FOMC

Meeting, Small Business Failures, Markets, and the Mid-Term Elections

By Victor

Sperandeo with the Curmudgeon

Introductions:

Lots of important topics to cover this week. We hope

you find them informative and enlightening.

Please let us know.

Aftermath of the November FOMC Meeting:

During his Wednesday afternoon November 2nd

press conference, Fed Chairman Jerome Powell could not have said anything worse

for the markets. His key words were “Talk

of a pause in the central bank’s tightening efforts is premature.”

Financial markets had initially rallied following the

Fed’s 75bps rate hike announcement, but the leading benchmark indexes erased

their gains and tanked on Powell’s remarks.

Other Powell remarks like, “More rate increases may be

needed then what was indicated,” also added to the declines. In other words,

rate hikes of 50 bps (or more) in December and continuing into the 2023?

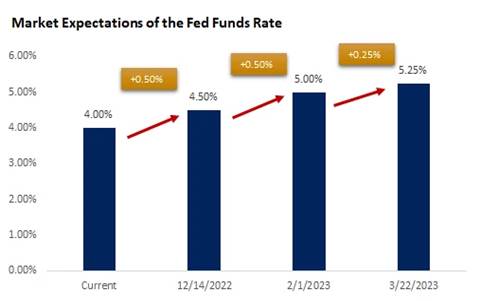

The Fed Funds futures market now pegs the “Terminal”

Fed Funds (policy) rate to be 5.25% after the 3/22/2023 FOMC meeting. That’s shown in this chart:

Source: CME Fed Watch Tool

BofA’s U.S. economist

Michael Gapen forecasts that the Fed will lift its policy rate by 50bps in

December. He then expects another 50bp hike in February, followed by a 25bp

hike in March for a terminal rate of 5-5.25%, which is 25bps higher than his

previous estimate. BofA continues to expect a hard landing for the U.S. economy in the first half of 2023 followed

by rate cuts starting next December.

………………………………………………………………………………………...

A Depression Led by Small Business Failures?

I have stated in several previous Curmudgeon blog

posts (and remain of the belief) that if the Fed executed its planned non-stop

jumbo rate rising policy (combined with a larger QT since September) it would

cause a depression. The U.S. has been in

a recession since the beginning of this year so continued tightening will be

disastrous for the economy.

A depression is not as clearly defined as a “recession.”

It is based on a longer period of zero or negative economic growth and a much

higher unemployment rate.

Let’s use an example on how we might get there:

Nearly 40% of small businesses in the US failed to pay rent

in October

Small

businesses in various states are struggling to pay their rent, a new report

shows, with rent delinquency at nearly 40 percent this month. The findings, published Tuesday by

Boston-based business tracker Alignable, are raising

more than eyebrows, as they illustrate the stark effect inflation is having on

everyday Americans.

The

survey of 4,789 randomly selected small business owners saw more than half of

respondents say their rent is at least 10 percent higher than six months

ago. If you go back seven months, the

majority said their rents had increased by at least 20 percent.

Moreover,

the study found that roughly 37 percent of small businesses - almost half of

all Americans working in the private sector - were left unable to pay rent in

October. Compounding concerns is the

fact that several states, including New York and California, are well over the

already-high national average.

Small businesses generally have 500 employees, or

fewer. What percentage of people work for small businesses? “In a given year, small businesses account

for 60-65% of net new jobs. Specifically, this amounts to around 2 million jobs

a year. For example, small businesses brought 1.9 million jobs in 2015.”

Estimates vary but more than 50% to 70% of U.S. workers are employed by small

businesses.

-->If small businesses die en

masse, we will have a depression.

Powell made another disturbing and naive comment on

Wednesday afternoon. He said the Fed

would rather “over tighten than keep rates too low,” adding that the Fed has

the tools to fix over tightening later.

What Powell means is that the Fed can lower rates and do another round

of QE, which would cause the markets to rally.

True, but if you put many companies out of business

(via continued jumbo rate hikes and QT) the economy won’t grow. Once a company is out of business with its

capital gone, it is very difficult (if not impossible) to raise new capital as

banks won’t lend and markets won’t accept new debt or equity offerings.

Review of the Markets:

After the BLS employment report on Friday, the U.S.

dollar declined 1.8%, Gold rallied 2.8%, and Copper was up 7.6%. Some say it was due to rumors of China ending

its COVID induced lock downs. We’ll see

if this rumor has merit.

I believe Gold should start to move higher if the Fed

continues to raise rates without decreasing money supply growth.

The 10-year Treasury Note yield closed at a new

multi-year high of 4.163% on Friday vs 1.51% on January 3, 2022.

