Geopolitical Threats to 2023 Global Economy and

Markets

By the

Curmudgeon with Victor Sperandeo

Introduction:

Geopolitical tensions dominated 2022.

Contrary to popular belief, they were far more important than what the

Fed’s ultra-hawkish monetary policy did to crash markets and may yet do to

weaken the U.S. and global economy.

Escalation of Russia’s war in Ukraine, Iran’s role in

supplying drones to Russia, and the real threat of China invading Taiwan could

collectively cause unprecedented world-wide havoc with severe disruptions of

supply chains. If unchecked by peace

talks, these threats could lead to the potential end of civilization and life

as we know it!

Several experts and respected world news sources

weigh in with their take on these and other geopolitical hot spots they are

watching closely in 2023.

War in Ukraine Risks, Charles Schwab:

An escalation by Russia could take the form of

further large-scale attacks on civilian infrastructure or restrictions on

export capacity through military constraints on the use of Black Sea shipping

routes. More significantly, it may take the form of using prohibited

nuclear, biological, or chemical weapons to defend what it sees as Russian

territory, preemptively striking arms shipments to Ukraine by members of NATO,

or drawing others into the conflict with either an intentional or unintentional

strikes on neighboring countries.

Murray Gunn—Head of Global Research, Elliott Wave

International:

“The main socioeconomic trend I will be following in

2023 is geopolitics. Russia’s invasion of Ukraine in February

2022 came after its clear negative trend in social mood. China too, has

been experiencing a negative trend in social mood since then and so, with the

territorial issue of Taiwan increasingly in the spotlight as well as

other regional tensions, the probability of negative social actions is growing

by the month.

European politics is also on my radar. In 2022, Italy

elected its first far-right government since Mussolini and is now led by

the country’s first female prime minister. Both are manifestations of the

country’s 22-year negative trend in social mood. Without the full fiscal union

that only a positive mood trend will bring, the European project will continue

to come under pressure. As for the dis-United Kingdom, Scotland has

promised to hold another vote on independence, perhaps in 2023, as the fallout

from the Brexit vote in 2016 (a result of a 16-year negative mood trend)

continues to ripple through society.”

Henry Kissinger warns against escalating

Russia-Ukraine conflict, urges peace talks:

"In my view, a movement towards negotiations on

peace needs to begin in the next two months or so. The outcome of the war

should be outlined by them before it creates upheavals and tensions that will

be even harder to overcome, particularly between the eventual relationship of

Russia towards Europe and of Ukraine towards Europe," Kissinger said at

the World Economic Forum in Davos, Switzerland.

"Ideally, the dividing line should return to the

status quo ante. I believe pursuing the war beyond that point could turn it

into a war not about the freedom of Ukraine, which has been undertaken with

great cohesion by NATO, but into a war against Russia itself, and so this seems

to me to be the dividing line, that it is just impossible to define... It will

be difficult."

“Who controls the food supply controls the

people. Who controls the energy can

control whole continents. Who controls money can control the world.”

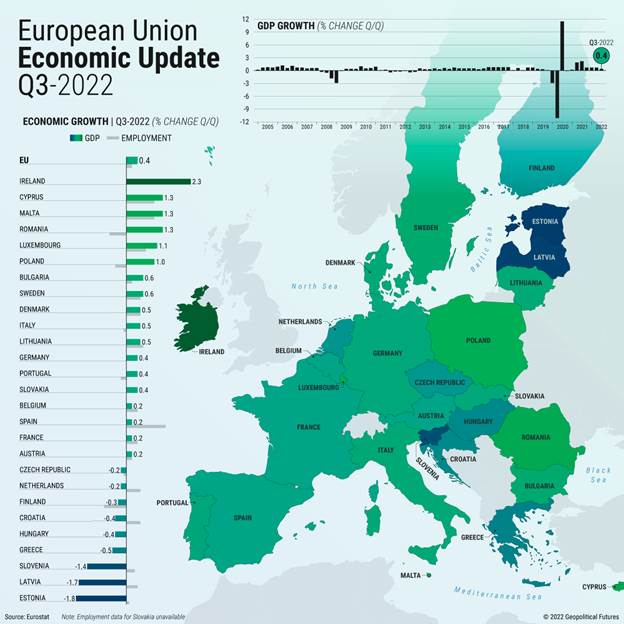

European Economy Hits Skids due to War in Ukraine:

The European Union (EU) continued its economic

slowdown in the third quarter. High inflation, an energy crisis, a global slowdown,

and tighter financing conditions were drags on EU growth. The war in Ukraine

continues to take its toll on regional economies. High prices depressed

consumer and business confidence and hampered energy-intensive industries.

