Fed Pivot

Rumor Drives Dow to Best October in Decades

By Victor

Sperandeo with the Curmudgeon

Introduction:

We attribute the recent U.S. equity market rally to

Wall Streets perception (yet again) that the Fed wont raise rates as much as

theyve hinted at with their seemingly never-ending hawkish drumbeat talk. While that also drove the rally from July to

mid-August which fizzled (all averages broke their June lows in September), the

market believes this time is different. Do you?

The Fed Whisperer that seemingly sparked

this months rally on October 21st has just published a WSJ article

that implies the Fed will be raising rates higher than they planned due to a

resilient consumer. That despite the

Feds attempt to reduce consumer spending via a reverse wealth effect due to

crashing markets.

We examine the Feds balance sheet and an under

reported shortage of diesel fuel that could drive up prices and keep rates

higher for longer. Finally, we conclude with a comment on the November 8th

U.S. mid-term elections and a supporting cartoon.

Equity Markets Rally on (yet another) Perceived Fed

Back-Off:

The stock market rally that began on Friday morning,

October 21st was stimulated by an article in the WSJ by a reporter known as

the Fed Whisperer (whose real name is Nick Timiraos). It was very important because Timiraos is

supposedly connected to leaked inside Fed information. He let it be known that

the Fed was going to hike rates by 75bps in November followed by a lower Fed

Funds rate increase (50bps?) in December.

Timiraos wrote, Some Fed members are concerned about

the danger of raising rates too high. However, he indicated the Fed did NOT want

markets to rally as they did from July to mid-August on the expectations of a

more dovish Fed monetary policy.

Markets rallied in July and August on expectations

that the Fed might slow rate rises. That conflicted with the central banks

goals because easier financial conditions stimulate spending and economic

growth. The rally prompted Fed Chairman Jerome Powell to redraft a major speech

in late August to disabuse investors of any misperceptions about his

inflation-fighting commitment.

If officials are entertaining a half-point rate rise

in December, they would want to prepare investors for that decision in the

weeks after their Nov. 1-2 meeting without prompting another sustained rally.

-->According to several credible sources, this new

assessment of the Fed backing off their jumbo rate hikes is what caused

the equity markets to rally this month.

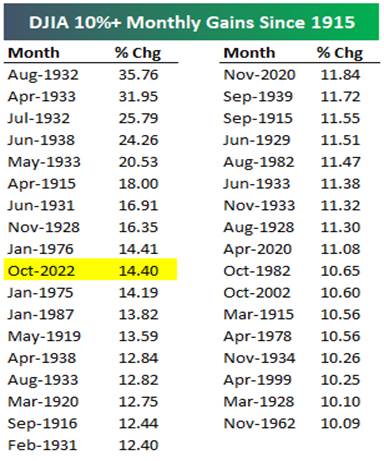

Its the best October rally since 1976 for the Dow Jones Industrial

Average (DJIA) which has rallied for the last six consecutive trading days

(from the 30,291.18 open on October 21st to the 32,861.80 close on

October 28th).

With a month-to-date gain of 14.40% through Friday,

the DJIA, +2.59% is on track for its best monthly performance since January

1976, when it rose 14.41%, according to Joe Adinolfi who reports for MarketWatch.

The DJIA just needs to close higher by 2 basis points on

Monday, October 31st to surpass January 1976 as the best month since

the 1930s. A historical look at October DJIA rallies is depicted in this table:

Table courtesy of Bespoke Research

..

Is the Fed Whisperer Now Trying to Talk the Markets

Down?

This Sunday, October 30th, Mr. Timiraos wrote a WSJ article implying

the Fed will have to raise rates higher than the U.S. central bank forecast at

their September 2022 meeting.

From that new WSJ article:

Some economists think it (the Fed Funds rate) will

have to go higher than 4.6%, citing in particular reduced sensitivity of

spending to higher interest rates.

The big question will be, given the resilience the

economy has had to interest-rate increases so far, whether that will actually

be sufficient, said former Boston Fed President Eric Rosengren. The risks are

theyre going to have to do a bit more than theyre suggesting.

This is not the earnings season the [Fed] wanted to

see, said Samuel Rines, managing director at Corbu LLC, a market intelligence

firm in Houston. For now, the consumer is too strong for comfort.

The Commerce Department reported Friday that consumer

spending adjusted for inflation rose 0.3% in September from August, a pickup

from prior months.

The upshot is that cooling the U.S. economy might

require even higher interest rates. The household savings buffer suggests to

me we may have to keep at this for a while, said Federal Reserve Bank of

Kansas City President Esther George in a webinar earlier this month.

Steven Blitz, chief U.S. economist at research firm

TS Lombard, thinks the central banks policy rate will rise to 5.5%. A

recession is coming in 2023, but there is more work for the Fed to do to create

one, he said.