Weekly Market Stats:

|

INDEX |

CLOSE |

WEEK |

YTD |

|

Dow Jones Industrial Average |

32,403 |

-1.4% |

-10.8% |

|

S&P 500 Index |

3,771 |

-3.3% |

-20.9% |

|

NASDAQ |

10,475 |

-5.6% |

-33.0% |

|

MSCI EAFE * |

1,731 |

-1.0% |

-25.9% |

|

10-yr Treasury Yield |

4.163% |

0.1% |

2.66% |

|

Oil ($/bbl) |

$92.53 |

5.3% |

23.0% |

|

Bonds |

$94.34 |

-0.9% |

-15.7% |

SOURCE: FactSet

11/4/2022. Bonds represented by the iShares Core U.S. Aggregate Bond ETF. Past

performance does not guarantee future results. * 4-day performance ending on

Thursday.

Why Equities Beat Bonds in 2022:

The equity market has done better than the debt

markets this year. Lance Roberts at RIA Advisors LLC said in a November 5th interview with Wealthion

that bonds have performed the worst since 1788! I concur. Why?

It’s because companies can raise prices to protect

earnings so that higher interest rates (costs) can be passed on to customers. Hence, corporate earnings and stock prices

don’t crash like bonds have done in 2022.

If big companies cannot raise prices earnings will

decline along with stock prices.

Here’s a recent example of cost pass through to

consumers:

“Chicago-based McDonald’s (MCD ticker symbol) freshly

appointed CFO — Ian Borden — said on a Thursday October 27th

earnings call that prices at its restaurants in the U.S. rose just over 10% in

the third quarter from the year-earlier period, with roughly the same gains

expected in the U.S. for the full year. The higher menu prices helped offset

inflation, boost average check size, and drive the company’s U.S. comparable

sales up more than 6.1% in the quarter from the year earlier, while global comp

sales increased 9.5%, according to company executives on the call and the

company’s third quarter earnings release. Net income in the quarter declined to

$1.9 billion from $2.14 billion year-over-year and the company said the

quarter’s results were negatively impacted by the weakening of major currencies

against the strong U.S. dollar.”

However, MCD made an all-time high on 11/2/22 at

$275.25 per share due to sharply rising prices. It is one of the 30 companies

in the Dow Jones Industrial Average.

We hope you see the point: Bond prices decrease on higher interest rates

as the new yield mathematically adjusts to current yields.

Stocks are less affected by higher interest rates if

prices (for goods and services) are raised to offset rate increases. That is

why the industrial stocks in the DJIA (which have pricing power) have held up

so well.

The Fed has hardly touched corporations balance

sheets with higher rates or QT.

Consumer credit is rising, and savings are declining

as people must buy the necessities. Big corporations win in this

environment. Consumer discretionary

companies lose.

The FAANGs (Facebook, Amazon, Apple, Netflix, and

Google) and other high P/E tech stocks are adjusting to higher interest

rates. A forward P/E of 40 might be

justified on some strongly growing companies with zero interest rates, but not

with a 4.5% T-Bill rate during a recession!

For example, the Ark Innovation Fund (AARK) is down 64% this year

and has declined 77% from its all-time 2/15/21.

When Might Bonds Recover?

If the Fed curbs money supply growth, bonds should do

well relative to stocks as the economy would weaken further and corporate profits

decline.

U.S. government and investment grade corporate bond

prices rise during a recession as credit demand contracts. However, bond prices

are also sensitive to credit and default risk, so if a recession harms a

corporate borrowers' ability to repay, it will cause further price declines.

That is why junk bond prices decline and yields rise during a recession as

default risk rises.

Cartoon of

the Week:

Mid-Term Elections:

We don’t usually comment on politics, but a few words

are appropriate here as the markets will be affected by the outcome of the

November 8th U.S. elections.

Projections are for the Republicans to take back the

House by 25 seats. I’m more in the camp of 50 GOP seats gained. The Senate is

also going to flip to the GOP and my assumption is by four or more seats.

There will also be gubernatorial elections in 36

states and 3 territories, with 31 incumbent Governors. Politico forecasts 17 states are either leaning,

likely or solid for the GOP.

That outcome will put a great deal of pressure on the

Fed as Democrats will be blamed for their election losses.

My assumption is based on a relatively honest

election. We certainly hope so!

End Quote:

“In a society governed passively by free markets and

free elections, organized greed always defeats disorganized democracy.” By Matt Taibbi, Griftopia: Bubble Machines, Vampire Squids, and the

Long Con That Is Breaking America

…………………………………………………………………………………

Be well,

stay healthy, try to cope with the financial havoc the Fed has created. Wishing

you peace of mind and contentment. Till next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).