Recession Fears for 2023 May Dampen Usual Santa Claus

Rally

By the

Curmudgeon

Introduction:

Despite the Feds seemingly never-ending pledge to maintain

its aggressive rate hike policy (to fight the inflation that it caused),

markets are pricing in that the world's most influential central bank will not

raise rates above 5% and will be cutting them by year end 2023.

In particular, the U.S. dollar (DXY) foreign exchange market,

interest rate derivatives and the Fed Funds futures market do not believe Federal

Reserve Board Chairman Jerome Powells rants and raves about more big rate

hikes and for longer than expected. Instead,

Foreign Currency and Fed Funds Futures markets are forecasting that the Fed

will be cutting rates in 2023 due to a sharp economic downturn.

U.S. stock market participants are now worried about the Fed

exacerbating the current recession by continuing to raise rates well into

2023. Inflation fears have subsided for

reasons weve documented in many recent Sperandeo/Curmudgeon blog posts.

Lets have a closer look at these three markets: U.S. dollar, Fed Funds futures, and U.S.

equities.

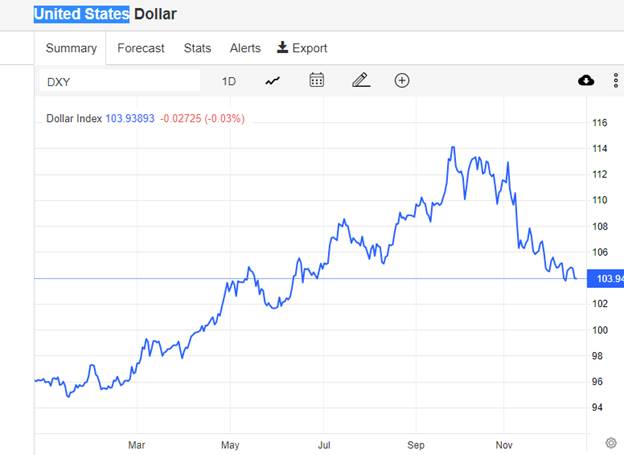

U.S. Dollar May Have

Peaked?

The DXY dollar is about 8% down since its multi-decade peak

in September and has given up almost half its gains for 2022

as a whole. The dollar index moved below the 104 mark,

down from 114.1 on September 28th and closing at its lowest level

since June. Foreign exchange traders

evidently think that the Fed will stop raising rates in the first quarter of

2023 as the U.S. economy goes into a serious recession.

Heres a six-month chart of the U.S. Dollar Index (DXY) which

clearly shows the recent downtrend:

Fed Funds in 2023?

Interest-rate derivatives suggest that investors expect the

Fed to raise rates from their current level between 4.25% and 4.5% to around

4.9% by the middle of next year. After that, however, investors expect significant

reduction in economic growth and easing inflation to quickly lead to looser

monetary policy, with rates falling to 4.4% by the end of 2023 and roughly 3%

by the end of 2024.

In contrast, the Feds latest interest-rate projections (dot

plots) showed that the median official expected Fed Funds rate to end 2023 at

5.1% and fall only to 4.1% at the end of 2024.

The CMEs Fed Funds

Watch Tool currently assigns a 70% probability of a 25 bps rate

increase at the Feds Feb 1, 2023 meeting, which result in a range 4.5% to

4.75%. 54.8% of Fed Funds Futures

participants see another 25 bps increase at the March

FOMC meeting, with a terminal Fed Funds rate of 4.75% to 5%.

A plurality of traders expects the Fed to CUT rates 25 bps at

both the November and December FOMC meetings, with 31% targeting a year end

2023 rate in the range of 4.25% to 4.5%.

Will U.S. Equities End

December with a Loss?

The U.S. stock market evidently believes the Feds rate rise

rhetoric as its on track to end December with a loss. As of Tuesdays close, the S&P 500 had

fallen 6.4% this month. The equity

market expects the Fed to keep raising rates as the economy weakens which will

have a very negative impact on corporate profits.

Its important to note that Powell did not rule out a 50 bps rate hike in February during his news conference last

Wednesday, December 14th after the Fed hiked rates by 50 bps (which

was widely expected). Equity markets had

rallied into that news conference, expecting Powell to say that the next rate

hike would be 25 bps and it would be wait and see after that. When Powell refused to rule out a 50 bps rate hike in February and suggested rates would not

be cut in 2023, equity markets dropped sharply. They continued to decline the

next three days, with a more or less flat session

today (Tuesday).

If stocks end December lower, it will be a somewhat unusual

occurrence. The S&P 500 has risen in 73% of Decembers since 1928,

according to Dow Jones Market Data. As of Tuesdays close, the S&P 500 had

fallen 6.4% this month.

However, we are about to enter the Santa Claus rally time-window.

The Santa Claus rally refers to the stock market's history of rising

over the last five trading days of the year and the first two market days of

the new year. Yale Hirsch first

documented the pattern in 1972, writing in "Stock Trader's Almanac" that the S&P 500 had gained an

average 1.5% during that seven-day period from 1950 through 1971.

The Santa Clause rally pattern has worked well since 1950,

with the broad market index increasing an average of 1.3%. Additionally, the

market has gained during those days in 34 of the previous 45 years, or more

than 75% of the time.

What about year-end rallies within bear markets? There was a Santa Claus rally in December

2008 to early January 2009 which was in the midst of

the great recession/mortgage meltdown multi-year bear market. During the seven-day

period of favorable seasonality, the S&P 500 gained 7.5%. However, it then fell steeply for the next 2

½ months before bottoming out on March 9, 2009.

If there is a Santa Claus rally this year, expect it to be

just another bear market rally. We think

stocks are likely to fall in early 2023 due to the U.S. economy weakening

significantly with earnings forecasts dropping like a rock.

Cartoon of

the Week:

Cartoon by

Bob Rich, Hedgeye

We

wish all readers a joyous holiday season and a happy new year. Victor and I wish you all the best in

2023. Till next time.

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).