Explosive Market Moves, Mid-Term Elections and

Requirements to Work at the Fed

By Victor

Sperandeo with the Curmudgeon

Introduction:

We review last week’s markets and assess the mid-term

elections with profound disappointment and skepticism.

For readers that are interested in Victor’s recent

views on the markets and economy, please visit https://fiendbear.com/ and scroll down to

Current Links of Interest.

Market Review and Outlook:

The two most obvious market drivers last week were

Thursday’s CPI release, and the mid-term election results.

·

Equity markets rallied on

Monday and Tuesday anticipating strong GOP gains but then sold off on Wednesday

when it became apparent there was no “Red Wave.”

·

The CPI came in better than

expected at a 7.75%, year-over-year and 0.4% month-over-month. That sparked a

massive rally that included stocks, bonds, notes, REITs, gold, and

commodities. The U.S. dollar declined

sharply after Thursday’s CPI release (the DXY dropped from 110.85 at 8:30am

Thursday to 106.42 at Friday’s close).

-->I follow more than a dozen various professional

traders and money managers, but none saw this coming. Most are still bears.

It appears that the markets were washed out when the better-than-expected

CPI report was released. The incredible

damage done to U.S. and Corporate Bonds, NASDAQ 100 (S&P 500 and DJI to a

lesser degree), REITs, Gold mining shares, Bit Coin/Cryptos, etc. set the stage

for a strong rally on any good news -- like the better-than-expected CPI

report.

The meaning of last week’s

across the board rally, and what it portends for the future, is extremely

important for investors.

The key index to watch to determine the intermediate

stock market trend is the Dow Jones Transportation (DJT) average, which

is leading the way forward as per this graph:

Nov 7 Nov

8 Nov 9

Nov 10 Nov 11

……………………………………………………………………………………………….

As of today, one has to be Bullish

on the intermediate and short-term stock market trends. Short term, the market is overbought, but the

intermediate trend can still be bought (e.g. via stock

index ETFs or mutual funds) for a trade on weakness. The long-term trend is

still Bearish.

Curmudgeon Comment:

Sharp but short rallies are a defining characteristic

of bear markets. In 2008 there were 19 days where the S&P 500 went up by

more than 3% in a day (12% was the highest daily move).

2023 Markets and the Fed:

After the Fed raises rates by 50 bps at the FOMC

meeting in December (as widely advertised) and 25 bps in January, the markets

are hoping for a pause. That could lead

to a change in long term market trends in 2023. However, lots of work (price

action supported by higher volume) has to be done for

the markets to be considered long term bullish.

So far, the FOMC members have not come out jawboning

the markets down as they’ve done on other rallies this year. This must be closely watched, but for now

it’s a positive sign.

Mid-Term Election Results:

As of this moment, the Democrats will continue

to have control of the Senate (either 50 or 51 seats depending on the

December 6th Georgia run-off election). Control of the House of Representatives

has not yet been determined, due to extremely slow vote counting in many

Congressional districts. CBS News

predicts Republicans will win a narrow majority of House seats as per

this graphic:

………………………………………………………………………………………………..

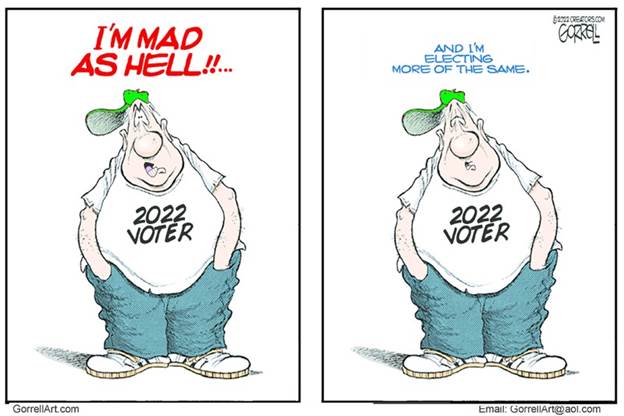

The election results have been a huge disappointment

for many people (like me) who were hoping for a strong change in the U.S.

government. Please see my Opinions

below for more.

Comparing 1994 vs 2022 Mid-Term Elections:

Mid-Term Election gains usually go to the political

party that does not hold the White House. The example I relied on as a model

was 1994. Interest rates (Fed

Funds) were raised six times in 1994 for a total of 2.5% and the Democrats lost

54 House seats, eight Senate Seats, and 10 Governors. In sharp contrast to this

year, there was no recession in 1994 and the CPI increased only +2.67% for the

entire year.

Small cap stocks were up +6.56% YTD on October 30,

1994 (before the midterm elections), the S&P 500 was +3.61%, U.S.

intermediate T-Notes were -4.98%. The

Fed Funds Rate was 4.75% in August 1994 through the election.

In addition, crime was not rising in 1994, the U.S.

southern border was stable, gasoline prices averaged $1.11 a gallon and there

were no major increases in deaths due to drug overdoses. Compared to today,

those numbers are terrific!

After the 1994 election the GOP held power in both

Chambers of Congress (House and the Senate), while Bill Clinton was still

President. The greatest five-year stock

market returns in American history followed.

The S&P 500 compounded annually at +28.5% from 1995-1999.

Contrast 1994 with this year: the Fed has raised rates six times in 2022,

while the Fed Funds rate went from 0% to 0.25% to 3.75% to 4%, inflation has

increased the most in 40+ years, and all major markets have tanked. Hence, one might be deeply puzzled on how the

GOP didn’t win more seats and by landslides? Everyone was looking for a “Red

Wave” for the above reasons, but it didn’t happen.