The danger is that higher interest rates or a stronger

dollar make trouble in corners of a global financial system that had come to

expect low interest rates to persist.

..

Feds Hawkish Talk/QT Hasnt Materially Reduced its

Balance Sheet:

The original Fed (dot plot) projections for rate

increases were: +75bps November 2nd, then 50 bps on December 14th

and 25bps in January. Well have to

wait for Powells November 2nd news conference to get a hint at

whats to expect at the December FOMC meeting (the market now expects a 50bps

rate hike) and for early 2023.

.

IMPORTANT Opinion: The

Curmudgeon and I strongly oppose Fed talk (hawkish or dovish) and forward

guidance outside of FOMC meetings. We think there should be a quiet period,

much like what applies to companies before earnings releases. Furthermore, the Fed should NEVER use a

whisperer to convey its plans to the markets.

Instead, the Fed should deliberate and debate the

course of monetary policy at each FOMC meeting and not say anything for public

consumption between meetings! Such

silence would be golden for the markets.

.

Despite the jumbo rate hikes and accelerated pace of Quantitative

Tightening (QT) that commenced in September, the Feds balance sheet is

still higher than it was on 11/30/21 when the Fed admitted that inflation was

NOT TRANSITORY. As weve previously noted,

its mind boggling to us that Powell and his motley crew waited till March

2022 to stop QE and raise rates by only 25bps.

Diesel Supply Shortage Could Drive Up

Prices/Inflation:

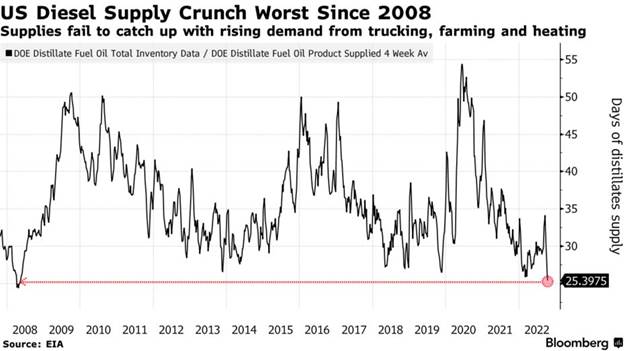

On October 19th, Bloomberg reported that the U.S. has just

25 days of diesel supply, the lowest since 2008, according to the Energy

Information Administration. At the same, the four-week rolling average of

distillates supplied, a proxy for demand, rose to its highest seasonal level

since 2007. While weekly demand dipped slightly, its still at highest point in

two years amid higher trucking, farming, and heating use.

The diesel crunch comes just weeks ahead of the

midterm elections and has the potential to drive up prices for consumers

who already view inflation and the economy as a top voting issue. Retail prices

have been steadily climbing for more than two weeks. At $5.324 a gallon,

theyre 50% higher than this time last year, according to AAA data.

Fox News host Tucker Carlson

ripped the Biden administration Thursday for the U.S. ongoing

diesel shortage, saying that America faces an economic catastrophe if stocks

arent replenished. Thanks to the Biden

administrations religious war in Ukraine, this country is about to run out of

diesel fuel. According to data from the Energy Information Administration,

by the Monday of Thanksgiving week, thats 25 days from now, there will be no

more diesel [fuel]. So, whats gonna happen then?

Everything will stop, Carlson said.

The truth is these people are bumping right smack up

against reality. Here is the reality: We have 25 days to avert economic

catastrophe, Carlson said. Catastrophe is what will happen if we run out of

diesel fuel. Thats more important than prosecuting a jihad in Ukraine. Its

more important than World War Trans.

Mid-term Elections:

The mid-term elections on November 8th are

of great importance and we strongly recommend all Americans vote. The

Curmudgeon spent the better part of two days reviewing the candidates and

CA/Santa Clara propositions and is voting today.

However, dont look to the polls to forecast the

election results as per this cartoon:

Cartoon courtesy of http://www.gorrellart.com/

..

Sidebar: BofA

- S&P 500 quarterly EPS forecasts 2021-2023:

(Bottom-up consensus vs. BofA estimates)

End Quote:

With this weeks FOMC meeting, please think about

this quote:

The process [of monetary inflation] gives rise to a

redistribution of income in favor of those who first received the new

injections or doses of monetary units, to the detriment of the rest of society,

who find that with the same monetary income, the prices of goods and services

begin to go up.

. Jesus

Huerta de Soto is a Spanish economist of the Austrian School. He is a

professor in the Department of Applied Economics at King Juan Carlos University

in Madrid, Spain, and a Senior Fellow at the Mises Institute

Be well, stay healthy, try to cope with the financial

chaos and all asset wipe-out the Fed has created. Wishing you peace of mind,

and till next time

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).