Emergency fiscal measures have offset some of the effects but at the cost of

higher debt.

European energy crisis, Charles Schwab:

Tensions in the European energy market continue to

loom large, with Russia suspending natural gas flows through the Nord Stream

gas pipeline indefinitely and the European import ban and G7 price cap on

Russian oil recently implemented. But adequate reserves, conservation of gas

use, new Liquid Natural Gas (LNG) contracts, and a very mild start to Europe's

winter weather have reduced the risk of an energy crisis in the form of forced

rationing this winter. Markets have reassessed the risk, with natural gas

prices in Europe having fallen sharply from their summer highs and European

stocks rebounding in the fourth quarter.

Nonetheless, Europe's gas supply situation remains

fragile, and a cold winter globally could result in increased consumption of

gas combined with reduced availability of gas exports from the U.S., prompting shutdowns

for Europe's industrial and automotive businesses.

Curmudgeon Note: A

new wrinkle is Russia planning to ban oil sales to states that impose a price

cap. That would certainly worsen any

European energy crisis.

Victor’s Comment:

Nothing is more gravely existential then this threat

and it’s hardly discussed as a major problem in the mainstream media.

The obvious consequence, assuming the world does not

enter a WW III, is the end of Globalism due to the split of the East and

West on world trade. In that case, we will have two different economic,

monetary, and political systems that are getting further apart.

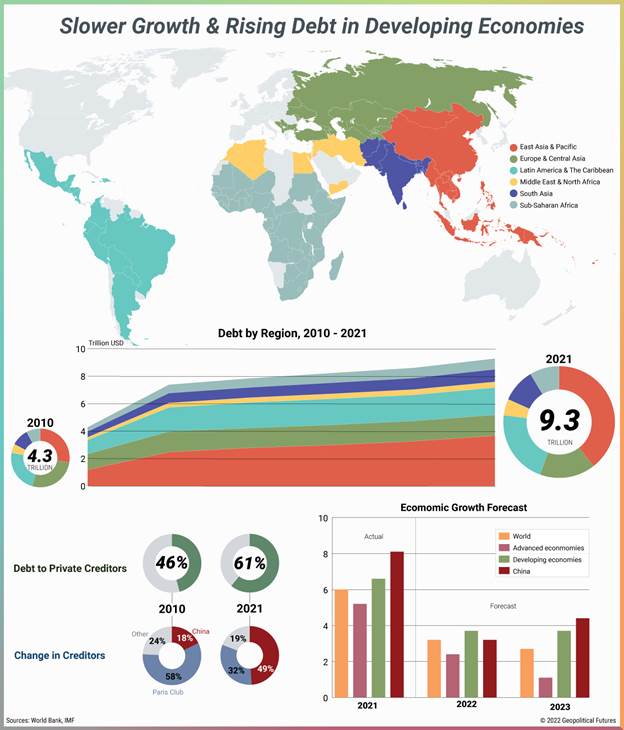

Rising Debt in Developing Economies:

Several are close to full-fledged financial crises!

Around the globe, spiraling debt in low- and middle-income countries is

threatening their pursuit of sustainable development. Between 70 percent and 85

percent of developing nations’ debt is in a foreign currency. So far in 2022,

around 90 percent of countries have seen their currencies depreciate against

the U.S. dollar. If the dollar strengthens further, it will make debt repayment

prohibitive which risks multiple defaults.

Government

debt levels as a share of gross domestic product have increased by about $2

trillion. With interest rates rising sharply, the debt crisis is putting

enormous strain on public finances, especially in vulnerable nations with

deficient investment in education, health care and economic growth. As

developed countries try to cope with high food and energy prices, they have

been reluctant to restructure loans. As a result, several developing countries

are close to defaulting and being pushed into full-fledged financial crises.