Victor’s Opinions:

The election expectations, except for Florida

Republicans, was a virtual disaster! Why

is question? One reason, according to my

research, was President Biden’s College Loan Forgiveness plan. It

worked! (The Curmudgeon detests this

“gift” because it is incredibly unfair to those students that have repaid their

loans.)

“According to exit polls, 63% of voters ages 18 to 29

voted for the left in the 2022 midterm elections. That means a

majority of Gen Z support destructive left-wing policies, such as

socialism, open borders, student loan forgiveness, higher taxes, and late-term

abortion.”

This is the outcome of an unconstitutional, but legal

tactic, to buy votes. The offer to these voters was $10,000 deducted from their

college loan debt for votes, and implied if the Dems remain in power there may

be more to come?

Very honestly, I’ve seen nothing positive from the

Biden Administration since its inception. A standout example of his failed diplomacy is

the Saudi’s pushing OPEC+ in October to cut oil output which will raise gas

prices. That comes after Biden’s MBS

fist-bump Saudi trip in July to persuade the Kingdom to lower oil prices.

In 2019 the U.S. was a net oil exporter, but due to

Biden’s suppression of domestic energy production in the name of “climate

change,” the U.S. is now a net energy importer.

As a result, Biden has had to tap the U.S. Strategic Petroleum to

curtail rising gas prices.

Congress has also been a huge disappointment. Hence, I was hoping

for stronger GOP leadership in 2023 and beyond.

So was the Curmudgeon!

Let me stress the Republican leadership --Mitch

McConnell in the Senate and Kevin McCarthy in the House -- are as bad as it

gets! They are phonies and really do not care about society or the people as a whole.

They’re only concerned about themselves and retaining their power.

-->In order for America

to get back on track these so-called “leaders” have to go! (the

Curmudgeon concurs 100%).

Unfortunately, the policies of the Democrats are

causing the country to decline into an abyss. Sadly, the election results

indicate that decline will continue. Our representatives don’t seem very

concerned and seem content to just do minor complaining if anything at all!

At best if these policies continue the U.S. political

system will be nothing more than the old USSR or a Banana Republic (think South

American dictatorships). We will become Serfs and Slaves to the State. This is

not about power; it’s about following the laws of our country and liberty.

Without the rule of law and adherence to the U.S. Constitution we will become a

country like Cuba or (even worse) an autocratic Communist regime like

China/North Korea.

The 2022 Election Process:

My extensive research into the 2022 election outcome is

controversial and beyond the scope of this commentary. I encourage readers to

investigate and judge for themselves why the Republicans did so poorly in the

Mid-Terms? Here’s a clue:

Tucker Carlson of Fox News (the most watched show on

TV) recently suggested to end computer voting machines. His reason was the

breakdown of the ability to count the votes in Arizona.

“Fox News host Tucker Carlson called for an end to

the use of electronic voting machines Tuesday night, citing issues in Arizona

where nearly one-fifth of the machines broke down. At least 20% of tabulation

machines in Maricopa County, Arizona, malfunctioned, leading Republicans to

file litigation seeking extended voting hours.”

Sadly, there are far more reasons to end these

machines and mail-in ballots. It is my opinion that American’s need confidence

in the election system to move forward.

What was an “election day” has now become an election

week and election month. We can go to Mars, but counting votes can’t be done?

-->This causes a loss of confidence in the system as a whole.

.………………………………………………………………………………………………...

Want to Work at the Fed?

The Federal Reserve controls the economy, prints

trillions of dollars so they can make you poorer without taxing you, and they

raise interest rates to overcompensate for past mistakes. Is a job at the

Fed something you'd be interested in?

Check out this list of key job requirements to work at the

Fed from The Babylon Bee -

“15 Job Qualifications To Work For The Fed”:

·

Must be a United States

citizen

·

Up to date with all 20 COVID

boosters

·

Know how to change an ink

cartridge on a money printer

·

Must possess all fingers and

toes (for counting purposes)

·

Little to no knowledge of

economics, basic math required

·

Ability to go on TV and look

concerned whenever there's a recession brewing

·

Must think Paul Krugman is

the greatest living economist

·

Make a 1% into a 2% and vice

versa

·

Must be proficient in double

speak, always leaving ambiguity in your words

·

Experience with blame

shifting

·

Must be able to call a

hundredth of a percent "one basis point" to sound smarter

·

Able to sound 2000% certain

about something that has a 5% chance of happening

·

Communists preferred;

socialists accepted

·

Must be out of touch with the

American people

·

Experience with Microsoft

Office preferred, but not required.”

End Quote:

One of the most important comments about the Fed was

from House Member Charles A. Lindbergh Sr. (the father of the first man to fly

across the Atlantic Ocean). It was

recorded in the Congressional Record, Vol. 51, p. 1446 on December 22, 1913:

“This [Federal Reserve Act] establishes the most

gigantic trust on earth. When the President Woodrow Wilson signs this bill, the

invisible government of the monetary power will be legalized.... the worst

legislative crime of the ages is perpetrated by this banking and currency

bill.”

“The new law will create inflation whenever the

trusts want inflation. It may not do so immediately, but the trusts want a

period of inflation, because all the stocks they hold have gone down... Now, if

the trusts can get another period of inflation, they figure they can unload the

stocks on the people at high prices during the excitement and then bring on a

panic and put them back at low prices.…The people may not know it immediately,

but the day of reckoning is only a few years removed.”

― Charles A. Lindbergh Sr., Lindbergh on the

Federal Reserve

………………………………………………………………………………………………..

Be well, stay healthy, try to cope with our extremely

volatile markets. Wishing you peace of mind and contentment. Till next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).