and certain foreign corporations, but it is not

an exhaustive list of taxable incomethe definitions in the section apply only

to that section.

Victors Conclusions:

In this brief synopsis of how we got here you can

easily deduce the main culprit and primary miscreant of U.S. deterioration are

the Judges of the Supreme Court. The original opinions of the judges were

changed and replaced by the opinions of the elites, if it didnt fit the

desires of the powers that be.

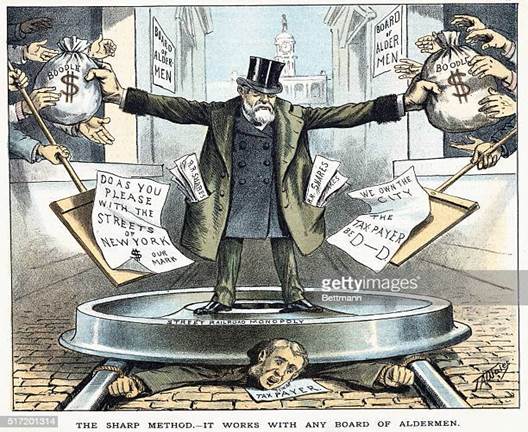

Americas biggest growth industry is corruption,

which weve explained in many previous Sperandeo/Curmudgeon blog posts. Heres an example: Political

Corruption and a New World Monetary Order. No one gets punished for

taking bribes, so it is therefore very lucrative and not at all risky.

We have the best government money can buy, Mark Twain said and that now rings true more than ever

before!

The bottom line is the principles of liberty and laws

adhering to the Constitution have been changed by Supreme Court Judges and

corruption of our elected officials. The U.S. is now at a foreboding stage of

its history. The future looks very bleak.

Cartoon of the Week:

End Quote:

A great patriot, President Andrew Jackson,

ended the Second Federal Reserve Bank (The Bank of the U.S.).

I weep for the liberty of my country when I see at

this early day of its successful experiment that corruption has been imputed to

many members of the House of Representatives, and the rights of the people have

been bartered for promises of office. Andrew Jackson

.

Be well, stay healthy, warm, and dry. Please email

the Curmudgeon (ajwdct@gmail.com) if you have any comments, questions, or

concerns. Till next time

...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).