Latin America shifts to the left:

Latin America has seen (once again) a tilt to the

left, with six of the largest economies run by leftist governments once Brazil’s

Luiz Ignacio Lula da Silva takes office in January. While this could create

space for more cooperation on issues of mutual interest (climate protection and

expanded intra-regional trade, for example), there are two different competing

economic models at play — the more populist economics of Argentina and perhaps

Brazil, and the more statist policies in places like Chile and Colombia.

Contrary to trend (and regional cooperation) sits Uruguay, which is seeking

bilateral trade deals outside the Mercosur [1.] framework and

testing the limits of South American cohesion.

Note 1. The Southern

Common Market, commonly known by Spanish abbreviation Mercosur,

and Portuguese Mercosul, is a South American trade

bloc established by the Treaty of Asunción (Paraguay) in 1991 and Protocol

of Ouro Preto in 1994. Its full members are Argentina, Brazil, Paraguay, and

Uruguay.

Venezuela is a

full member but has been suspended since 1 December 2016. Associate countries

are Bolivia, Chile, Colombia, Ecuador, Guyana, Peru, and Suriname.

North Korean conventional weapons tests:

While North Korea’s nuclear weapons normally get all

the attention, Pyongyang (capital of North Korea) has stepped up development

and testing of conventional weapons, with a particular focus on large-caliber

rockets and shorter-range ballistic and cruise missiles. These are relatively

low-cost battlefield weapons that give Pyongyang a greater ability to strike at

military bases, depots, and staging grounds in South Korea.

By upping its conventional capabilities, North Korea

has developed a capability and apparent doctrine of calibrated escalation,

something demonstrated this year during U.S.-South Korea defense exercises,

when the North launched multiple rounds of missiles and artillery and ran

large-scale air exercises of its own.

North Korea continues to rely on nuclear weapons as

the backbone of its strategic defense, but the expanded conventional

capabilities give the North the ability to step up coercive military behavior.

While

seemingly contradictory, this both increases the risks of short,

sharp clashes between North Korean and South Korean (or even U.S. or

Japanese) forces or assets and decreases the risk of rapid escalation to

nuclear conflict or all-out war. Coupled with Japan’s shifting defense posture

and continued Chinese military expansion, it portends a more contentious and

unstable Northeast Asia in the coming year or two.

Graphic from Deutsche Bank:

Geopolitical Futures: Russia Reduces Use of Western Currencies

Russia’s Finance Ministry announced that it is

doubling the maximum share of Chinese yuan and gold that can be held in the

National Wealth Fund (NWF) to 60 percent and 40 percent, respectively. It also reset

its accounts in British pounds and Japanese yen to zero. Previously, they

could account for up to 5 percent and 4.7 percent of the fund, respectively. In

addition, NWF resources can no longer be used to purchase assets denominated

in U.S. dollars. The ministry said the changes were made to reduce the

share of currencies of “unfriendly states.”

Victor’s Comment:

The talk of the BRICS nations (Brazil, Russia, India,

China, and South Africa) developing a reserve currency and clearing facility,

which will be backed by a commodities basket is real (not a fiat currency like

U.S. dollar or Euro). I believe it will happen. However, the timing and the

details are not known yet.

Outlook for Gold:

Central Banks around the world have bought more Gold

in the last four years- more than at any time since 1967!

“The Russian central bank is leading the way as it

looks to reduce its reliance on dollar reserves.”

China also has been a huge buyer of Gold. Saudi

Arabia is looking like it’s also moving in this direction. That could threaten the U.S. dollar being the

world’s reserve currency!

Geopolitical tensions and uncertainty are likely to

boost the price of Gold in 2023 due to its safe haven status.

Conclusions:

The obvious world changes are very profound indeed!

2023 has to be considered in the light of these changes. Please do not ignore

them.

……………………………………………………………………………………..

Happy New Year, stay healthy, happy, warm, and dry.

Please let us know your interests for 2023. Till next time…...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).